Optical Sensing Market Outlook:

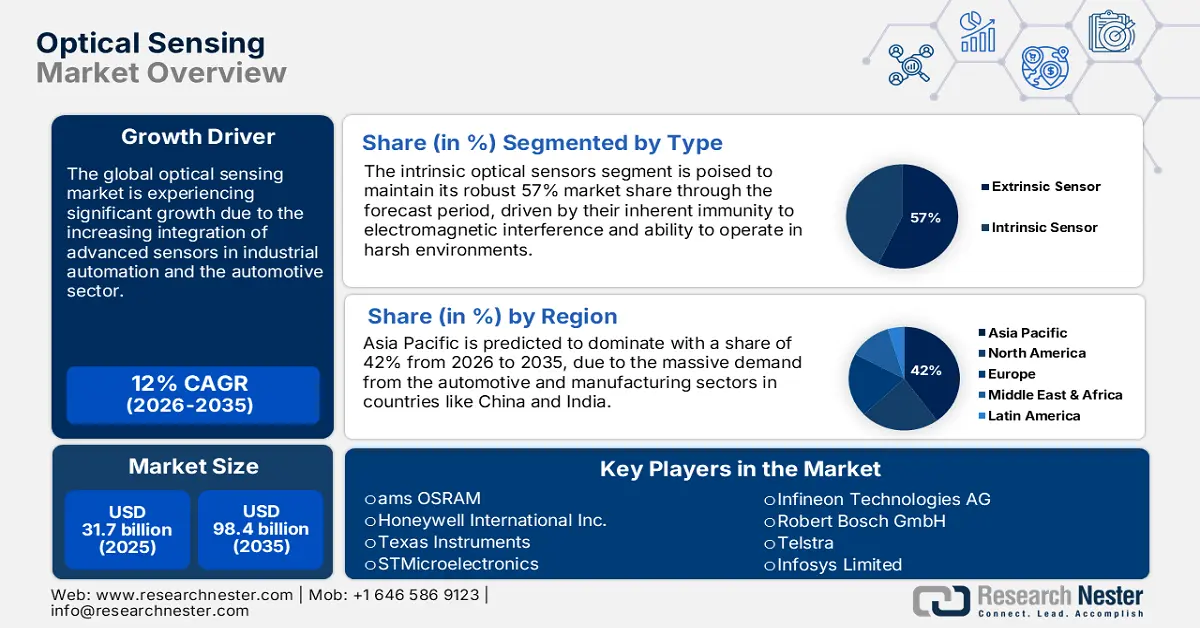

Optical Sensing Market size was valued at USD 31.7 billion in 2025 and is projected to reach a valuation of USD 98.4 billion by the end of 2035, rising at a CAGR of 12% during the forecast period, i.e., 2026-2035. In 2026, the industry size of optical sensing market is evaluated at USD 35.5 billion.

The global market is experiencing significant growth due to the increasing adoption of smart technologies across all major industries. The development is complemented by advancements in IoT and AI technologies, which are massively dependent on precise optical sensors for data acquisition and environmental sensing. For instance, in May 2024, the U.S. Commerce Department National Institute of Standards and Technology (NIST) provided over USD 1.2 million to 12 small businesses in eight states through the Small Business Innovation Research (SBIR) Program. The grants will fund research and development on new products in healthcare, semiconductor manufacturing, and other fields of greatest significance, demonstrating the ongoing commitment to investment and innovation that drives this sector's growth.

The market expansion is significantly driven by substantial government and private investment in strategically critical high-technology domains. Furthermore, the growth is fueled by a need for quicker, smaller, more accurate sensors operating under tougher conditions. In March 2025, Huawei demonstrated this trend by unveiling its F5G-A optical connectivity and sensing solutions, which will accelerate industrial intelligence by replacing manual processes with advanced optical technology in the oil and gas sector. This transition from basic components to intelligent, networked systems is transforming the market landscape at its foundation.

Key Optical Sensing Market Insights Summary:

Regional Highlights:

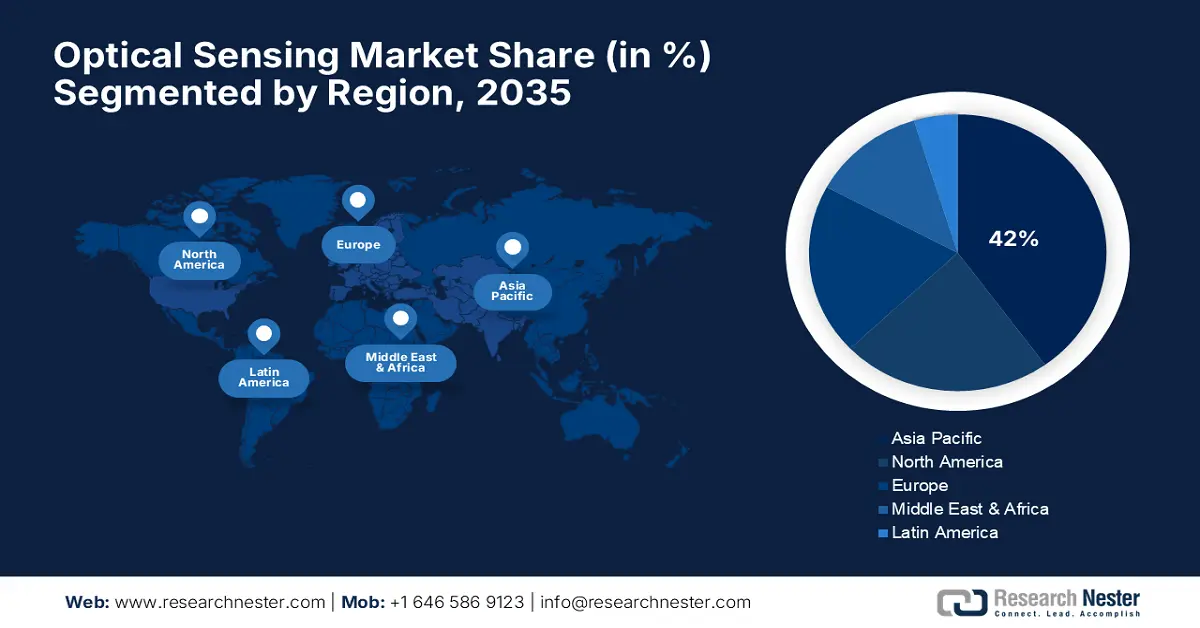

- Asia Pacific optical sensing market is anticipated to hold a dominant 42% share during the forecast period, fueled by the region's rising electronics manufacturing hub, rapid industrialization, and widespread use of automation technology.

- North America is expected to achieve a CAGR of 10% by 2035, impelled by its technological superiority and extensive investment in aerospace, healthcare, and automotive sectors.

Segment Insights:

- Intrinsic optical sensors segment is projected to account for 57% share in the optical sensing market through the forecast period, propelled by its natural suitability for use in distributed sensing applications.

- Optical temperature sensors segment is anticipated to hold a 37% share by 2035, owing to the rising demand for thermal management and process control solutions.

Key Growth Trends:

- Miniaturization revolution in consumer and medical electronics

- Development of AI-driven machine vision and automation

Major Challenges:

- Improving performance in challenging environments

- Overcoming physical and environmental difficulties

Key Players: ams OSRAM, Honeywell International Inc., Texas Instruments, STMicroelectronics, Infineon Technologies AG, Robert Bosch GmbH, Telstra, Infosys Limited, ViTrox Corporation Berhad, Samsung Electronics, TE Connectivity, Broadcom Inc.

Global Optical Sensing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.7 billion

- 2026 Market Size: USD 35.5 billion

- Projected Market Size: USD 98.4 billion by 2035

- Growth Forecasts: 12% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Vietnam, Thailand

Last updated on : 21 August, 2025

Optical Sensing Market - Growth Drivers and Challenges

Growth Drivers

-

Miniaturization revolution in consumer and medical electronics: A key factor fueling the market growth is the continuing miniaturization of optical sensors, which is enabling them to be integrated into the next generation of small and powerful consumer and medical products. In a ground-breaking development, SCIVAX and TSLC joint-ventured in April 2025 to create the world's smallest Photoplethysmography (PPG) sensor head for vital signs monitoring. One-tenth the size of conventional devices, this innovation opens the way for more discreet and sophisticated health monitoring in wearables like smartwatches and fitness bands, providing new possibilities for personal and remote healthcare.

-

Development of AI-driven machine vision and automation: AI-driven, high-speed inspection systems are in high demand since manufacturers prefer more efficiency and quality control. In April 2023, Cognex released its In-Sight 3800 vision system, with edge learning capability for high-speed inspection on high-speed production lines. The trend has deep connections to the development of robotics, with a report by the International Federation of Robotics (IFR) revealing that China's production of industrial robots rose by 17% in the first half of 2024 alone.

