Oligonucleotide Pool Market Outlook:

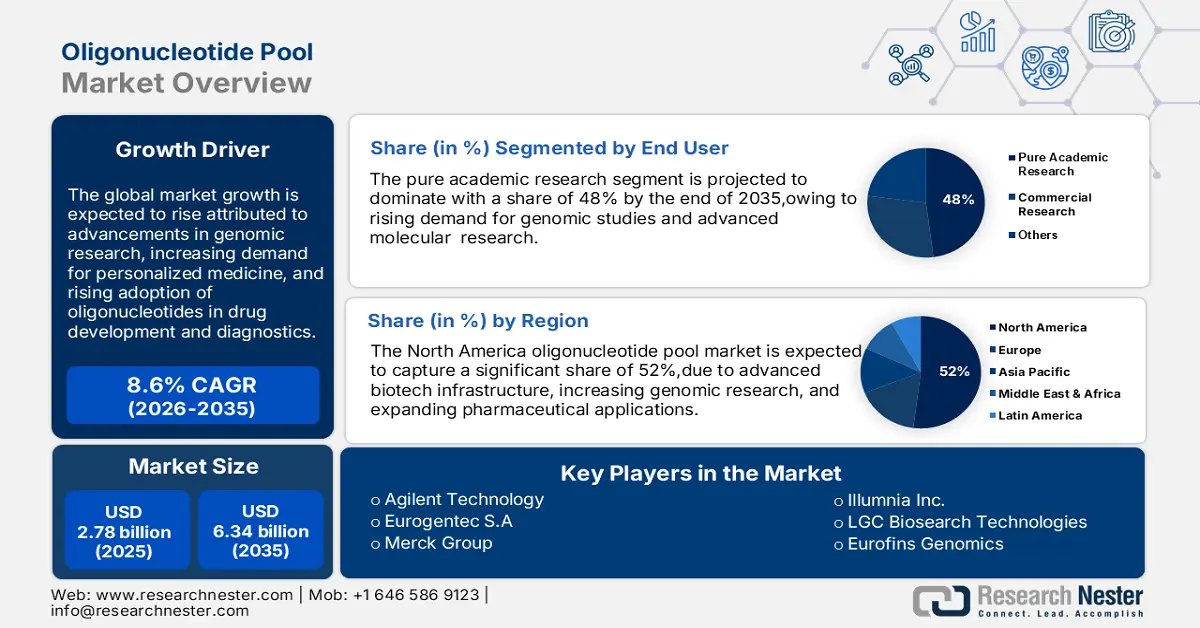

Oligonucleotide Pool Market size was over USD 2.78 billion in 2025 and is projected to reach USD 6.34 billion by 2035, witnessing around 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oligonucleotide pool is evaluated at USD 3 billion.

Advancements in gene therapy are significantly driving the demand for oligonucleotide pools, which play a pivotal role in developing targeted treatments for genetic disorders, cancer, and other chronic diseases. These pools are crucial for enabling precise therapeutics interventions in cutting- edge technologies such as CRISPR-cas9 gene editing, RNA interference (RNAi), and antisense therapies. For instance in Dec 2023, Vertes Pharmaceuticals and CRISPR Therapeutics received UK MHRA approval for CRISPR/Cas9 therapy, CASGEVY, advancing gene-edited treatments and driving oligonucleotide pool market growth. By providing the foundation for these innovative treatment modalities, oligonucleotide pools are fueling growth in the market and transforming the landscape of modern medicine.

Additionally, the shift towards personalized medicine has significantly increased the demand for customized oligonucleotide pools, as they are crucial for developing treatments tailored to an individual; unique genetic profile. According to research released by the tailored Medicine Coalition (PMC), for the fourth consecutive year in 2023, tailored medications accounted for one-third of newly approved FDA drugs. Oligonucleotide pools are vital for precision treatments, addressing complex diseases such cancer and genetic disorders, driving adoption in research and personalized healthcare expansion.

