Omega-3 Prescription Drugs Market Outlook:

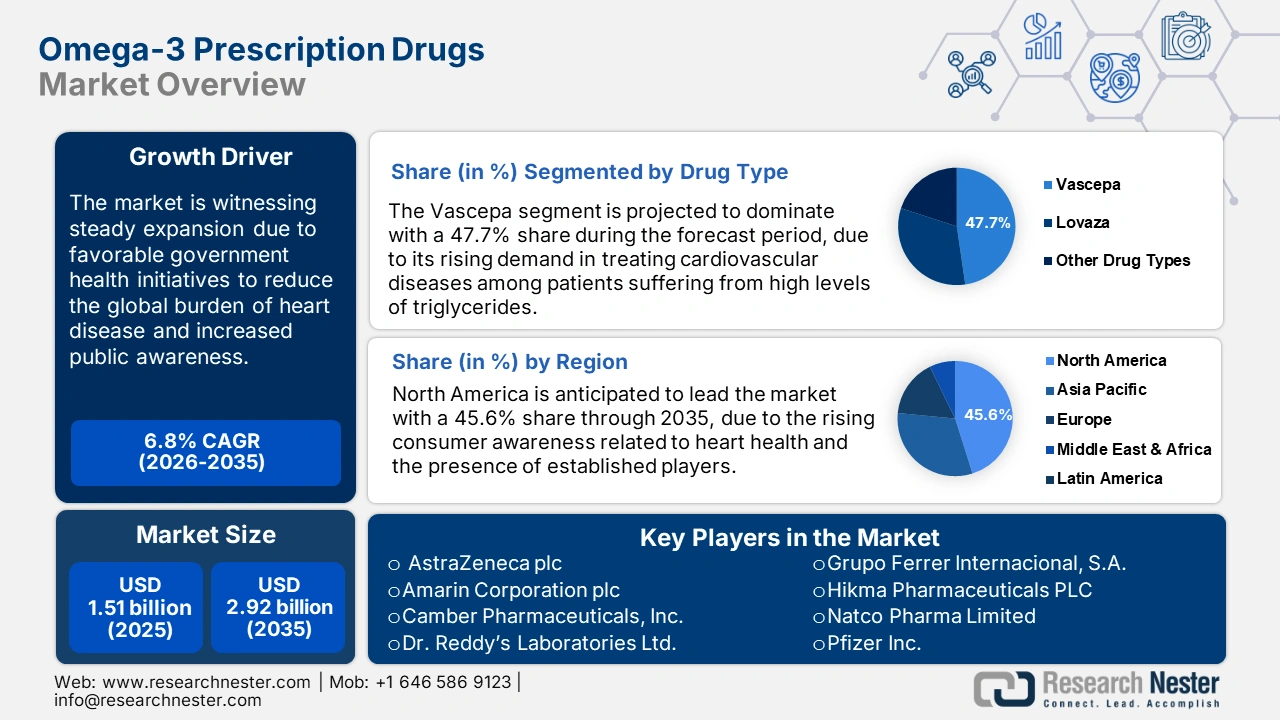

Omega-3 Prescription Drugs Market size was valued at USD 1.51 billion in 2025 and is set to exceed USD 2.92 billion by 2035, registering over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of omega-3 prescription drugs is estimated at USD 1.6 billion.

The omega-3 prescription drugs market has grown significantly based on increasing awareness about health benefits attributed to these fatty acids, associated particularly with the prevention of cardiovascular diseases. Fundamentally, active ingredients such as EPA and DHA reduce triglyceride levels effectively and are highly in demand for reducing heart diseases. Thus, prescription drugs such as Vascepa and Lovaza are becoming popular in the healthcare industry. Better drug formulations and access to improved healthcare services have created significant opportunities for manufacturers in this sector.

Several governments worldwide now recognize the significant contribution that omega-3 can make to improving public health and are actively advocating research and healthcare reforms to extend their reach and visibility. As omega-3 supplements are presumed to provide health benefits, especially in the prevention of heart diseases and stroke, their use has gained popularity, with the Centers for Disease Control and Prevention (CDC) estimating that American adults, 5.4% of age group 20 to 39, 12.5% of age group 40 to 59, currently use omega-3 supplements. This represents a growing trend in preventive healthcare and heightened interest in proactive health management by consumers.

