Oilwell Spacer Fluids Market Outlook:

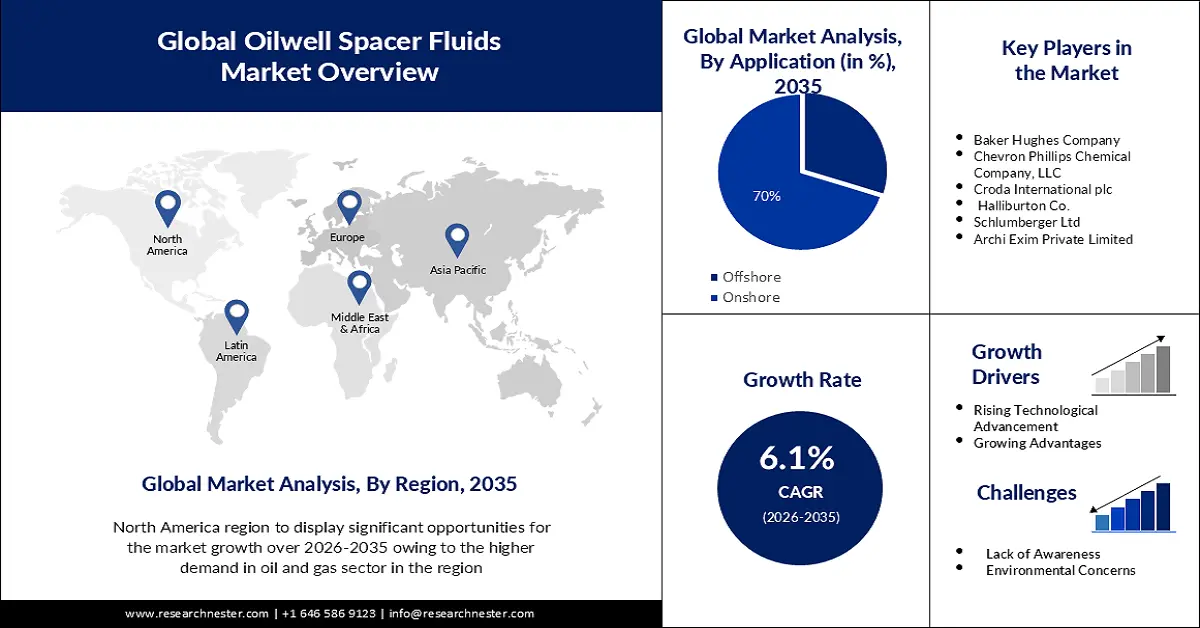

Oilwell Spacer Fluids Market size was valued at USD 159.21 billion in 2025 and is likely to cross USD 287.82 billion by 2035, expanding at more than 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oilwell spacer fluids is assessed at USD 167.95 billion.

Numerous factors influence the need for oilwell spacer fluids worldwide. The rising investment in the oil and gas industry's output is one of the main factors propelling the global market. The developed countries rely heavily on the oil and gas industries. The Department for Promotion of Industry and Internal Trade Policy (DPIIT) released data indicating that between April 2000 and December 2020, the oil and gas sector in India attracted foreign direct investment (FDI) valued at USD 7.91 billion. This sector plays a major role in economic growth. The governments are concentrating on this industry as a result. The global market for Oilwell Spacer Fluids will also be driven by advancements in cement technology.

The need for the oil and gas industry is growing quickly along with urbanization. The developed areas are concentrating on safe and efficient methods of producing gas and oil. The oil and gas industry makes use of the oilwell spacer fluids market. Therefore, possibilities for the Global Oilwell Spacer Fluids industry will arise from developments in the oil and gas sector.

