Offshore Wind Energy Market Outlook:

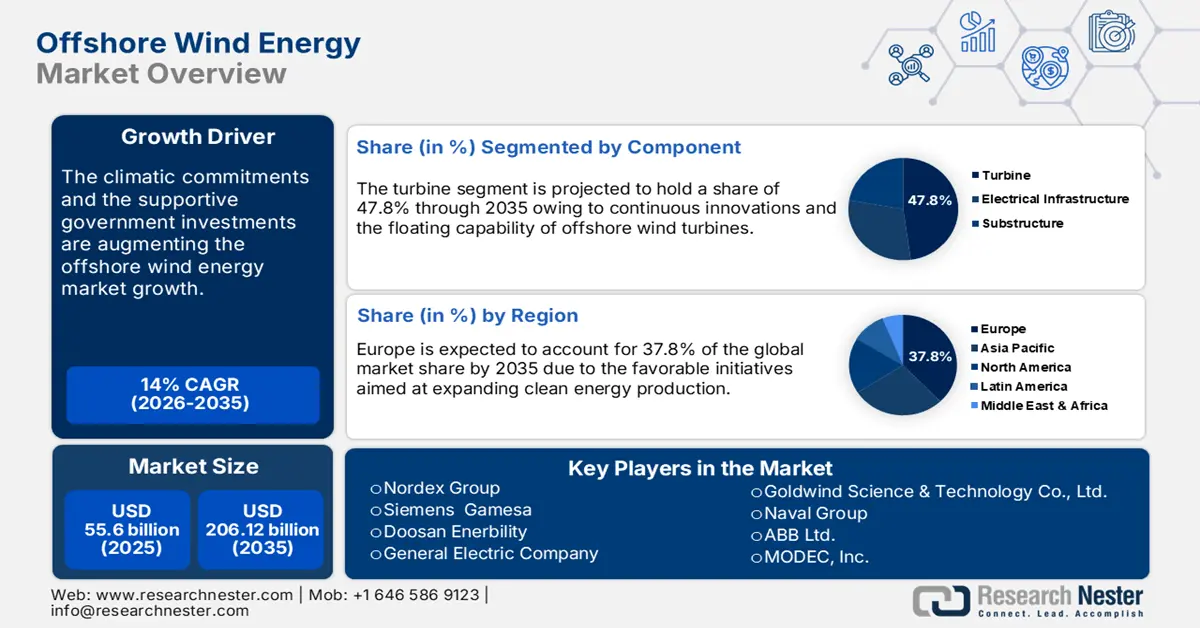

Offshore Wind Energy Market size was valued at USD 55.6 billion in 2025 and is expected to reach USD 206.12 billion by 2035, expanding at around 14% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of offshore wind energy is evaluated at USD 62.61 billion.

The increasing importance of clean energy and the mitigation of carbon emissions is significantly augmenting the demand for decarbonized energy systems. Offshore wind energy is emerging as the most effective technology to meet energy demands and zero carbon emission goals. For instance, the International Energy Administration (IEA) estimates that the worldwide offshore wind capacity is poised to expand 15-fold and reach nearly USD 1.0 trillion by 2040. Supportive government policies and technological advancements are anticipated to drive this growth. The same source also states that renewable energy is estimated to capture 46.0% of the total electricity sector by 2030 from 30.0% in 2023, with solar and wind dominatingly backing the growth.

The wind electricity generation recorded 265 TWh in 2022 and is set to reach around 7400 TWh by 2030. Public and private investments owing to zero emission scenarios are likely to uplift the revenues of offshore wind energy companies in the years ahead. The rising investments in renewable energy projects particularly wind and solar are foreseen to propel the North America market growth during the foreseeable period. The National Renewable Energy Laboratory (NREL) estimates that the U.S. has around 25,116 MW in the floating offshore wind energy pipeline as of May 2024 including the east and west coasts. The same source also states that the 132-megawatt (MW) South Fork Wind Farm off Rhode Island is the first commercial-scale offshore wind power plant of the U.S., which started transporting power to New York in November 2023 and was fully started by March 2024.

