Oleochemicals Market Outlook:

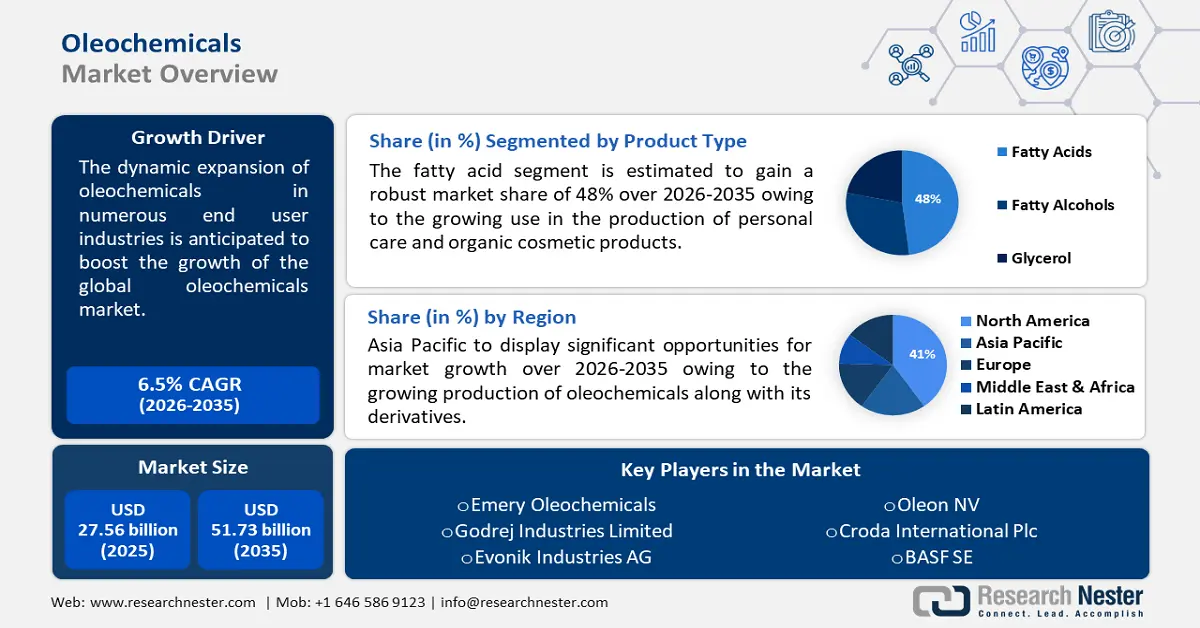

Oleochemicals Market size was valued at USD 27.56 billion in 2025 and is expected to reach USD 51.73 billion by 2035, expanding at around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oleochemicals is assessed at USD 29.17 billion.

The market growth is driven by dynamic expansion in various end-use industries comprising textile, pharmaceuticals, food processing, and so on, coupled with surging demand for chemical-free natural and organic cosmetics, and personal care products across the globe. For instance, from around USD 32 billion in 2021, the worldwide revenue for natural cosmetics and personal care is predicted to rise to around USD 60 billion by the year 2030. Since oleochemicals are derived from natural sources such as plant and animal fats. Therefore, they have been highly utilized in the production of organic and natural beauty products.

In addition, the market revenue is propelled by surging preference for sustainable packaging among consumers across the world. Based on a survey figure conducted in 2020, more than 65% of the United States participants stated spending extra money on a product having sustainable packaging. In addition, the associated properties of oleochemicals are estimated to spur the growth of the market as these green chemicals are highly safe, renewable, natural, and biodegradable in nature. Moreover, easy availability of raw materials of oleochemicals will drive the market expansion.

Key Oleochemicals Market Insights Summary:

Regional Highlights:

