Orally Disintegrating Tablet Market Outlook:

Orally Disintegrating Tablet Market size was over USD 14.83 billion in 2025 and is anticipated to cross USD 31.72 billion by 2035, witnessing more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of orally disintegrating tablet is assessed at USD 15.88 billion.

The demand for patient-friendly drugs, easy-to-swallow, and technological advancement in formulations are steadily amplifying the orally disintegrating tablet market globally. Additionally, continuous research and development are contributing to the taste, stability, and bioavailability of these formulations. As per an article published by the Journal of Young Pharmacists Organization in December 2022, ranolazine as an ODT comprises 35% to 50% bioavailability, 62% protein binding nature, and it gets dissolved in kidneys by 75% and faeces by 25%. Therefore, the presence of such drugs with fast dissolving ability is readily boosting the market.

Moreover, the orally disintegrating tablet market is subjected to expansion based on the rising demand for anti-epileptic drugs. In this regard, a study was conducted by the International League Against Epilepsy Commission on Epidemiology regarding the payer’s pricing of epilepsy treatment which was published by NLM in April 2022. The study included 101 cost-of-illness, both from direct and indirect healthcare cost databases that further included 74 cases from North America and Western Europe. It was reported that the average yearly cost for each person ranged between USD 204 in developing nations to USD 11,432 in developed nations. Also, the overall total price of epilepsy treatment was USD 119.27 billion, thus driving the market expansion.

Key Orally Disintegrating Tablet Market Insights Summary:

Regional Highlights:

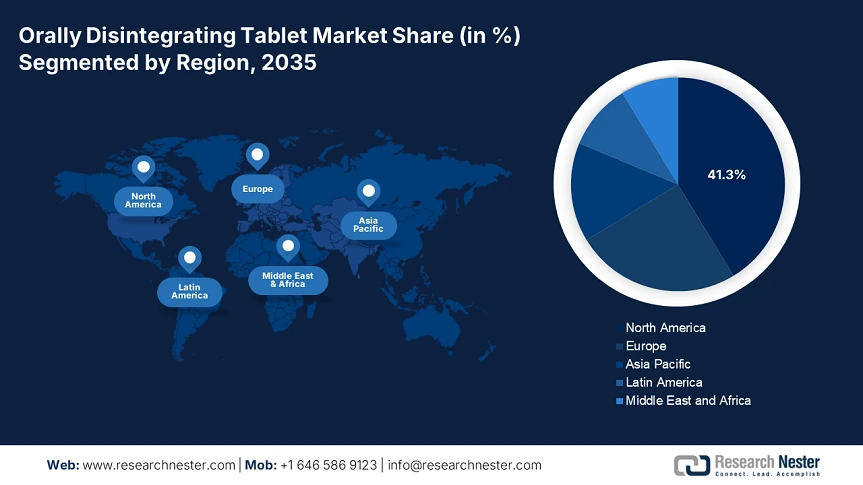

- North America leads the Orally Disintegrating Tablet Market with a 41.3% share, driven by increased prevalence of chronic conditions, with a significant impact on healthcare expenditure, fueling growth through 2035.

- Asia Pacific's orally disintegrating tablet market is poised for the fastest growth by 2035, fueled by high demand for ODTs in a convenient form for aiding chronic diseases.

Segment Insights:

- The Anti-Psychotics Drug Type segment is forecasted to secure around 46.5% market share by 2035, driven by the rising global incidence of mental disorders.

- The CNS Disease Application segment of the Orally Disintegrating Tablet Market is forecasted to hold around 49.8% share by 2035, propelled by the rising occurrence of neurodegenerative diseases, mental disorders, and neurological illnesses globally.

Key Growth Trends:

- Diversified therapy applications

- Alternative to traditional tablets

Major Challenges:

- Limitation in drug compatibility

- Lack of mechanical strength

- Key Players: AstraZeneca plc, Mylan N.V., Pfizer Inc., Johnson & Johnson Services, Inc..