Key Offshore Wind Energy Market Insights Summary:

Regional Highlights:

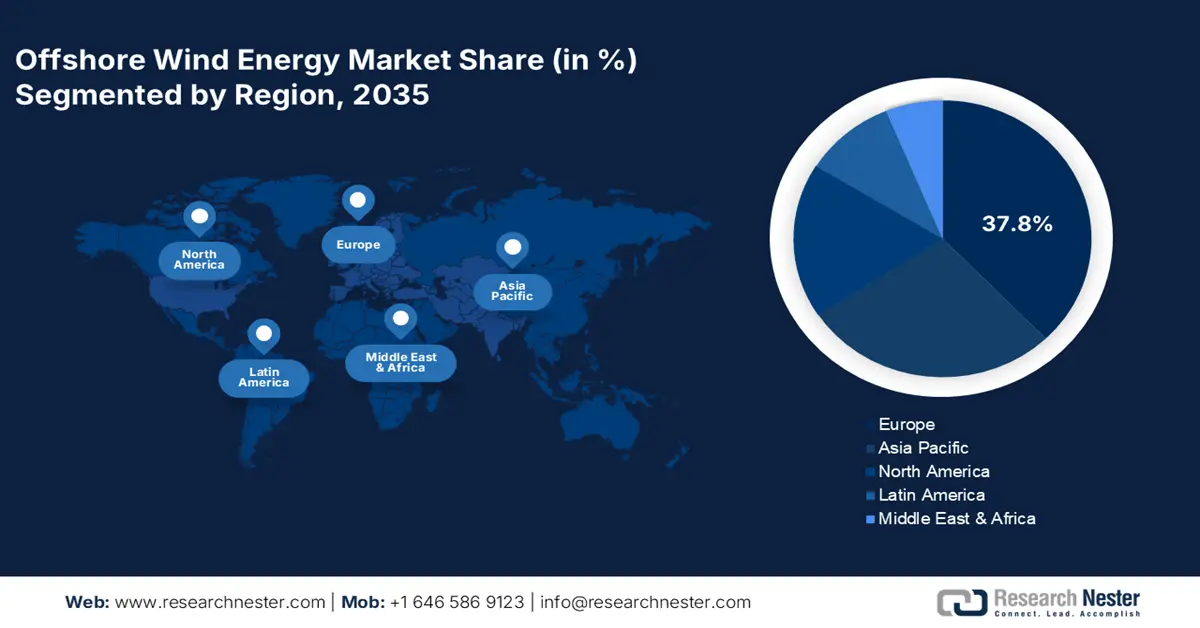

- Europe commands the Offshore Wind Energy Market with a 37.8% share, fueled by carbon neutrality goals and wind capacity investments, driving sustained growth through 2026–2035.

- Asia Pacific's Offshore Wind Energy Market is anticipated to experience high growth by 2035, propelled by wide coastline and rising public-private investments.

Segment Insights:

- The 3 MW to 5 MW Segment is expected to achieve a 43.1% share by 2035, fueled by its cost-effective and scalable wind energy capacity options.

- The Turbine Segment is projected to capture a 47.80% share by 2035, fueled by innovations in floating offshore turbine platforms and DOE initiatives.

Key Growth Trends:

- Offshore wind resources abundance

- Climatic commitments driving investments in wind energy production

Major Challenges:

- Offshore wind energy a capital-intensive business

- Grid infrastructure and connectivity challenges

- Key Players: Nordex Group, Siemens Gamesa, Doosan Enerbility, and General Electric Company.