Key Oligonucleotide Pool Market Insights Summary:

Regional Highlights:

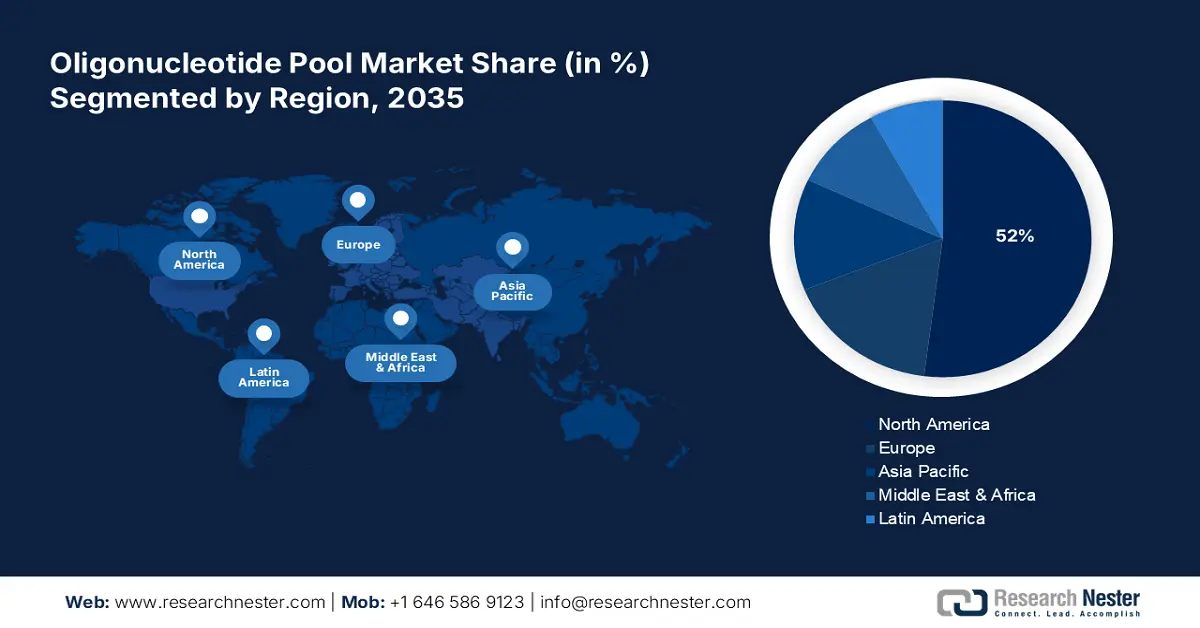

- North America holds a 52% share in the Oligonucleotide Pool Market, propelled by increasing focus on individualized therapies, such as gene therapies and precision medicine, driving expansion through 2026–2035.

Segment Insights:

- The Pure Academic Research segment is expected to capture over 48% market share by 2035, fueled by increased focus on genetic mechanisms, molecular biology, and gene editing technologies.

- DNA segment is anticipated to hold the majority share by 2035, driven by extensive use in gene synthesis, PCR amplification, and DNA sequencing applications.

Key Growth Trends:

- Expansion of healthcare infrastructure in emerging market

- Biotech investments & innovations

Major Challenges:

- High production costs

- Supply chain disruptions

- Key Players: MYcroarray, Sigma Aldrich, TriLink BioTechnologies, Twist Bioscience.

Global Oligonucleotide Pool Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.78 billion

- 2026 Market Size: USD 3 billion

- Projected Market Size: USD 6.34 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Oligonucleotide Pool Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of healthcare infrastructure in emerging market: The shift towards personalized medicine has significantly increased the demand for customized oligonucleotide pools, as they are crucial for developing treatments tailored to an individual’s unique genetic disorders, and chronic conditions, where traditional therapies may not be as effective. By enabling precision treatment, oligonucleotide pools are becoming essential tools in both research and clinical settings, driving their widespread adoption and expanding their role in personalized healthcare. This further fueling market growth and broadening the scope of their use in healthcare.

