Oral Antibiotics Market Outlook:

Oral Antibiotics Market size was over USD 24.8 billion in 2025 and is estimated to reach USD 37.1 billion by the end of 2035, expanding at a CAGR of 3.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of oral antibiotics is estimated at USD 25.2 billion.

The increasing occurrence and mortality of bacterial infections worldwide represent a continuously expanding field of application and consumer base for the oral antibiotics market. Besides, the notable impact of the underlying demographic and clinical conditions, including aging populations and antimicrobial resistance (AMR), is amplifying the volume of the patient pool in this sector. Tetifying to the same, in July 2022, a study was published in support of the NTNU Norwegian University of Science and Technology, demonstrating a sharp spike in the rate of prevalence for urinary tract infections (UTIs) with age. It underscored the incidence rate of UTI to rise from 90 per 100.0 thousand among patients aged 30 to 2473 after the age of 80.

Source: 2022 NLM Article

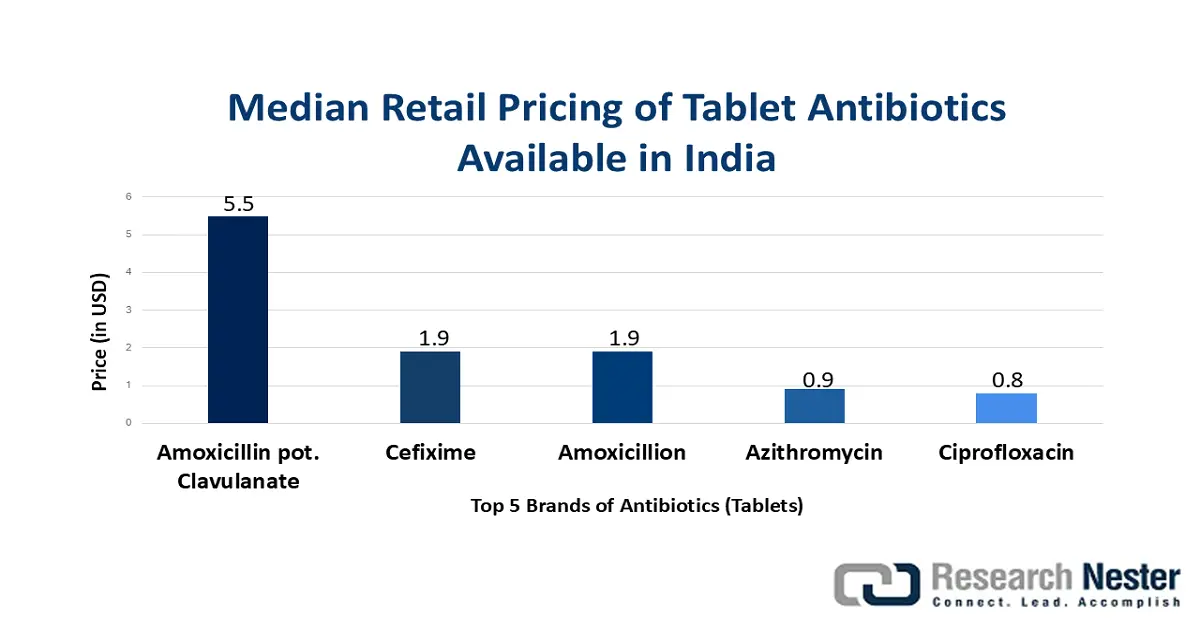

Similarly, the 2024 findings from the Journal of Medicine, Surgery, and Public Health revealed that the world is expected to witness an escalation of AMR-linked deaths, surpassing an annual 10 million by 2050 in the absence of adequate preventive and treatment measures. These epidemiological trends are creating a surge in demand for advanced formulations, fueling the scope of future expansion in the oral antibiotics market. Besides, the financial exhaustion due to cost inflation in injectables remains a persistent driver in the adoption of oral drugs. Exemplifying the same, in a 2024 article, the Consumer Expenditure Surveys and the Social Consumption of Health Survey showed that the share of injectable antibiotics in nationwide spending in India was 28.4% lower than that of oral due to higher defined daily dose (DDD) pricing.

