Oil and Gas Data Monetization Market Outlook:

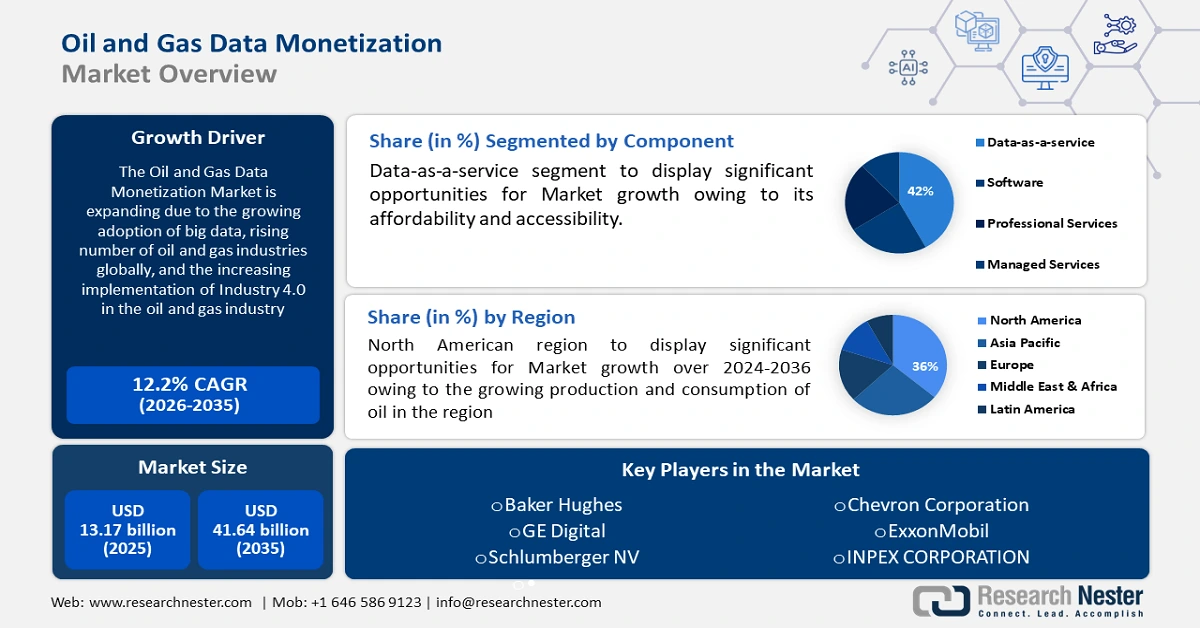

Oil and Gas Data Monetization Market size was over USD 13.17 billion in 2025 and is poised to exceed USD 41.64 billion by 2035, witnessing over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oil and gas data monetization is estimated at USD 14.62 billion.

Potential avenues for data monetization include investing in renewable energy, cutting carbon emissions, and increasing operational transparency. Major oil and gas firms are expected to invest more than USD 4.6 billion in renewable energy projects by 2021, with offshore wind power generation accounting for more than half of total capital expenditure (USD 2.7 billion).

Companies make sure that, in the framework of changing data privacy laws, they safeguard the security and privacy of their stakeholders and consumers. It will take cross-industry cooperation, including alliances between oil companies and technology businesses, to fully monetize oil and gas data. All of these factors contribute to the oil and gas data monetization market growth.

Furthermore, oil and gas firms can use data monetization to leverage their current data sets and obtain insights into their operations. In addition to cutting expenses, it can raise safety regulations and customer satisfaction. Moreover, data monetization can help businesses discover new oil and gas data monetization market and customize goods and services to suit the wants of their clients. Data monetization can help oil and gas companies compete more successfully, in addition to finding new business opportunities and creating creative solutions.

Key Oil and Gas Data Monetization Market Insights Summary:

Regional Highlights:

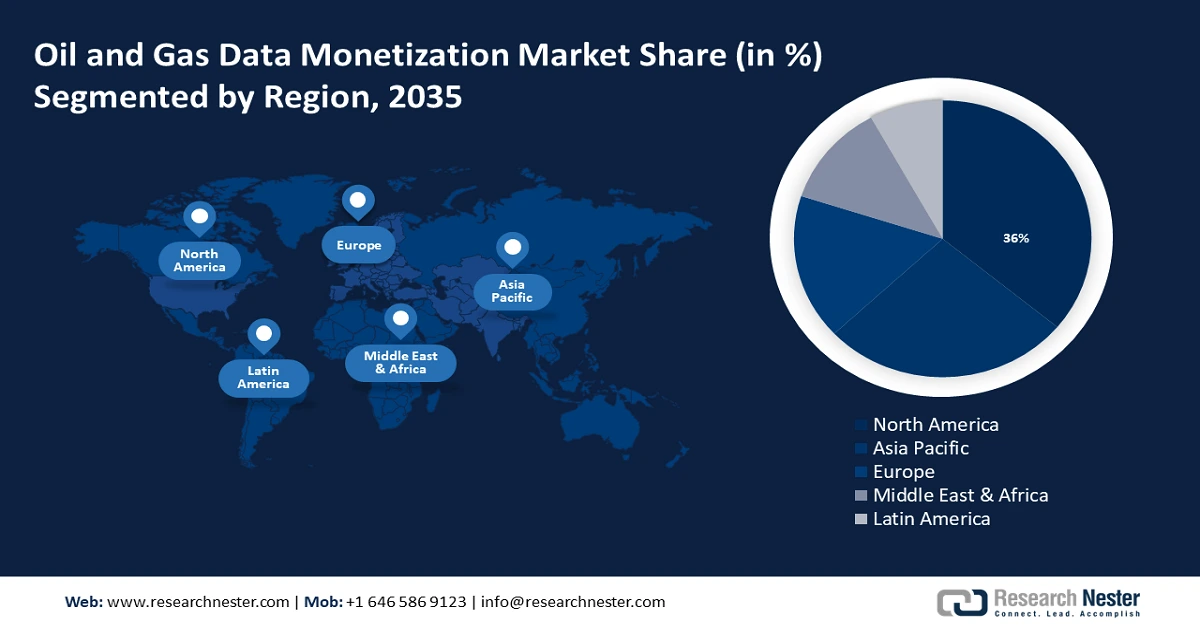

- North America’s oil and gas data monetization market will hold over 36% share by 2035, driven by growing production and consumption of oil and infrastructure development.

- Asia Pacific’s market will achieve a 27% share by 2035, driven by adoption of digital technologies and increasing oil and gas demand.

Segment Insights:

- The upstream segment in the oil and gas data monetization market is expected to secure a 46% share by 2035, driven by increasing upstream activities, technological advances, and rising global energy demand.

- The data-as-a-service segment in the oil and gas data monetization market is forecasted to achieve a 42% share by 2035, driven by the flexibility, scalability, and expertise offered by data-as-a-service providers.

Key Growth Trends:

- Growing adoption of big data

- Growing implementation of industry 4.0 in the oil and gas industry

Major Challenges:

- Integration with existing legacy infrastructure

- A lack of awareness regarding the implementation of advanced technologies may hamper market growth.

Key Players: Microsoft UAE, Baker Hughes, GE Digital, Schlumberger NV, Chevron Corporation, ExxonMobil, INPEX CORPORATION, ENEOS Corporation, HACARUS INC, Iwatani Corporation.

Global Oil and Gas Data Monetization Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.17 billion

- 2026 Market Size: USD 14.62 billion

- Projected Market Size: USD 41.64 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, China, Canada, Germany

- Emerging Countries: China, India, United Arab Emirates, Saudi Arabia, Qatar

Last updated on : 16 September, 2025

Oil and Gas Data Monetization Market Growth Drivers and Challenges:

Growth Drivers

- Growing adoption of big data - Due to the ongoing changes in the supply chain and demand, the oil and gas industry has been redefining its boundaries in recent years. As a result, oil and gas companies are implementing cutting-edge solutions like oil and gas data monetization to overcome obstacles throughout the value chain and make data-driven decisions.

Oil and gas industries have been using prescriptive and predictive analytics systems for real-time data analysis and cost reduction in recent years. As a result, advancements in big data, analytics, and cloud computing are opening up enormous prospects for the oil and gas data monetization market and assisting oil and gas organizations in keeping up with the continuous digital transformation. - Growing number of oil and gas industries globally - The growing number of oil and gas companies across the globe acts as one of the major factors driving the growth of the market. Also, the growing production and consumption of oil and gas are escalating the growth of the oil and gas data monetization market. For instance, the production of oil globally exceeds four billion metric tons annually, with the Middle East holding about half of the proven oil reserves. The increase in the adoption of advanced technologies in the oil and gas industry has enabled the collection of real-time data from various sources, such as sensors, equipment, and production systems.

