Opioid Antagonist Market Outlook:

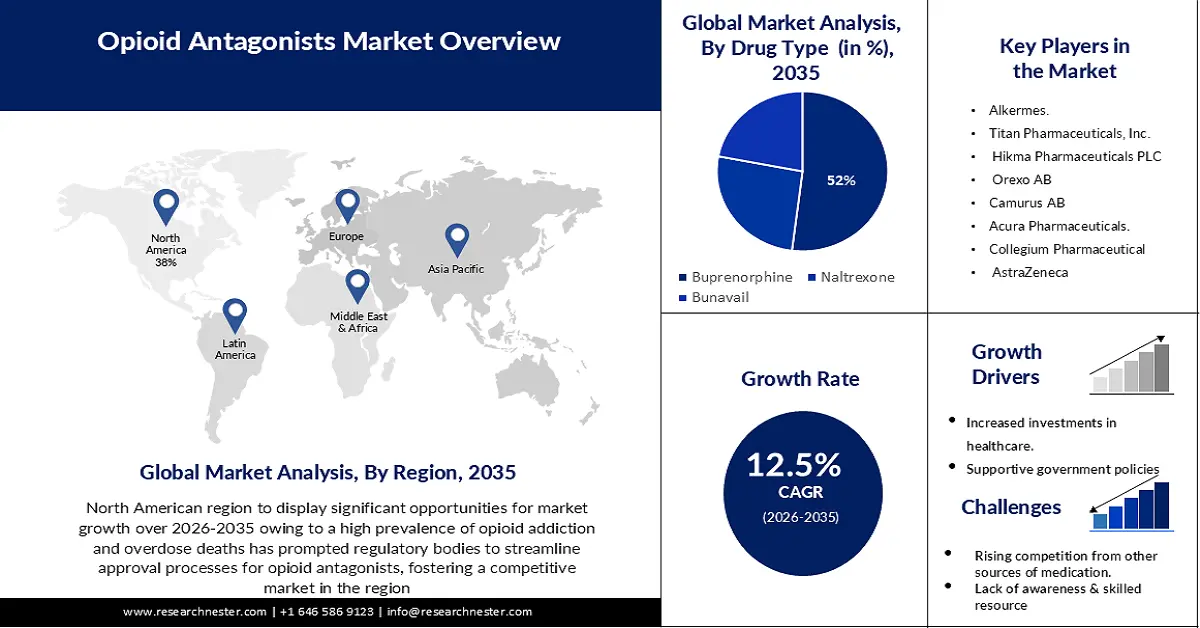

Opioid Antagonist Market size was over USD 3.69 billion in 2025 and is poised to exceed USD 11.98 billion by 2035, growing at over 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of opioid antagonist is evaluated at USD 4.11 billion.

Ongoing research and development efforts within the pharmaceutical industry have been dedicated to enhancing the usability and effectiveness of opioid antagonists, particularly in addressing opioid overdoses. One notable advancement involves the evolution of formulations and delivery methods, exemplified by the creation of nasal sprays and auto-injectors specifically designed for naloxone administration. Estimates indicate that the rate of naloxone administrations rose by almost 75%, from 573 to 1004 per 100,000 EMS incidents. This increase is consistent with a 79% rise in the age-adjusted opioid death rate.

Further, The expansion of opioid antagonist applications beyond immediate overdose reversal has significantly impacted market growth. Naltrexone, originally recognized for its role in blocking opioid receptors, has diversified its application, particularly in addressing addiction. Its effectiveness in preventing relapse among individuals grappling with opioid or alcohol dependence has broadened its market potential. Injectable naltrexone was used in 13% of medical programs for Alcohol Use Disorder Treatment , and 3% of programs for opioid use disorder, according to Research Nester Analysts' analysis.