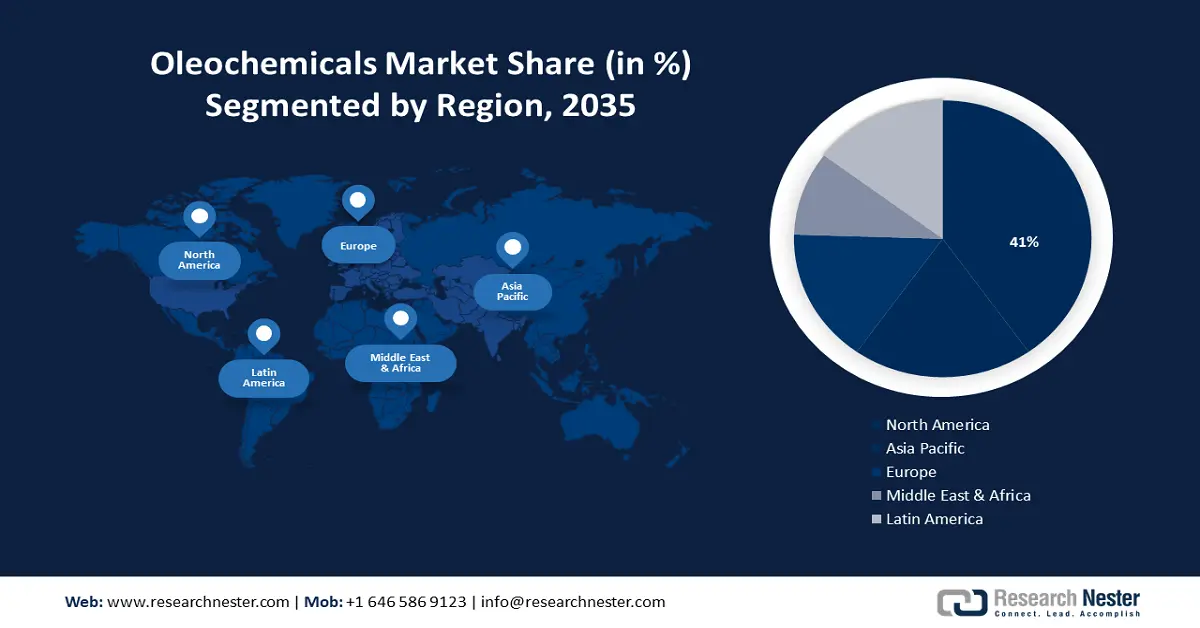

- Asia Pacific oleochemicals market will dominate over 41% share by 2035, driven by increasing production of oleochemicals along with their derivatives, coupled with the high availability of raw materials in the region.

- North America market will capture a 24% share by 2035, driven by growing preference for natural-based personal care and cosmetic products, along with stricter sustainability regulations.

Segment Insights:

- The fatty acid segment in the oleochemicals market is projected to hold a 48% share by 2035, driven by rising demand for bio-based cosmetics and versatile industrial use.

- The food & beverages segment in the oleochemicals market is expected to capture a 38% share by 2035, fueled by the adoption of bio-based additives.

Key Growth Trends:

- Growing Demand for Biopolymers

- Rising Usage of Food Additives

Major Challenges:

- Risk of VOC Exposure During Glycerin Processing

- Existence of Other Substitutes

Key Players: Emery Oleochemicals, Cargill, Incorporated, Vantage Specialty Chemicals, BASF SE, DuPont de Nemours, Inc., Oleon NV, Solvay SA, Croda International Plc, Evonik Industries AG, Godrej Industries Limited.

Global Oleochemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.56 billion

- 2026 Market Size: USD 29.17 billion

- Projected Market Size: USD 51.73 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Malaysia, Indonesia, Germany

- Emerging Countries: China, India, Japan, Malaysia, Indonesia

Last updated on : 8 September, 2025

Oleochemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand for Biopolymers - Biopolymers are polymers derived from organic compounds that are either chemically generated from biological materials or completely synthesized by living organisms. The biopolymers have been proven to be biocompatible and biodegradable, which makes them highly advantageous for a variety of applications, including edible films, emulsions, packaging materials, and medical implants including organs, tissue scaffolds, wound healing, and dressing materials in the pharmaceutical industries. Therefore, such wider use of biopolymers in the varied arrays has increased the demand for biopolymers, which is further estimated to spur the growth of the oleochemicals market in the projected time frame. For instance, in 2020, approximately 39.5 million metric tons of biopolymers were produced throughout the world.

-

Rising Usage of Food Additives - Diverse food and beverages use oleochemicals for the maximum part as emulsifiers, food thickeners, or food additives in numerous food items comprising bread, cakes, and confectioneries. Customized oils and margarine are prepared by utilizing oleochemicals. Another significant operation of oleochemicals is in the making of nutrition-enriched food additives that are largely utilized as a part of packaged food products. For instance, food thickeners and stabilizers were the most commonly used food additives in 2020 throughout the world, accounting for approximately USD 9 billion in revenue. Thus, the rising use of food additives is also estimated to drive market growth in the coming years.

-

Worldwide Increasing Use and Production of Rubber – Rubber is produced by extracting a milky liquid sap, known as latex, from some specific types of trees. Currently, rubber is highly utilized in the production of several products such as shoe soles, tires and tubes, engine seals, rubber hoses, and so on. Oleochemicals in the form of fatty acids are widely utilized to improve the process of extracting rubber. Thus the surging demand and production of rubber are estimated to fuel market growth over the forecast period. For instance, global rubber production had surged to around 26 million metric tons by 2020.