Global Offshore Wind Energy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 55.6 billion

- 2026 Market Size: USD 62.61 billion

- Projected Market Size: USD 206.12 billion by 2035

- Growth Forecasts: 14% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (37.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United Kingdom, China, United States, Japan

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 13 August, 2025

Offshore Wind Energy Market Growth Drivers and Challenges:

Growth Drivers

- Offshore wind resources abundance: The abundance of offshore wind resources is impressively fueling the overall market growth by attracting potential investments. Cities with larger coastlines are poised to meet the increasingly expanding electricity demands by generating huge amounts of renewable energy from offshore wind projects. For instance, the National Renewable Energy Laboratory discolses that U.S. offshore wind has the technical resource potential of over 4,200 gigawatts of capacity or 13,500 terawatt-hours annual production. This is nearly 3 times the electricity consumed by the Americans, yearly. Thus, the larger coastlines with larger amounts of offshore winds are highly aiding in clean energy production and long-term benefits.

- Climatic commitments driving investments in wind energy production: The climatic commitments and carbon emission goals are driving investments in clean energy production. Public and private entities are heavily investing the clean energy projects to gain gigantic returns on investments and offshore wind energy is gaining traction in this scenario. For instance, the IEA study estimates that the investment in wind energy generation surpassed by 20.0% and reached a record USD 185 billion in 2022 from 2021 owing to focused zero emission goals of governments, supportive policies, and increasing competitiveness.

Challenges

- Offshore wind energy a capital-intensive business: The high upfront cost required for the construction of the overall infrastructure is hindering the entry of new and small-scale companies. The construction of wind turbines, substructures, and electrical infrastructure is capital-intensive. Also, financing offshore wind projects is quite risky due to long payback periods and unpredictable returns on investments. Thus, high capex requirements limit the entry of new companies.

- Grid infrastructure and connectivity challenges: In certain cases, the location of offshore farms is far away from shore, which creates major challenges in connection with onshore power grids. Conventional and insufficient transmission infrastructure lack to ensure offshore energy generation and transportation. Furthermore, the grid capacity and compatibility issues hinder the overall offshore wind energy market growth to some extent. In certain regions, the opposition to offshore wind farms is another major challenge for market players.

Offshore Wind Energy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 55.6 billion |

|

Forecast Year Market Size (2035) |

USD 206.12 billion |

|

Regional Scope |

|

Offshore Wind Energy Market Segmentation:

Component (Turbine, Electrical Infrastructure, Substructure)

The turbine segment is predicted to hold over 47.8% offshore wind energy market share by the end of 2035. The floating capability of offshore wind turbines is substantially contributing to the segment growth. The key market players are continuously investing the R&D to introduce innovative floating offshore wind platforms. For instance, the U.S. Department of Energy (DOE) states that around 80.0% of offshore wind energy projects invest in semi-submersible turbine platforms. DOE introduced Energy Earthshot in 2022 to mitigate the costs of floating offshore wind turbines to 75.0% by 2035, particularly for those in deep waters, which are far from shore.

Capacity (Up to 3 MW, 3 MW to 5 MW, Above 5 MW)

By the end of 2035, 3 MW to 5 MW segment is expected to capture around 43.1% offshore wind energy market share. Compared to larger capacities the 3 MW to 5 MW is relatively a cost-effective investment. This lower capital expenditure attracts developers and financers to invest in 3 MW to 5 MW projects. Smaller projects also require lower operational and maintenance costs compared to bigger counterparts. Furthermore, greater flexibility, scalability, and adaptability are driving the overall segmental growth.

Our in-depth analysis of the global offshore wind energy market includes the following segments:

|

Component |

|

|

Location |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Offshore Wind Energy Market Regional Analysis:

Europe Market Forecast

Europe in offshore wind energy market is set to account for around 37.8% revenue share by 2035. The region is pioneering in offshore wind energy technology and is estimated to position as the global powerhouse in the coming years. IEA report states that currently the European Union accounts for over 20 gigawatts of wind capacity and this is poised to increase to 180 gigawatts by 2040. The carbon neutrality goals and increasing investments in offshore wind capacities are augmenting the overall market growth.

