Oil Storage Tank Service Market Outlook:

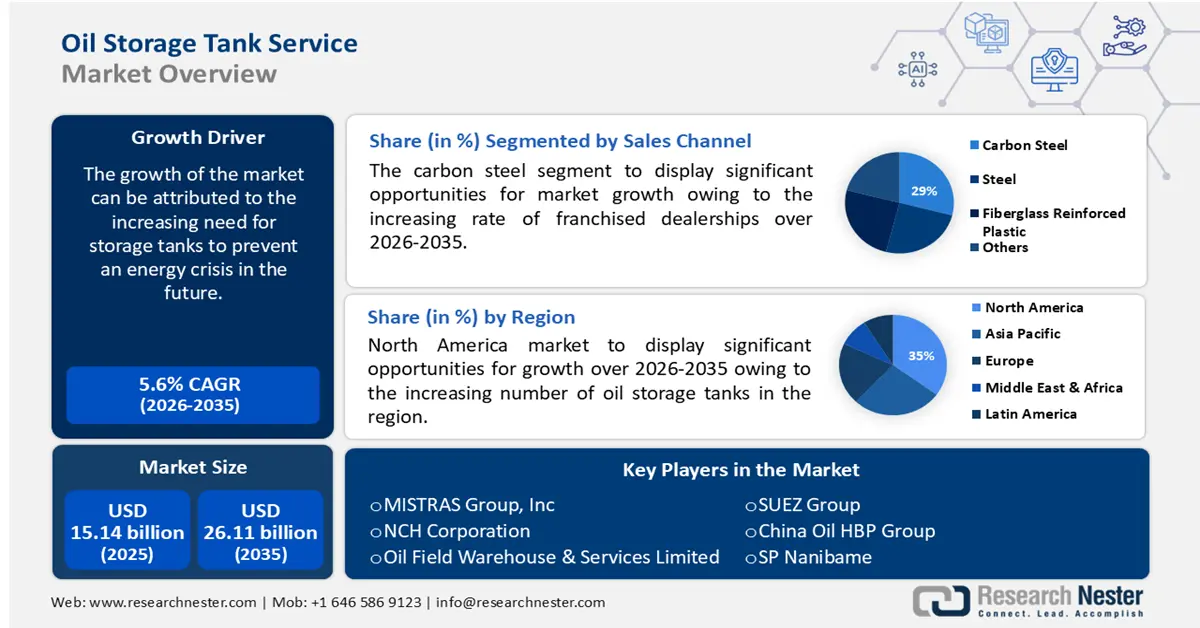

Oil Storage Tank Service Market size was valued at USD 15.14 billion in 2025 and is set to exceed USD 26.11 billion by 2035, expanding at over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil storage tank service is evaluated at USD 15.9 billion.

The growth of the market can be attributed to the increasing need for storage tanks to prevent an energy crisis in the future. Also, the rising consumption of fossil fuels in industries is estimated to boost the market growth. The total fossil fuel consumption in the year 2020 was 129,000 terawatt-hours as per the estimations which were over 90 million barrels per day globally.

In addition, the increasing need for distribution channels and refineries around the world is estimated to rise the need for an oil storage tank market. As per the estimations, more than 3 billion barrels of crude oil are stored in oil tanks across the world as of 2020. The growing demand for petroleum products for various uses is also estimated to hike the market growth during the forecast period. The demand for crude oil across the world in 2020 was reduced to 90 million during the COVID-19 disruption but was projected to reach more than 96 million barrels per day in 2021 with rising demand.

Key Oil Storage Tank Service Market Insights Summary:

Regional Highlights:

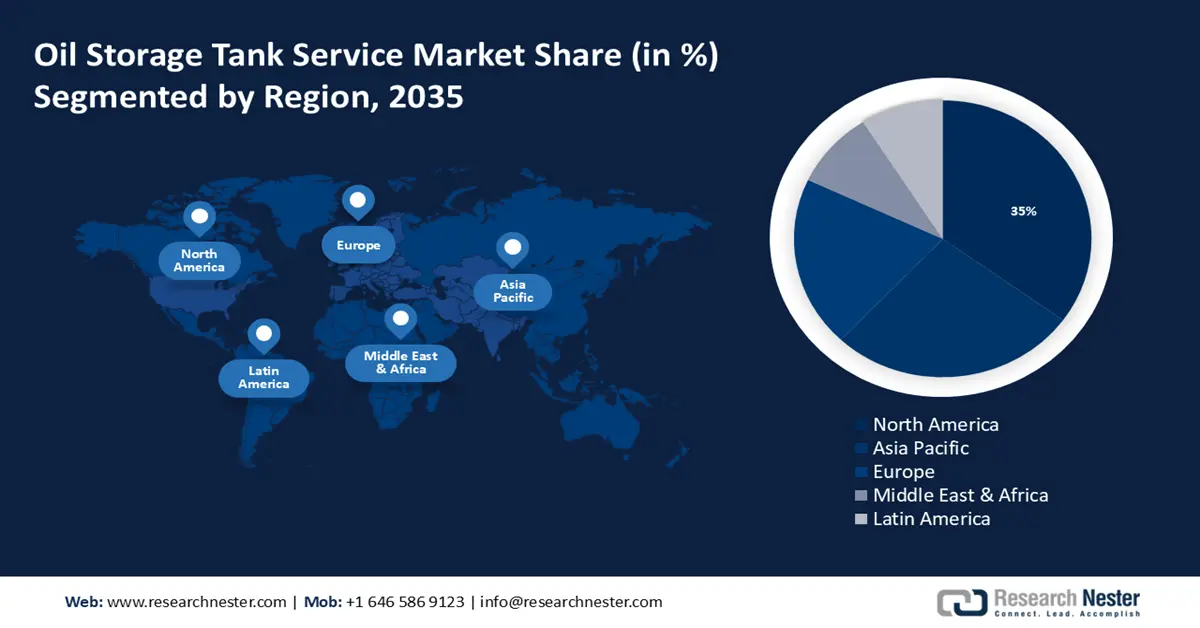

- North America is projected to capture a 35% share by 2035 in the Oil Storage Tank Service Market, supported by expanding storage infrastructure and rising governmental preparedness initiatives.

- The Asia Pacific region is anticipated to secure about 27% share by 2035, bolstered by the expanding petroleum reserves and increasing transportation activities.

Segment Insights:

- The carbon steel segment is estimated to hold about 29% share by 2035 in the Oil Storage Tank Service Market, propelled by its widespread use in cost-efficient and durable tank construction.

- The floating roof segment is expected to garner around 32% share by 2035, supported by the rising crude oil demand and heightened safety awareness in storage operations.

Key Growth Trends:

- Rising Oil Consumption with Increasing Automotive Vehicles on Road

- Increasing Demand for Crude Oil in Various End User Industries

Major Challenges:

- High Cost of Deploying Oil Storage Tank Service

- Property and Environmental Damage When Met with Fire

Key Players: John Wood Group PLC, MISTRAS Group, Inc, NCH Corporation, Oil Field Warehouse & Services Limited, System Kikou Co., Ltd., Veolia Environnement S.A., SUEZ Group, China Oil HBP Group, SP Nanibame, Petroleum Sarawak Berhad.

Global Oil Storage Tank Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.14 billion

- 2026 Market Size: USD 15.9 billion

- Projected Market Size: USD 26.11 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: – United States, China, India, Germany, Japan

- Emerging Countries: – Brazil, Indonesia, UAE, Saudi Arabia, South Korea

Last updated on : 20 November, 2025

Oil Storage Tank Service Market - Growth Drivers and Challenges

Growth Drivers

- Rising Oil Consumption with Increasing Automotive Vehicles on Road – The increasing adoption of automobiles across the world for convenience and comfort of the person is estimated to propel the market growth. The rising disposable income and living standards of people are also propelling the growth of automobiles in the coming years thereby driving the market growth during the forecast period. As of 2021, the total consumption of oil or gasoline by vehicles was reported to be more than 8.5 million barrels per day that were more than 40% of the total petroleum consumption in the U.S.

- Increasing Demand for Crude Oil in Various End User Industries – The worldwide demand for oil as of 2023 was set to reach 2 million barrels per day with more than half the profit from China.

- Rising Utilization of Fuel in the Aviation Sector for Engines – The consumption of jet fuel by domestic flights in the year 2020 July as per the estimations was reported to be 70% rising from the base of 55% in January.

- Growing Transportation Sector with Rising Passenger and Goods Transport – The value of public transportation in the world was projected to reach over 290 billion by the end of 2028 according to the reports.

- Increasing Imports and Exports around the World with Rising E-commerce – The net value of exports and imports in the world as of 2020 was shown to be 19,240,000 million and 17, 230,000 million respectively.

Challenges

- High Cost of Deploying Oil Storage Tank Service

- Property and Environmental Damage When Met with Fire – The presence of oil storage tanks in any location is highly hazardous as it leads to an explosion, asphyxiation, entrapment, falls, fire accidents, and others. Also, the physical and chemical harms caused by the steam, heat, noise, electric, and cold shocks are estimated to hamper the market growth.