Key Omega-3 Prescription Drugs Market Market Insights Summary:

Regional Highlights:

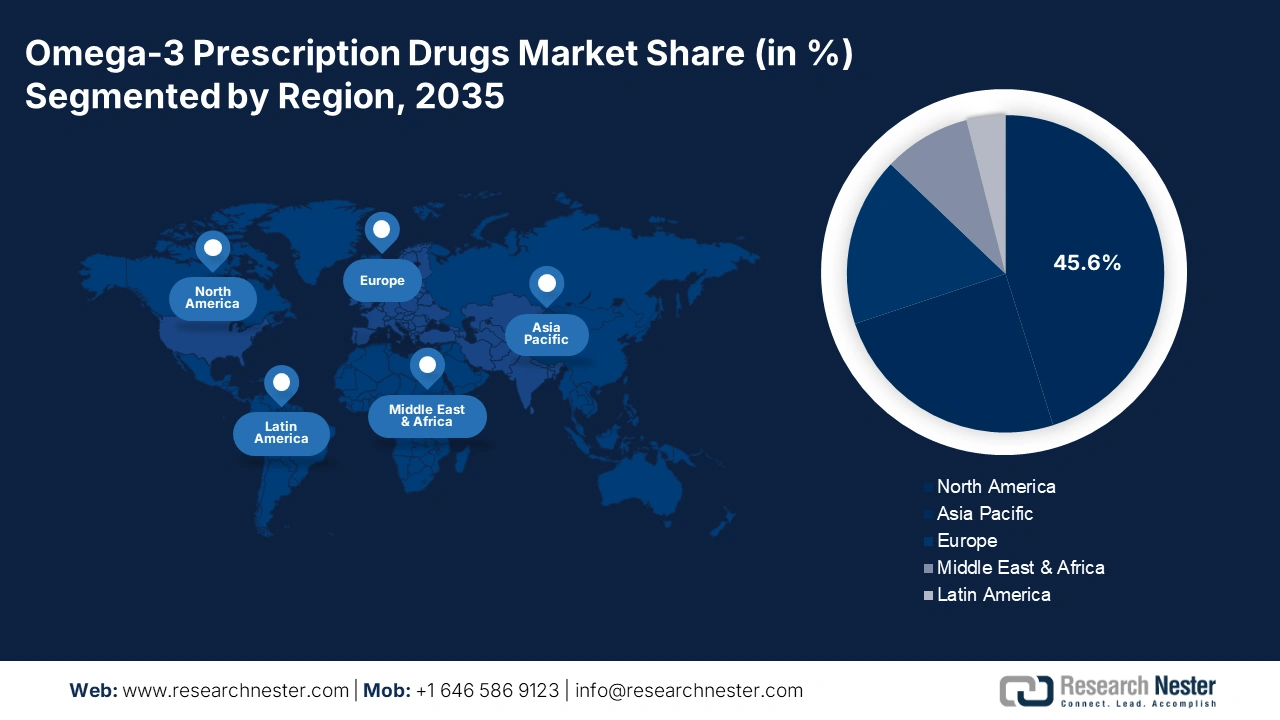

- North America omega-3 prescription drugs market will account for 45.60% share by 2035, driven by the increasing incidence of cardiovascular diseases and pharmaceutical presence.

- Asia Pacific market will capture a 25% share by 2035, driven by growing consumer awareness, rising heart disease incidences, and government policies.

Segment Insights:

- The retail pharmacy segment in the omega-3 prescription drugs market is projected to achieve a 52.30% share by 2026-2035, driven by increasing convenience, e-prescriptions, telehealth, and over-the-counter preference.

- The vascepa segment in the omega-3 prescription drugs market is projected to achieve a 47.70% share by 2035, driven by established preference for cardiovascular risk reduction and FDA approval.

Key Growth Trends:

- Prevention of cardiovascular diseases

- Increased consumer awareness

Major Challenges:

- Regulatory hurdles and market approvals

Key Players: AstraZeneca plc, Amarin Corporation plc, Camber Pharmaceuticals, Inc., Dr. Reddy’s Laboratories Ltd., GSK plc, Pfizer Inc., Grupo Ferrer Internacional, S.A., Hikma Pharmaceuticals PLC, Natco Pharma Limited, Viatris Inc., Zydus Lifesciences Limited.