-

Technological developments in cars and Advanced Driver Assistance Systems (ADAS): The auto sector's rapid advancement towards enhanced safety and autonomous driving features has transformed it into a significant consumer of high-performance optical sensors. The sensors are critical to a broad suite of Advanced Driver Assistance Systems (ADAS), ranging from lane-keep assist to pedestrian detection. In November 2024, onsemi revealed that its Hyperlux AR0823AT image sensor was chosen by Subaru for its next-generation EyeSight stereo-camera front sensing system. This inroad by high-performance optical sensors into high-volume vehicle platforms is a strong and persistent market growth factor.

Challenges

-

Improving performance in challenging environments: A critical challenge for the optical sensing industry is to deliver high reliability and performance in harsh ambient conditions, such as extreme brightness or challenging surface conditions. Traditional sensors may not necessarily be capable of gathering reliable data in these conditions, limiting their application. Overcoming such hurdles entails the application of advanced solutions that can cope with variations of light and surface texture. Designing rugged sensor technologies that can eliminate noise and maintain signal integrity is the answer. This is likely to enable broader use of optical sensing in industrial and business applications.

-

Overcoming physical and environmental difficulties: Optical sensors are destined to face inherent physical limitations upon implementation in particular media, such as water, that cause blurriness and distortion, reducing image quality. Besides, external environmental factors such as extremely high or low temperature or pressure also affect their functioning and usability. These limitations are destined to necessitate advanced workarounds or make optical sensors unavailable in certain challenging scenarios. Countermeasures that can overcome these inherent limitations must be developed to enhance sensor technology and expand its applications in various sectors.

Optical Sensing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12% |

|

Base Year Market Size (2025) |

USD 31.7 billion |

|

Forecast Year Market Size (2035) |

USD 98.4 billion |

|

Regional Scope |

|

Optical Sensing Market Segmentation:

Type Segment Analysis

The intrinsic optical sensors segment is poised to maintain its robust 57% market share through the forecast period, driven by its natural suitability for use in distributed sensing applications. Intrinsic sensors allow continuous measurement of attributes like temperature and strain over extended distances. The segment's dominance is also aided by advanced research that is extending the boundaries of intrinsic sensing into innovative and new form factors. In January 2025, researchers at Beijing Normal University published on the development of a flexible optical skin capable of reading Braille at high speed and accuracy. The new sensor uses an optical fiber ring resonator in a soft material to detect pressure fluctuations. This demonstrates the ability of intrinsic optical sensing to move beyond traditional infrastructure applications into robotics and prosthetics.

Sensor Type Segment Analysis

The optical temperature sensors segment is anticipated to have a 37% market share by 2035, as temperature is one of the most basic and most broadly measured physical parameters in industrial, scientific, and consumer applications. The segment growth is also bolstered by the overall growth in the electronics and industrial segments, which are principal end-applications for temperature sensing technologies. In 2023, Eurostat data indicated a 3.2% increase in the production of electronic components and boards in the European Union. This increase in production is an indicator of an increasing need for thermal management and process control solutions that are critical to guaranteeing the quality and reliability of these components, which in turn is driving the demand for advanced optical temperature sensors.

Application Segment Analysis

The consumer electronics market is poised to dominate the global market through 2035, driven by the sheer volume of devices being manufactured and the increasing number of optical sensors on each device. From the ambient light and proximity sensors on every smartphone to the advanced camera systems and biometric sensors used in facial recognition technology, optical sensing is the backbone of the consumer electronics experience today. In January 2024, Samsung introduced its latest ISOCELL Vizion 931 global shutter image sensor, which is aimed at uses such as iris recognition and gesture recognition in next-generation robotics and XR devices. The segment leadership is also being driven by the spectacular growth of the wearables market and growing consumer interest in personal health and wellness monitoring.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Sensor Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Sensing Market - Regional Analysis

APAC Market Insights

Asia Pacific optical sensing market is anticipated to hold a dominant 42% market share during the forecast period. This is driven by the region's rising electronics manufacturing hub, rapid industrialization, and widespread use of automation technology. China, Japan, and South Korea's huge production capacities make APAC the leading consumer and producer of optical sensing components. According to World Bank statistics in 2023, the East Asia & Pacific high-technology exports represented 33% of its total manufactured exports, demonstrating the region's focus on cutting-edge technology.

China market is experiencing significant expansion, fueled by a strategic national focus on robotics and smart manufacturing. China's fast-expanding automation rate is creating enormous demand for optical sensors for industrial robots and other machines. The International Federation of Robotics (IFR) during the first half of 2024 reported that China's national industrial robot production increased by a record 17% year-on-year, the rate of expansion that is most fueling the demand for optical sensing components.