Global Orally Disintegrating Tablet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.83 billion

- 2026 Market Size: USD 15.88 billion

- Projected Market Size: USD 31.72 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Orally Disintegrating Tablet Market Growth Drivers and Challenges:

Growth Drivers

- Diversified therapy applications: The wide application of ODT is prevalent for mental illnesses, epilepsy, and respiratory and nervous disorders, which is highly driving the demand for the orally disintegrating tablet market. The consumption of traditional tablets to overcome these disorders results in dysphagia which affects 6 million adults internationally, out of which 38% suffer for their entire lifetime as stated in the October 2020 article published by NLM. Hence, to combat swallowing difficulty, ODTs are manufactured with analgesics, acetaminophen, or opioids for their use as medications for gastrointestinal conditions as well, thus ensuring market expansion.

- Alternative to traditional tablets: ODTs are a successful alternative to conventional tablets owing to increased bioavailability and rapid absorption capability, positively bolstering the orally disintegrating tablet market growth. As per an article published by NLM in December 2021, levodopa or benzyl hydrazine is a type of ODT to ease patients with Parkinson’s disease. It is formulated with 25.7% microcrystalline cellulose, 6.22% cross-polyvinylpyrrolidone, 5.36% sodium carboxymethyl starch, and 22% mannitol, thus making it an effective alternative to traditional tablets.

Challenges

- Limitation in drug compatibility: Few medications tend to weaken rapidly in the formulation of ODTs owing to the utilization of excipients in high temperature, table matrix, and moisture presence, hindering the growth of the orally disintegration tablet market. Besides, limitation in taste-masking procedures results in the absence of synthesizing medications into over-the-counter formulations. Also, the presence of limited solubility makes the manufacturing process difficult which creates a barrier for the expansion of the market.

- Lack of mechanical strength: Tablets need to survive a drop of several inches during the manufacturing process, and are required to stay intact at the time of packaging and shipping. Therefore, these situations create a challenge for orally disintegrating tablets since there is an absence of durability in comparison to traditional pills. However, the presence of cellulose ensures rigidity, but it dissolves in ODTs, allowing manufacturers to identify fewer sturdy alternatives. All these factors negatively imapct the orally disintegrating tablet market, thus a potential restraint for its upliftment.

Orally Disintegrating Tablet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 14.83 billion |

|

Forecast Year Market Size (2035) |

USD 31.72 billion |

|

Regional Scope |

|

Orally Disintegrating Tablet Market Segmentation:

Application (CNS Disease, Gastrointestinal Disease, CVS Disease)

CNS disease segment is set to dominate orally disintegrating tablet market share of around 49.8% by the end of 2035, based on the application segment. The occurrence of neurodegenerative diseases, mental disorders, and neurological illnesses falls under the category of central nervous system disorders. According to the March 2024 WHO report, more than 1 in 3 people are affected with neurological conditions and over 80% of neurological deaths take place in developing nations. To combat this, Tascenso ODT is a useful drug that prevents the crossing of the blood-brain barrier into the central nervous system, as stated in the 2024 National Multiple Sclerosis Society Organization article.

Type (Anti-Psychotics Drug, Anti-Epileptics Drug)

In orally disintegrating tablet market, anti-psychotics drug segment is expected to dominate revenue share of around 46.5% by the end of 2035. Anti-psychotic medication operates by fluctuating brain chemistry to assist in reducing psychotic symptoms such as disordered thinking, delusions, and hallucinations. Besides, as per the September 2022 WHO report, nearly 15% of the global working population suffers from mental disorders, and this costs the international economy USD 1 trillion every year. Therefore, to keep a check on such medical situations, the overall market is expected to amplify effectively.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Orally Disintegrating Tablet Market Regional Analysis:

North America Market Analysis

North America orally disintegrating tablet market is predicted to account for revenue share of around 41.3% by 2035. Orally disintegrating tablets are readily available in the region to help patients get rid of swallowing. Besides, the region is subjected to increased long-term conditions such as the central nervous system, heart disease, and diabetic disorders. As per the February 2024 CDC report, nearly 42% of the population suffers from 2 or more chronic disorders, and 12% experience at least 5 such disorders. In addition, chronic conditions have a significant effect on US healthcare with 90% of the yearly USD 4.1 trillion healthcare expenditure credited to managing and treating chronic diseases and mental health conditions.

