Oral Cancer Treatment Market Outlook:

Oral Cancer Treatment Market size was valued at USD 2.19 billion in 2025 and is likely to cross USD 3.64 billion by 2035, registering more than 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oral cancer treatment is estimated at USD 2.29 billion.

The need for early detection to prevent the severity and fatality of oral cancer is one of the major driving factors in this industry. Innovative methods and tools such as biomarkers, imaging techniques, and genetic profiling for advanced diagnosis have helped to offer better treatment outcomes. This further accelerates the technological progress of this sector to introduce more diagnostic tools.

Many companies and research institutions are now collaborating to develop new technologies for early detection. For instance, in August 2024, a chemical engineering team from IIT Kapur passed their newly discovered portable oral detection device, Munh-Parikshak to Scangenie Scientific Pvt. Ltd. for commercialization. The non-invasive kit can be wirelessly connected to smartphones, tablets, and iPads to display its 90% accurate screening results. Such developments are encouraging healthcare companies to invest in R&D projects to produce more revolutionary solutions. This is also propelling the demand for preventive diagnostic solutions in the oral cancer treatment market.

Key Oral Cancer Treatment Market Market Insights Summary:

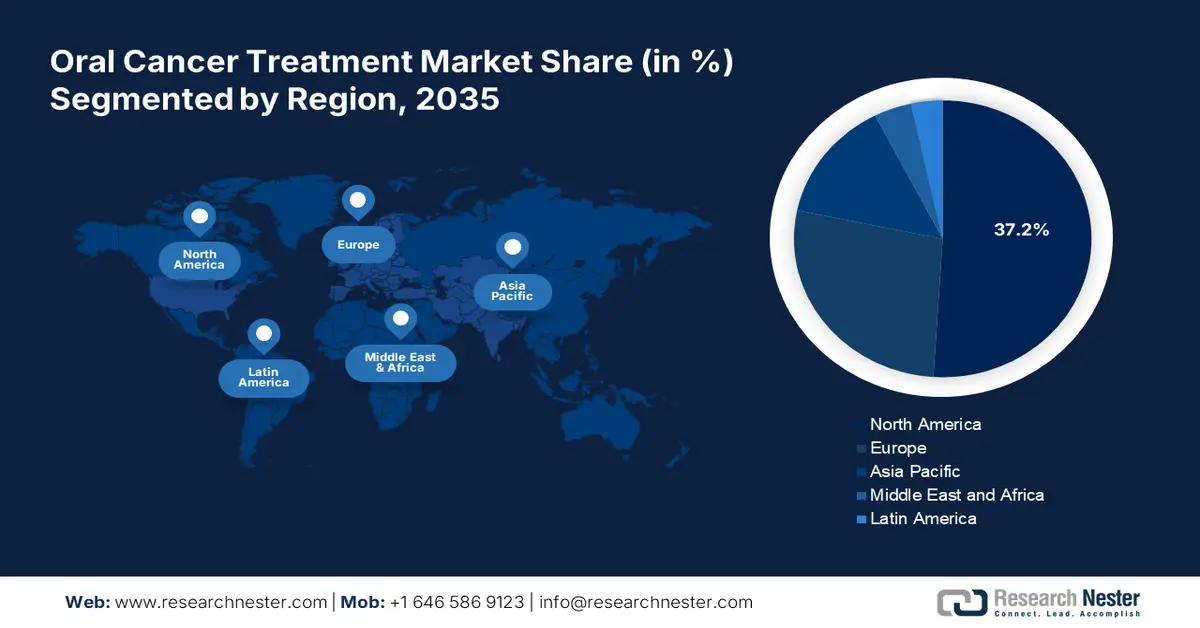

Regional Highlights:

- North America's 37.2% share in the Oral Cancer Treatment Market is bolstered by well-established healthcare infrastructure and advancements in treatment, positioning it as a leader through 2035.

- Asia Pacific’s oral cancer treatment market is gaining traction through 2026–2035, driven by increased oral malignancy due to lifestyle changes and better healthcare access.

Segment Insights:

- The Hospitals and Clinics segment is projected to hold a 57.40% share by 2035, driven by comprehensive cancer care integrating therapeutics, surgery, and therapies.

