Oil & Gas Magnetic Ranging Market Outlook:

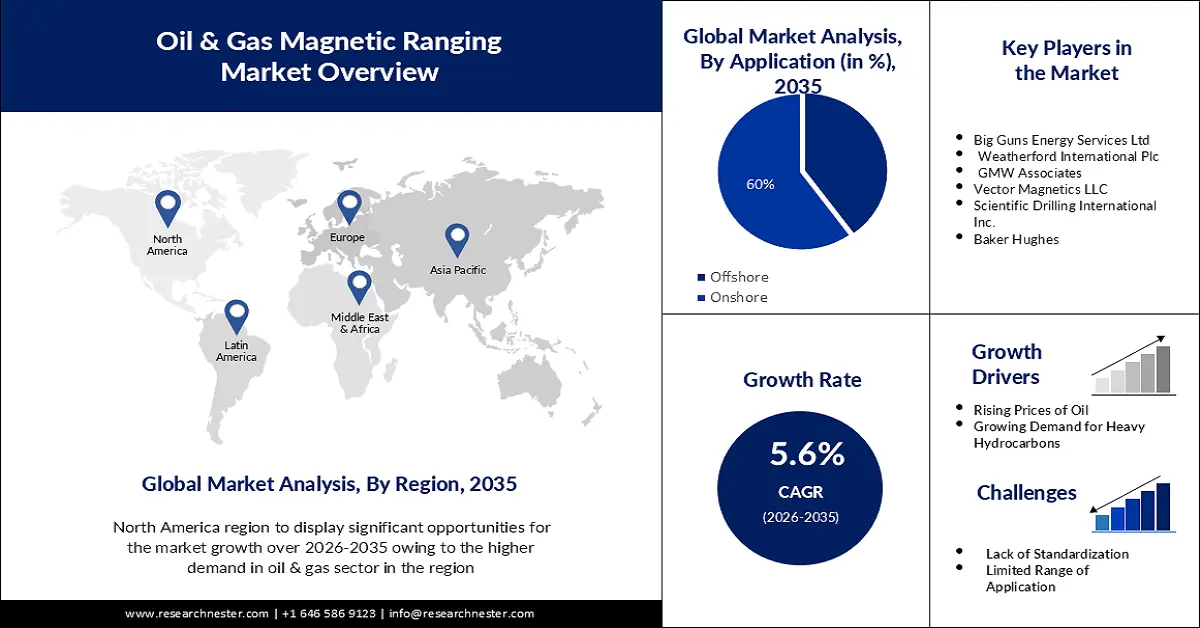

Oil & Gas Magnetic Ranging Market size was over USD 818.16 million in 2025 and is anticipated to cross USD 1.41 billion by 2035, growing at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil & gas magnetic ranging is assessed at USD 859.4 million.

The growth of this market can be primarily driven by the increasing prices of oil across the globe. The demand for oil & gas magnetic ranging is significantly increasing along with growing need for higher efficiency and productivity in oil extraction fields. In the last three months, Brent crude oil prices have risen by more than 30% and are currently trading at around USD 93 per barrel, the highest level since November 2022.

Support for gravity drainage is expected to be required with a view to increasing the number of advanced fields which will lead to market growth. Market growth is projected to take place over the next few years as a result of high oil production and extensive oil fields in the region. The rise in demand in the oil and gas sector are predicted to boost the market growth of oil & gas magnetic ranging in the projected time period.

Key Oil & Gas Magnetic Ranging Market Insights Summary:

Regional Highlights:

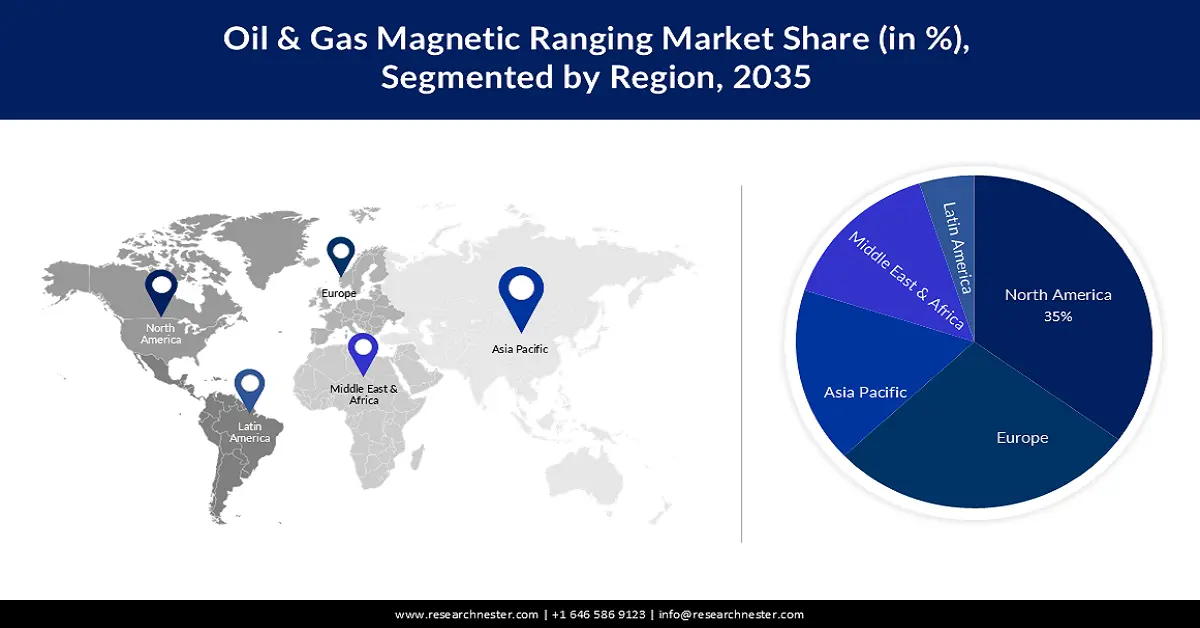

- By 2035, North America is projected to secure a 35% share in the oil & gas magnetic ranging market, supported by expanding shale gas recovery and rising steam-assisted gravity drainage operations in dense oil reserves owing to extensive upstream activities.

- Europe is anticipated to capture a notable share by 2035 as its widespread oil and gas infrastructure and advancing magnetic ranging technologies enhance operational efficiency due to rising regulatory emphasis on minimizing environmental risks.

Segment Insights:

- The onshore segment in the oil & gas magnetic ranging market is forecast to command a 60% share by 2035 as operators increasingly depend on magnetic ranging to optimize heavy hydrocarbon extraction impelled by the growing need for dewatering support in heavy oil fields.

- The active magnetic ranging segment is expected to lead through 2026-2035 by enabling precise well placement for enhanced oil recovery projects propelled by the rising integration of AMR in mature field development.

Key Growth Trends:

- High Demand in the Production of Heavy Hydrocarbons

- Increasing Integration of Horizontal and Directional Drilling

Major Challenges:

- Susceptibility to Interference

Key Players: Halliburton Company, Big Guns Energy Services Ltd., Weatherford International Plc, GMW Associates, Vector Magnetics LLC, Scientific Drilling International Inc., Baker Hughes, Bartington Instruments Ltd., Transocean Ltd., Schlumberger NV, Sierra Leone Petroleum Directorate, Abu Dhabi National Oil Company.

Global Oil & Gas Magnetic Ranging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 818.16 million

- 2026 Market Size: USD 859.4 million

- Projected Market Size: USD 1.41 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Saudi Arabia, Russia, China, Canada

- Emerging Countries: Brazil, United Arab Emirates, Norway, India, Mexico

Last updated on : 26 November, 2025

Oil & Gas Magnetic Ranging Market - Growth Drivers and Challenges

Growth Drivers

- High Demand in the Production of Heavy Hydrocarbons - The market for magnetic ranging is also expected to increase in the coming years, driven by growing demand for heavy hydrocarbons such as crude oil and bitumen. This magnetic range also supports coalbed methane production, steam-assisted gravity drainage, and other activities expected to be a catalyst for growth in oil and gas magnetic ranging markets.

- Increasing Integration of Horizontal and Directional Drilling – Horizontal and directional drilling techniques are becoming increasingly popular in the oil and gas industry as they allow operators to reach reservoirs that are not accessible from the surface. Magnetic ranging can be used to accurately track the position of the drill bit during these operations, which can help to prevent accidents and ensure that the well is drilled in the correct location.

- Development of New Technologies - New technologies are being developed that are making magnetic ranging tools more accurate, reliable, and cost-friendly. These technologies consist of advanced sensors, data processing algorithms, and cloud based software. This growing development of technology is boosting the expansion of the oil & gas magnetic ranging market in the studied period.

