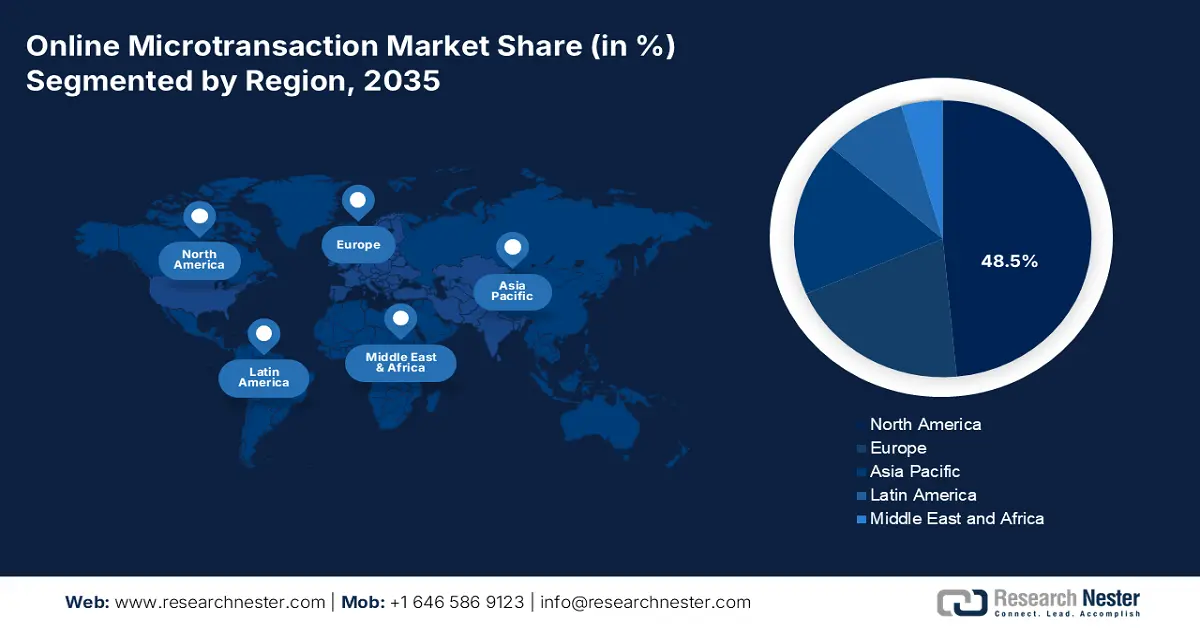

Online Microtransaction Market - Regional Analysis

North America Market Insights

North America is dominating the online microtransaction market and is expected to hold the revenue share of 48.5% by 2035. The market is driven by the technological infrastructure and high consumer disposable income. The growth is fueled by the deepening monetization within an established user base rather than new user acquisition. The key drivers include the dominance of premium console and PC gaming ecosystems, high smartphone penetration enabling mobile-first strategies, and advanced digital payment adoption. Primary trends involve a strategic focus on player lifetime value via personalized live service content, increased regulatory scrutiny on loot boxes and deceptive design patterns, and the expansion of cross-platform play that enhances the utility and value of virtual goods.

The online microtransaction market in the U.S. is navigating a shift from expansion to advanced monetization, with the personalization via first party data analytics becoming a core competitive differentiator. A dominant trend is the regulatory environment where the Federal Trade Commission actively enforces against the dark patterns and undisclosed loot box mechanics, directly shaping the ethical design standards. The dissolution of platform silos via cross-platform play and cloud gaming is increasing the permanence and value of virtual goods, encouraging spending. The Pew Research Center in November 2025 indicated that 16% of U.S. people are smartphone-only internet users, facilitating the impulse-driven purchasing essential to the market. This infrastructure, combined with the high per-user spending, makes the high-value microtransaction arena, forcing business models to prioritize retention and lifetime value over user acquisition.

Percentage of U.S. People Who Own a Smartphone by Age

|

Age |

Percentage |

|

18-29 |

97 |

|

30-49 |

96 |

|

50-64 |

90 |

|

65+ |

78 |

Source: Pew Research Center November 2025

Canada’s online microtransaction market exhibits robust growth driven by digital inclusivity and cultural diversity. A key trend is the move towards localization of content and monetization to serve its multilingual population, extending beyond translation to cultural relevance. The regulatory alignment with the international standards for consumer protection and privacy is increasingly shaping the marketplace fairness. The government policy plays a supportive role via the Canadian Radio-Television and Telecommunications Commission focus on universal broadband, expanding the reliable digital access necessary for market participation. The Government of Canada report in September 2025 has noted that 98% of the people are expected to connect to high-speed internet by 2026, which reflects a mature acceptance of microtransaction models.

APAC Market Insights

Asia Pacific is the fastest-growing online microtransaction market and is expected to grow at a CAGR of 8.8% during the forecast period 2026 to 2035. The market is driven by its massive digitally native population and the region’s pioneering role in mobile-first and free-to-play gaming. The unparalleled smartphone penetration, mainly in countries such as China and India, provides a ubiquitous platform for gaming and in-app spending. The integration of gaming into daily social life and the acceptance of virtual goods as valuable commodities are more pronounced than in Western markets. A key regional trend is the dominance of the gacha monetization model, a mechanic for obtaining the random virtual items that originated in Japan and has become highly refined across the region.