Key Oral Antibiotics Market Insights Summary:

Regional Highlights:

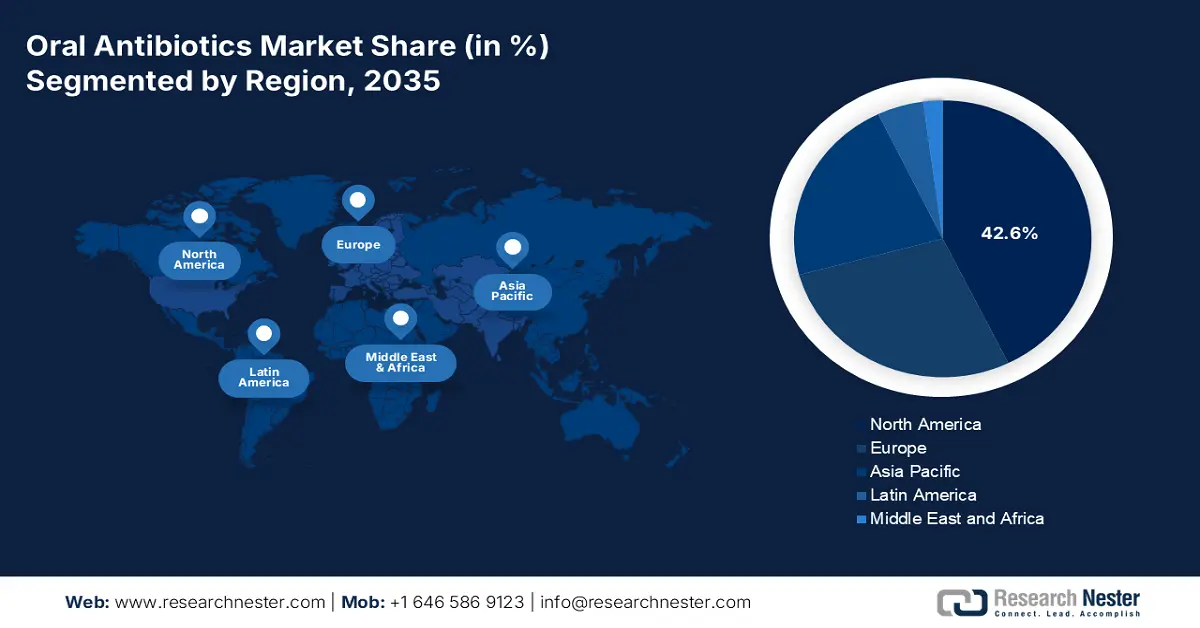

- North America is projected to secure a 42.6% share by 2035 in the oral antibiotics market, upheld by strong healthcare infrastructure, high bacterial infection incidence, and increased AMR-focused R&D spending.

- Asia Pacific is expected to witness the fastest expansion through 2035, owing to rising antimicrobial consumption, a growing patient pool, and widespread OTC-driven self-medication behavior.

Segment Insights:

- The respiratory infections segment is set to achieve a 32.9% share by 2034 in the oral antibiotics market, propelled by the rising global burden of pneumonia and lower respiratory tract infections.

- Fluoroquinolones are projected to hold a 28.8% share by 2034, driven by their broad-spectrum effectiveness and strong utility against multi-drug-resistant bacterial infections.

Key Growth Trends:

- Efforts to improve access to healthcare

- Administrative convenience and consumer preference

Major Challenges:

- Limitations in profit margins

- Declining use of antibiotics due to AMR

Key Players: Pfizer Inc., GlaxoSmithKline (GSK), Novartis AG, Merck & Co., Sanofi, AstraZeneca, Teva Pharmaceuticals, Sun Pharmaceutical, Cipla, Lupin Limited, Dr. Reddy’s Laboratories, Mylan (Viatris), Bayer AG, Roche, Hikma Pharmaceuticals, Yuhan Corporation, CSPC Pharmaceutical, Pharmaniaga, Innoviva, Inc.

Global Oral Antibiotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.8 billion

- 2026 Market Size: USD 25.2 billion

- Projected Market Size: USD 37.1 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: USA, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Vietnam, Thailand, Indonesia

Last updated on : 14 August, 2025

Oral Antibiotics Market - Growth Drivers and Challenges

Growth Drivers

-

Efforts to improve access to healthcare: The escalated pace of infrastructural development, particularly in emerging economies, is amplifying cash inflow in the market. Governments and international organizations are playing a crucial role in this process by investing heavily in enabling broader access to essential solutions for bacterial infections. Extending health insurance coverage and generic drug affordability are also evidence of such efforts. For instance, from 2021 to 2022, the Ayushman Bharat scheme expanded antibiotic access to patients from rural areas by establishing 150.0 thousand new Health and Wellness Centres across India, as per the Ministry of Health and Family Welfare (MoHFW).