Challenges

- Susceptibility to Interference - Magnetic ranging tools can be interfered with by magnetic anomalies in the subsurface. This can make them less accurate in certain areas, such as those with high iron content. The development of new technologies could mitigate the effects of magnetic interference but this is an ongoing challenge. This is set to hamper the market growth in the estimated time period.

- Decline in Crude Oil Prices owing to less demand among the consumers has led to a decrease in drilling activities. These are Predicted to Hamper the Market Expansion in the Future Times

- Accuracy and Reliability Issues Associated with Magnetic Ranging is Anticipated to Pose Limitation on the Market Growth in the Upcoming Future.

Oil & Gas Magnetic Ranging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 818.16 million |

|

Forecast Year Market Size (2035) |

USD 1.41 billion |

|

Regional Scope |

|

Oil & Gas Magnetic Ranging Market Segmentation:

Application Segment Analysis

In terms of application, the onshore segment is poised to dominate the global oil & gas magnetic ranging market by registering a revenue share of 60% by the end of 2035. Magnetic ranging is used for a variety of oilfield applications, including blowout relief well positioning, steam-assisted gravity drainage, heavy oil applications, and planned well-to-well connections. Simple oil depletion is causing the oil and gas industry to switch to other options such as heavy oil and asphalt. Heavy hydrocarbon production requires dewatering assistance, increasing the need for magnetic ranging. Although global heavy oil production decreased to 11.6 million barrels per day in 2019 due to an increase in upcoming deepwater projects, horizontal drilling, and CBM projects, the magnetic ranging market is expected to grow significantly.

Technology Segment Analysis

Based on technology, the active magnetic ranging segment in the oil & gas magnetic ranging market is set to hold the largest revenue share during the expected period. The growth can be ascribed to the account of increasing integration in oil & and recovery techniques. EOR techniques are being used to extract more oil from mature fields. These techniques often require the precise placement of injection and production wells that can be facilitated by AMR. Such as AMR is used in steam-assisted gravity drainage projects to ensure that the steam injector and producer wells are placed at the optimal distance from each other.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil & Gas Magnetic Ranging Market - Regional Analysis

North American Market Insights

North America industry is expected to hold largest revenue share of 35% by 2035. The United States is one of the largest producers of crude oil and natural gas, accounting for approximately 18% and 23% of global production, respectively, in 2019. 8,390 uncompleted wells have already been drilled and new projects are expected to come online within the forecast period. Canada's oil reserves are the third largest in the world, 96% of which are oil sands reserves. The sand oil available here is a dense oil and has a high content of sand particles. Therefore, steam-assisted gravity drainage is increasing in such fields and requires efficient magnetic ranging results. In addition, North America is dominant in the magnetic range oil and gas market due to its huge amounts of recoverable shale gas as well as tight oil reserves worldwide. In the forecast period, this trend is projected to be maintained and further drive the market growth in this region.

European Market Insights

The oil & gas magnetic ranging market in the Europe region is anticipated to grow substantially by the end of the prediction period. It can be explained by the presence of a high number of oil and gas production facilities in these regions. In view of its extensive pipeline network and its robust oil and gas exploration activities, the UK is a major market contributor. Furthermore, technological advancements are making magnetic ranging tools more accurate, reliable, and affordable. This is making the technology more attractive to oil and gas operators. The oil and gas sector in Europe is facing increasing scrutiny from environmental regulators. Magnetic ranging technology can help to reduce the environmental impact of oil and gas operations by improving well placement and reducing the risk of spills and leaks.

Oil & Gas Magnetic Ranging Market Players:

- Halliburton Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Big Guns Energy Services Ltd.

- Weatherford International Plc

- GMW Associates

- Vector Magnetics LLC

- Scientific Drilling International Inc.

- Baker Hughes

- Bartington Instruments Ltd.

- Transocean Ltd.

- Schlumberger NV

- Sierra Leone Petroleum Directorate

- Abu Dhabi National Oil Company

Recent Developments

- In August 2022, the Sierra Leone Petroleum Directorate expressed interest in working with GCC and other African oil and gas producing countries and companies to foster socio-economic growth in their respective regions.

- In March 2019, Abu Dhabi National Oil Company announced that it would increase its oil and gas production capacity to 5 million barrels per day by 2030. This will open up new growth opportunities for the market in the coming years.

- Report ID: 5437

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oil & Gas Magnetic Ranging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.