Oral Health Monitors Market Outlook:

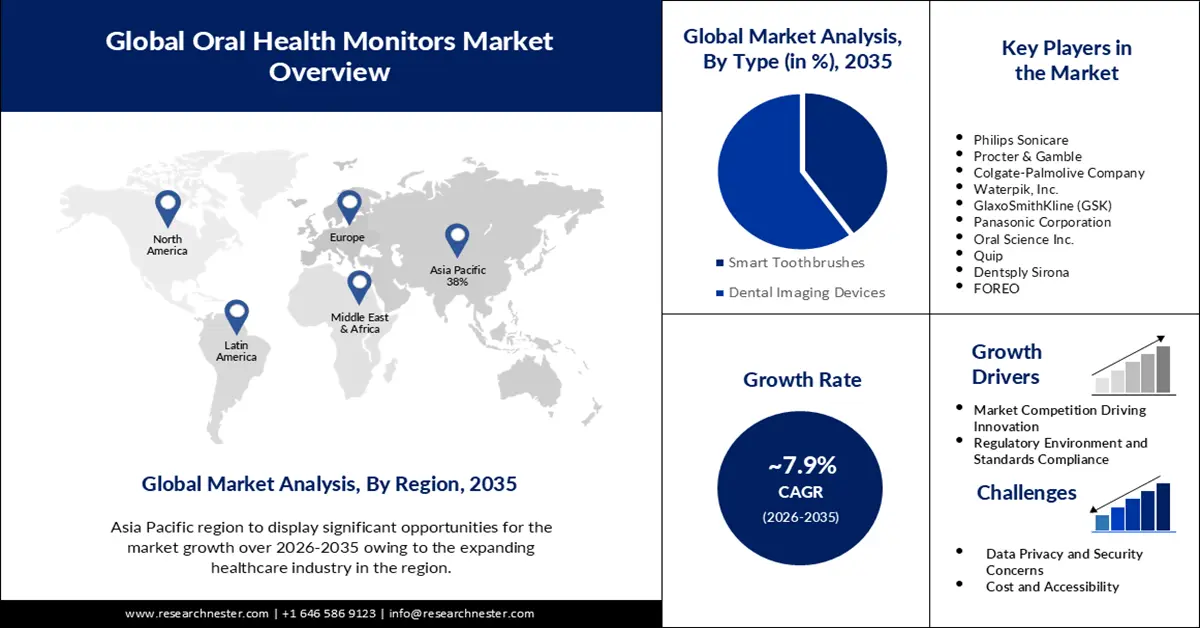

Oral Health Monitors Market size was over USD 11.55 billion in 2025 and is poised to exceed USD 24.71 billion by 2035, witnessing over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oral health monitors is evaluated at USD 12.37 billion.

Continuous innovations in sensor technologies, artificial intelligence, and connectivity have the potential to enhance the capabilities of oral health monitors. These advancements are anticipated to lead to more accurate monitoring and analysis of oral health metrics. Increasing awareness of the importance of oral health and the role of preventive care is estimated to drive the demand for oral health monitoring devices. Consumers seek tools that help them proactively manage their oral hygiene. The integration of oral health monitors with smart devices and platforms contributes to their popularity. Connectivity with smartphones and other digital platforms are estimated to enable users to track their oral health data over time. If oral health monitors prove to be effective tools for preventive care, dental professionals can adopt these technologies to enhance patient care and provide personalized recommendations.

Oral health monitors are devices designed to help individuals and healthcare professionals track and assess various aspects of oral health. These monitors can include technologies such as smart toothbrushes, dental imaging devices, and apps that provide real-time feedback on brushing techniques or monitor oral conditions. Regulatory approvals and standards play a crucial role in the adoption of health-related technologies. Compliance with regulatory requirements is essential for the success and widespread use of oral health monitors.

