Orthobiologics Market Outlook:

Orthobiologics Market size was valued at approximately USD 7.46 billion in 2025 and is projected to reach around USD 10.24 billion by the end of 2035, rising at a CAGR of 3.23% during the forecast period 2026-2035. In 2026, the industry size of orthobiologics is estimated at USD 7.70 billion in size.

Ongoing research and development activities are a prominent catalyst for the market growth, as numerous academic institutions are continuing to invest in the latest biologic therapies. Various innovations in the stem cell therapies and synthetic bone graft substitutes are propelling the scope beyond the traditional surgical methods. Extensive research and development have also enabled the development of minimally invasive biologic procedures. This further lowers the recovery times and enhances the patient outcomes. These developments not only widen the therapeutic applications in spinal fusion and sports injuries but also develop treatments more cost-efficient over time, propelling overall market expansion.

The government is focusing on making a robust and well-structured supply chain that plays a pivotal role in propelling the market growth. A resilient supply chain is helpful for manufacturers to streamline procurement of the raw materials and lower the lead times. Also, the worldwide distribution channel enables the companies to expand into rising markets in which the demand for modern regenerative treatments is mushrooming. Ultimately, a robust supply chain not only increases the product accessibility and cost efficiency but also develops trust among healthcare service providers, thereby speeding up the adoption and fueling market growth.

Key Orthobiologics Market Insights Summary:

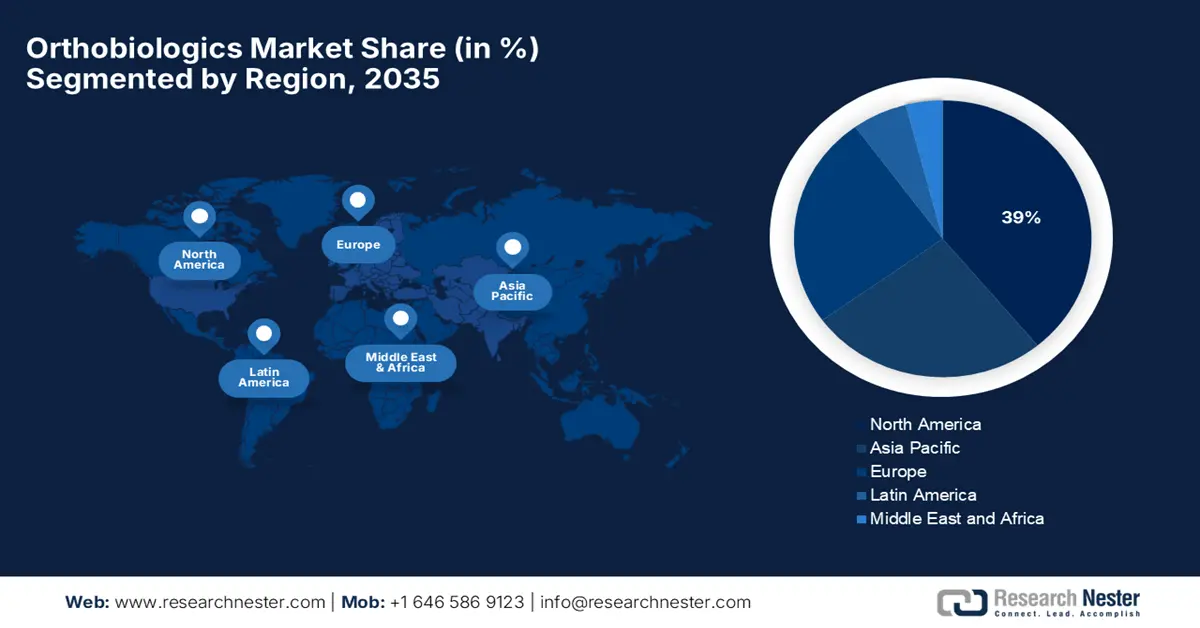

Regional Insights:

- North America is projected to hold a 39% share in the Orthobiologics Market by 2035, driven by the high prevalence of orthopedic conditions and well-established surgical infrastructure.

- Asia Pacific is expected to account for 26% of the market by 2035, impelled by expanding healthcare infrastructure and rising orthopedic disorders.

Segment Insights:

- Hospitals in the end-user sector of the Orthobiologics Market are projected to capture a 41% share by 2035, owing to their capacity to purchase high volumes and provide comprehensive post-operative care.

- Orthopedic surgery is expected to hold a 33% share by 2035, fueled by the rising incidence of osteoarthritis, trauma, and degenerative bone disorders.

