Optical Preclinical Imaging Market Outlook:

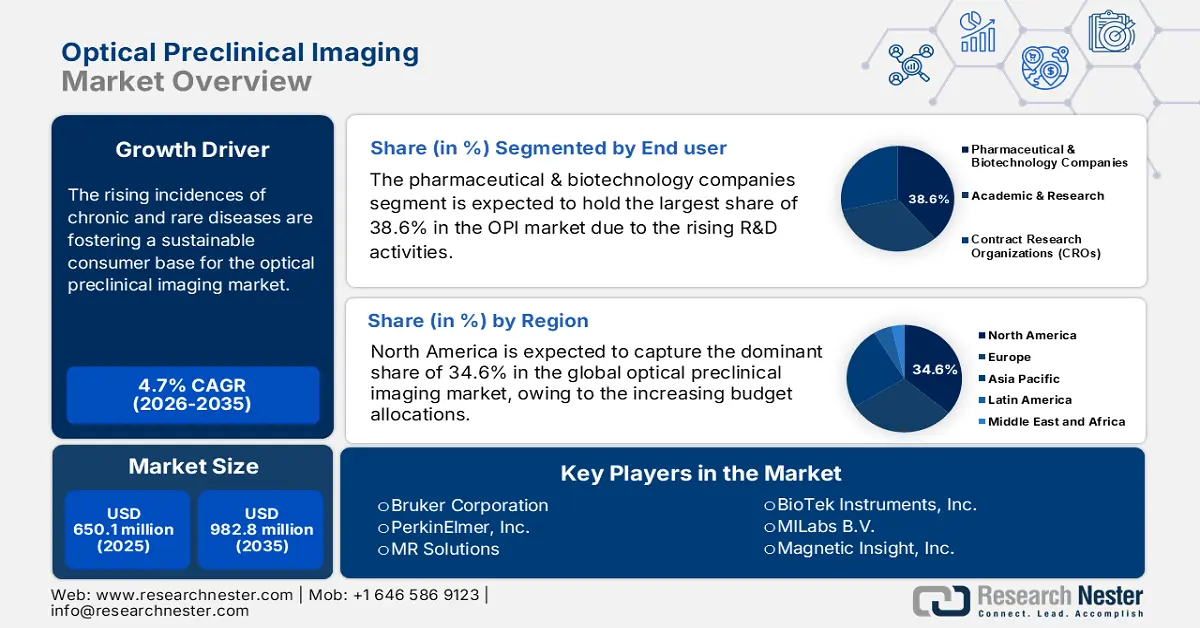

Optical Preclinical Imaging Market size was over USD 650.1 million in 2025 and is estimated to reach USD 982.8 million by the end of 2035, expanding at a CAGR of 4.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of optical preclinical imaging is assessed at USD 680.6 million.

The rising incidences of chronic and rare diseases are fostering a sustainable consumer base for the market. Testifying to the continuous amplification of the burden, the NLM predicted the cost of chronic ailments to surpass $47 trillion worldwide by 2030. Besides, the underlying comorbidities, such as a sedentary lifestyle and aging, are propelling the volume of this population. As evidence, a 2024 NLM article exposed that 50.0% of preventable deaths caused by cancer, chronic respiratory diseases, type 2 diabetes, and cardiovascular disease (CVD) in the U.S. are highly originate to physical inactivity, poor nutrition, tobacco use, and excessive alcohol use. This evidently indicates the urgent need to manage risk factors and, hence, fuel the market.

Despite the growing demand for precision diagnosis or treatment prognosis, the procurement and integration of tools related to the market is still expensive for consumers, including academic and government settings. The heightening cost of sourced materials and budget overflow in instrument production often translates to a notable rise in the payers' pricing, causing disparity between both service providers and patients in need. Thus, the sector is currently focusing on the development of value-based, cost-efficient tools to enhance affordability. In this regard, the University of Strathclyde published a thesis paper in 2024, identifying a portable AI-enhanced fluorescence microscope, built on a webcam and the NVIDIA Jetson Nano (NJN), which delivers real-time analysis functionality while costing only $400.