India optical sensing market is growing at a rapid rate with the government policies, including Make in India, which are geared towards promoting local manufacturing of electronic hardware. The push in policies is leading to a steep rise in the manufacture and export of electronic items based on optical sensors for various applications. In the financial year 2023-2024, data published by India's Ministry of Commerce and Industry indicated that exports of Indian electronics products rose by approximately 6%, a clear indication of the increasing domestic manufacturing base for these critical technologies.

North America Market Insights

North America is expected to achieve a CAGR of 10% by 2035 on account of its technological superiority and extensive investment in rapidly growing sectors such as aerospace, healthcare, and the automotive industry. The region has a strong research and development infrastructure with a good combination of established firms and start-up companies continuously developing and innovating optical sensing technology. The innovative environment, complemented by high demand driven from an industrialized base, ensures that companies in North America witness stable growth.

The U.S. industry is garnering stable growth, with stable government backing for strategic technology industries and a robust domestic production base. One tangible indicator of such industrial growth, figures released by the U.S. Bureau of Labor Statistics indicated a 2.6% increase in employment in the production of semiconductors and other electronic devices in 2023. Such job growth is an indicator of higher manufacturing and demand for the advanced electronic devices that rely heavily on optical sensors for a wide range of applications.

Canada optical sensing market is leading the charge for innovation, particularly in high-performance, niche applications in challenging environments. One example of this expertise is the May 2025 introduction of the Ontario-based Voyis company's Deep Vision Optics. This cutting-edge optical solution is designed to correct for distortion in underwater imaging, a critical technology for subsea inspection and mapping. This focus on specialist, high-margin solutions is propelling Canada's growing share of the global market.

Europe Market Insights

Europe is expected to drive significant expansion between 2026 and 2035. This growth is anticipated to be powered by its robust industrial foundation and a widespread commitment across the continent to Industry 4.0 and automation. In turn, demand for optical sensors is closely tied to the health of the region's manufacturing base, a big user of these technologies for process control, quality assurance, and robotics. In 2023, Eurostat data recorded a 3.2% increase in the EU's annual production of electronic components and boards, a healthy indicator of the underlying demand for optical sensing components.

Germany is another considerable sector in Europe, and its leading automotive and capital goods industries generate high demand for advanced optical sensors. Industrial production in Germany's capital goods sector saw a positive trend in the first half of 2024, with the Federal Statistical Office reporting a 1.8% increase. This is considered favorable news for the sector. This segment, including machinery and equipment, is a big end-user of optical sensors for automation and quality control, a sign that there is a trend up in the use of these important technologies in Germany's industrial powerhouse.

The UK market is being shaped by strategic government investment in high-technology sectors and a high research and development focus. In April 2025, the UK Space Agency issued a procurement for a new national optical tracking station network, a move that will generate high demand for advanced optical sensing systems to advance the sovereignty of the nation's space capabilities. This is supported by a broader trend of increasing R&D investment, with Office for National Statistics data showing an 8.2% increase in R&D spend by UK manufacturing firms in 2023.

Key Optical Sensing Market Players:

- ams OSRAM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Texas Instruments

- STMicroelectronics

- Infineon Technologies AG

- Robert Bosch GmbH

- Telstra

- Infosys Limited

- ViTrox Corporation Berhad

- Samsung Electronics

- TE Connectivity

- Broadcom Inc.

The optical sensing market is highly competitive with extensive players ranging from niche photonics players to global semiconductor players. Some of the major players in the market include ams OSRAM, Honeywell, STMicroelectronics, Sony, and Hamamatsu Photonics. These companies are fighting hard on various fronts, like technological innovation in sensor performance, miniaturization for new applications, energy efficiency, and integration of AI and machine learning capabilities to create more intelligent and autonomous sensing solutions.

One of the most significant advancements was when AT Sensors introduced a new high-performance laser module for its modular 3D sensor series in March 2025. This laser was developed for high-speed applications or those requiring a large working distance, such as inspecting road surfaces, rails, or extrusion processes. In a market where size, performance, and price are crucial, the ability to deliver such an improvement is a differentiator and a strong indicator of the race to define the future of optical sensing.

Here are some leading companies in the optical sensing market:

Recent Developments

- In August 2025, Northern Gritstone announced a £4 million seed round investment in an optical sensor startup, PhovIR, along with SCVC. PhovIR uses its NIR optical sensor technology to identify optical fingerprints of solids, liquids and gases, in a portable devices.

- In September 2024, Renesas Electronics Corporation expanded its R-Car family with new System-on-Chips (SoCs), the R-Car V4M series, for entry-level Advanced Driver Assistance Systems (ADAS). The new devices deliver robust AI processing and are designed for applications like front smart cameras, surround-view systems, and automatic parking.

- Report ID: 3253

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Sensing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.