- Can Contaminate Drinking Water and Underground Water Bodies

Oil Storage Tank Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 15.14 billion |

|

Forecast Year Market Size (2035) |

USD 26.11 billion |

|

Regional Scope |

|

Oil Storage Tank Service Market Segmentation:

The market is segmented and analyzed for demand and supply by material into steel, carbon steel, and fiberglass-reinforced plastic. Out of these types, the carbon steel segment is estimated to gain the largest market share of about 29% in the year 2035. The growth of the segment can be attributed to the increasing demand for carbon steel for the manufacturing of storage tanks across the world. Carbon steel is the most popular and widely used across the world for its wear resistance, stronger and harder compared to steel. The carbon steel tanks are lined and painted to enhance their resistance to chemicals and water making them a high preference for liquid and gas storage. These factors are estimated to hike the market segment growth in the coming years. The market segment growth is also attributed to the increasing oil storage tanks construction across the world with carbon steel to reduce cost and fulfill the requirements across the world. The carbon steel production and sales value in the year 2022 was estimated to be over USD 83 billion according to the statistics report.

The global oil storage tank service market is also segmented and analyzed for demand and supply by tank design into open-top, fixed roof, and floating roof. Amongst these three segments, the floating roof segment is expected to garner a significant share of around 32% in the year 2035. The market segment growth is attributed to the rising oil and gas production and increasing demand for crude oil across the world. The growing awareness of safety and the wastage of oil in storage tanks caused by dust, fire, and other particulate matter is estimated to drive the market segment growth in the coming years. The storage capacity of crude oil and crude oil products in 2020 for onshore and on-floating vessels was nearly 7 billion barrels. The increasing use of floating roof tanks is high in petroleum reserves as it is a volatile oil and tends to evaporate more often compared to other fossil fuels and is estimated to propel the market segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Material |

|

|

By Tank Design |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil Storage Tank Service Market - Regional Analysis

North American Market Insights

North America industry is poised to account for largest revenue share of 35% by 2035, The growth of the market can be attributed majorly to the increasing number of oil storage tanks in the region owing to rising government initiatives to prevent future crises. The past experiences of the U.S. in 1970 when the petrol supply from the Gulf cost is completely stopped as the U.S. supported Israel in the Yom Kippur War and this made Americans conscious about the fuel crisis to build many underground fuel tanks. Also, the U.S. is the largest oil storage region with Strategic Petroleum Reserve maintained for emergencies. The increasing presence of many inventories and refineries in the region during the forecast period is also estimated to fuel market growth. The increasing refinery capacity in the Gulf Coast of Mexico is estimated to hike the market growth. The rising industrial sector in the region that increases the consumption of oil for the working of machinery across the region is driving the market growth. According to the estimations, more than 6 billion barrels of crude oil reserves were located in Texas as of 2020.

APAC Market Insights

The Asia Pacific oil storage tank service industry is estimated to be the second largest, registering a share of about 27% by the end of 2035. The growth of the market can be attributed majorly to the increasing presence of huge petroleum reserves and crude oil resources in the region. The growing investment in petrol stations and pumps with increasing transportation in the region. The growing petroleum reserves in Saudi and other Gulf Nations are propelling the market growth. The presence of many oil-producing countries in the region along with growing fossil fuel demand is propelling the market growth in the region. As per the market analysis, the market growth is also attributed to the increasing imports and exports in the region. The rising transport to the marine industry to generate electricity and other power supply is driving the market growth during the forecast period. The increasing adoption of personal vehicles for transport is driving the use of oil in the region thereby propelling the market growth.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing initiatives to prevent environmental pollution caused by greenhouse gasses and prevent global warming. Also, the increasing oil storage industries in the region and increasing imports from across the world to meet the demands are projected to hike the market growth. The rising demand for petroleum products with the growing transportation sector is driving market growth in the region. The increasing use of oil in military and arm forces for manufacturing and production of weapons is estimated to propel market growth. Increasing investment in storage capacity construction and new pipelines in the region is fueling the market growth. Reducing the reliance on other countries such as Russia for oil and natural gas in coming years is estimated to increase the building of new storage tank facilities. The increasing consumption of oil for vehicles, power generation, and heating buildings is estimated to hike market growth.

Oil Storage Tank Service Market Players:

- John Wood Group PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MISTRAS Group, Inc

- NCH Corporation

- Oil Field Warehouse & Services Limited

- System Kikou Co., Ltd.

- Veolia Environnement S.A.

- SUEZ Group

- China Oil HBP Group

- SP Nanibame

- Petroleum Sarawak Berhad

Recent Developments

- MISTRAS Group joined Engineering Equipment and Materials Users Association (EEMUA) as an associate to extend the company’s operations in the UK, Netherlands, Belgium, Germany, and France.

- System Kikou Co., Ltd. was awarded an order for Crude Oil Washing (COW) cleaning work of 15 large crude oil tanks in total from Mutsu-Ogawara Oil Storage Co., Ltd. scheduled for one year of service which ends in 2022.

- Report ID: 3806

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil Storage Tank Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.