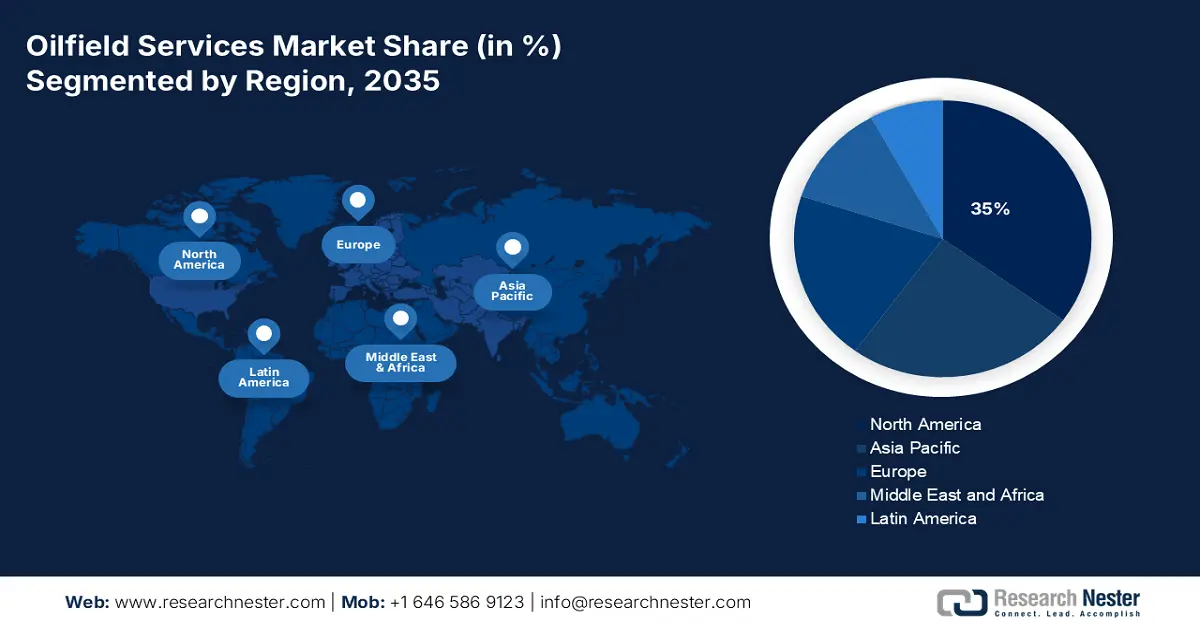

Oilfield Services Market Regional Analysis:

North American Market Insights

North America industry is anticipated to hold largest revenue share of 35% by 2035. North American oil and gas projects are becoming more competitive as a result of increased efficiencies and tighter supply chains, along with rising government initiatives in oil and gas sector which is further boosting market growth. As a result, drilling expenses have decreased and many projects are now feasible. Fracking, horizontal well drilling, and the recent emergence of shale plays have all contributed to a sharp rise in the demand for oilfield services in the United States region. Also, growing export of crude oil from this region is also expected to boost the market. With a production of about 3 million barrels per day (mb/d) of crude oil in 2018, Canada is a significant provider of safe, dependable crude oil to worldwide markets. Only Saudi Arabia and Venezuela have more oil reserves than Canada, which is one of the world's top oil producers. The proven oil reserves in Canada include approximately 167 billion barrels, about 163 billion of which are oil sands.

APAC Market Insights

The Asia Pacific oilfield services market is estimated to be the second largest, to have the highest growth. The market for oilfield services in the Asia-Pacific region is anticipated to be driven by factors such an increase in demand for cutting-edge technology, tools, and equipment to boost the efficiency of exploration and production activities in onshore and offshore areas. Nonetheless, there has always been a large demand for oil and gas, which has fueled offshore development in Australia, Malaysia, and Indonesia. Thus, it is anticipated that during the forecast period, this would present a market opportunity. Moreover, the region's biggest oilfield services market that also includes oil and gas accumulator services is China. The nation has begun to utilize its shale gas supplies to satiate domestic demand and plans to lessen its reliance on natural gas imports. Additionally, the new reforms pertaining to the oil and gas sector are anticipated to make it simpler for private businesses to invest in this region, which is anticipated to aid in lessening the monopoly of state-owned businesses. The private sector's expanding investment is anticipated to enhance the oil and gas sector, which would in turn propel the market for oilfield services in this region.

Europe Market Insights

Additionally, the oilfield services market in Europe region is also estimated to have a significant growth over the forecast period. The oil and gas industry is observing scientific advancements in exploration technologies for deep-water drilling operations and project economic feasibility in this region which is estimated to boost the growth of the market. Moreover, oil companies are also increasing recovery and boosting output through contemporary technical breakthroughs. Many levels of automation are possible for offshore wells, from simple one-way monitoring to intricate subsurface controls with intelligent completions. Hence, this factor is estimated to boost the growth of the oilfield services market in this region.