- Growing implementation of industry 4.0 in the oil and gas industry - Oil and gas industries have improved remarkably with the introduction of innovations like automation, artificial intelligence (AI), and machine learning. For instance, smart sensors and thermal detectors have been installed on transportation railcars and tracks midstream to improve safety and reduce the risk of a derailment; advanced 4D modeling in seismic imaging is being used upstream to enable more efficient and effective exploration and production; and predictive data analytics are helping to improve forecasting and automation downstream for increased productivity and efficiency and less waste.

Challenges

- Integration with existing legacy infrastructure - One of the main things that are anticipated to impede the growth of the oil and gas data monetization market is the integration of oil and gas data monetization solutions with the current legacy infrastructure. It can be difficult to comply with data protection laws, intellectual property rights, and data-sharing agreements, particularly when working with outside parties. Therefore, this factor may hamper the growth of the oil and gas data monetization market.

- A lack of awareness regarding the implementation of advanced technologies may hamper market growth.

- An increase in the complexity of data structures may hinder the growth of the market.

Oil and Gas Data Monetization Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 13.17 billion |

|

Forecast Year Market Size (2035) |

USD 41.64 billion |

|

Regional Scope |

|

Oil and Gas Data Monetization Market Segmentation:

Component Segment Analysis

In oil and gas data monetization market, data-as-a-service segment is poised to dominate over 42% share by 2035. Oil and gas companies may now easily and affordably access and use critical data due to data-as-a-service. They can rely on specialist data service providers rather than purchasing pricey infrastructure and resources to gather, store, and analyze data themselves. Furthermore, data-as-a-service offers flexibility and scalability.

Businesses may find it challenging to maintain the requisite infrastructure and knowledge as the amount and complexity of data in the oil and gas sector continue to rise. Additionally, vendors of data-as-a-service frequently possess knowledge of data science and advanced analytics methods. They can use artificial intelligence (AI), machine learning, and complex algorithms to extract useful patterns and trends from the data.

Application Segment Analysis

In oil and gas data monetization market, upstream segment is estimated to account for around 46% revenue share by 2035. The upstream segment, which involves exploration and production activities, generates a vast amount of data throughout the entire lifecycle of oil and gas projects. Data monetization in the upstream segment enables companies to enhance their asset management and predictive maintenance capabilities. Also, advancements in technology made it easier to collect, store, and analyze large volumes of data in the upstream segment.

Techniques like horizontal drilling and hydraulic fracturing have opened up previously inaccessible reserves, leading to increased activity in the upstream segment. Also, the rising global population and increasing energy consumption drive the demand for oil and gas. For instance, in 2018, worldwide energy demand climbed by 2.9%. If nothing changes, by 2040, global energy consumption is expected to reach 740 million terajoules or an extra 30% growth. As economies grow and industries expand, the need for energy continues to rise. Therefore, these factors are escalating the growth of the upstream segment.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Application |

|

|

Method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oil and Gas Data Monetization Market Regional Analysis:

North American Market Insights

By 2035, North America region, is expected to dominate over 36% oil and gas data monetization market share. The growth can be attributed to the growing production and consumption of oil in the region. For instance, oil production in North America increased to 25.3 million barrels per day in 2022 from about 24 million barrels per day the year before.

Also, the implementation of necessary infrastructure in the oil and gas industries in the region is propelling market growth. Furthermore, the growing use of indirect data monetization solutions in the industry may further accelerate the growth of the market.

APAC Market Insights

By 2035, Asia-Pacific region in oil and gas data monetization market is anticipated to account for around 27% revenue share. The growing adoption of digital technologies in the region is one of the major factors driving the growth of the market. Also, the increasing demand for oil and gas is driving the growth of the market. Furthermore, the increase in initiatives taken by the government for the adoption of renewable energy in various industries is also escalating oil and gas data monetization market growth in the region.

Oil and Gas Data Monetization Market Players:

- Microsoft UAE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baker Hughes

- GE Digital

- Schlumberger NV

- Chevron Corporation

- ExxonMobil

- INPEX CORPORATION

- ENEOS Corporation

- HACARUS INC

- Iwatani Corporation

Recent Developments

- To establish global best practices for the aluminum industry and enhance the sustainability of EGA's computing operations, Microsoft UAE and Emirates Global Aluminum, the largest industrial company in the United Arab Emirates outside of oil and gas, announced their partnership on Industry 4.0 and broader digital transformation.

- The BHC3 output OptimizationTM program, developed by C3.ai and Baker Hughes, enables well operators to better forecast future output, analyze real-time production data, and optimize operations for increased rates of oil and gas production. The application is the most recent addition to the expanding library of BHC3 AI apps.

- Report ID: 5497

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.