Global Omega-3 Prescription Drugs Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.51 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 2.92 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 18 September, 2025

Omega-3 Prescription Drugs Market Growth Drivers and Challenges:

Growth Drivers:

- Prevention of cardiovascular diseases: Omega-3 prescription drugs have proven clinically efficient in the reduction of fatal and nonfatal cardiovascular events, hence forming a backbone in health strategies aimed at preventing cardiovascular diseases. Such drugs play a key role in the pharmaceutical sector mainly as cardiovascular diseases remain the leading causes of mortality worldwide, as reported by the World Health Organization (WHO), annually accounting for 17.9 million deaths. Results derived from these studies have raised and continue to drive up the demand for omega-3 prescription drugs as physicians continue recommending them to patients at risk.

- Increased consumer awareness: Consumers are growing increasingly educated on the various ways omega-3s, from heart health to improved cognitive function, can benefit them, and this is driving the demand for prescription drugs containing omega-3. This constitutes the raised demand in the market, underlined by new launches such as the DHA Starter Kit launched by Orlo Nutrition in November 2022. The introduction of this innovative product highlights the industry's response to growing consumer interest in personalized omega-3 supplementation, further stimulating market growth.

- Government support for healthcare initiatives: Government-sponsored health initiatives to reduce the global burden of heart disease is a major factor boosting the omega-3 prescription drugs market growth. According to a report by WHO in March 2022, about 800 million people in the world were found to be suffering from obesity, which is highly related to heart disease. It is now a focus of nations to invest in preventive care and find solutions for complications arising due to obesity, wherein omega-3 prescription drugs will witness increased adoption.

Challenges:

- Generic competition: The market for omega-3 prescription drugs faces tough challenges from the increasing generic competitors, which have been an immense challenge to the sales of branded products like Vascepa. Emerging generic drugs are likely to harm the profitability of established manufacturers of omega-3 prescription drugs and may dampen overall growth.

- Regulatory hurdles and market approvals: The complex nature of regulatory processes with respect to the approval from regulatory authorities like the FDA or EMA poses a threat to market entry. Furthermore, issues concerning the expiry of patents are another factor that may challenge the market penetration of omega-3 prescription drugs.

Omega-3 Prescription Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 1.51 billion |

|

Forecast Year Market Size (2035) |

USD 2.92 billion |

|

Regional Scope |

|

Omega-3 Prescription Drugs Market Segmentation:

Drug Type Segment Analysis

The vascepa segment is anticipated to hold a revenue share of around 47.7% in the omega-3 prescription drugs market during the forecast period. Such a dominating position is mainly due to its already established preference to reduce cardiovascular risks among patients suffering from high levels of triglycerides. Vascepa is uniquely formulated based on highly purified EPA and has been approved by the FDA, extending its applicability in the prevention of heart disease. In August 2023, Amarin Corporation and Neopharm collaborated to make an exclusivity agreement for the commercialization of VAZKEPA in Israel, continuing to further strengthen the company's leading position in international markets. Such developments are anticipated to boost the segment’s growth over the forecast period.

Distribution Channel Segment Analysis

By 2035, retail pharmacy segment is expected to hold more than 52.3% omega-3 prescription drugs market share. This is due to the increasing convenience and accessibility of prescription drugs from retail settings. Preference for over-the-counter solutions among the patients is one of the major distribution dynamics that drives the omega-3 products. This is also being driven by the increasing adoption of e-prescriptions and telehealth services. In October 2022, the European Commission approved plant-based omega-3 products from DSM, enabling its wider dissemination across retail pharmacies within the EU. Such approvals are likely to drive the sales of omega-3 prescription drugs in retail pharmacies during the forecast period.

Our in-depth analysis of the omega-3 prescription drugs Market includes the following segments:

|

Drug Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Omega-3 Prescription Drugs Market Regional Analysis:

North America Market Insights

North America is anticipated to lead the omega-3 prescription drugs market, holding a share of 45.6% during the forecast period. Some of the major factors driving the growth of the market include the increasing incidence of cardiovascular diseases and the strong presence of leading pharmaceutical companies. Besides this, rising consumer awareness related to heart health is one of the key factors highly influencing the demand for omega-3 prescription drugs in the region.