Key Optical Preclinical Imaging Market Insights Summary:

Regional Highlights:

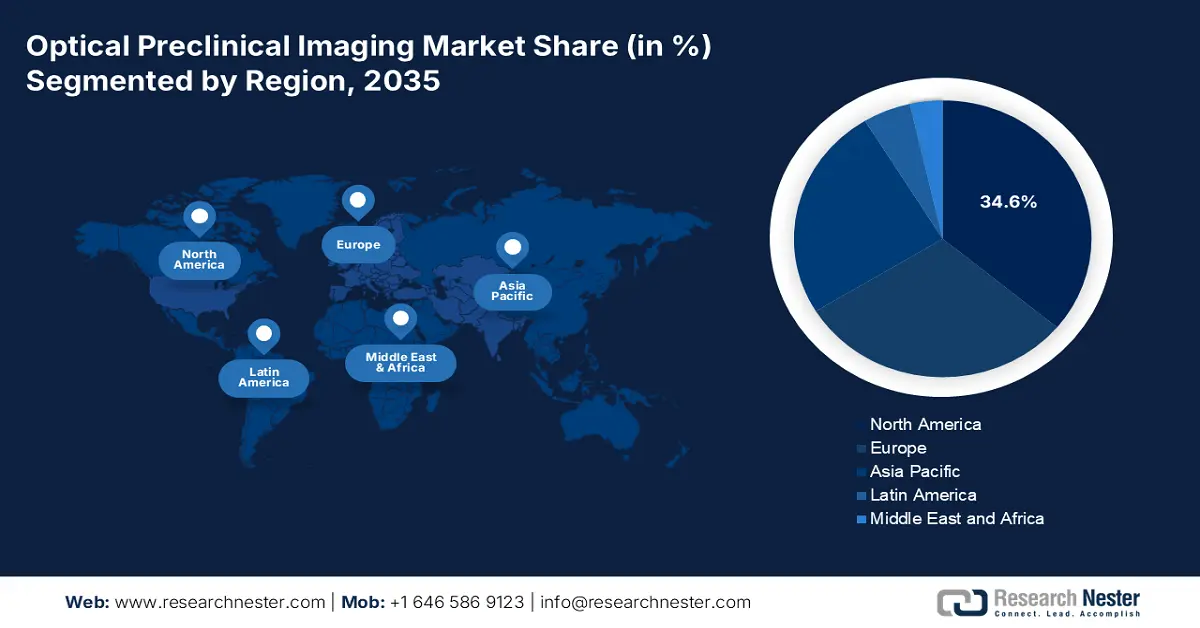

- North America is expected to secure a 34.6% share by 2035 in the optical preclinical imaging market, attributable to increasing federal healthcare budgets and the rising prevalence of chronic diseases.

- Asia Pacific is projected to emerge as the fastest-growing region by 2035, supported by strong government initiatives, expanding healthcare R&D investments, and escalating demand for non-invasive diagnostic technologies.

Segment Insights:

- The pharmaceutical & biotechnology companies segment is projected to command a 38.6% share by 2035 in the optical preclinical imaging market, bolstered by rising R&D activities aimed at accelerating drug discovery and strengthening the predictive accuracy of preclinical models.

- The in vivo imaging segment is set to capture a 35.8% share by 2035, reinforced by expanding government investor support for advanced imaging applications across long-term R&D workflows.