-

Expanding Production of Detergents – For instance, the amount of detergents manufactured in Russia has continuously increased, reaching a record of over 2.7 million metric tons in 2021.

-

An Upsurge in Chemical Industry - For instance, the chemical industry garnered approximately USD 5 trillion in revenue in 2021 throughout the world.

Challenges

- Risk of VOC Exposure During Glycerin Processing – There is a higher risk of exposure to voltaic organic compounds in the production of processing of glycerin. This VOC vapor can trigger several health issues such as anxiety, damage to the central nervous system, along with the damage to kidney and liver. Hence, this factor is estimated to hinder market growth in the projected time frame.

- Existence of Other Substitutes

- Fluctuation in Raw Materials Prices

Oleochemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 27.56 billion |

|

Forecast Year Market Size (2035) |

USD 51.73 billion |

|

Regional Scope |

|

Oleochemicals Market Segmentation:

Product Type Segment Analysis

The fatty acid segment is estimated to account for 48% market share by 2035, propelled by increasing usage of bio-based fatty acid in the production of various personal care and organic cosmetics products such as creams, soaps, lotions, and others, followed by the surging demand for fatty acid in various end-use industries such as pharmaceuticals, food and beverage, cosmetics, and so on. For instance, in 2021, the global revenue from the natural and organic cosmetics sector was estimated to be approximately USD 12 billion. In addition to this, fatty acid acts as a vital basic material in the manufacturing of several secondary compounds comprising biocides, toiletry, softeners, elastomers, bio-wax, and so on for various industries.

Application Segment Analysis

The food & beverages segment is expected to garner around 38% share by 2035. escalating use of bio-based stabilizers, thickeners, and other types of food additives in the food and beverage industry. On the other hand, the pharmaceutical & personal care segment is projected to witness a massive CAGR during the forecast period, on the back of rising deployment of oleochemicals in the production of numerous kinds of pharmaceutical drugs and personal care products, coupled with the massively rising demand for pharmaceutical drugs, and bio-based personal care products throughout the world.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oleochemicals Market Regional Analysis:

APAC Market Insights

The oleochemicals market share in Asia Pacific is poised to surpass 41% by the end of 2035. The market growth is impelled by increasing production of oleochemicals along with their derivatives, coupled with the high availability of raw materials to derive oleochemicals in the region. For instance, Malaysia and Indonesia were the biggest manufacturers of palm oil in 2020, which serves as the main feedstock for the production of oleochemicals. Out of that, Malaysia exported approximately 33% and produced around 26% of the world's total palm oil.

Further, the upsurge in plantation undertakings in countries such as Indonesia, Malaysia, and the Philippines, to manufacture various cosmetics and personal care products from oleochemicals, is projected to fuel the market demand in the region. In addition, low production costs, labor costs, and lenient rules in these nations are inspiring manufacturers to multiply their manufacturing units in these regions.

North American Market Insights

The North American oleochemicals market is estimated to account for 24% share by 2035, led by growing preference for natural-based personal care and cosmetic products, along with the surge in the strict regulation by the government to practice sustainability. For instance, in 2023, the revenue of the natural cosmetics sector in the United States is expected to increase to around USD 2 billion. Moreover, the rising demand for bio-lubricants, along with the surging demand for biopolymers is estimated to fuel the market revenue.

Europe Market Insights

Europe is poised to hold a notable share of about 20% by the end of 2035. The market growth is propelled by surging practice of sustainability, on the back of the expanding awareness in people regarding pollution, climate change, and several other environmental issues. In addition, the surging shift towards biodiesel to replace conventional petroleum-based fuel will drive the market size.

Oleochemicals Market Players:

- Emery Oleochemicals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cargill, Incorporated

- Vantage Specialty Chemicals

- BASF SE

- DuPont de Nemours, Inc.

- Oleon NV

- Solvay SA

- Croda International Plc

- Evonik Industries AG

- Godrej Industries Limited

Recent Developments

-

Emery Oleochemicals has launched EMERY E general-purpose fatty acid esters product range. These fatty acid esters can be used in the manufacturing of a variety of consumer and industrial systems since they have excellent color stability, and minimal odor, and are environmentally friendly alternatives to petrochemical-based materials.

-

Croda International Plc has decided to acquire Solus Biotech, a pioneer in high-end, biotechnology-derived beauty actives, from Solus Advanced Materials. Croda's Beauty Actives portfolio is estimated to be considerably strengthened as a result of this acquisition.

- Report ID: 2736

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oleochemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.