The U.S. dominates the market in North America due to its modern healthcare infrastructure and significant research and development related to omega-3 drugs. In March 2023, Hikma Pharmaceuticals launched Icosapent Ethyl Capsules in the U.S., further strengthening the favorable growth trends of the market. The higher the number of adoptions of omega-3 prescription drugs for cardiovascular risk reduction, the better the opportunity becomes for manufacturers in the sector.

Prescription omega-3 drugs are also finding increased demand in Canada in a national healthcare effort to combat heart disease. Increasing healthcare spending and a favorable government outlook toward parity in prevention are brightening the prospects for the omega-3 prescription drugs market. The various health programs of the government identify the key role omega-3 supplements play in maintaining long-term heart health.

Asia Pacific Market Insights

Asia Pacific in omega-3 prescription drugs market is estimated to capture over 25% revenue share by 2035, driven by growing awareness among consumers and rising incidences of heart diseases. Moreover, attractive government policies toward preventive healthcare in the region is creating avenues for omega-3 drug producers. The growth in the middle-class population and increase in disposable income also surged demand for high-quality health supplements, including omega-3 products. In addition, stronger local pharmaceutical manufacturing is expected to improve the prospects of growth of both domestic and international participants in Asia Pacific.

India has emerged as a key omega-3 prescription drugs market in the Asia Pacific, fueled by growing awareness of preventive health. Various governmental healthcare-related initiatives have also stimulated the consumption of omega-3 supplements. Coromega launched its Pup Packets for pets in India in July 2021, whereby the innovation continued to meet not only human but also animal health care. This, along with the increasing demand for omega-3 supplements in various clinical applications for the management of heart diseases, has positioned India as one of the leading countries in the Asia Pacific.

The omega-3 prescription drugs market in China is expanding rapidly, fueled by growing awareness with respect to cardiovascular health and huge government support for improvement in healthcare. In February 2023, NMPA approved Vascepa from Amarin for a new drug application and opened the route for the launch of the drug in China. The approval is thus likely to have a big impetus on market growth during the forecast years.

Omega-3 Prescription Drugs Market Players:

- AstraZeneca plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amarin Corporation plc

- Camber Pharmaceuticals, Inc.

- Dr. Reddy’s Laboratories Ltd.

- GSK plc

- Grupo Ferrer Internacional, S.A.

- Hikma Pharmaceuticals PLC

- Natco Pharma Limited

- Pfizer Inc.

- Viatris Inc.

- Zydus Lifesciences Limited

The omega-3 prescription drugs market remains fiercely competitive among key players such as Amarin Corporation, Hikma Pharmaceuticals, Nordic Naturals, and DSM. These firms are emphasizing product innovation, strategic collaborations, and further expansion of their global reach. Vascepa by Amarin is among the popular products in the market, especially in cardiovascular health, whereas Hikma and Nordic Naturals continue expanding their product offerings within related markets. For example, In March 2023, Hikma Pharmaceuticals launched Icosapent Ethyl Capsules in the U.S., expanding its omega-3 prescription drugs portfolio. This is indicative of growing consciousness toward the prevention of cardiovascular diseases and exemplifies increasing competition amongst key players in the industry.

Here are some leading players in the omega-3 prescription drugs market:

Recent Developments

- In June 2024, Daewoong Bio introduced a new hyperlipidemia treatment called CRA-TG Soft Capsule. This innovative product combines rosuvastatin, a well-known drug for managing high cholesterol, with omega-3 fatty acids. Omega-3s are commonly used to lower triglyceride levels in patients with high triglycerides.

- In May 2024, MegaFood launched Omega 3-6-9, which is a plant-based supplement that features a unique blend of fatty acids, including 600 mg of Omega-3, designed to support heart, brain, vision, and joint health. The product is crafted using sustainably sourced Ahiflower and fish-free algae oil to reduce environmental impact.

- In January 2023, AstraZeneca completed the acquisition of CinCor Pharma, Inc., a biopharmaceutical company specializing in innovative hypertension treatments. This acquisition significantly strengthened AstraZeneca's cardiovascular portfolio and enhanced its research and development capabilities.

- Report ID: 6461

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.