Key Growth Trends:

- Rising prevalence of oral cancer

- Governmental support

Major Challenges:

- High treatment cost

- Concern about side effects

- Key Players: Bristol-Myers Squibb Company, Qilu Pharmaceutical Co., Ltd., Teva Pharmaceutical Industries Ltd., Eli Lilly and Company., F Hoffmann-La Roche Ltd, Merck & Co., Inc., Novartis AG, Pfizer Inc..

Global Oral Cancer Treatment Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.19 billion

- 2026 Market Size: USD 2.29 billion

- Projected Market Size: USD 3.64 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 14 August, 2025

Oral Cancer Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of oral cancer: The increasing number of oral cancer incidences have inflated the demand in the oral cancer treatment market. According to an NLM report published in June 2022, 377,713 new and 177,757 death cases of oral cancer were registered worldwide in 2020. Lifestyle factors, particularly smoking, alcohol consumption, and poor diet in developing regions are growing the volume of potential cancer patients. The increasing number of patients is driving the surge for effective treatment and detection solutions. The industry is curating technological advancements to cope with inflating demand, creating opportunities for global leaders.

- Governmental support: Initiatives and funding issued by the governing bodies have greatly influenced the oral cancer treatment market. Many countries are encouraging development in health infrastructure, inflating the adoption of new treatment methods. Improvement in treatment facilities also ensures open access to cancer treatments, fostering an established supply-demand chain in this industry. The government authorities are also releasing projects to introduce innovative treatment methods in the market. For instance, in February 2024, ICMR funded a project based on the evaluation of non-invasive adjuncts in OPMDs to set up early detection and development in primary healthcare settings in India.

Challenges

- High treatment cost: Expensive treatment and therapeutics are some of the major setbacks of the oral cancer treatment market. The associated cost of advanced therapies such as immunotherapy, targeted therapy, and personalized medicine can be higher than other treatments. This may prohibit patients from low or middle-income regions from investing in this sector. This further limit access to treatment for a large segment of the population, restricting optimum adoption.

- Concern about side effects: Traditional treatment methods such as chemotherapy and radiation therapy come with significant side effects. Most of the undergoing patients experience pain, difficulty in eating and swallowing, dry mouth, and oral infections. This further hinders the quality of life for people suffering from cancer. Such drastic changes in normal lifestyles may prevent them from adopting long-term management. This further becomes a hurdle in the way of expansion in the oral cancer treatment market.

Oral Cancer Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 2.19 billion |

|

Forecast Year Market Size (2035) |

USD 3.64 billion |

|

Regional Scope |

|

Oral Cancer Treatment Market Segmentation:

Application (Hospitals and Clinics, Research Organizations, Academic Institutes)

Hospitals and clinics segment is predicted to account for around 57.4% oral cancer treatment market share by 2035. The growth in this segment is driven by the availability of therapeutics, surgical interventions, and various therapies under one roof. This multidisciplinary approach of cancer care centers ensures comprehensive care of patients, encouraging more investment in this sector. The wide range of facilities including diagnosis, surgery, chemotherapy, and rehabilitation helps these institutions to establish steady growth. Rising oral cancer incidences have also inflated the frequency of hospital admissions for treatment, which shows the potential for this segment to grow higher.

Product Type (Squamous Cell Carcinoma, Verrucous Carcinoma, Minor Salivary Gland Carcinomas, Lymphomas)

Based on product type, the squamous cell carcinoma segment is predicted to generate remarkable revenues in the oral cancer treatment market. Innovation in immunotherapy has created new paradigms to offer better outcomes in advanced cases. Recently developed biologic agents and checkpoint inhibitors have opened new possibilities for recovering critical-stage patients. Increased survival rates due to advancements in early detection are also encouraging companies or research centers to develop new technologies such as liquid biopsies and enhance imaging techniques. For instance, in May 2o21, Viome launched an FDA-approved oral and throat cancer detection tool, based on its patented metatranscriptomics and AI platform. The screening test can detect OSCC and OPC by making saliva a liquid biopsy.