China’s online microtransaction market is the world’s largest, defined by its scale and advanced platform-driven ecosystems. Dominated by domestic giants Tencent and NetEase, growth is fueled by the deep integration of gaming with everyday digital life via super apps such as WeChat. The market is highly mobile, first with a vast engaged user base across diverse demographics. A defining characteristic is its operation under a proactive and strict regulatory framework focused on youth protection and content oversight. For instance, the National Press and Publication Administration (NPPA) mandates playtime and spending limits for minors. The report from the People’s Republic of China in December 2025 indicates that the number of digital consumers in China reached 958 million in the first half of 2025. This data highlights the growing role of digital spending in China’s overall consumption.

India represents the Asia Pacific region’s most dynamic high-growth online microtransaction market, primarily fueled by an unprecedented mobile gaming revolution. The catalyst for this expansion is the widespread availability of affordable smartphones and some of the world’s cheapest mobile data that has brought hundreds of millions of new users online. The market is driven by a young, digitally native population with a strong preference for casual, hyper casual, and real money gaming formats, with cricket-themed games being mainly potent for monetization. The data from the IBEF in November 2024 shows that in-app purchases are the fastest-growing revenue stream in India’s gaming sector, with 41% YoY in FY2024 and projected to grow at a 44% CAGR through FY2029. This growth is attracting significant investment and facing evolving regulatory scrutiny concerning real-money gaming and user data protection.

India Gaming Market & Online Microtransaction Alignment (2024-2029)

|

Category |

Data Point |

Relevance to Online Microtransaction Market |

|

Total Gaming Market Size |

USD 3.8 billion in FY24 |

Establishes overall revenue base from which microtransactions are expanding |

|

Market Growth |

23% YoY growth in FY24 |

Indicates strong underlying demand for digital gaming spend |

|

Projected Market Size |

> USD 9.2 billion by FY29 |

Expanding addressable market for in-app purchase monetization |

|

Fastest-Growing Revenue Segment |

In-app purchases grew 41% YoY in FY24 |

Direct evidence of accelerating microtransaction adoption |

|

In-App Purchase Outlook |

44% CAGR (FY24–FY29); projected to surpass RMG |

Signals structural shift toward microtransaction-led revenues |

|

Largest Revenue Contributor (FY24) |

Real-money gaming (USD 2.4 billion) |

Benchmark for upcoming crossover with in-app purchases |

|

Game Type Growth |

Mid-core games +53% YoY; casual games +10% |

These segments primarily rely on microtransactions |

|

Paying User Base |

25% of 590 million gamers |

Indicates scalable volume for low-value, high-frequency transactions |

|

Demographic Reach |

44% women; 66% non-metro users |

Broad, diversified microtransaction demand base |

|

Regulatory Context |

28% GST on online gaming |

Highlights resilience of non-RMG microtransactions under tax pressure |

Source: IBEF November 2024

Europe Market Insights

Europe’s online microtransaction market is a diverse segment of the global digital gaming industry. The key drivers of the market are high levels of internet and smartphone penetration across the continent, coupled with a large and engaged gamer population across all age groups. Growth is primarily sustained by the global industry-wide shift towards live service games, which rely on ongoing player engagement and recurrent spending for virtual items, battle passes, and downloadable content. However, the market operates under a distinct regulatory landscape that shapes its operation. The key trends include the increasing scrutiny of loot box mechanics under the national gambling regulations, the need for clear consumer protection regarding in-game purchases, and the push for transparency in odds disclosure. Further, Europe’s complex data privacy regulations under the General Data Protection Regulation significantly impact how companies collect and use player data for personalized monetization.

The UK’s online microtransaction market is supported by a digitally engaged population and is one of Europe’s largest. The primary driver is the country’s mature gaming ecosystem featuring a major development hub and a high-spending player base. The online microtransaction market is heavily influenced by the widespread adoption of free-to-play live service models on the mobile and console platforms, which generate recurring revenue streams. The NLM study in November 2024 has indicated that 39% of 11 to 16-year-olds were aware of and used in-game items such as skins and loot boxes, which directly reflects the participation in microtransaction-based monetization models. The skins, loot boxes, and similar virtual items are core microtransaction formats mainly in the online gaming ecosystem. Their use indicates early adoption and the normalization of the small-value digital purchases that expand the long-term user base and lifetime value potential for platforms.

Germany is a vital online microtransaction market in Europe and is defined by a large tech-savvy population and a strong economy. The growth is fueled by a significant PC and console gaming culture alongside rapidly increasing mobile game penetration. The online microtransaction market evolution is notable, having matured from historical regulatory constraints on certain game content. The current growth is driven by the normalization of in-game purchases across all age groups and the success of major international live service titles. The country’s regulators maintain a focus on consumer protection and youth media literacy. Underpinning this activity is solid household expenditure on entertainment. The household expenditure on leisure entertainment and culture demonstrates the substantial budget allocation to discretionary digital entertainment, where the microtransactions compete.