Key Growth Trends:

- Surge in burden of musculoskeletal disease

- Increase in sports-related injuries

Major Challenges:

- High manufacturing costs & pricing pressure

- Complex reimbursement landscape and payer fragmentation

Key Players:Stryker Corporation,Zimmer Biomet Holdings,Medtronic PLC,Smith & Nephew,NuVasive, Inc.,Orthofix Medical Inc.,Arthrex, Inc.,Globus Medical,RTI Surgical,Wright Medical Group,BioMimetics Symbiosis,LifeNet Health,Cerapedics,CollPlant,OrthogenRx

Global Orthobiologics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.46 billion

- 2026 Market Size:USD 7.70 billion

- Projected Market Size: USD 10.24 billion by 2035

- Growth Forecasts: 3.23% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, Canada, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 7 October, 2025

Orthobiologics Market - Growth Drivers and Challenges

Growth Driver

- Surge in burden of musculoskeletal disease: With the rising geriatric population, the prevalence of osteoarthritis and chronic musculoskeletal conditions is burgeoning. Older patients usually require and prefer solutions that restore function and lower the recovery time. Biologic solutions such as biologic scaffolds and bone graft substitutes that promote tissue regeneration are in high demand from all ages of the population. According to data published by the World Health Organization in July 2022, almost 1.71 billion people have musculoskeletal conditions globally. Also, the demographic tailwind develops swift baseline demand across elective orthopedics and underpins long-term market expansion.

- Increase in sports-related injuries: Globally, there has been an increase number of people participating in sports and recreational activities. According to data published by the Pew Research Center in March 2024, almost 4 out of 10, or 38% of Americans, are involved in college sports. More sports activities in younger and middle-aged cohorts are driving high incidences of cartilage injuries and ligament tears. The rising number of sport-related injuries is creating repeatable demand for injectable and graft products. These factors are propelling the market growth during the forecasted period.

- Patient preference for faster recovery, lower morbidity, and biologic solutions: In the current world, patients are more acquainted, outcome-oriented, and tend to opt for treatments that give giving promising and quicker return to function and that have fewer lifelong hardware-associated issues. Demand from patients is usually reinforced by direct-to-consumer education, recommendations from clinicians and is based on the real-world stories of quicker rehabilitations. These factors are creating a market pull that complements clinician-led adoption and raises willingness to pay for effective orthobiologics options and further augmenting the market growth during the forecasted period.

Challenges

- High manufacturing costs & pricing pressure: Orthobiologics undergo biologic processing and therefore have extremely high costs. The bulk of new treatments, therefore, are rendered commercially unviable, thereby curbing the availability of products and market growth worldwide, especially in developing nations where barriers to affordability are high.

- Complex reimbursement landscape and payer fragmentation: The orthobiologic market is facing unstandardized reimbursement policies by various payers, as Medicare, Medicaid, private payers, and healthcare systems worldwide each have varied criteria for coverage and reimbursement. Such a scenario places market instability in front of manufacturers in terms of access to the market and the predictability of revenue. An unusually extended period in deciding on coverage and inconsistency in the level of reimbursement discourage uptake by providers, impeding patient access and weakening the overall development of the market despite the clinical advantages of orthobiologics.

Orthobiologics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.23% |

|

Base Year Market Size (2025) |

USD 7.46 billion |

|

Forecast Year Market Size (2035) |

USD 10.24 billion |

|

Regional Scope |

|

Orthobiologics Market Segmentation:

End User Segment Analysis

Hospitals, in the end-user sector of the orthobiologics market, are expected to capture the highest revenue market share of 41% in 2035. Hospitals are where most orthopedic procedures and intricate interventions take place that need high-end products of orthobiologics. This is due to their ability to purchase high volumes and provide adequate post-operative care, which enables them to achieve this share. According to data published by the American College of Rheumatology, more than 544,000 hip replacements and 790,000 knee replacements are done every year in the U.S. In addition, government funding and reimbursement schemes facilitate hospital adoption, stimulating segment growth.

Application Segment Analysis

The segment of orthopedic surgery is projected to hold a market share of 33% of the market by 2035. The growth of the market can be attributed to the rising incidence of osteoarthritis, trauma, and degenerative bone disorders, which demand surgical intervention. These types of conditions often need surgical interventions such as spinal fusion, joint reconstruction, fracture repair, and bone grafting, where orthobiologics like bone graft substitutes, platelet-rich plasma (PRP), bone morphogenetic proteins (BMPs), and stem cell-based therapies. These therapies are extensively utilized to speed up healing, increase tissue regeneration, and enhance patient outcomes.

Source Segment Analysis

Autologous orthobiologics in the source segment are anticipated to achieve a 31% revenue in 2034 because of the reduced risk of immune rejection and improved healing percentages. Autologous products, which come from the tissue or cells of the patient, are utilized in the treatment plan in personalized therapy. Autologous therapies have also proven to be superior in bone regeneration, and based on this, the National Institute of Health Sciences Japan has encouraged their extensive use in all clinical therapies. Moreover, government policies for ensuring patient safety and quality standards again enhance the use of autologous sources, thus driving the growth of the sub-segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orthobiologics Market - Regional Analysis

North America Market Insights

North America is expected to be the leading region in the global orthobiologics market, with the highest share of 39% in 2035. This is due to the high prevalence of orthopedic conditions, well-established surgical infrastructure, and extensive public insurance coverage in the United States and Canada. The growth of the U.S. orthobiologics market is mainly bolstered by the burgeoning prevalence of musculoskeletal disorders, mainly arthritis, osteoarthritis, etc. According to the National Council on Aging, nearly 58 million citizens in the U.S. are 65 and older. The report further states that the number is anticipated to reach 88 million by 2060. This further amplifies this demand as age is a major risk factor for bone and joint degeneration.