Key Oral Health Monitors Market Insights Summary:

Regional Highlights:

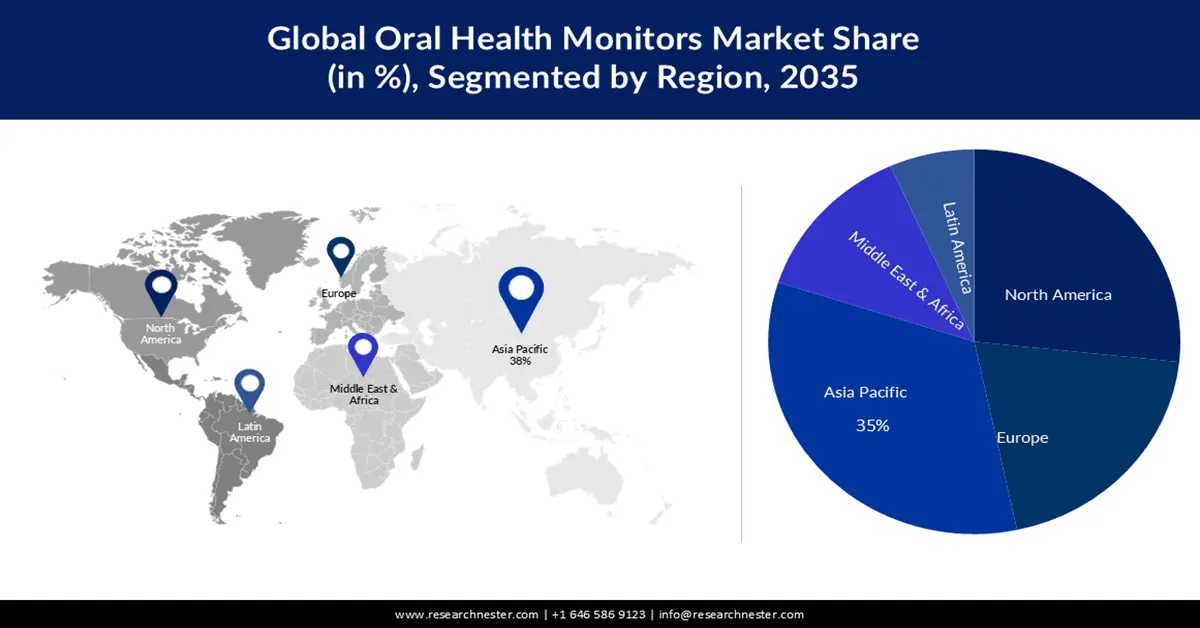

- By 2035, the Asia Pacific region in the oral health monitors market is predicted to hold a 38% share, owing to rising awareness of preventive healthcare.

- The North America region is projected to secure the second-largest share by 2035, attributed to the high prevalence of oral health issues.

Segment Insights:

- The dental imaging devices segment in the oral health monitors market is estimated to account for a 60% share by 2035, propelled by technological advancements enhancing diagnostic precision.

- The hospitals segment is expected to garner a significant share by 2035, supported by the integration of comprehensive healthcare services.

Key Growth Trends:

- Technological Advancements in Oral Health Monitors

- Market Competition Driving Innovation

Major Challenges:

- User Engagement and Adherence

- Data Privacy and Security Concerns

Key Players: Philips Sonicare, Procter & Gamble (Oral-B), Colgate-Palmolive Company, Waterpik, Inc., GlaxoSmithKline (GSK).

