Oilfield Services Market Outlook:

Oilfield Services Market size was over USD 133.33 billion in 2025 and is anticipated to cross USD 201.19 billion by 2035, growing at more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oilfield services is assessed at USD 138.37 billion.

The growth of the market can be attributed to growing demand for oil. In 2022, when global oil consumption was expected to reach about 98 mb/d, growth was slightly curtailed to approximately 2 mb/d. However, in 2023, an additional about 3 mb/d increase is anticipated, driven primarily by non-OECD nations' robust growth trends. Hence, the extraction of oil is anticipated to grow further boosting the oilfield services market for oilfield services.

Moreover, another two important aspects, such as reducing the price of oilfield services and raising production, have also fueled the global industry. Major upstream service providers provide a variety of tailored packages that may save operators millions of dollars. Additionally, the growing usage of hydraulic fracturing and other stimulation techniques for shale gas extraction is also estimated to support the oilfield services sector. According to the U.S. Energy Information Administration (EIA), the amount of dry natural gas produced in the United States in 2022 from shale formations was around 28.5 trillion cubic feet (Tcf), or 80% of all dry natural gas produced in the country that year.

Key Oilfield Services Market Insights Summary:

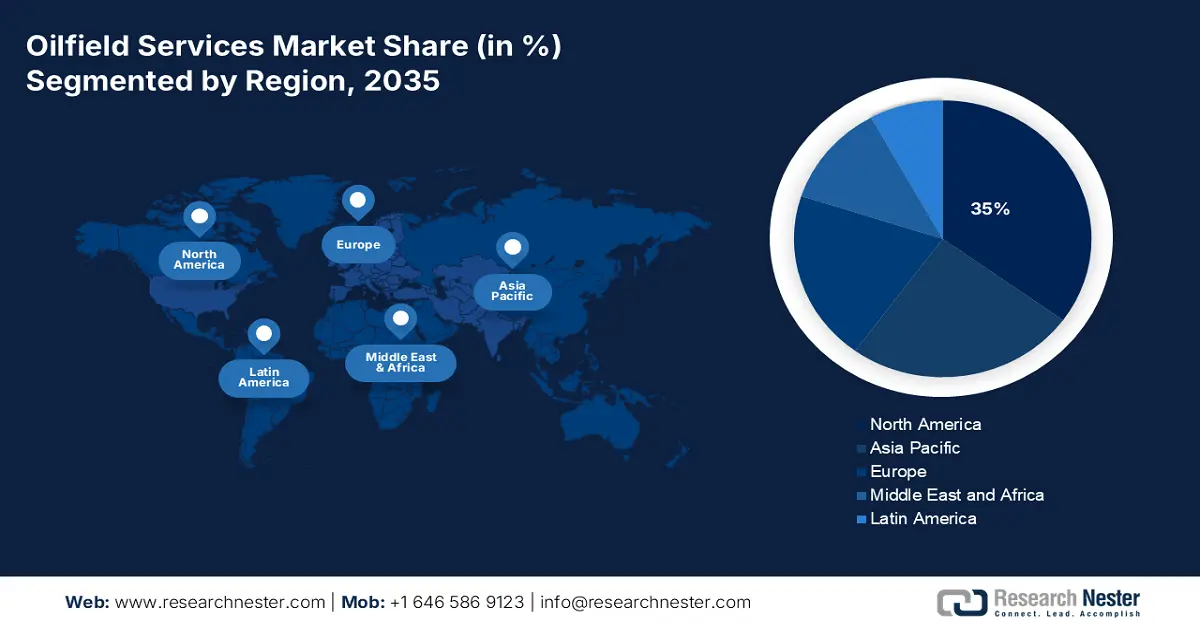

Regional Highlights:

- North America oilfield services market will hold over 35% share by 2035, shale development, fracking, and crude oil exports.

- Asia Pacific market will secure the second largest share by 2035, offshore developments and rising private investments in oil and gas.

Segment Insights:

- The onshore segment in the oilfield services market is forecasted to hold the highest market share by 2035, driven by the rising onshore oil and gas exploration due to its cost-effectiveness.

- The drilling segment in the oilfield services market is projected to achieve significant growth during 2026-2035, fueled by increasing demand for oil and benefits of directional drilling.