Key Growth Trends:

- Regulatory push for standardization

- Expansion of CRO and CDMO services

Major Challenges:

- High operational and installation costs

- Technological limitations and lack of competency

Key Players: Bruker Corporation, PerkinElmer, Inc., MR Solutions, BioTek Instruments, Inc., MILabs B.V., Magnetic Insight, Inc., MBF Bioscience, Mediso Ltd., Andor Technology (Oxford Instruments), Applied Spectral Imaging, Karl Storz SE & Co. KG, LI-COR Biosciences, Inc., Endress+Hauser (Analytik Jena US LLC), Vieworks Co., Ltd., Vilber Smart Imaging Ltd., Nanoco Technologies Ltd., Photon etc.

Global Optical Preclinical Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 650.1 million

- 2026 Market Size: USD 680.6 million

- Projected Market Size: USD 982.8 million by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 14 August, 2025

Optical Preclinical Imaging Market - Growth Drivers and Challenges

Growth Drivers

-

Regulatory push for standardization: The growing focus on the 3Rs, including Replacement, Reduction, and Refinement, in animal testing supports the widespread adoption in the market. The ability to reduce the need for invasive evaluations makes this technology both compliance-friendly and efficient, attracting ethically conscious research organizations. Besides, a 2025 journal on the evolution of animal testing in drug development revealed that approximately 95% of animal-tested drugs failed to reach the industry in 2021. This is pushing pharma companies to adopt alternatives, such as optical preclinical imaging (OPI), that are clinically proven to deliver greater performance.

-

Expansion of CRO and CDMO services: The rapid growth of Contract Research Organizations (CROs) and Contract Development & Manufacturing Organizations (CDMOs) is creating a surge in scalable, cost-effective testing solutions. As evidence, the global formulation development outsourcing industry is predicted to account for USD 49.1 billion by 2037. Thus, the high-throughput capabilities of the commodities available in the market are increasingly adopted by such CROs to support the cohort of speedy drug discovery. This can be testified by the rising public-private partnerships (PPPs), particularly in North America and Asia Pacific, where India alone accounted for more than 250 PPP initiatives in 2024.

-

Government and institutional funding: The stability of capital influx is playing a crucial role in the continuous growth of the market. The financial backing provided by national research institutes and health departments, dedicated to extensive cancer and genetic research, is boosting the adoption of in vivo imaging tools. According to the 2024 findings collected from the American Association for Cancer Research (AACR), the global healthcare industry invested $80 billion in oncology R&D through clinical trials. Moreover, initiatives such as Horizon Europe and the Moonshot R&D Program of Japan are offering coverage for imaging infrastructure reinforcement in academic and contract research centers.