In Canada, the market growth is propelled by the rising prevalence of the arthritis. According to Arthritis Society Canada, currently 1 in 5 adults are suffering from the arthritis in the country. Additionally, disease also makes a prominent economic impact due to lost productivity and exorbitant healthcare costs, resulting in the need for innovative, minimally invasive, and prompt recovery treatments such as orthobiologics. These factors are augmenting the market growth in the country.

Asia Pacific Market Insights

The Asia Pacific is the fastest-growing market segment for orthobiologics and is expected to hold 26% of the market revenue share in 2035, growing at a strong CAGR of 5.7% in the forecast period of 2026–2035. Growth in the market is mainly influenced by expanding healthcare infrastructure, rising orthopedic disorders, and government initiatives for the spread of regenerative medicine. China has been dominating its investments into biomanufacturing, supporting regulatory-wise, creating its colossal domain, while India bridges cost reductions for treating and increasing patient pools and biosimilar adoption. Japan enjoys the support of huge healthcare budgets with an aging population seeking advanced therapies.

The market in China the market is mainly propelled by the rising aging population and high prevalence of orthopedic disorders. The government in the country has executed policies to upgrade the healthcare access as well as infrastructure. These initiatives endeavor to lower the disparities in healthcare access and encourage the adoption of ultra-modern medical treatments such as orthobiologics. Additionally, in India, the market growth is driven by a surge in the adoption of advanced medical technology. Also, there has been a surge in government health expenditure in the country. For instance, according to the Press Information Bureau, the total health expenditure in 2022 reached USD 109 billion, propelling the market growth.

Europe Market Insights

The market in Europe is experiencing impeccable growth, augmented by the amalgamation of clinical and demographic factors. Moreover, the surge in cases of fractures is further driving the demand for advanced stem cell-based therapies. In the UK, the market growth is propelled by a surge in sports injuries and the presence of state-of-the-art healthcare infrastructure. According to data published by Sport England, 30 million adults in England are participating in sport or doing any physical activity. Additionally, exhaustive research programs in regenerative medicine is leading to the development of new orthobiologic products and therapies, further propelling the market growth.

In Germany, the market growth is increasing due to a myriad of factors such as rising sports injuries and technological advancements. Also, the innovations in medical technology such as ultra-modern imaging systems, are augmenting the efficacy of therapies related to the orthobiologic. Technological integration in the advanced digital health tools are high in demand and further augmenting treatment precision and outcomes, further supporting market growth. Germany is also a hub for biomedical research and clinical trials, with numerous universities, research institutes, and biotech companies developing next-generation orthobiologic products.

Key Orthobiologics Market Players:

- Stryker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zimmer Biomet Holdings

- Medtronic PLC

- Smith & Nephew

- NuVasive, Inc.

- Orthofix Medical Inc.

- Arthrex, Inc.

- Globus Medical

- RTI Surgical

- Wright Medical Group

- BioMimetics Symbiosis

- LifeNet Health

- Cerapedics

- CollPlant

- OrthogenRx

The high competition is determined by the ortho-biologics market, with U.S.-based companies competing innovatively in bone graft substitutes, cellular therapies, and minimally invasive techniques. Market leaders such as Stryker and Zimmer Biomet spent heavily on R&D to diversify the range of offerings and further strengthen efficacy. Strategic partnerships, acquisitions, and geographic expansions characterize typical growth strategies. Japanese manufacturers hold a niche but increasing share, concentrating on regenerative medicine parallel to advanced biomaterials. Governments are increasingly supporting the cause, orthopedic disorders are rising worldwide, and reimbursement policies are being expanded worldwide to further fuel market growth. As a result, players have had to ramp up their innovation and collaboration for a sustainable competitive advantage.

Here is a list of key players operating in the global market:

Recent Developments

- In September 2025, Stryker launched Incompass™ Total Ankle System, designed for patients with end-stage ankle arthritis, featuring an innovative implant and enhanced instrument platform. The FDA-cleared system is intended for patients with end-stage ankle arthritis and introduces an innovative implant with an enhanced instrument platform.

- In March 2025, Zimmer Biomet Holdings launched Persona® Revision SoluTion™ Femur knee implant that offer advanced revision capabilities. This offers an alternative to cobalt-chrome (Co-Cr-Mo) alloy for patients with sensitivities to certain metals.

- Report ID: 773

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orthobiologics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.