Key Growth Trends:

- Rising Demand for Energy to Heat Homes

- Growing Adoption of Vehicles

Major Challenges:

- Rising Price of Crude Oil

- Surge in Use of Sustainable Alternative

Key Players: Schlumberger Limited, Baker Hughes Company, Halliburton Energy Services, Inc., NOV Inc., Archer Limited, TechnipFMC plc, Nabors Industries Ltd, Aker BP, General Electric, Welltec A/S.

Global Oilfield Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 133.33 billion

- 2026 Market Size: USD 138.37 billion

- Projected Market Size: USD 201.19 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Russia, Canada, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Saudi Arabia

Last updated on : 10 September, 2025

Oilfield Services Market Growth Drivers and Challenges:

Growth Drivers

- Rising Demand for Energy to Heat Homes - 31.7% of the total energy consumed by EU households in 2020 came from natural gas. Using energy to heat homes accounted for the majority of household energy use in the EU in 2020 (62.8% of total residential energy consumption). Furnaces, boilers and space heaters all use natural gas to heat people's houses. Hence with the growing demand for energy to heat house the demand for natural gas is estimated to boost. Therefore, influencing the market growth further.

- Growing Adoption of Vehicles - Over 65 million vehicles were sold globally in 2021, however about 66 million vehicles were sold globally in 2022. Hence, the demand for oil is estimated to grow further boosting the oilfield services market growth.

- Surge in Number of Aircraft - The general aviation fleet was estimated to have about 204,404 aircraft in the United States in 2021, a rise from the previous year. Hence, the demand for jet fuel is estimated increase. To produce jet fuel that satisfies particular military or industrial requirements, various crude oil petroleum distillation products are commonly blended and refined into naphtha, petrol or kerosene.

- Growth in Government Initiatives - A reduction in excise duty of about USD 0.9 per liter for petrol and approximately USD 0.076 per liter for diesel in India was announced by the government on May 21, 2022. Hence, the demand for petrol and diesel is estimated to boost. Moreover, the Indian government approved oil and gas projects in Northeast India totaling about USD 12 billion in September 2021. By 2025, these projects are expected to be finished.

- Upsurge in Drilling Activities - Almost about 17 billion barrels of recoverable oil equivalent (Bboe) has been found from approximately 177 discoveries made by new-field wildcat drilling by the end of November 2022 across the globe.

Challenges

- Rising Price of Crude Oil - The fluctuating demand and supply of crude oil are to blame for the oil and gas sector's inflexibility in crude oil pricing. This variation considerably affects oilfield services market demand while also escalating rivalry between the United States, OPEC members, and non-OPEC nations. The increased price of oil causes investments and forthcoming projects to be delayed, which halts drilling projects and causes a decline in oilfield services. As a result, market expansion is expected to be hampered by crude oil price volatility.

- Stringent Government Laws on E&P Activities

- Surge in Use of Sustainable Alternative

Oilfield Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 133.33 billion |

|

Forecast Year Market Size (2035) |

USD 201.19 billion |

|

Regional Scope |

|

Oilfield Services Market Segmentation:

Application Segment Analysis

The global oilfield services market is segmented and analyzed for demand and supply by application into onshore, and offshore. Out of which, the onshore segment is anticipated to garner the highest revenue by the end of 2035. The growth of the segment can be attributed to growing exploration and production of onshore oil and gas. Forecasts indicate that in 2025, offshore production would account for about 27% of worldwide crude oil production, with onshore production accounting for the remaining approximately 73%. Hence, this segment is anticipated to have the highest growth owing to the fact that, the method of onshore production benefits the oil and gas sector greatly. Moreover, offshore drilling has various hazard to the environment. However, onshore fracking does have some environmental drawbacks, but the oil and gas sector is currently taking action at onshore sites that should assist protect the local surroundings where natural gas and oil production are taking place. Moreover, onshore drilling makes use of locally available shales as well as other resources that make drilling sites flexible and mobile, such as skids, which make it simple to move equipment from one location to another. This lowers the installation and transportation expenses that would otherwise be significantly greater for an offshore project.