The U.S. orally disintegrating tablet market is gaining traction since pharmaceutical organizations are initiating investments in collaboration with governmental bodies. For instance, in May 2022, Pfizer planned to make an investment by acquiring Biohaven for USD 11.6 billion. The purpose was to expand Biohaven's oral CGRP franchise to more than USD 6 billion during peak sales. In addition, this investment contributed towards Pfizer’s prevailing plan to add USD 25 billion in risk-adjusted revenues by 2030 through business advancement. Hence, organizational investment like this is a steady factor driving market growth in the country, ultimately resulting in the expansion of pharma businesses.

The orally disintegrating tablet market in Canada is witnessing significant growth owing to the increasing prevalence of different types of orally disintegrating tablets. According to the July 2021 Government of Canada report, ondansetron ODTs have a strength of 4 mg and 8 mg with oral route of administration. Besides, in the September 2022 governmental update, Sanis Health Inc. reported its usage among adults (18 to 64 years of age), pediatrics (less than 18 years), and geriatrics (more than 65 years) to prevent vomiting and nausea. However, its increased dosage can result in headaches and constipation, therefore prescribed consumption is recommended, thus amplifying the market growth.

APAC Market Statistics

The orally disintegrating tablet market in APAC is the fastest-growing region and is poised to witness lucrative growth during the forecast timeline. The region is subjected to a high demand for ODTs in a convenient form for aiding chronic diseases. The older population in the country is on the outlook for easy-to-consume and handy drugs that provide adherence in place of traditional medicines. Moreover, there is a rise in the provision of patient-centric healthcare solutions and local businesses are initiating funding for the manufacturing and production of the latest ODT drugs which is positively boosting the market expansion.

The orally disintegrating tablet market in India is expecting substantial growth since there are advancements in the healthcare industry with generous contributions made by medical companies. For instance, in December 2021, Shilpa Medicare Limited launched PRUCALSHIL (Prucalopride) orally disintegrating strips of 1 mg and 2 mg in the country. It is an exclusive formulation that has been developed for the first time internationally and received approval from the Drug Control General of India. This ODT-based drug has been used for the indicative treatment of chronic constipation in adults in whom laxatives fail to deliver satisfactory relief.

The orally disintegrating tablet market in China is gaining exposure owing to its high prevalence and rapid disintegration effect over regional medicines that are available in an immediate-release dosage form. Besides, in November 2020, Viatris which was formed by Pfizer Upjohn and Mylan, launched a healthcare brand in the country. The purpose was to provide high-quality medicines, forward-looking disease management, and digital health technologies to patients and empower healthy lifestyles. Moreover, this contribution also focused on the evolution of the national health plan ‘Healthy China 2030’ as an essential development strategy. Therefore, with such innovative ideas, the market is expected to flourish in the country.

Key Orally Disintegrating Tablet Market Players:

- AstraZeneca plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mylan N.V.

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Bausch Health

- GlaxoSmithKline plc.

- Sun Pharmaceutical Industries Ltd.

- Bayer AG, Eli Lily and Company

- Mind Medicine Inc.

- Edenbridge Pharmaceuticals, LLC

Companies dominating the orally disintegrating tablet market are gaining rapid exposure due to strategic partnerships for the effective development of tablets to cater to rapid oral disintegration. For instance, in July 2023, Aneva Group and Galvita entered into a partnership with the objective to expand the development, formulation, and production of oral dosage forms. With Galvita’s specific child- and senior-friendly formulations, there has been provision of better taste masking and higher drug loading than oral dosage forms currently in the market. Thereby, with such contributions from companies, the orally disintegrating tablet market is expected to readily amplify internationally.

Here's the list of some key players:

Recent Developments

- In July 2024, Mind Medicine Inc. stated the issuing of the latest patent by the United States Patent and Trademark Office (USPTO) covering MM120 (lysergide) orally disintegrating tablet.

- In December 2021, Edenbridge Pharmaceuticals, LLC notified the U.S. FDA approval regarding the 505(b)(2) new drug application (NDA) for DARTISLA ODT (glycopyrrolate) orally disintegrating tablets.

- Report ID: 7287

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Orally Disintegrating Tablet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.