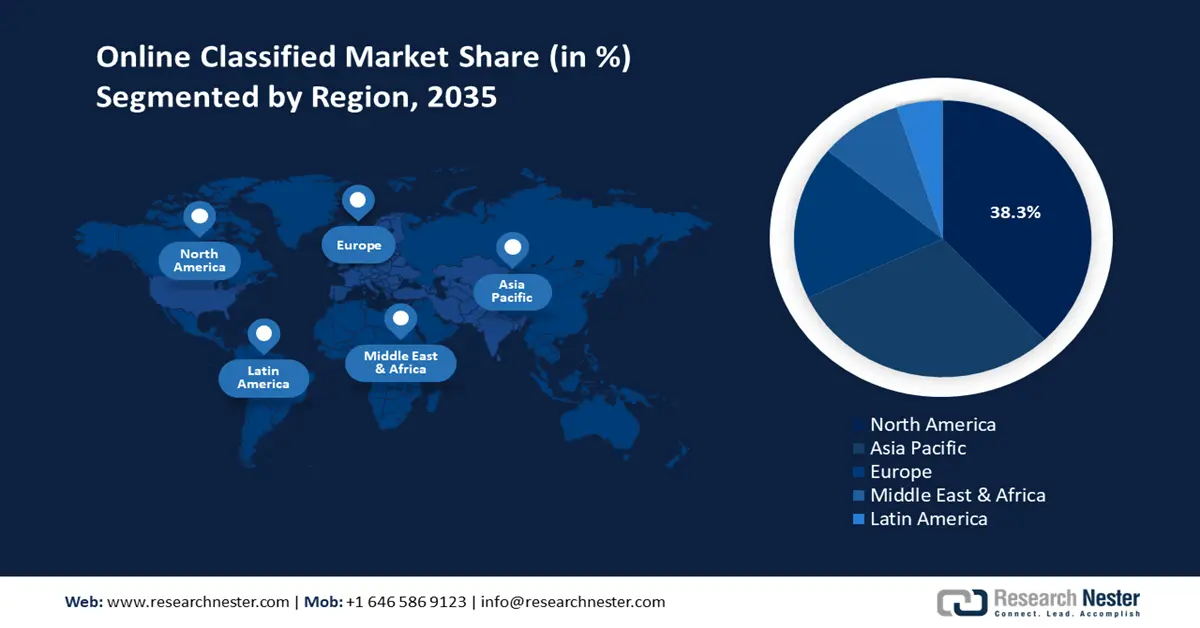

Online Classified Market - Regional Analysis

North America Market Insights

The online classified market in North America is anticipated to hold a notable share of 38.3% through 2035, due to robust government investment and regulatory initiatives, high digital maturity, and widespread use of smartphones. Consumers generally prefer digital platforms for convenience, real-time listings, and localized transactions. Strict regulatory frameworks and consumer protection laws improve trust, pushing individuals to choose online transactions. Additionally, AI-driven personalization and rising demand for second-hand goods in North America are encouraging user engagement across categories, namely real estate, jobs, and used cars.

The U.S. online classified market is rapidly expanding, owing to widespread internet access, strong digital infrastructure, and a digitally active population. Additionally, changes in consumer behavior to digital-first platforms for convenience, swift action, and access to hyperlocal listings drive growth. The strong data privacy regulations enforced by the FTC ensure a secure environment, fostering user trust and repeat activity. Moreover, AI adoption by Craigslist and eBay improves customized services to users and helps to detect fraud, boosting consumer engagement and trust. The International News Media Association (INMA) reports that in 2024, 22% of people in the U.S. said they paid for online news or used a paid online news service in the past year. This indicates that the strong presence of early adopters is propelling the sales of online classifieds.

Asia Pacific Market Insights

The online classified market in Asia Pacific is projected to capture a 35.0% share by 2035, due to rapid digital infrastructure expansion and rising internet penetration across diverse economies such as Japan, China, India, Indonesia, Malaysia, Australia, and South Korea. Government-backed investments in ICT are playing a key role, particularly in developing countries, where digital adoption is changing business and consumer behavior. The market growth is also driven by increased mobile usage, e-commerce integration, and supportive regulations around data privacy and platform security. Additionally, the region’s urbanization, growing middle class, and youthful demographics are boosting demand for fast, user-friendly online classified solutions.

The online classified market in China is expected to hold the highest share during the forecast period, owing to strong government backing, a mature e-commerce ecosystem, and a large tech-savvy population. The infrastructure and trust-enabling regulations are expected to propel the sales of online classified services in the years ahead. Consumers are increasingly using platforms such as 58.com and Ganji for listing everything from housing and jobs to used cars by AI-powered search, verified listings, and in-app payments. Urban migration and the rising demand for second-hand goods among consumers are fueling continuous platform engagement.

Europe Market Insights

The Europe online classified market is foreseen to expand at the fastest CAGR from 2026 to 2035. The region’s high internet penetration and smartphone adoption are influencing the sales of online classified services. The rising preference for digital-first commerce is also contributing to the increasing popularity of online classified platforms. Horizontal platforms are highly demanded, such as OLX Group, eBay Classifieds, and Adevinta in the EU countries. The regulatory initiatives targeting digital transparency and consumer protection are also driving the use of online classified platforms among both individuals and businesses.

Germany online classified market is expected to lead the sales of online classified services in the years ahead, owing to its large digital consumer base. The robust rise in e-commerce activities and cultural acceptance of secondhand trade is also contributing to the increasing application of online classified platforms. Further, the country’s strong economy and high purchasing power are making it attractive for advertisers, while widespread smartphone penetration is supporting mobile-first transactions.