-

Administrative convenience and consumer preference: The market benefits from a strong patient and physician preference for non-invasive, convenient treatment options, particularly in outpatient settings. As this route of administering eliminates the need for rigorous monitoring, it reduces healthcare costs and improves treatment adherence. Thus, this advantage is globally recognized for pediatric, elderly, and chronic infection patients, where ease of use inflates prescription rates. According to an evaluation by the Clinical Microbiology and Infection article, published in September 2023, early switch to oral therapy from intravenous antibiotics for native joint septic arthritis treatment can deliver an overall 98% rate of cure within 2 or 4 weeks.

-

Ongoing innovations in formulations: Sustained R&D investments from both public and private entities are securing future progress in the existing pipelines of the market, with reduced side effects and enhanced resistance profiles. For instance, in November 2024, a team of researchers in India created a novel oral macrolide antibiotic, Nafithromycin (Miqnaf), for treating resistant community-acquired bacterial pneumonia (CABP). This groundbreaking medicine is 10 times more effective than current treatments. Hence, the cohort of innovation in this sector is earning higher consumer trust and greater capital influx.

Historical Patient Pool Growth and Its Impact on the Oral Antibiotics Market

Oral Antibiotic Prescription Rates (2000-2020)

|

Period |

Prescription Rate & Change |

Notes |

|

2011-2016 |

Decreased ~5% from 877 to 836 prescriptions per 1,000 persons |

Decline driven mainly by children (-13%); adults saw a +2% increase; broad-to-narrow spectrum ratio dropped from 1.62 to 1.49 |

|

2020 (Apr-May vs. 2019) |

Significant decrease |

Due to COVID-19 factors: reduced healthcare visits, social distancing, and lower infection transmission rates |

Source: NLM and CDC

Recent Trends and Dynamics of Clinical Trials in the Market

Recent Launches and Clinical Trials

|

Company Name |

Drug Name |

Status |

Year |

|

Acurx Pharmaceuticals, Inc. |

ibezapolstat (IBZ) |

Phase 2b Clinical Trial Data |

2025 |

|

Innoviva, Specialty Therapeutics, Inc. |

zoliflodacin |

Phase 3 trial |

2024 |

|

GSK plc |

gepotidacin |

phase III EAGLE-2 and EAGLE-3 trials |

2022 |

|

Iterum Therapeutics plc |

sulopenem etzadroxil+probenecid |

FDA approved for NDA |

2024 |

Source: Press Releases

Challenges

-

Limitations in profit margins: The tendency to offer lower profit margins compared to other therapeutic areas, such as oncology and chronic disease treatments, the volume of participation in the market is often limited. This is largely attributable to their short-term utilization, widespread generic competition, and pricing pressures. As a result, many pharmaceutical companies are less inclined to invest in research and development for new formulations, shrinking the scope of innovation in this sector.

-

Declining use of antibiotics due to AMR: Despite growing the urge for innovation among pioneers, the widespread AMR still acts as a major roadblock in the market. The misuse and overuse of antibiotics, such as taking them without prescriptions or not completing prescribed courses, have led to the development of resistant bacterial strains. This hampers the efficiency of existing pipelines, forcing healthcare authorities to restrict the consumption volume. Hence, future investors often prohibit themselves from engaging capital in this category.

Oral Antibiotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 24.8 billion |

|

Forecast Year Market Size (2035) |

USD 37.1 billion |

|

Regional Scope |

|

Oral Antibiotics Market Segmentation:

Application Segment Analysis

Respiratory infections are poised to contribute to the largest revenue share of 32.9% in the market by the end of 2034. This dominance is largely acquired through the rising incidence of pneumonia and other lower respiratory tract infections (LRTIs), particularly among the elderly and immunocompromised populations. This demographic can be displayed by the 2021 Global Burden of Disease report, which recorded 2.1 million deaths from pneumonia worldwide in the same year. It also identified children under 5 and adults over 70 to be the most vulnerable populations, accounting for more than 500.0 thousand and 1 million fatalities, respectively. Further, till 2024, the ailment claimed the lives of over 700.0 thousand children aged under 5 annually.