Key Opioid Antagonist Market Insights Summary:

Regional Highlights:

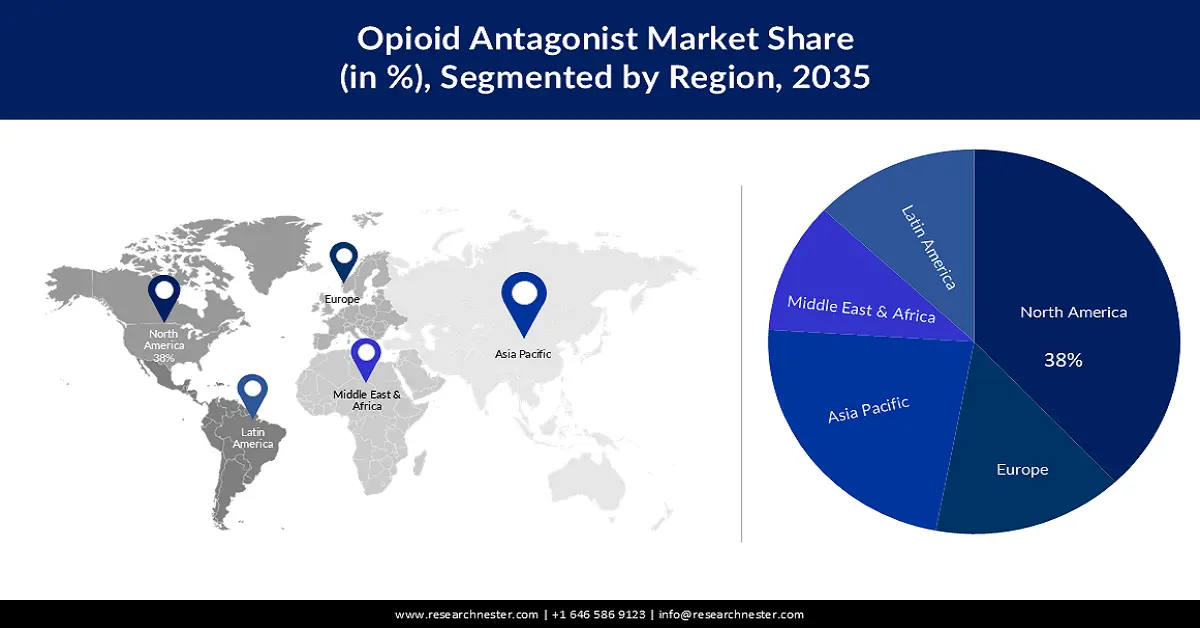

- By 2035, North America is expected to dominate with a 38% revenue share in the opioid antagonist market, attributed to streamlined regulatory approvals and expanded access to naloxone through government-led distribution initiatives.

- Asia Pacific is projected to secure a significant share by 2035, sustained by varying country-level opioid misuse patterns and expanding naloxone adoption despite infrastructural and awareness disparities.

Segment Insights:

- The buprenorphine segment of the opioid antagonist market is set to capture a 52% share by 2035, driven by its strong clinical profile, low abuse potential, and broad formulary support.

- The hospital segment is anticipated to achieve notable share by 2035, underpinned by rising cases of opium and alcohol dependency requiring specialized clinical intervention.

Key Growth Trends:

- Increased Advancement in Formulation and Delivery

- Public Health Initiatives

Major Challenges:

- Affordability & Accessibility

- Regulatory barriers leading to hindrances in Formulation.

Key Players: Merck & Co., Inc., Siemens Healthcare GmbH, Boston Scientific Corporation, Johnson & Johnson Services, Inc., Valenta Pharmaceuticals Company, Novartis AG, Sanofi-Aventis Groupe, AbbVie Inc., Elli Lilly and Company.

Global Opioid Antagonist Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.69 billion

- 2026 Market Size: USD 4.11 billion

- Projected Market Size: USD 11.98 billion by 2035

- Growth Forecasts: 12.5%

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Australia, South Korea

Last updated on : 19 November, 2025

Opioid Antagonist Market - Growth Drivers and Challenges

Growth Drivers

- Increased Advancement in Formulation and Delivery - Ongoing research and development have led to advancements in formulations and delivery methods for opioid antagonists. For instance, the development of nasal sprays and auto-injectors for naloxone has made administration easier, especially for non-medical personnel.

- Public Health Initiatives - Various public health initiatives, including harm reduction strategies, needle exchange programs, and addiction treatment centers, have contributed to the demand for opioid antagonists as a crucial component of addressing the opioid crisis. To effectively combat the opioid epidemic, public health policies must address both the supply and demand for opioids. For example, an increase in the number of prescriptions for opioid analgesics is linked to an increase in the number of fatal overdoses. On the other hand, increased availability of opioid antagonist therapy is necessary to reduce the demands resulting from opioid use disorders. Oregon's multimodal strategies for addressing opioid abuse and misuse resulted in a 20% decrease in opioid prescriptions as well as a 30% drop in the rate of opioid overdose deaths.