Key Oilwell Spacer Fluids Market Insights Summary:

Regional Highlights:

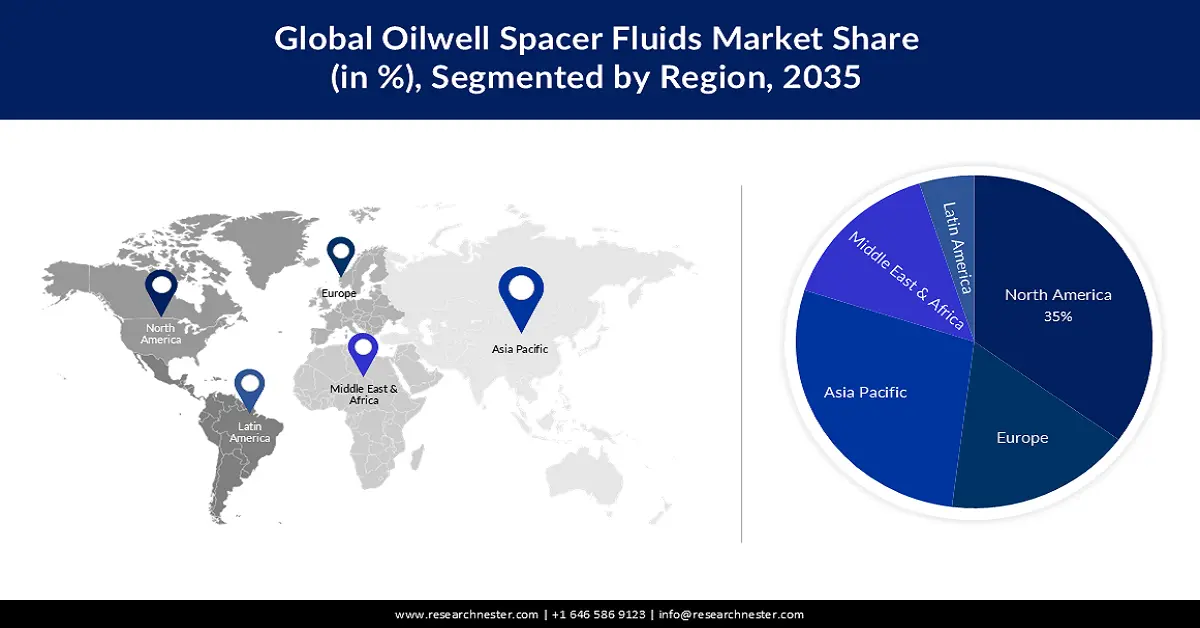

- North America oilwell spacer fluids market is expected to capture 35% share by 2035, driven by an increase in oil and gas finds and government initiatives.

Segment Insights:

- The onshore segment in the oilwell spacer fluids market is projected to capture a 70% share by 2035, fueled by increased investment due to lower operational costs than offshore.

- The water-based segment in the oilwell spacer fluids market is anticipated to capture a 60% share by 2035, driven by cost-effectiveness and environmental friendliness compared to oil-based types.

Key Growth Trends:

- Increasing Number of Benefits Associated

- Growing Technological Advancements

Major Challenges:

- Environmental Concerns Associated are anticipated to hamper the market growth in the upcoming period.

- Lack of awareness about oilwell spacer fluids is set to pose a limitation on the market growth during the projected period.

Key Players: Baker Hughes Company, Chevron Phillips Chemical Company, LLC, Croda International plc, Halliburton Co., Schlumberger Ltd, Archi Exim Private Limited.

Global Oilwell Spacer Fluids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 159.21 billion

- 2026 Market Size: USD 167.95 billion

- Projected Market Size: USD 287.82 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, United Kingdom, Norway

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Oilwell Spacer Fluids Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Number of Benefits Associated - Viscous fluids called oilwell spacer fluids are utilized to keep undesirable drilling fluids from compromising the slurry of oilwell cement. Cementing is used in oil and gas closing operations to maintain the casing pipe's position and stop drilling fluids from migrating into the formation. Most notably, they are made to remove various kinds of gas and oil drilling fluids, including water-based and oil-based drilling fluids. Zone isolation is achieved by injecting oilwell spacer fluid into the oilwell before the cement slurry. This keeps fluids from combining, such as water and gas, from one zone with oil and gas from another. Throughout the projected period, the expansion of the oilwell spacer fluids market will be propelled by these advantages.

- Growing Technological Advancements - Remedial cementing is mostly done to resume digging and completion operations for oil and gas wells. It raises the cost and duration of the oil and gas E&P operations, including drilling and completion. On the other hand, lowering the operating costs of oilwell sealing operations is probably possible with an inventive strategy for enhancing the cementing task. Smart cement also makes the oil and gas industry safer to work in and lowers the potential operating costs associated with corrective cementing.