Our in-depth analysis of the market includes the following segments:

|

Application |

|

|

Product Type |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Cancer Treatment Market Regional Analysis:

North America Market Analysis

North America industry is likely to dominate majority revenue share of 37.2% by 2035, The region is witnessing significant growth due to its well-established healthcare infrastructure. This has further brought advancements in treatment modalities through innovative solutions. The evaluating medical industry of this region is now focusing on providing remote testing facilities to ensure early testing. For instance, in August 2022, Viome launched an FDA-approved at-home oral and throat cancer testing platform, CancerDetect. This saliva-based diagnostic platform is equipped with AI and Mrna technology to deliver 95% specificity and 90% sensitivity rates.

The U.S. is estimated to hold a large value in the oral cancer treatment market by the end of 2035 due to the increasing incidences of oral cancer. The country has noticed the deteriorating survival rate of patients due to late diagnosis. According to a study conducted by NLM in June 2022, around 70% of oral cancer cases are diagnosed at later stages in this country. This further reduced the 5-year survival rate from 83.7% tested in earlier stages to 38.5% when the cancer had metastasized. Such surveys show the importance of adopting advanced testing to improve patient outcomes.

Canada is presenting a great scope of development in the oral cancer treatment market due to growing awareness of oral cancer risks. The country has now put its focus on precise medicine to offer better and more personalized treatment options for patients. The improved patient outcomes have further propelled the need for innovating effective methods of screening and rehabilitation. The domestic healthcare landscape is now adopting advanced technologies such as fluorescence and endoscopic imaging, minimally invasive surgeries, and proton therapy.

APAC Market Statistics

The Asia Pacific oral cancer treatment market is gaining traction due to rapid changes in lifestyle in developing countries. The incidence rate of oral malignancies has increased due to excessive consumption of alcohol, cigarettes, and other tobacco products. This is further contributing to heightening the demand for effective treatments and therapies. Well-developed countries such as Japan, Australia, and South Korea have built healthcare systems to support the inflating rate of prevalence. Both the private and public authorities are now focusing on building specialized fields of expertise to enable access to treatment for urban regions. This is encouraging more companies to invest in this sector.

India is experiencing a major increase in oral cancer incidences, particularly in the youth generation. According to a report published by WHO, in May 2024, around 3600 people die each day due to tobacco consumption in this country. The report further states, that tobacco usage among children aged between 13-15 accounted to be 8.4% in 2019. As a result, the fatalities and casualties of oral carcinomas are setting new records every year. The government of India has stepped in to control consumption and introduce treatments to save future generations. This is further increasing demand in the oral cancer treatment market.

China is also developing its healthcare infrastructure and investing heavily to bring development in the domestic oral cancer treatment market. Authorities are running awareness campaigns to promote early detection to improve survival rates. The programs are further extended to target tobacco and alcohol consumption to reduce incidence rates of oral cancer. The country is adopting biologics, immunotherapies, and personalized medicines, expanding the industry. Leading pharmaceutical companies are solidifying their presence to capture such a consumer base.

Key Oral Cancer Treatment Market Players:

- Bristol-Myers Squibb Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Qilu Pharmaceutical Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company.

- F Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Jaguar Health

- VELscope

The current dynamics of the oral cancer treatment market are changing due to the integration of advanced technologies such as AI and cloud-based platforms. These are increasing the effectiveness of available treatments and therapies for the patients. For instance, in March 2023, IJNRD released a research paper on the usage of artificial intelligence in oral medical oncology and CDSS. The journal further states that chatbots and virtual assistants can help clinical professionals suggest the most effective treatment options. Such innovations are encouraging global leaders to expand their reach by introducing new therapeutics. Such key players in the market include:

Recent Developments

- In October 2024, Jaguar launched the FDA-approved oral mucositis prescription product, Gelclair to commercialize it in the U.S. market. The product can offer significant relief to mouth inflammation, adverse of oncology treatments.

- In January 2024, VELscope collaborated with OralMedicine.com to launch a clinical decision support service to assist dental professionals in oral cancer screening and mucosal disease management. The support system is powered by ahVanguard healthcare consultants to assist all VELscope users.

- Report ID: 6708

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Cancer Treatment Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.