Oil and Gas Pipeline Market Outlook:

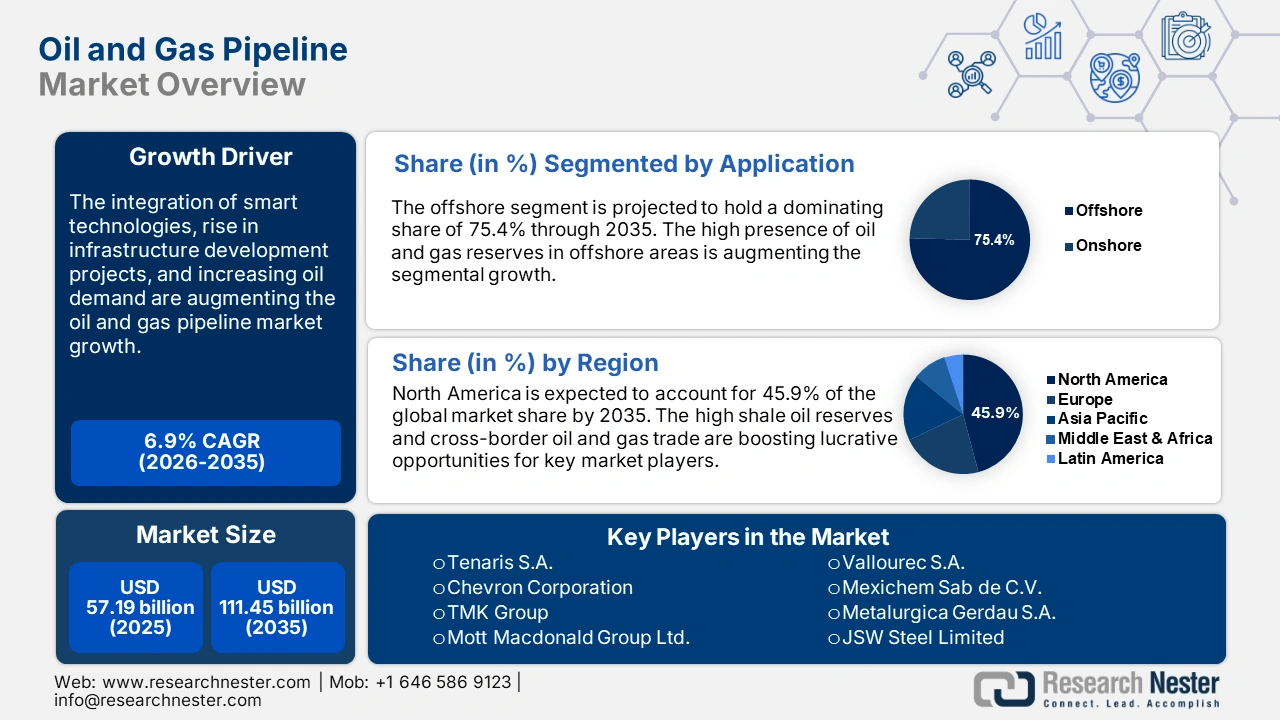

Oil and Gas Pipeline Market size was over USD 57.19 billion in 2025 and is projected to reach USD 111.45 billion by 2035, witnessing around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas pipeline is evaluated at USD 60.74 billion.

The overall energy landscape is shaped by four disruptors: macroeconomic variables including rising materials costs and high interest rates, evolving policies and regulations, the emergence of new technologies, and geopolitical factors. These disruptors influence the demand and supply, along with the trade and investments in the crude oil and natural gas (O&G) sector. With the addition of the Organization of the Petroleum Exporting Countries (OPEC+) output cutback of 2.5 million barrels per day (mbpd) in early November 2023, the U.S. Henry Hub natural gas prices rebounded to USD3.50/mmBtu and pushed Brent oil prices over USD 90/bbl.

Despite the abovementioned disruptions, the global oil demand increased between 2.3 mb/d to 101.7 mb/d in 2023 and this masked the impact of the macroeconomic climate. With Europe accounting for half the decline, the global 4Q23 demand growth was revised down by 400 kb/d and the slowdown continued in 2024, with global gains halving to 1.1 mb/d. Furthermore, the oil & gas sector faces pivotal opportunities to adapt to the evolving clean energy transitions and stringent energy economy regulations. Even under present-day policy settings including the Paris Agreement, the worldwide demand for both oil and gas is expected to peak by the end of 2030.

The rise in the oil and gas demand across the world is fuelling the need for safe and efficient pipelines. For instance, as per the International Energy Agency (IEA), in 2023, the global oil demand averaged over 102 million barrels per day. Several factors are contributing to the rising oil demand such as rapid urbanization and industrialization, a rise in shipping trade, and high energy consumption, worldwide. Thus, to ensure a stable supply of oil and gas the demand for advanced pipelines is gaining traction.

To reduce the dependency on a single oil and gas supplier, countries are investing in the diversification of oil and gas supply sources and routes, which is directly boosting the need for modern oil and gas pipelines. For instance, according to the European Commission, to mitigate the dependency of EU countries on a single oil and gas supplier, the Southern Gas Corridor project was carried out. This project was commissioned at the end of 202o and delivered 8.1 billion cubic meters of gas to Europe in 2021 and 11.4 billion cubic meters in 2022. The building of new routes drives investments in infrastructure development, increasing the need for the latest technologies and materials including advanced oil and gas pipelines.