The U.K. in offshore wind energy market is the most profitable marketplace in Europe owing to robust public investments in renewable energy projects. The IEA study highlights that the country in 2022 installed nearly 3 GW of offshore wind capacity, which was higher than the rest of the countries excluding China. For the first floating offshore wind project in England and Wales Hexicon's TwinHub project received 15-year revenue support from the government. The U.K. government revealed that in April 2022, the British Energy Security Strategy (BESS) intended its ambition to generate around 50 GW of offshore wind, with 5 GW from innovative floating technology by 2030, offering nearly 90,000 direct and indirect jobs.

The green trend in France is set to uplift its position in the Europe offshore wind energy markt during the study period. The rise in renewable and carbon-free energy production is further opening profitable doors for offshore wind energy technology producers. For instance, in July 2023, Iberdrola’s Saint-Brieuc offshore wind farm supplied the first green megawatts to the French national electricity grid. This project is estimated to generate 9.0% of Brittany’s total electricity consumption.

Asia Pacific Market Statistics

Asia Pacific offshore wind energy market is likely to witness high growth rate till 2035. The region’s wide coastline area is strongly supporting the sales of offshore wind energy solutions. The emerging economies in the region are positively influencing offshore wind energy production and consequently technology sales. China, India, South Korea, Japan, and Taiwan are the fastest-expanding markets for offshore wind energy companies. The hike in public and private investments coupled with strict emission goals are likely to fuel the consumption of offshore wind energy in the years ahead.

China’s efforts to reduce air pollution and the increasing popularity of renewable energy sources are expected to boost the number of offshore wind energy farms in the coming years. The country’s major population lives across the east and southern parts, which makes it lucrative for offshore wind energy investors. IEA estimates that by the end of 2025, China is estimated to have the largest offshore wind fleets overtaking other countries across the world. The country’s offshore wind capacity is expected to reach 110.0 gigawatts by 2040 from 4.0 gigawatts in 2019. The climatic commitments and sustainable energy goals are even estimated to promote the capacity to over 170.0 gigawatts.

India is witnessing high growth in the consumption of renewable energy sources including wind, solar, and water. The International Trade Administration (ITA) estimated that in 2023, renewable energy sources achieved a combined installed capacity of 125.159 gigawatts. The country’s vast coastline of around 7,600 km is offering positive prospects for offshore wind energy solution manufacturers. Offshore wind energy production is aiding the country to achieve 500.0 gigawatts of renewable energy capacity by 2030 and a net zero carbon emission goal by 2070. The Ministry of New and Renewable Energy (MNRE) is actively supporting the country to develop and use maritime space for offshore wind energy production. By 2030, the country is poised to achieve 30 GW of offshore wind projects. Gujarat and Tamil Nadu alone have the potential of 70.0 GW offshore wind power production, which powers more than 50 million residential structures.

Key Offshore Wind Energy Market Players:

- Nordex Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Gamesa

- Doosan Enerbility

- General Electric Company

- Equinor ASA

- Iberdrola, S.A.

- Goldwind Science & Technology Co., Ltd.

- Naval Group

- Nordex SE

- ABB Ltd.

- MODEC, Inc.

- EDF Renewables

The leading companies in the offshore wind energy market are being widely supported by public and private investments to expand their operations. The climatic commitments of the countries coupled with zero emission goals are further uplifting the offshore wind energy demand and subsequently the market shares of key players. The industry giants are employing several organic and inorganic strategies such as the introduction of new technologies, continuous investments in research and development activities, strategic collaborations & partnerships, mergers & acquisitions, and global expansion to earn high profits and maximize their reach.

Some of the key players include in offshore wind energy market:

Recent Developments

- In April 2024, Nordex Group announced that it received orders for 295 MW from EDF Renewables in South Africa for two wind energy projects. The projects are part of the Korosun 2 cluster and are being built on the border of the Eastern Cape and Northern Cape provinces with an estimated commission by Q1 of 2026.

- In February 2023, Siemens Gamesa and Doosan Enerbility revealed the signing of a binding framework agreement for a strategic partnership for the growth of South Korea offshore wind market. This partnership focuses on staging harbor turbine assembly, knowledge exchange for technology on offshore wind turbine nacelle assembly, and offshore service contracts.

- Report ID: 7216

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Offshore Wind Energy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.