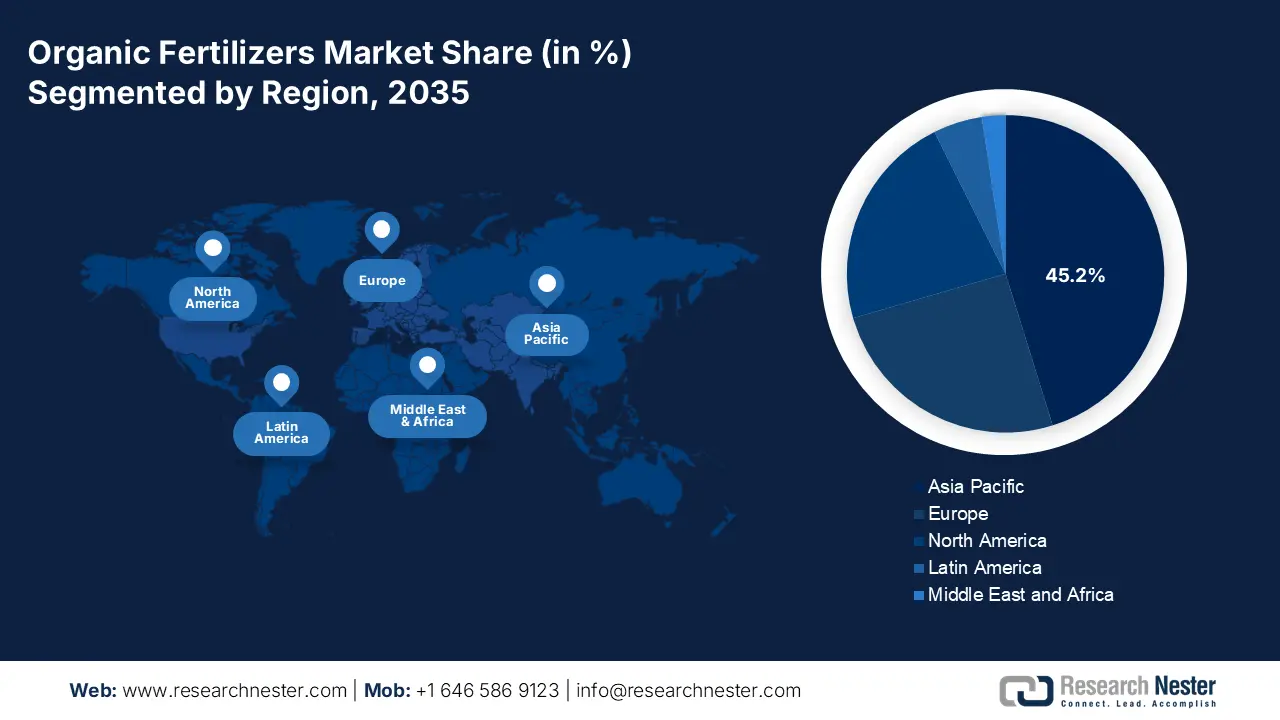

Organic Fertilizers Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the organic fertilizers market is anticipated to hold the largest share of 45.2% by the end of 2035. The market’s upliftment is highly attributed to the dual pressure of food security due to the critical environmental degradation and the massive population caused by chemical overuse. Additionally, strict governmental policies, including China’s Zero-Growth in Fertilizer Use action plan and India’s PMPRF scheme promoting organic nutrients, are also driving the market in the region. According to an article published by the FAO Organization in October 2024, an estimated 23% of the population in the region experienced food insecurity as of 2022, along with increased rates of malnutrition. Besides, the region plays a pivotal role in the international agri-food system, employing 793 million of the 1.2 billion people in the agricultural industry, and effectively contributes to feeding the 8 billion population globally, thus denoting a huge growth for the organic fertilizers market.

China in the organic fertilizers market is growing significantly, owing to the state-mandated transition towards agricultural sustainability by implementing the Ministry of Agriculture and Rural Affairs' Zero-Growth Action Plan for Chemical Fertilizers and Pesticides by the end of 2025. As stated in the 2022 Climate and Clean Air Coalition Organization report, the livestock production in the country has readily increased, with a surge in overall milk, egg, and meat production by 12.0, 10.0, and 6.0. Meanwhile, more than 70% of farms, such as livestock production and crop production, are specialized crop production systems, which are extremely suitable for the organic fertilizers market in the country. Besides, with an increase in bio-fertilizer and specialty segment, along with regulatory pressure to diminish chemical utilization is suitable for uplifting the market in the country.

India in the organic fertilizers market is also growing due to the confluence of a critical soil health crisis and federal policies. In addition, the government’s PM Programme for Restoration, Management, and Health (PM-PRANAM) has been significantly designed to incentivize different states to promote integrated and balanced nutrient management. As per a data report published by the PIB Government in August 2025, the agriculture industry contributes to 16% of the country’s GDP and readily supports more than 46% of the population. The budget estimate for the Department of Fertilizers was revised between 2024 and 2025, amounting to ₹1,91,836.2 crore from ₹1,68,130.8 crore, which has been possible through supplementary demands for grants passed by parliament, thereby bolstering the market’s expansion.

