Online Gaming Market Outlook:

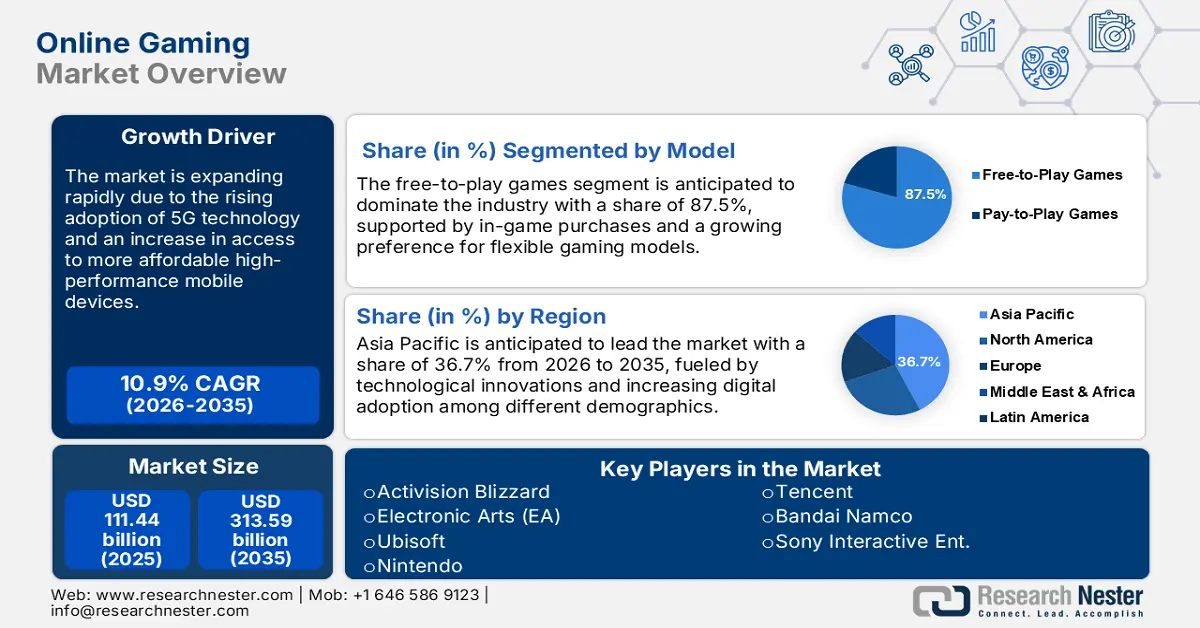

Online Gaming Market size was valued at USD 111.44 billion in 2025 and is expected to reach USD 313.59 billion by 2035, expanding at around 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of online gaming is evaluated at USD 122.37 billion.

The market is rising rapidly with the advancement in mobile technology and internet facilities. The increasing use of mobile technologies and improved internet connectivity has opened up lucrative opportunities for gamers across various age groups. With everyday expenses rising, players demand more immersive gaming experiences online on their day-to-day gadgets. Meanwhile, developers are focused on free-to-play models, which allow players not to pay out upfront and later monetize on in-game purchases.

Many governments across the globe have been contributing to the market growth through various campaigns and collaborations. For instance, the European Union has established programs to popularize eSports and digital skills among gamers that could drive the future of the market in the region. Second, the U.S. Department of Education, in September 2023, introduced the ED Games Expo, displaying the potential of education-based games and supporting game developers who focus on the same. All such initiatives are steadily broadening the horizons of gaming from just mere entertainment to impacting what games are going to be developed in the future.

Key Online Gaming Market Insights Summary:

Regional Highlights:

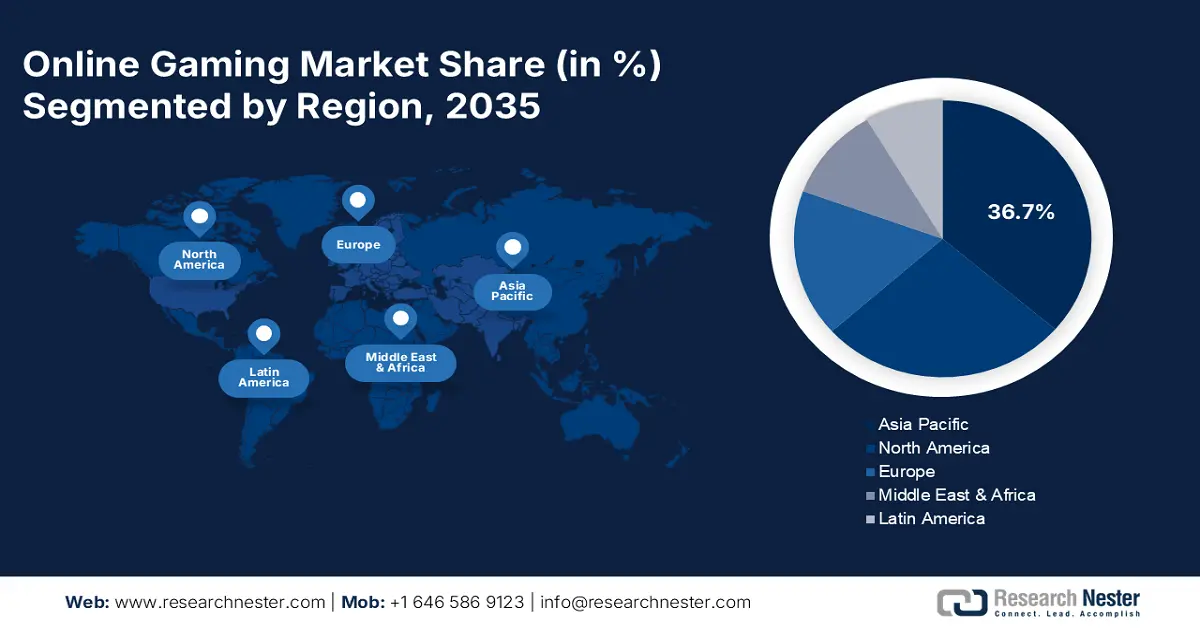

- Asia Pacific dominates the Online Gaming Market with a 36.7% share, propelled by strong infrastructures for both mobile and PC gaming, driving robust growth through 2026–2035.

- North America’s online gaming market is set for significant growth by 2035, fueled by high-speed infrastructure and significant online gaming activities.

Segment Insights:

- The Free-to-Play Games segment is expected to dominate the Online Gaming Market with over 87.5% share by 2035, driven by revenue generation through in-game purchases and its scalable model.

- The Live Streaming segment is poised for substantial growth from 2026 to 2035, driven by the rising popularity of eSports and increased brand investments in streaming platforms.

Key Growth Trends:

- Rising mobile gaming and social interaction

- Advancements in cloud gaming

Major Challenges:

- Government regulatory backlash

- Cybersecurity issues

- Key Players: Tencent, Microsoft, Activision Blizzard, Electronic Arts (EA), and Ubisoft.

Global Online Gaming Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 111.44 billion

- 2026 Market Size: USD 122.37 billion

- Projected Market Size: USD 313.59 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Online Gaming Market Growth Drivers and Challenges:

Growth Drivers

- Rising mobile gaming and social interaction: Rising demand for different types of online games is a primary growth factor for the online gaming industry. Expansion within this segment continued to be tipped by high penetration of smart handsets and high-speed internet, especially in developing online gaming markets. Advanced and immersive mobile games remained the focus of game developers. In addition, social interaction has made online gaming the medium primarily for this purpose. Multi-player games and eSports tournaments gain millions of viewers. Currently, competitive gaming has progressed to the first degree where its influence saw events including the League of Legends World Championship which took place in August 2023. Hence, it further gives strength to community-driven games and platforms such as Twitch and YouTube Gaming.

- Advancements in cloud gaming: The appearance of cloud-based gaming platforms minimized the hardware's limitations on gamers. For instance, games in this category do not need the purchase of an expensive console or computer. Microsoft launched Xbox Cloud Gaming in November 2020, which best explains the practice. This factor opened access and enlarged the players' user base worldwide.

Challenges

- Government regulatory backlash: Major gaming region governments are implementing more stringent regulations. For instance, the new policies in China concerning the availability of hours to play games for minors affect game developers. In March 2022, the government in China launched regulatory mechanisms to control the rising rate of gaming addiction. Such a new regulation may influence game development and revenue streams, mainly for games targeted toward the youth market.

- Cybersecurity issues: The rise of online gaming only means the rise of cybersecurity issues. In March 2023, the United States Federal Trade Commission publicized a report regarding the alarming number of cyberattacks taking place within gaming platforms, particularly in data breaches and in-game frauds. Of course, more transactions take place within the game, making a secure payment system and personal information, among many other issues, still crucial to the developers.

Online Gaming Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 111.44 billion |

|

Forecast Year Market Size (2035) |

USD 313.59 billion |

|

Regional Scope |

|

Online Gaming Market Segmentation:

Model (Free-to-Play Games, Pay-to-Play Games)

Free-to-play or F2P segment is anticipated to capture over 87.5% online gaming market share by 2035. This business model by developers offers the game at no upfront cost while generating revenue from in-game purchases or advertisements, attracting a broad demographic, including casual and hardcore players. Some popular examples of the model include Fortnite and League of Legends. In January 2024, in-game purchases from Fortnite exceeded USD 1 billion, a clear indication of how this model works, enabling gamers to maintain high levels of engagement and profitability. In comparison, the F2P model allows for the possibility of scalability, hence enabling game developers to launch regular updates welcoming and retaining customers for more extended periods.