Drug Class Segment Analysis

Fluoroquinolones are predicted to hold the dominant share of 28.8% in the market over the assessed timeframe. The broad spectrum of application and high efficiency gain against multi-drug-resistant (MDR) bacterial infections are the foundational pillars of the leadership. These medicines are highly preferred for treating complex infections where resistance to other drug classes is a concern, particularly in urinary and respiratory tract infections. Furthermore, being the gold standard for regulatory compliance has strengthened the sub-segment's position, where government-led initiatives are securing steady capital influx for future research and development.

Distribution Channel Segment Analysis

Hospital pharmacies are poised to acquire the leading share of 38.7% in the market throughout the discussed tenure. This is attributed to the heightening prescription volume, particularly in inpatient and emergency settings, where immediate access to antibiotics is critical. Besides, a majority of these facilities comply with strict regulatory and reimbursement criteria, ensuring the increased use of oral formulations after initial intravenous treatment. As evidence, the proportion of hospitals in the U.S. meeting each of the 7 Core Elements of antibiotic stewardship reached 94.9% in 2021, where the share of facilities having compliance with 6 of the 7 Core Elements was 98.1%, as per the CDC. Moreover, the streamlined bulk purchasing trend among hospital pharmacies contributes to consistent distribution.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Application |

|

|

Distribution Channel |

|

|

Age Group |

|

|

Formulation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Antibiotics Market - Regional Analysis

North America Market Insights

North America is predicted to capture the highest share of 42.6% in the global market during the discussed timeline. This proprietorship is accomplished through the region’s well-developed healthcare infrastructure, high incidence of bacterial infections, and substantial public healthcare spending. The presence of a strong R&D directed capital influx, aimed at combating widespread AMR, is also a major growth factor in this landscape. The surge in this aspect can be validated by the 20% collective increase in the 6 bacterial antimicrobial-resistant hospital-onset infections in the U.S. from 2021 to 2022, as unveiled by the 2024 CDC report.

According to the U.S. Department of Health and Human Services, approximately 1 in every 31 hospitalized patients suffers from at least 1 HAI at any given time, with more than 680.0 thousand infections related to HAIs occurring across the country every year. This testifies to the sustainable demand base present nationwide, fostering a favorable business environment for the market. Besides, the growing burden of AMR is notably enlarging the patient pool, which is creating opportunities for both innovations and widespread adoption in this sector.

Canada is also fueling the regional market with access improvement and greater cash inflow by leveraging federal allocations and policy reforms. As per the 2025 report from the Government of Canada, retail pharmacies across the nation distributed more than 24.4 million antimicrobial prescriptions in 2024 alone. Besides, 71% of this volume of consumption falls under the AWaRe Access antibiotics category, surpassing recommended benchmarks. This signifies the positive impact of the country's success in the responsible and controlled use of these medicines.

APAC Market Insights

Asia Pacific is expected to become the fastest-growing region in the global market by the end of 2035. The remarkable increase in antimicrobial consumption and the enlarging patient population are the propellers of the region's progress in this sector. Testifying to the same, the survey conducted by St. George’s University of London revealed that the rate of human antibiotic consumption in Vietnam and Thailand witnessed significant increases of 111.2% and 122.8%, respectively, from 2016 to 2023. Besides, the growing behavior of self-medication among people suffering from bacterial infection, coupled with the easy availability of these medicines as over-the-counter (OTC) products, is also making APAC the epicenter of high-volume utilization in this category.

China is cultivating a strong emphasis on the regional market, as both a large consumer base and a manufacturing hub. The notable expansion in the user volume across the country is primarily attributable to the rapid centralization of the healthcare system. This demography can be displayed through the 3.5 million patient population of Class A and B infectious diseases in China, as per the 2023 records collected by the NLM. It also reported more than 25.5 thousand deaths due to these ailments in the same year.