Challenges

- Fluctuating Crude Oil Prices - The demand for oilwell spacer fluids might fluctuate due to the influence of exploration and production activities caused by price volatility in crude oil. Uncertainty in the market limits oilwell spacer fluids market expansion.

- Environmental Concerns Associated are anticipated to hamper the market growth in the upcoming period.

- Lack of awareness about oilwell spacer fluids is set to pose a limitation on the market growth during the projected period.

Oilwell Spacer Fluids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 159.21 billion |

|

Forecast Year Market Size (2035) |

USD 287.82 billion |

|

Regional Scope |

|

Oilwell Spacer Fluids Market Segmentation:

Application Segment Analysis

The onshore segment is expected to dominate the oilwell spacer fluids market with 70% share during the projected period. An important part of oil and gas exploration and production activities is offshore exploration and production activities. The operational costs for oil and gas exploration and production activities are lower than those of offshore E&P because onshore operations require less advanced technologies in drilling. In the case of onshore oil and gas exploration and production, this has led to increased investment. The market for oilwell spacer fluids will grow during the forecast period as a result of this increase in investments. The market will be driven by rising activity in gas and oil drilling. Less advanced technologies, which are more cost-effective than offshore, are needed for offshore activities. This has led to increased investment in the onshore sector and is projected to have a dominant position in the market over the coming years.

Type Segment Analysis

Based on type, the water-based segment is predicted to account 60% oilwell spacer fluids market share by the end of 2035. The type of water-based spacer fluid which is preferred for its cost-effectiveness and compatibility with a variety of drilling mud systems, is water-based spacer fluids. The fluids are suitable for the displacement of mud and their compatibility with cement slurries is excellent. Oil and gas companies are facing increasing pressure to reduce their environmental impact. Water-based spacer fluids are a more environmentally friendly alternative to oil-based spacer fluids, as they are less toxic and biodegradable.

Our in-depth analysis of the global oilwell spacer fluids market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oilwell Spacer Fluids Market Regional Analysis:

North American Market Insights

The oilwell spacer fluids market in the North America industry is likely to account for largest revenue share of 35% by 2035. Throughout the projection period, the growth of the market in North America will be facilitated by an increase in oil and gas finds as well as increased investments and initiatives from various governments. The major producers of oil and gas in this region are the US, Mexico, and Canada. In addition to that government, these are also making efforts to boost this region's oil and gas production. The US Energy Information Administration states that the country generated 6,44 million barrels of crude oil per day.

APAC Market Insights

The oilwell spacer fluids market in the Asia Pacific region is set to grow significantly during the forecast period. The region is home to some of the world’s largest and fastest-growing economies such as China, India, and Japan. This leads to an increase in demand for oil and gas which is driving exploration and production activities in the region. As a result, there is a growing need for oilwell spacer fluids to ensure the efficient and safe completion of wells. Governments in the Asia Pacific region are providing support for the oil and gas industry, through tax breaks, subsidies, and other incentives. This is helping to attract investment into the sector, which is boosting the demand for oilwell spacer fluids.

Oilwell Spacer Fluids Market Players:

- M&D Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atlantic Richfield Company,

- Elkem

- BASF SE,

- Baker Hughes Company,

- Chevron Phillips Chemical Company, LLC

- Croda International plc,

- Halliburton Co.,

- Schlumberger Ltd,

- Archi Exim Private Limited

Recent Developments

- Halliburton won nine contracts for offshore oil and gas projects on the West African coast during August 2019. Completions, drilling, cementing, and testing services are covered by this contract. The company will further strengthen its position in Africa through this contract.

- Chevron Phillips Chemical declared the expansion of its production capacity for Oronite performance additives used in various oilfield applications comprising spacer fluids. This expansion aims to meet the growing demand for these additives.

- CEMENT SPACER and Flushing Agent are additives that pump between the drilling fluid and the cement slurry, to create a buffer that prevents it from entering contact with each other. GDFCL shall manufacture a wide range of High-performance Slurry spacers, which can be adapted and produced according to individual customer requirements such as variations in temperature, Oilwell specifications, or Cementological Specifications, this further would require oilwell spacer fluids.

- Report ID: 5625

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oilwell Spacer Fluids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.