Oil and Gas Refinery Maintenance Services Market Outlook:

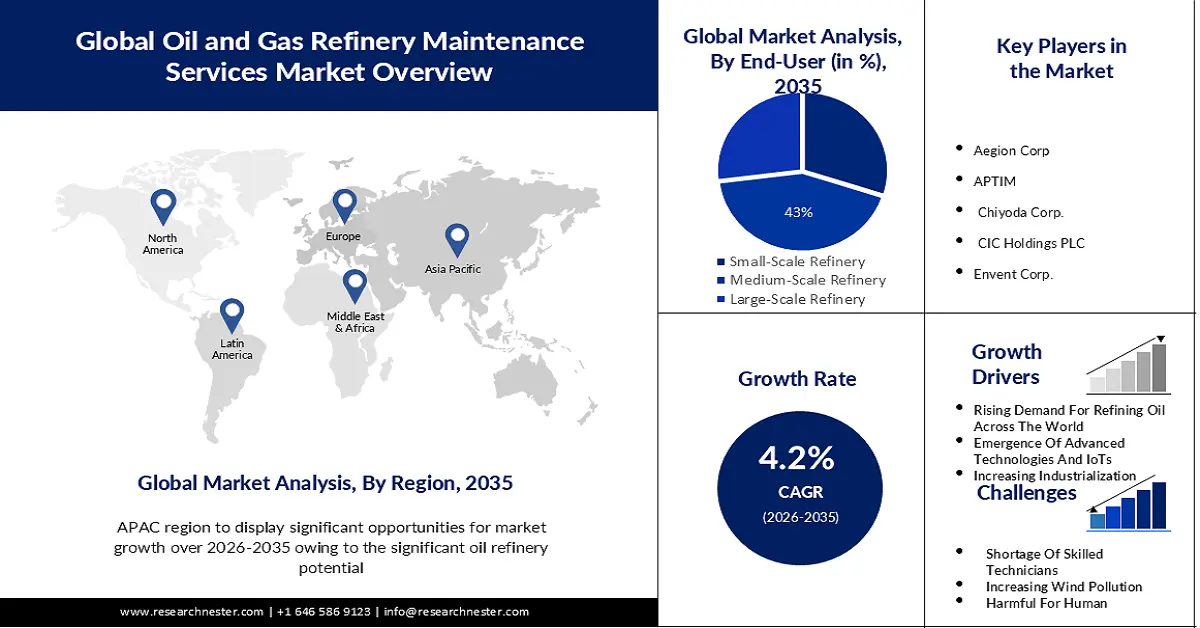

Oil and Gas Refinery Maintenance Services Market size was over USD 528.81 million in 2025 and is anticipated to cross USD 797.95 million by 2035, witnessing more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas refinery maintenance services is assessed at USD 548.8 million.

The primary reason for the expansion of the market can be attributed to the increasing demand for refined fuel across the world. The generation expansion of refined oil materials was pushed by OECD countries (+5%) like the United States (+5.2%), the EU (+5.4%, mainly in Italy, France, Germany, and Spain), the UK (+12%), South Korea (+7%) and Japan (+6%). It also rose in Saudi Arabia (+9.3%), India (+4.8%), and Latin America (+8.2%, comprising +7.2% in Brazil and +14% in Mexico).

Another reason that will help to grow the oil and gas refinery maintenance services market is the increasing number of offshore reserves and their activities. In a Sustainable Development Scenario, in which the globe gets on track to have its climate, air quality, and energy avail objectives, the offset of offshore activity transformation, but the total level stays significant. By the 2030s, offshore investment in this case – recently strongly weighted towards oil – is deeply divided into three roughly equal parts as oil and (to a lesser compass) gas output expansion is lower than in our primary case, while offshore electricity production increases twice as quick and gives 4% of international power production by 2040. Tapping the world’s massive offshore resources will be essential to match future energy requirements, but the dynamics of offshore energy are transforming quickly. The shale revolution is asking fresh questions for investment in offshore oil and gas. And, policy support and technology growth are encouraging major cost cutbacks for the next wave of offshore wind projects.

Key Oil and Gas Refinery Maintenance Services Market Insights Summary:

Regional Insights:

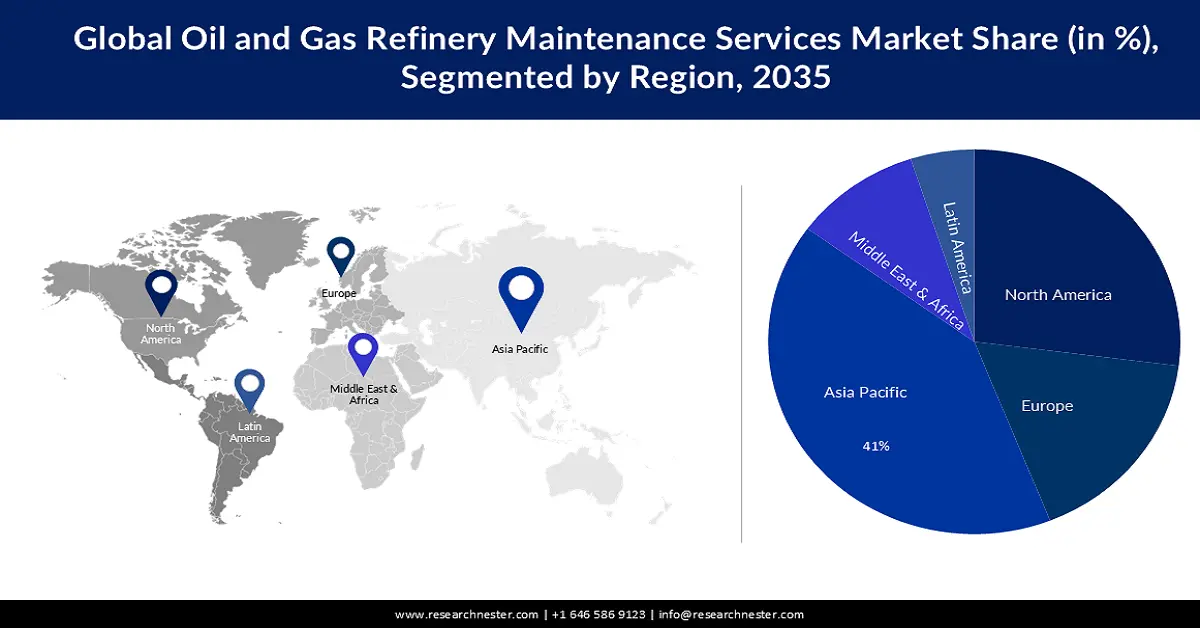

- By 2035, the Asia Pacific region is expected to hold about 41% share of the oil and gas refinery maintenance services market, stemming from increasing refining capacity in this region.

- North America is set to secure the second-largest position through 2035, bolstered by its significant oil refinery potential.

Segment Insights:

- By 2035, the medium-scale refinery segment of the oil and gas refinery maintenance services market is projected to command about 43% share, supported by the increasing number of medium-scale refineries across the world.

- The downstream segment is anticipated to capture a 40% share by 2035, underpinned by increasing revenue generation of downstream refineries worldwide.

Key Growth Trends:

- The Emergence of Smart Refineries

- Increasing Industrialization and The Need for Refined Oil

Major Challenges:

- Less Maintenance and Weak Refinery Plants

- Health and Environmental Rules Against Oil and Gas Refineries

Key Players: Aegion Corp, APTIM, Chiyoda Corp., CIC Holdings PLC, Envent Corp., Fluor Corp., Intertek Group Plc, KBR Inc., Matrix Service Co., MedEuropa Refining Group, Japan Petroleum Exploration Co., Ltd., Mitsubishi Oil Co., Maruzen Oil Co., Yokogawa Electric Corporation.

Global Oil and Gas Refinery Maintenance Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 528.81 million

- 2026 Market Size: USD 548.8 million

- Projected Market Size: USD 797.95 million by 2035

- Growth Forecasts: 4.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Japan, United Kingdom

- Emerging Countries: Brazil, Indonesia, UAE, Saudi Arabia, Mexico

Last updated on : 27 November, 2025

Oil and Gas Refinery Maintenance Services Market - Growth Drivers and Challenges

Growth Drivers

- The Emergence of Smart Refineries - There is a constantly increasing conviction in technological modifications vital to keep competitive and productive. Been refined petrochemical generation at your fingertips. Created to leverage the new modifications in automation, analytics, and data technology to maximize operations and optimize value, a ‘smart refinery’ can be explained by the increasing advantages of multiple different operational technologies implemented in pairs. By implementing automated systems to control and supervise production techniques, straight-aimed real-time management, and limiting waste, requirements can be met adaptable, and a short action plan for waste limitation can both mitigate OPEX and step in the command of meeting the net zero aim. In comparison to conventional maintenance of workflows, a smart refinery can also promote better strategy and programming of activities, resulting in quicker performance and modified protection.

- Increasing Industrialization and The Need for Refined Oil - There is much-existing literature assessing industrialization from an economic viewpoint. For example, recently, because of the recent unparalleled urbanization and industrialization, energy usage in China has been rising at a massive speed. Energy might be critical for accomplishing renewable growth. There is no doubt that it is the primary driver of economic expansion and has a substantial influence on the environment. Renewable energy growth is the primary focus of energy policy in all countries worldwide that are committed to renewable growth and climate change limitation. In line with the statistical data, the urbanization rate in China touched 56.1% which was 55% higher than that regarded in 2000. The industrialization level stayed stable from 40% to 45% marked by only a small fluctuation.

- Rapid Research and Development Activities in The Refinery Field - In developed countries, research and development (R&D) activities are the primary driver of technological transformation. This is not, however, the only mechanism of technological transformation. Companies and individual employees understand by doing, rising output and efficiency even if technology or inputs stay constant. As R&D activities in developing countries are comparatively restricted and countries are far from the technological border, global technology dispersion is vital for efficiency growth.