North America Market Insights

North America in the organic fertilizers market is expected to emerge as the fastest-growing region during the forecast duration. The market’s development in the region is highly fueled by the sophisticated customer demand, strict regulatory frameworks, and innovative agricultural practices. In addition, the strong demand for organic food, with the U.S. market continuously outperforming the traditional segment, is also propelling the market in the region. According to an article published by the U.S. Government Accountability Office in January 2024, 27% of ranches or farms utilize precision agricultural practices to effectively manage livestock or crops. Besides, the USDA, along with the National Science Foundation (NSF), has offered nearly USD 200 million for precision agriculture research and development funding, which has created an optimistic outlook for the overall market in the region.

The U.S. in the organic fertilizers market is gaining increased traction, owing to the presence of a well-established organic food industry, increasing environmental consciousness among growers, and a surge in the demand for manure-based and bulk compost products. Additionally, specialty horticulturalists and crop growers are driving the need for processed and high-value organic fertilizers, such as liquid fish emulsion and blood meal. As per a data report published by the Natural Resources Conservation Service (NRCS) in 2023, the organization offers USD 850 million for forestry and climate-smart agriculture mitigation activities through different administrative programs. Moreover, the organization obligated 99.8% of the available 2023 Inflation Reduction Act financial assistance grants to farmers, forest landowners, and ranchers across the region, thus suitable for implementing conservation practices.

Fund Provision in the U.S. by the NRCS and the Inflation Reduction Act (2023)

|

Program Name |

2023 Available Fund (USD Million) |

Overall Inflation Reduction Act Requests |

Conservation of the Landscape |

|

Environmental Quality Incentives Program (EQIP) |

250 |

Almost 8,000 applications (USD 405 million) |

2,812 landowners received climate-focused contracts on 762,698 acres of land |

|

Agricultural Conservation Easement Program (ACEP) |

100 |

More than 250 applications (USD 180 million) |

27 landowners received an ACEP Agricultural Land Easement climate-focused contracts on 53,476 acres of grasslands. |

|

Regional Conservation Partnership Program (RCPP) |

250 |

Over USD 2 billion requested |

More than USD 1 billion is being invested to advance partner-driven solutions to conservation on agricultural land through 81 projects |

|

Conservation Stewardship Program (CSP) |

250 |

More than 3,000 applications (USD 230 million) |

2,406 landowners received climate-focused contracts on 3,312,492 acres of land |

Source: Natural Resources Conservation Service (NRCS)

Canada in the organic fertilizers market is also developing due to the existence of federal policy alignment, shift in consumer and agricultural paradigms, and provincial initiatives. For instance, as stated in the October 2024 article, the Government of Canada readily initiated a commitment of USD 62.9 million for more than 3 years, which commenced between 2024 and 2025. This investment is suitable for Agriculture and Agri-Food Canada to renew and extend the program, and generously cater to the localized food infrastructure. Moreover, the USD 250 million cost-shared Resilient Agricultural Landscape Program has also been designed to utilize an ecological goods and services payment strategy to support on-farm adoption of management practices, including restoring and maintaining grasslands, along with wetlands, which is creating a positive outlook on the overall organic fertilizers market in the country.

Europe Market Insights

Europe in the organic fertilizers market is forecasted to experience steady growth by the end of the stipulated duration. The market’s growth in the region is extremely propelled by the regional Green Deal and its cornerstone policies, including the Biodiversity and Farm to Fork Strategies. These particular regulations have mandated an effective shift towards sustainable agriculture, such as adopting ambitious targets to diminish fertilizer and chemical pesticide utilization. According to a report published by the Europe Journal of Agriculture and Food Sciences in February 2024, the region has successfully set the objective of 25% organic by the end of 2030. Based on this goal, the organic agriculture in the region currently accounts for 9.6% of the region’s agriculture. Additionally, over the past two years, there has been a significant growth in organic agriculture hectares, increasing by 6.7%, which is expected to result in a 17.5% uplift by the end of 2030.

The organic fertilizers market in Germany is gaining increased exposure, owing to the existence of a massive agricultural industry, the highest organic food market sector, and strict national regulations that have exceeded regional mandates. Besides, the Federal Soil Protection Act and the German Sustainable Development Strategy have created a regulatory setting that tends to penalize poor soil health and reward practices that develop soil organic matter. According to a data report published by the AMI Organization in July 2022, the organic share of milk alternatives ranged between 62.4% to 64.2%, followed by 26.6% to 32.0% for meat alternatives. In addition, the share is 15.2% to 16.7% for eggs, along with 11.2% to 15.4% for flour, thereby denoting an increased exposure of the organic food industry in the country, which is positively impacting the overall market’s development.

The organic fertilizers market in Poland is also growing due to massive inflows of regional cohesion and Common Agricultural Policy (CAP) funds for greening and modernizing the agricultural industry, significant potential for expansion, and a low initial base of organic farmland. Meanwhile, the country’s Green Deal approach, along with the National Action Plan for the Sustainable Use of Pesticides, aggressively encourage the integration of organic practices. As stated in the 2022 EKOCONNECT report, the overall area of the country accounts for 312,705 km², along with €13,640 in gross domestic product (GDP), 1,317,000 farms, of which 2.4% caters to fishing, forestry, and agriculture. In addition, 14,682,000 hectares of land have been readily utilized for agricultural areas, with 11.1 ha constituted for agricultural farms, based on which 9.4% of the overall population is employed in this field, thus suitable for the market’s exposure.