- Biotech investments & innovations: government and private organizations are significantly investing in biotechnology research and development, accelerating the production of oligonucleotide-based therapies and diagnostics. The Department of Biotechnology has been given USD 2.9 billion during 2022–2023, 51% of which goes toward research and development in biotechnology. This boost in funding is driving the demand for high quality oligonucleotide pools. Additionally, innovations in oligonucleotide synthesis, such as automation and improved purification processes are enhancing production efficiency and quality. These advancements not only reduce costs but also expand the application of oligonucleotides.

Challenges

- High production costs: The production of oligonucleotide pools is a resource-intensive process that requires advanced synthesis technologies, specialized equipment, and rigorous quality control protocols to ensure high purity and accuracy. These complex requirements drive up production costs significantly, making oligonucleotide-based solutions expensive. This high cost can pose challenges, particularly in cost-sensitive regions where affordability is a key concern. As a result, the adoption of oligonucleotide pools in therapeutic and diagnostic applications may be limited, restricting overall oligonucleotide pool market growth.

- Supply chain disruptions: The global oligonucleotide supply chain is vulnerable to various disruptions, including shortages of raw materials, geopolitical tensions, and economic instability. These challenges can cause significant delays in the production and delivery of oligonucleotide pools, affecting both research and therapeutic applications. Any interruptions in the supply chain can lead to shortages, increased costs, and uncertainty in meeting market demand. As a result, these disruptions can hinder the oligonucleotide pool market growth and slow down advancements in oligonucleotide-based therapies and diagnostics.

Oligonucleotide Pool Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 2.78 billion |

|

Forecast Year Market Size (2035) |

USD 6.34 billion |

|

Regional Scope |

|

Oligonucleotide Pool Market Segmentation:

End user (Commercial Research, Pure Academic Research)

By end user, the pure academic research segment is poised to hold oligonucleotide pool market share of over 48% by the end of 2035. The segment’s growth is attributed to increasing focus on understanding genetic mechanisms, advancing molecular biology, and exploring gene editing technologies such as CRISPR. Academic institutions are leveraging oligonucleotide pools for precise experimentation in genomics, transcriptomics, and proteomics research. Additionally, government funding and collaborations with industry players are fueling innovation in genetic studies, driving demand for high-quality oligonucleotide pools to support breakthrough discoveries and scientific advancements in academic settings.

Type (DNA, RNA)

Based on type, the DNA segment is poised to garner the majority of the oligonucleotide pool market share by the end of 2035. This dominance is driven by their extensive use in various applications, including gene synthesis, PCR amplification, and DNA sequencing. As an instance, GenScript announced the launch of GMP single-strand and double-strand services in May 2022 to help the development of gene and cell therapies. The increasing demand for synthetic DNA in molecular diagnostics, personalized medicine, and biotechnology research further supports their market leadership. Additionally, the rise in genetic studies and advancements in DNA-based therapeutic development bolster the growth and preference for DNA oligonucleotide pools over RNA.

Our in-depth analysis of the global market includes the following segments:

|

End User |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oligonucleotide Pool Market Regional Analysis:

North America Market Statistics

North America in oligonucleotide pool market is anticipated to account for around 52% revenue share by 2035. The increasing focus on individualized therapies, such as gene therapies and precision medicine, is driving demand for high-quality oligonucleotide pools in research and development. For instance, in February 2024, the FDA approved lifileucel for melanoma, boosting demand for oligonucleotide pools used in advanced gene therapies, and fueling market innovation. North America advanced healthcare system supports oligonucleotide pool market growth by promoting substantial R&D investments, encouraging the development of biologics, and boosting demand for oligonucleotide pools in research and therapies.

As biopharmaceutical companies develop gene-based therapeutics, the demand for oligonucleotide pools rises, as these companies rely on oligonucleotides to produce active pharmaceutical ingredients for innovative treatments. In 2023, U.S. biopharmaceutical firms spent USD 96 billion on R&D, representing over 20% of the total sales, highlighting substantial investments in research and innovation. Additionally, U.S. government initiatives and regulatory standards, including FDA support for gene therapies and biologics, foster the adoption and development of oligonucleotide-based treatments. These factors, combined with a stable regulatory environment, contribute to steady growth in the U.S. oligonucleotide pool market, fueling further advancements in precision medicine.