Historical Patient Pool Evolution and Market Implications

Trends in Historic Patient Pool Expansion

|

Category |

Metric / Trend |

Data / Statistics |

Remarks |

|

Global Deaths from Chronic Diseases |

Share of total global deaths due to chronic diseases (2010) |

67% |

Rising global burden of chronic illness |

|

Share of total global deaths due to chronic diseases (2019) |

74% |

+7% increase over the decade |

|

|

Cardiovascular Disease (CVD) |

Total CVD cases worldwide (2020) |

523 million cases |

Substantial growth in preclinical study demand |

|

Global deaths from CVD (2020) |

~19 million deaths |

Reflects 18.7% rise from 2010 |

|

|

U.S. Diabetes Prevalence |

Diabetes prevalence (2001-2004) |

10.30% |

Source: CDC/NCHS |

|

Diabetes prevalence (2017-2020) |

13.20% |

Indicative of growing metabolic disorder burden |

Source: NLM

Cultivation of Innovative Products and Progress in Research Cohorts

Recent Research Cohorts in Optical Preclinical Imaging

|

Cohort / Project Name |

Institution / Lead |

Timeframe |

Focus / Model |

|

Preclinical Imaging Consortium 2025 |

MD Anderson Cancer Center |

2025 |

Real-time metabolic imaging, retinoblastoma |

|

“Beyond the Surface”: Cardiometabolic Imaging |

National Health Research Institutes (Taiwan) |

2025 |

Cardiometabolic disease, 9.4T animal imaging |

|

SERB-CRG Optical Imaging Research |

BITS Pilani (India) |

2024-2027 |

Multimodal optical imaging, animal models |

|

Advanced Macular Degeneration Cohorts |

Shanghai Key Lab, Tsinghua Univ, UC Los Angeles, Queen’s Univ (Global) |

2022-2025 |

AI and optical imaging in retinal disease |

|

Stem Cell Imaging in Hematological Diseases |

Centre for Stem Cell Research, inStem Bengaluru |

2022-2023 |

Preclinical imaging in gene therapy, hematology |

Source: MD Anderson, NHRI Institute, BITS Pilani, NLM, and CSCR

Challenges

-

High operational and installation costs: The market requires integration and usage of sophisticated technologies, such as high-resolution cameras and specialized light sources, to fetch accurate images and analytical outcomes. This also requires a workforce of skilled personnel, which contributes to a continuous need for capital. As a result, smaller research laboratories and academic institutions often fail to procure these tools due to limited funding. Besides, the additional spending on maintenance, software updates, and consumables widens the economic disparity, restricting the expansion of this sector.

-

Technological limitations and lack of competency: The depth of tissue penetration of these techniques is limited to a certain level, which often imposes a loss of relevance in the market. This method of evaluation is mostly limited to surface or near-surface levels due to light scattering and absorption. This delineates its rate of utilization in studying deeper biological structures or organs in larger animal models. As a result, researchers may need to combine optical imaging with other modalities, increasing the complexity and budget of studies. This inherent constraint often shrinks the field of applications for this category.

Optical Preclinical Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 650.1 million |

|

Forecast Year Market Size (2035) |

USD 982.8 million |

|

Regional Scope |

|

Optical Preclinical Imaging Market Segmentation:

End user Segment Analysis

The pharmaceutical & biotechnology companies’ segment is expected to hold the largest share of 38.6% in the market by the end of 2035. This dominance is primarily attributable to the rising R&D activities worldwide with an aim to accelerate drug discovery and improve the predictive accuracy of preclinical models. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), in 2023, biopharmaceutical firms in the U.S. spent approximately $96 billion on R&D. Besides, public health funding to support early-stage drug development initiatives is also propelling the rate of OPI technology adoption to enhance research efficiency and outcomes.

Modality Segment Analysis

The in vivo imaging segment is poised to dominate the market with a 35.8% share in revenue generation during the analyzed tenure. The method's ability to offer a clear visualization of long-term R&D processes makes it a preferred choice for maintaining high throughput. This modality also consists of a continuous observational functionality that can track disease progression, drug efficacy, and biological responses seamlessly. This is making it indispensable for organizations involved in translational and drug discovery research. Government investors, such as the NIH and the European Commission, continue to support in vivo imaging through their respective funding and research programs, solidifying the segment's forefront position in this sector.

Application Segment Analysis

Oncology research is estimated to maintain its position as the largest source of revenue generation in the market over the assessed timeframe by acquiring a 32.7% share. The increasing cancer incidence and mortality are creating a sustainable demand for advanced preclinical tools to identify and monitor tumor biology and therapeutic responses at an early stage. Testifying to this, the GLOBOCAN reported 20 million and 9.7 million new and death cases of malignancy around the globe in 2022 alone. Moreover, the non-invasive tracking of tumor progression and metastasis in small animal models makes OPI technologies one of the most widely used tools in this medical discipline.

Our in-depth analysis of the optical preclinical imaging market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Modality |

|

|

Application |

|

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Preclinical Imaging Market - Regional Analysis

North America Market Insights

North America is expected to capture the dominant share of 34.6% in the global optical preclinical imaging market revenue by 2035. This position is consolidated by the increasing federal healthcare budgets and the growing prevalence of chronic diseases that necessitate advanced diagnostic tools. Evidencing the same, the Centers for Medicare & Medicaid Services (CMS) unveiled that the U.S. health care spending grew by 7.5% in 2023, reaching $4.9 trillion. Besides, testifying to the demography, the NLM reported that around 40% of deaths in the U.S. in 2022 were caused by heart disease and cancer. Moreover, the robust pharmaceutical R&D investments, coupled with the rapid expansion of personalized medicine initiatives, are accelerating growth in the region.