- Increased Awareness and Education - Efforts to raise awareness about opioid overdose risks and the availability of antagonist drugs have driven market growth. Education campaigns targeting both healthcare professionals and the public emphasize the importance of timely intervention using these antagonists.

Challenges

- Affordability & Accessibility- One of the primary challenges is ensuring widespread access to opioid antagonists. Affordability and availability issues can limit accessibility, particularly in regions with limited healthcare resources or areas where these drugs may not be readily accessible.

- Regulatory barriers leading to hindrances in Formulation.

- Chance of delayed administration on encounter with highly potent opioid leading to obstruction in achieving successful outcome in some cases.

Opioid Antagonist Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 3.69 billion |

|

Forecast Year Market Size (2035) |

USD 11.98 billion |

|

Regional Scope |

|

Opioid Antagonist Market Segmentation:

Drug Type Segment Analysis

The buprenorphine segment is estimated to hold 52% share of the global opioid antagonist market by 2035. Primarily owing to its excellent clinical profile. In 2020, an estimated 1.7 million individuals reported taking buprenorphine as directed by doctor. The drug has great efficiency in managing addiction, with low potential for abuse as well as relatively mild adverse effects and its favorable formulary coverage are some of the factors that can be attributed to the high adoption of this drug.

End User Segment Analysis

The hospital segment in the opioid antagonist market is anticipated to garner significant growth during the forecast period, owing to the increasing patient pool for opium and alcohol dependency. Moreover, the critical condition of the individual addicted to drugs, and the need for specific treatment is estimated to boost the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Drug Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Opioid Antagonist Market - Regional Analysis

North American Market Insights

North America industry is likely to dominate majority revenue share of 38% by 2035, due to high prevalence of opioid addiction and overdose deaths has prompted regulatory bodies to streamline approval processes for opioid antagonists, fostering a competitive market in the region.. The region has emerged as a significant producer of Naloxone, a primary antagonist used for reversing opioid overdoses which has become more accessible through governmental initiatives, community distribution programs, and increased awareness campaigns. The region's high prevalence of opioid addiction and overdose deaths has prompted regulatory bodies to streamline approval processes for opioid antagonists, fostering a competitive market landscape. Between 2020 and 2021, there was a more than 16% rise in the number of drug overdose deaths. Opioids accounted for more than 75% of the roughly 107,000 drug overdose deaths in 2021. Pharmaceutical companies have expanded research and development efforts, focusing on innovative formulations such as nasal sprays and auto-injectors to enhance ease of use in emergencies.

APAC Market Insights

Asia Pacific opioid antagonist market is slated to hold a significant revenue share during the forecast period. The region’s market reflects a diverse landscape shaped by varying degrees of opioid misuse and regulatory environments across countries. While countries like Australia and New Zealand have established robust programs promoting naloxone distribution to combat opioid overdoses, other nations within the region face challenges in acknowledging and addressing opioid abuse. Cultural stigma, limited healthcare infrastructure, and differing levels of awareness contribute to disparities in opioid antagonist adoption.

Opioid Antagonist Market Players:

- Indivior PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- •Regional Presence

- SWOT Analysis

- Alkermes.

- Titan Pharmaceuticals, Inc.

- Hikma Pharmaceuticals PLC

- Orexo AB

- Camurus AB

- Acura Pharmaceuticals.

- Collegium Pharmaceutical

- AstraZeneca

- Viatris Inc.

- Catalent, Inc

Recent Developments

- A commercial supply agreement has been signed by Harm Reduction Therapeutics, a 501(c)(3) non-profit pharmaceutical company whose mission is to prevent opioid overdose deaths by making affordable naloxone available to everyone, and Catalent, the global leader in enabling the development and supply of better treatments for patients. As per the agreement, Catalent will produce RiViveTM (3.0 mg) naloxone nasal spray from Harm Reduction Therapeutics for the urgent treatment of confirmed or suspected opioid overdoses.

- The U.S. Food and Drug Administration ("FDA") has approved Titan Pharmaceuticals, Inc.'s application for an Investigational New Drug ("IND") study of its subdermal formulation of nalmefene, an opioid antagonist, for up to six months or longer. The purpose of the formulation is to prevent relapse in adults with opioid use disorder ("OUD") after they have completed opioid detoxification.

- Report ID: 3179

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Opioid Antagonist Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.