Challenges

- Less Maintenance and Weak Refinery Plants - Unexpected events like refinery explosions or leakages can have more quick impacts on community health because of the higher focus on toxins in the air. Even more, some refineries utilize various chemicals from other organizations. Refinery margins collapsed in October from the near-record levels accomplished during 3Q23. Weaker gasoline cracks host much of the reduction, but still-raised middle distillate cracks confirmed margins stayed above the five-year average. International crude runs are projected to increase by 1.9 mb/d in 2023 and 1 mb/d in 2024, to average 82.6 mb/d and 83.6 mb/d, individually. The health effects of living near a refinery prove to be chronic and gradual. These unseen fumes creep into the lives of thousands and short-change many.

- Health and Environmental Rules Against Oil and Gas Refineries

- Crisis of Skilled Technicians

Oil and Gas Refinery Maintenance Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 528.81 million |

|

Forecast Year Market Size (2035) |

USD 797.95 million |

|

Regional Scope |

|

Oil and Gas Refinery Maintenance Services Market Segmentation:

End-user (Small-scale refinery, Medium-scale refinery, Large-scale refinery)

Oil and gas refinery maintenance services market from the medium-scale refinery segment will have rapid growth and will hold the largest revenue share by the end of 2035 owing to the increasing number of medium-scale refineries across the world with a revenue share of almost 43%. In 2021 and 2022, the average dealing rate of refinery assets—as analyzed by both the number of refineries and capability—demonstrated powerful recovery, with 25 refineries transforming ownership, depicting 2.5 million barrels per day of capability. Projected expansion in post-pandemic international crude distillation capability through 2027 is collected to reinforce demand for high-execution catalysts to reconcile consequently capacity expansion for middle-scale refining techniques focused on meeting requirements for higher-value specialty materials according to a low-carbon future.

Product Type (Downstream, Midstream, And Upstream)

The downstream segment is poised to account for 40% share of the global oil and gas refinery maintenance services market by 2035. This growth will be encountered mainly because of the increasing revenue generation of the downstream refineries worldwide. For instance, BP's downstream business segment produced a profit of 188.6 billion USD in 2022. In 2020, BP's downstream profit declined by 35 percent from the earlier year, as the coronavirus epidemic massively limited transportation fuel requirements, specifically inside the aviation industry. BP is an internationally functioning oil and gas organization, headquartered in London, United Kingdom. The better part of BP's functioning profit was produced through its downstream division.

Our in-depth analysis of the global oil and gas refinery maintenance services market includes the following segments:

|

End-User |

|

|

Maintenance Type |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil and Gas Refinery Maintenance Services Market - Regional Analysis

APAC Market Analysis

Asia Pacific industry is estimated to dominate majority revenue share of 41% by 2035, This growth in the oil and gas refinery maintenance services market will be found due to the increasing refining capacity in this region. To illustrate, China’s refining capacity is projected to increase by almost 25.6 million mt/year in 2022, primarily because of PetroChina's latest Guangdong Petrochemical with a potential of 20 million mt/year and Sinopec Hainan Petrochemical's 5 million mt/year growth, which are to be submitted this year. China is focusing on capping the country's basic refining potential at 1 billion mt/year, or 20 million b/d, by 2025 while increasing implementation rates of its refining facilities to above 80%, in line with the national carbon peaking action strategy declared by the State Council in October.

North American Market Statistics

North America region will also encounter massive growth in the oil and gas refinery maintenance services market and will hold the second largest position in the world. This growth can be noticed primarily because of this region’s significant oil refinery potential. In 2021, oil refinery capacity in the United States was estimated to be roughly 17.9 million barrels per day, while the real refinery throughput was 17.5 million barrels of oil daily. The North American country has persistently managed a significant oil refinery potential worldwide. The most general mode of conveyance for their domestic crude oil refining was through pipelines. In 2020, 2.8 billion barrels of crude oil were conveyed by pipelines to refineries across the United States. Chevron, a multinational energy organization with headquarters in California, had a crude oil refining potential that tackled 1.8 billion barrels of crude oil daily across the world.

Oil and Gas Refinery Maintenance Services Market Players:

- Aegion Corp

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- APTIM

- Chiyoda Corp.

- CIC Holdings PLC

- Envent Corp.

- Fluor Corp.

- Intertek Group Plc

- KBR Inc.

- Matrix Service Co.

- MedEuropa Refining Group

Recent Developments

- Aegion Corporation, the foremost provider of infrastructure management, rehabilitation, and technology-offered water solutions, released the accomplishment of Culy Inc., an organization that provides analysis, management, and installation services for water and wastewater pipelines around the Midwest and Southeast. Culy will work as an Aegion portfolio organization.

- Intertek Group Plc, a chief Total Quality Assurance provider to industries across the world, magnifies its quality, protection, and renewability solution by presenting with the launch of Intertek Hydrogen Assurance, an end-to-end, consultative and assurance platform giving organizations with unparalleled entrance to hydrogen expertise and engineering resources for their projects and techniques.

- Report ID: 5536

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil and Gas Refinery Maintenance Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.