Service Segment Analysis

The global oilfield services market is also segmented and analyzed for demand and supply by service into geophysical, drilling, completion & workover, production, and processing & separation. Amongst which, the drilling segment is anticipated to have the significant growth over the forecast period. To produce a well for the production of oil and natural gas, a hole is created using a directional drilling tool. Owing to the growing need for oil the services of drilling is growing extensively. Oil drilling lowers the pressure in subterranean oil reserves, which significantly lowers the amount of hydrocarbon seepage and methane gas in the atmosphere. Also, increased drilling operations, according to scientific theory, might continue to improve atmospheric and aquatic conditions. Hence, the segment is estimated to grow owing to these factors, further boosting the market growth.

Our in-depth analysis of the global oilfield services market includes the following segments:

|

By Type |

|

|

By Service |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oilfield Services Market Regional Analysis:

North American Market Insights

North America industry is anticipated to hold largest revenue share of 35% by 2035. North American oil and gas projects are becoming more competitive as a result of increased efficiencies and tighter supply chains, along with rising government initiatives in oil and gas sector which is further boosting market growth. As a result, drilling expenses have decreased and many projects are now feasible. Fracking, horizontal well drilling, and the recent emergence of shale plays have all contributed to a sharp rise in the demand for oilfield services in the United States region. Also, growing export of crude oil from this region is also expected to boost the market. With a production of about 3 million barrels per day (mb/d) of crude oil in 2018, Canada is a significant provider of safe, dependable crude oil to worldwide markets. Only Saudi Arabia and Venezuela have more oil reserves than Canada, which is one of the world's top oil producers. The proven oil reserves in Canada include approximately 167 billion barrels, about 163 billion of which are oil sands.

APAC Market Insights

The Asia Pacific oilfield services market is estimated to be the second largest, to have the highest growth. The market for oilfield services in the Asia-Pacific region is anticipated to be driven by factors such an increase in demand for cutting-edge technology, tools, and equipment to boost the efficiency of exploration and production activities in onshore and offshore areas. Nonetheless, there has always been a large demand for oil and gas, which has fueled offshore development in Australia, Malaysia, and Indonesia. Thus, it is anticipated that during the forecast period, this would present a market opportunity. Moreover, the region's biggest oilfield services market that also includes oil and gas accumulator services is China. The nation has begun to utilize its shale gas supplies to satiate domestic demand and plans to lessen its reliance on natural gas imports. Additionally, the new reforms pertaining to the oil and gas sector are anticipated to make it simpler for private businesses to invest in this region, which is anticipated to aid in lessening the monopoly of state-owned businesses. The private sector's expanding investment is anticipated to enhance the oil and gas sector, which would in turn propel the market for oilfield services in this region.

Europe Market Insights

Additionally, the oilfield services market in Europe region is also estimated to have a significant growth over the forecast period. The oil and gas industry is observing scientific advancements in exploration technologies for deep-water drilling operations and project economic feasibility in this region which is estimated to boost the growth of the market. Moreover, oil companies are also increasing recovery and boosting output through contemporary technical breakthroughs. Many levels of automation are possible for offshore wells, from simple one-way monitoring to intricate subsurface controls with intelligent completions. Hence, this factor is estimated to boost the growth of the oilfield services market in this region.

Oilfield Services Market Players:

- Schlumberger Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baker Hughes Company

- Halliburton Energy Services, Inc.

- NOV Inc.

- Archer Limited

- TechnipFMC plc

- Nabors Industries Ltd

- Aker BP

- General Electric

- Welltec A/S

Recent Developments

-

In order to demonstrate its commitment to the Kingdom of Saudi Arabia, Baker Hughes Company, a GE business, announced plans to erect a cutting-edge oilfield services (OFS) facility in King Salman Energy Park (SPARK). Drilling services, wireline services, and pressure pumping are three OFS product lines that the new facility was estimated to be supported, assuring high-quality service delivery and preparing BHGE for future expansion in the area.

-

In order to start work on the Engineering, Procurement, and Construction (EPC) agreement with Assiut National Oil Processing Company (ANOPC) for the building of the new Hydrocracking Complex for the Assiut refineries in Egypt, TechnipFMC plc has successfully fulfilled the last conditions needed.

- Report ID: 4824

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oilfield Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.