The U.S. is predicted to dominate the regional optical preclinical imaging market, which primarily benefits from its predominant captivity over the global biopharmaceutical research. As evidence, in 2022, the National Cancer Institute (NCI) allocated $6.8 billion toward cancer-related research projects, much of which supports imaging technologies used in preclinical oncology studies. In addition, a notable portion of the foreign-owned companies operating in the U.S. contributed $26 billion in R&D funding in the same year, underscoring the country’s appeal as a hub for a large consumer base in this category. Furthermore, these investments, combined with its amplifying patient pool, continue to propel the deployment volume of OPI technologies.

Canada is attaining traction in the optical preclinical imaging market, backed by targeted initiatives to accelerate the enhancement of access to elderly and neurological care. This can be exemplified by the commitment of investing $44.8 million, made by the Government of Canada in 2025, in partnership with local health organizations. This allocation was specifically dedicated to analyzing and maintaining the health of brain aging, which underscores the country's focus on early detection and diagnostics. Besides, the Canadian Institutes of Health Research (CIHR) provides financial backing for over 15.0 thousand researchers working across the nation on preclinical studies, leveraging the surge for optical imaging tools.

APAC Market Insights

Asia Pacific is emerging as the fastest-growing region in the global optical preclinical imaging market by the end of 2035. The region's propagation in this sector is underpinned by strong government support, healthcare R&D investments, and rising demand for non-invasive diagnostic technologies. Continuous expansion in the patient population is also a major stimulator behind the pace of progress in this landscape. Besides, technologically advanced countries, such as Japan and South Korea, are establishing a sustainable foundation for innovation by prioritizing funding for advanced imaging under national health and innovation policies. Further, Malaysia and India have also scaled their respective capital influx to expand access to imaging in translational research settings.

China is establishing a strong foundation of regional leadership in the optical preclinical imaging market on account of its exceptional capacity in pharma production and innovation. This can be evidenced by the global dominance over medical innovations of the country, where the country accounted for 41,834 (22.53% of total) clinical trials between 2022 and 2024, as per the WHO report. Further, testifying to the manufacturing potential, the Ministry of Industry and Information Technology (MIIT) unveiled that China was home to more than 10.0 thousand major pharmaceutical industrial enterprises till 2023. It also highlighted that the annual average R&D expenditure of its domestic pharma industry exceeded 20% from 2020.

India is emerging as the growth engine for the APAC optical preclinical imaging market with an enlarging patient pool, expanding pharma industry, and government investments in innovation. Evidencing the same, the India Brand Equity Foundation (IBEF) calculated the industry value of pharmaceuticals in the country to reach USD 130 billion by 2030. For instance, a team of developers in the Bhabha Atomic Research Centre created an easy-to-use, compact, and portable optical fluorescence imaging instrument, TuBerculoScope, for rapid detection of Mycobacterium tuberculosis. Priced at around ~ Rs. 1 lakh as compared to the fluorescence microscope costing over Rs. 50 lakh, the device is highly suitable for resource-limited rural health services.

Country-wise Government Provinces

|

Country |

Allocated Amount |

Purpose |

Year |

|

Australia |

$1.6 million |

Funding for the National Imaging Facility to advance medical research |

2024 |

|

South Korea |

KRW 1 trillion |

Backing to support escalation in AI-semiconductor, advanced biotechnology, and quantum technology |

2025 |

|

Malaysia |

RM 31.0 million |

Research and Development Allocation for the conduct of health research at the MOH |

2023 |

Source: National Imaging Facility, Ministry of Science and ICT, and MOH Malaysia

Europe Market Insights

Europe is expected to maintain its position as the second-largest shareholder in the optical preclinical imaging market during the timeline between 2026 and 2035. The region's steady growth is attributable to the robust government healthcare funding, increasing investments and participation in medical research, and a growing patient base requiring advanced diagnostic tools. Leading economies, such as the UK, Germany, and France, testify to the consistent capital influx through their respective budget allocations toward preclinical imaging. For instance, in 2024, the French Ministry of Higher Education and Research sanctioned a €80 million grant to promote nationwide research infrastructure in biology and health.