Global Oral Health Monitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.55 billion

- 2026 Market Size: USD 12.37 billion

- Projected Market Size: USD 24.71 billion by 2035

- Growth Forecasts: 7.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 19 November, 2025

Oral Health Monitors Market - Growth Drivers and Challenges

Growth Drivers

- Technological Advancements in Oral Health Monitors- The continuous evolution of technology is a primary growth driver for the oral health monitors market. Advanced sensor technologies, artificial intelligence (AI), and connectivity have revolutionized the landscape of oral health care. According to a report, the global dental diagnostic and surgical equipment sales, which includes oral health monitors, are projected to reach USD 6.7 billion by 2024. Furthermore, advancements in dental imaging technologies contribute to improved oral health assessment. Intraoral cameras and handheld X-ray devices enable detailed visualizations, aiding in the early detection of oral issues. The incorporation of AI algorithms in these devices enhances diagnostic accuracy. Connected oral health devices, such as those integrated with mobile apps, facilitate seamless data tracking and analysis. The ability to monitor oral health metrics over time encourages user engagement and adherence to oral care routines.

- Market Competition Driving Innovation - Intense competition within the oral health monitors market serves as a catalyst for innovation. Companies strive to differentiate their products by incorporating cutting-edge technologies, improving user experience, and addressing specific healthcare challenges. A diverse range of oral health monitoring products, including smart toothbrushes, dental imaging devices, and connected apps, characterizes the competitive landscape. The availability of various options allows consumers to choose products that best align with their preferences and needs. Companies engaged in oral health monitoring continually invest in research and development to stay ahead of the competition. This focus on innovation leads to the introduction of novel features and functionalities.

- Regulatory Environment and Standards Compliance - The regulatory environment plays a pivotal role in shaping the growth trajectory of the oral health monitors market. Adherence to regulatory standards and obtaining necessary approvals are essential for ensuring the safety, effectiveness, and market acceptance of these devices. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), set stringent requirements for medical devices, including oral health monitors. Manufacturers must demonstrate the safety and efficacy of their products through rigorous testing and clinical trials. The approval of oral health monitoring devices by regulatory authorities opens up new market opportunities. A case in point is the FDA clearance of certain smart toothbrushes and dental imaging devices, which has contributed to the expansion of these product categories. Regulatory approvals provide consumers and healthcare professionals with confidence in the reliability and safety of oral health monitors.

Challenges

- User Engagement and Adherence: Despite the availability of advanced oral health monitors, ensuring sustained user engagement and adherence to recommended oral care routines remains a significant challenge. Users may initially be motivated by the novelty of the technology, but maintaining long-term interest and compliance can be difficult. Low user engagement can undermine the effectiveness of oral health monitoring devices. If users discontinue or misuse these devices, the potential benefits of preventive care and early intervention may not be fully realized. Implementing comprehensive educational programs that emphasize the importance of consistent oral care and how monitoring devices contribute to overall health.

- Data Privacy and Security Concerns

- Cost and Accessibility

Oral Health Monitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 11.55 billion |

|

Forecast Year Market Size (2035) |

USD 24.71 billion |

|

Regional Scope |

|

Oral Health Monitors Market Segmentation:

Type Segment Analysis

The dental imaging devices segment in the oral health monitors market is estimated to gain the largest revenue share of 60% in the year 2035. Dental imaging devices have emerged as essential tools in the field of dentistry, revolutionizing diagnostic capabilities and treatment planning. The growth of this segment is propelled by several key factors. One of the primary drivers for the growth of dental imaging devices is the continuous evolution of technology, enhancing diagnostic precision and imaging capabilities. Advanced imaging modalities such as cone-beam computed tomography (CBCT) and digital radiography provide detailed three-dimensional views of the oral and maxillofacial regions. This high level of precision aids dentists in accurate diagnosis, treatment planning, and monitoring of oral conditions. The incorporation of AI algorithms into dental imaging devices further contributes to diagnostic accuracy. AI-powered systems can analyze imaging data, detect anomalies, and assist clinicians in identifying potential issues at an early stage. As technology continues to advance, dental imaging devices are becoming indispensable for delivering more effective and personalized patient care. The growth of the dental imaging devices segment is fueled by a combination of technological advancements, a rising prevalence of dental disorders, a shift towards preventive dentistry, a patient-centric approach to treatment planning, and integration with digital dentistry and EHRs. These factors collectively contribute to the increasing adoption of dental imaging devices, revolutionizing the landscape of oral healthcare and reinforcing the role of advanced diagnostics in modern dentistry.