India is one of the emerging landscapes in the Asia Pacific oral antibiotics market, which is primarily backed by recent government efforts toward improving rural healthcare access. The country's large population also benefits the sector with a sustainable consumer base. Besides, public allocations for biopharmaceutical advances are creating lucrative opportunities for both domestic and foreign innovation in this sector. Such an influx of capital can be exemplified by the ₹8 crore funding towards the development of a novel oral antibiotic, Nafithromycin, sanctioned by the Biotechnology Industry Research Assistance Council (BIRAC).

Country-wise Import-Export Data for Antibiotics (2023)

|

Country |

Import Value |

Export Value |

|

China |

$656 million |

$4.3 billion |

|

India |

$1.9 billion |

$944 million |

|

Malaysia |

MYR190 million |

MYR37.2 million |

Source: OEC Database

Europe Market Insights

Europe is poised to remain the second-largest shareholder in the oral antibiotics market during the tenure between 2026 and 2035. As the region's growing burden of bacterial infection became a critical public health concern, the demand in this category rose. Testifying to the same, a 2025 NLM study revealed that the consumption of broad-spectrum antibiotics in Switzerland alone increased by 12.3% overall and 17.3% in ICUs during the pandemic. Besides, the population and rising AMR cases pushed the governing bodies to enact adequate measures to allocate sufficient resources, including medicines, in primary healthcare settings, in order to prevent the widespread epidemic. Additionally, the region is seeking to reduce its reliance on Asian producers through proposed legislation, strengthening local production and supply resilience.

Germany is predicted to lead the regional oral antibiotics market with remarkable success in stewardship and increasing bacterial infections among children and adolescents. With a stable prescribing density and a modest increase in penicillin use, the country reflects persistence in maintaining its leadership in this landscape. As evidence, in 2025, the NLM unveiled that the overall penicillin usage in hospitals across Germany increased by 63% for the period from 2012/13 through to 2021/22. It also mentioned that antibiotic consumption volume in intensive care units was approximately twice as high as in normal wards.

According to a survey conducted by the government of the UK, a continuous rise in AMR cases was observed across the country from 2019 to 2023, accounting for an estimated 66.7 thousand serious incidences. This displays the enlarging population of patients with specific needs, and hence, fueling a surge in rigorous R&D in the oral antibiotics market. Providing an overview of this landscape, another report from the governing authorities revealed that, in 2023, antibiotic use in primary care settings accounted for 79.7% of the total nationwide consumption, where penicillins represented the most used antimicrobials.

Export-Import Data for Antibiotics nes, Formulated, in Bulk (2023)

|

Country |

Export Value |

Import Value |

|

France |

$10.6 million |

$3.3 million |

|

New Zealand |

$1.1 million |

$647 thousand |

|

Russia |

$385 thousand |

$16.8 million |

Source: OEC Database

Key Oral Antibiotics Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline (GSK)

- Novartis AG

- Merck & Co.

- Sanofi

- AstraZeneca

- Teva Pharmaceuticals

- Sun Pharmaceutical

- Cipla

- Lupin Limited

- Dr. Reddy’s Laboratories

- Mylan (Viatris)

- Bayer AG

- Roche

- Hikma Pharmaceuticals

- Yuhan Corporation

- CSPC Pharmaceutical

- Pharmaniaga

- Innoviva, Inc.

The oral antibiotics market is characterized by a dynamic and competitive environment shaped by a dual structure of branded and generic players. Established pharmaceutical giants augment the sector with robust R&D, strong distribution networks, and brand recognition. Whereas the generic pioneers are gaining traction by leveraging their portfolio in cost-effectiveness and regulatory adherence. Moreover, the strategic initiatives, such as acquisitions, collaborations, and new product launches, to overcome hurdles are constructing a progressive atmosphere in this field.

Such key players are:

Recent Developments

- In March 2025, GSK attained approval from the FDA for its Blujepa (gepotidacin) for the treatment of UTIs among female adults (≥40 kg) and paediatric patients (≥12 years, ≥40 kg). The accomplishment was gained based on the promising results from the phase III EAGLE-2 and EAGLE-3 trials.

- In February 2025, Innoviva gained acceptance of a New Drug Application (NDA) from the FDA for its first-in-class oral antibiotic, zoliflodacin, for treating uncomplicated gonorrhoea. The drug was designed to address adults and 12+ aged patients, even those who are suffering from infections caused by drug-resistant strains.

- Report ID: 8004

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Antibiotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.