The UK is augmenting the optical preclinical imaging market steadily, which is backed by the immense financial support from the National Health Service (NHS) and the Association of the British Pharmaceutical Industry (ABPI). Besides, public healthcare modernization initiatives reflect a national prioritization of precision diagnostics. Furthermore, the rising count of chronic disease incidence, including cancer and neurodegenerative disorders, is also fueling demand for early diagnostic solutions. As evidence, till 2022, approximately 50.0% of the total population in the UK were identified to have a long-term health problem, where the four most common chronic conditions were allergy, hypertension, low back disorder, and depression.

Germany plays a pivotal role in propelling the pace of expansion of the Europe optical preclinical imaging market. The country's robust healthcare system, which emphasizes early diagnosis and intervention with personalized medicine, is a major growth factor in this landscape. Additionally, such an infrastructure is highly affiliated with Federal funding, clinical innovation, and domestic production. Such a progressive environment of the country can be exemplified by the nation's position as the 6th highest clinical trial applicant in the world between 2023 and 2024, as per the WHO International Clinical Trials Registry Platform (ICTRP). Moreover, the reinforcement of advanced technologies in healthcare, being a national health priority, makes the nation an attractive option for global pioneers in this sector to participate.

Country-wise Government Financial Backing (2024)

|

Origin |

Allocation Amount (€) |

Puspose |

|

UK |

326 million |

Fasten the pace of R&D in biotechnology and biological sciences |

|

France |

9.2 million |

Rejuvenate and add existing and new technologies in biological imaging |

|

Italy |

50.0-80,803.1 thousand per project |

Integrate advances in genomic sciences into healthcare |

Source: UK RI, BIOGENI, and NLM

Key Optical Preclinical Imaging Market Players:

- Bruker Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PerkinElmer, Inc.

- MR Solutions

- BioTek Instruments, Inc.

- MILabs B.V.

- Magnetic Insight, Inc.

- MBF Bioscience

- Mediso Ltd.

- Andor Technology (Oxford Instruments)

- Applied Spectral Imaging

- Karl Storz SE & Co. KG

- LI-COR Biosciences, Inc.

- Endress+Hauser (Analytik Jena US LLC)

- Vieworks Co., Ltd.

- Vilber Smart Imaging Ltd.

- Nanoco Technologies Ltd.

- Photon etc.

The current dynamics of the optical preclinical imaging market are changing with the growing trend of leveraging technological capabilities and product differentiation. As evidence, in 2024, Bruker Corporation launched the OptoVolt module for its Ultima multiphoton microscope platform, delivering imaging speed surpassing 1000 frames per second. Its fluorescent voltage indicators help researchers capture millisecond-scale neural structures while offering higher temporal resolution, in comparison to conventional calcium-based imaging.

The cohort of such innovators include:

Recent Developments

- In February 2025, Bruker announces the launch of a high-performance 3D X-ray microscope (XRM), the new X4 POSEIDON, featuring micro-Computed Tomography (microCT). This innovative benchtop XRM system offers advanced capabilities comparable to larger, floor-standing systems.

- In September 2024, Photon introduced the newest instrument, the LightIR system, designed for preclinical fluorescence imaging and clinical research. It is an open, near-infrared (NIR) fluorescence imaging device that offers exceptional performance for Fluorescence Guided Surgery (FGS) and small animal imaging.

- Report ID: 8000

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Preclinical Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.