End User Segment Analysis

Oral health monitors market from the hospitals segment is expected to garner a significant share in the year 2035. Dental imaging devices serve as catalysts for multidisciplinary collaborations within hospital settings. The oral cavity is intricately connected to various aspects of overall health, and dental professionals often collaborate with other specialists, such as oncologists, ENT specialists, and plastic surgeons, to address complex healthcare needs. According to a survey, 77% of surveyed oral and maxillofacial surgeons reported collaborating with other healthcare professionals in hospitals for comprehensive patient care. The growth of hospital segment is driven by the integration of comprehensive healthcare services, enhanced diagnostics and treatment planning, facilitation of multidisciplinary collaborations, research and education initiatives, and the rising incidence of oral and maxillofacial conditions. As hospitals continue to evolve as hubs for multidisciplinary care and medical education, the strategic integration of advanced technologies plays a pivotal role in elevating the standard of broader healthcare landscape.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Health Monitors Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 38% by 2035, The Asia-Pacific (APAC) region is witnessing a significant surge in the adoption of oral health monitors, driven by several key factors that reflect the region's diverse healthcare landscape and evolving consumer preferences. A key driver for the growth of the market in the APAC region is the increasing awareness and emphasis on preventive healthcare. As healthcare systems in APAC countries evolve, there is a growing recognition of the importance of preventive measures in maintaining overall health, including oral health. Governments and healthcare organizations across the APAC region are actively promoting preventive healthcare practices. Oral health monitoring aligns with this trend by empowering individuals to take a proactive approach to their oral hygiene. Preventive measures, such as regular monitoring of brushing habits and gum health, supported by oral health monitors, contribute to the early detection of potential issues, fostering a culture of wellness and reducing the burden on healthcare systems. The growth of the market in the Asia-Pacific region is propelled by the increasing awareness of preventive healthcare, the rising middle-class population, technological advancements, the growing geriatric demographic, and increased healthcare expenditure.

North American Market Insights

The oral health monitors market in the North America region is projected to hold the second largest share during the forecast period. The market in North America is propelled by the high prevalence of oral health issues, technological advancements, the embrace of health and wellness trends, the increasing aging population, and strategic collaborations. As the region continues to prioritize preventive healthcare, digital health integration, and innovative health solutions, the market is poised for sustained growth and prominence in the healthcare landscape. The high prevalence of oral health issues, including gum disease and tooth decay, is a significant driver for the adoption of oral health monitors in North America. As a region with a well-established healthcare system, there is a growing recognition of the need for proactive oral health management to address these prevalent issues. According to the Centers for Disease Control and Prevention (CDC), almost 45% of adults aged 30 years and older in the United States have some form of gum disease. Oral health monitors play a crucial role in providing individuals with real-time data on their oral hygiene practices, gum health, and potential issues. The ability to monitor and assess oral health parameters at home contributes to early detection and intervention, aligning with the broader trend of preventive healthcare in North America.

Oral Health Monitors Market Players:

- Philips Sonicare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procter & Gamble

- Colgate-Palmolive Company

- Waterpik, Inc.

- GlaxoSmithKline (GSK)

- Panasonic Corporation

- Oral Science Inc.

- Quip

- Dentsply Sirona

- FOREO

Recent Developments

- Procter & Gamble acquired Billie, a direct-to-consumer personal care brand for women, for USD 1 billion. The acquisition gave P&G access to Billie's razor and shaving subscription service, which is popular among millennial and Gen Z women.

- Procter & Gamble merged its wholly owned subsidiary P&G Japan K.K., a Japanese consumer goods company, with P&G Asia Pacific Pte. Ltd., a Singapore-based consumer goods company. The merger was aimed at streamlining operations and improving efficiency in the Asia Pacific region.

- Report ID: 3128

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Health Monitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.