As gene therapy and personalized medicine advance in Canda, the demand for oligonucleotide pools for therapeutic applications, including gene editing and RNA-based therapies, is increasing. This growth is fueled by the rising adoption of gene-based treatment and the need for high-quality oligonucleotides in targeted treatment development. In January 2024, Health Canada approved BEQVEZ (fidanacogene elaparvovec), a gene therapy for hemophilia B, driving innovation in the oligonucleotide pool market by advancing AAV-based treatments. The ongoing advancements in gene therapy further drive market demand, making oligonucleotide pools essential in developing innovative, personalized therapies and explaining the overall market in Canada.

Asia Pacific Market Analysis

In APAC, the oligonucleotide pool market is estimated to grow at the fastest CAGR, from 2026-2035. The growing healthcare infrastructure in emerging economies such as India and China is boosting the adoption of oligonucleotide therapies, which, in turn, increases the demand for oligonucleotide pools. Additionally, the rising prevalence of chronic diseases, cancer, and genetic disorders across the Asia Pacific region is further fueling the need for advanced therapies. These therapies heavily rely on oligonucleotide pools, for the development of effective treatment, contributing significantly to the market’s growth in the region.

The growing incidence of genetic disorders, cancer, and chronic diseases in China is driving the demand for advanced treatment options, with oligonucleotide-based therapies playing a key role in developing targeted treatments. Additionally, the government of China supports the biopharmaceutical industry, particularly in gene therapies, through regulations, funding, and incentives is further boosting the use of oligonucleotide pools in research and development. As per a report by Frontiers Media S.A. in August 2022, biopharmaceutical sales surged from USD 3.5 billion in 2018 to USD 9.2 billion in 2020. This is driving growth in the oligonucleotide pool industry through increased demand for innovative treatments. These combined factors are contributing significantly to the growth of the oligonucleotide pool market in China.

The government of India invests in biotechnology and healthcare infrastructure are fostering R&D in generic therapies, driving the growth of the market. As per the IBEF in January 2025, both the government and the private sector contributed to the healthcare industries in India robust expansion in 2023, which saw it reach a valuation of USD 372 billion. Additionally, as the healthcare system in India focuses on personalized medicine, which relies heavily on oligonucleotides for precise treatment development, the demand for oligonucleotide pools is expected to rise. With more companies and institutions pursuing oligonucleotide-based treatments, this trend further supports oligonucleotide pool market expansion in India.

Key Oligonucleotide Pool Market Players:

- Illumnia Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Agilent Technologies

- Creative Biogene

- CustomArray

- Integrated DNA Technologies

- MYcroarray

- Sigma Aldrich

- TriLink BioTechnologies

- Twist Bioscience

Key companies in the oligonucleotide pool market are driving innovation through advancement in synthetic DNA technology, expanding their manufacturing capabilities, and developing longer, more efficient oligonucleotides. These companies improve success rates by introducing longer, higher-quality products. For instance, in August 2023, Intellengens secured a USD 1.7 million Innovate UK grant to apply machine learning for optimizing oligonucleotide therapy production, enhancing productivity, and quality control strategies in the industry. Investments in state-of-the-art laboratories and increased production capacity the helping meet the growing demand for high-quality oligos, further fueling oligonucleotide pool market growth. Some of the key companies:

Recent Developments

- In October 2024, CatSci Ltd.’s new oligonucleotide lab enhances RNA and DNA therapeutic development, supporting innovation and driving growth in the oligonucleotide pool market.

- In January 2023, Aligent technologies invested USD 725 million to expand therapeutic nucleic acid manufacturing boosting supply, meeting growing demand and driving growth in the oligonucleotide pool industry.

- In July 2019, Twist Bioscience launched 300-base long oligonucleotide enhancing biological research efficiency, driving demand and growth in the oligonucleotide pool market.

- Report ID: 7034

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oligonucleotide Pool Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.