Streaming (Live Streaming, On-Demand Streaming)

Live-streaming segment in the online gaming market is expected to record significant growth rate from 2026 to 2035. Gaming services such as Twitch and YouTube are evolving the game into a spectator sport that attracts millions of viewers to watch live gaming events and streams. eSports and other features, including real-time chat donations have further made live streaming popular. For example, in March 2023, the Call of Duty World Championship had reached more than 534.2K hours watched through live streaming. With more streamers building loyal communities, brands and advertisers are also investing in these platforms, which are further stimulating market growth.

Our in-depth analysis of the global market includes the following segments:

|

Model |

|

|

Platform |

|

|

Streaming |

|

|

Gamer Type |

|

|

Revenue Stream |

|

|

Genre |

|

|

Demographic |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Gaming Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific industry is expected to dominate majority revenue share of 36.7% by 2035. This is driven due to countries such as China, Japan, and South Korea, which boast strong infrastructures for both mobile as well as PC gaming. High-speed internet is a necessity in online games, and affordable smartphones comprise key pillars of steps forward in this region. Moreover, the popularity of eSports and government initiatives to enroll gaming as a cultural and economic asset for some countries boost this trend even more.

India is poised to experience rapid growth in the online gaming industry through 2035. The penetration of smartphones and the affordability of data plans make many Indians more likely to play games. As a result, mobile gaming is likely to be one of the key factors guiding India towards becoming the leading country in Asia Pacific.

China represents the largest market in Asia, primarily because of its large gaming ecosystem. Companies such as Tencent and NetEase remain among the world's biggest game developers. In October 2022, Tencent's mobile game Honor of Kings set record revenues, and that signifies that China's mobile gaming culture is strong. However, the regulatory factors of limited gaming hours imposed on minors since March 2022 remain challenging for this industry, especially in reaching out to the younger segments.

North America Market Analysis

North America online gaming market is likely to grow at a significant growth rate between 2026 and 2035. Growth in both the U.S. and Canada is likely to push North America online gaming industry forward. The region's market environment is characterized by high expenditure on gaming technology and a good presence of competitive eSports. This growth is fueled by high-speed infrastructure and significant online gaming.

The U.S. is still the biggest player in the North America market and the largest local companies are Microsoft, Sony, and Electronic Arts, among others. In January 2022, Microsoft sealed its acquisition of video game company Activision Blizzard worth $68.7 billion, confirming a deal that promises to change the future of gaming. The acquisition is described as strategic, whereby Microsoft increases its stake in mobile and cloud gaming.

The online gaming sector in Canada is also progressively rising with a focus on the development of talents and innovation in its game design. The government of Canada has continued to give support to the industry, which also includes tax incentives and funding for local developers through various initiatives. In February 2023, the Canadian Media Fund announced an investment of CAD 23 million to support interactive digital media projects, including video game development. This funding is supposed to contribute to the strengthening of local studios and reinforcing Canada's role in the North America market.

Key Online Gaming Market Players:

- Tencent

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft

- Activision Blizzard

- Electronic Arts (EA)

- Ubisoft

The online gaming market is fiercely competitive, dominated by key players such as Tencent, Sony, Microsoft, and Activision Blizzard. Indeed, with the emergence of technological advances in areas such as portfolio expansions across different platforms including console, mobile, and cloud gaming. For example, in August 2022, Sony made an encouraging move by acquiring Savage Game Studios to enter the field of mobile game development within the company's expansion plans for mobile gaming. This acquisition highlights the strategy Sony is taking in diversification beyond consoles into the lucrative and progressively developing mobile gaming market around the world. As investment in eSports, cloud gaming, and immersive technologies increases, so does competition to further spur innovation and global growth.

Here are some leading players in the online gaming market:

Recent Developments

- In July 2023, Tencent made a strategic move by acquiring a majority stake in Techland, the Polish game developer behind Dying Light. The acquisition grants Tencent access to Techland’s current and future projects, reinforcing its position in the AAA game development space and extending its influence in the global gaming market.

- In September 2023, EA launched EA Sports FC, a new football game franchise marking the end of its longstanding FIFA partnership. EA Sports FC includes fan-favorite features such as Ultimate Team, Career Mode, and Volta, positioning itself as a successor to the FIFA brand, which had dominated soccer gaming for decades.

- Report ID: 6503

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Gaming Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.