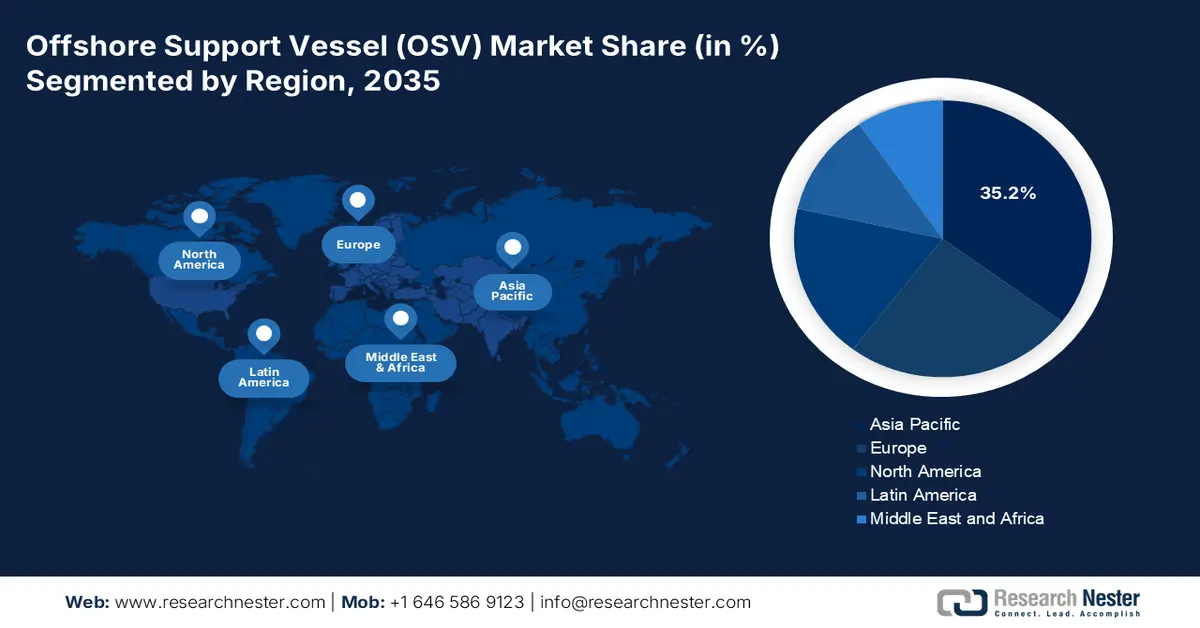

Offshore Support Vessel (OSV) Market - Regional Analysis

APAC Market Insights

Asia Pacific in the offshore support vessel (OSV) market is anticipated to garner the highest share of 35.2% by the end of 2035. The market’s upliftment is highly attributed to the state-backed and huge energy security, along with industrial development agendas. Besides, according to an article published by the Fundamental Research in September 2024, wind energy resources are abundant in China, with an approximate power generation of almost 17.5 PWh. In addition, the present utilization of offshore wind energy in China caters to 21% of international capacity; the overall share is restricted, readily supplying just 0.4% of regional electricity demands. Besides, countries in Southeast Asia, such as Vietnam, Malaysia, and Indonesia, have strongly developed into conventional oil and gas sectors, and nascent offshore wind projects to uplift the economic growth of the market.

China market is growing significantly, owing to the staggering scale of the offshore wind objective with coastal provinces, such as Jiangsu and Guangdong, mandating to installation of facilities as part of the national target. In this regard, as per an article published by NLM in November 2022, Jiangsu comprises the highest amount of offshore wind power of 4.2 GW, while Guangdong is projected to escalate offshore wind power construction to 30 GW by the end of 2035, along with 65 GW as of 2050. In addition, Guangdong has showcased the largest growth rate of offshore wind power, denoting an increase from 3.0% in 2025 to 11.4% in 2030, and it is further projected to increase to 24.8% in 2050, thereby boosting the market’s growth in the overall country.

India in the offshore support vessel (OSV) market is also growing due to the convergence of policy reforms, tactical energy security demands, and the launching of unexplored and massive offshore basins. In addition, the government’s Hydrocarbon Exploration and Licensing Policy (HELP), along with the recent introduction of the 52-block Discovered Small Fields (DSF) bidding rounds, has strongly attracted private investment into offshore oil and gas. As stated in a report published by the PIB Government in February 2024, the government of India has permitted bids for developing offshore wind energy, with an overall capacity of 4GW. This particular bid includes 4 blocks of 1 GW each on an open access basis off the Tamil Nadu coast. Moreover, offshore wind in the country approaches nearly 50% of the Capacity Utilization Function (CUF), which positively impacts the market’s growth.

North America Market Insights

North America in the offshore support vessel (OSV) market is projected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly fueled by sustained hydrocarbon activity in the Gulf of Mexico, along with the unprecedented U.S. federal investment in offshore wind. Besides, the region is gradually shifting from a historically dominated market to energy transition projects, which is also uplifting the market. As per an article published by the U.S. Department of Energy (DOE) in 2025, a clean hydrogen standard of 4 kg CO2e/kg H2 has been unveiled by the Hydrogen and Fuel Cell Technologies Office. This has also been introduced based on the Clean Hydrogen Production Tax Credit to provide almost USD 3 per kg to clean hydrogen producers. Besides, the DOE has launched the Energy Earthshots approach to diminish clean hydrogen cost by 80% to USD 1 per kg within 10 years, thus suitable for boosting the market.

The U.S. market is gaining increased traction, owing to a surge in federal spending, the offshore energy association, along with an increase in government expenditure. According to the 2022 United States Energy Association data report, the U.S. is on the pathway to diminish greenhouse gas (GHG) emissions between 24% and 35% by the end of 2030. In addition, if the Inflation Reduction Act (IRA) emerges as the ultimate law, then the GHG emission reduction will increase between 31% and 44% by the end of the same year. Besides, the progressive industrial facilities deployment program has created the latest USD 5.8 billion program under the Office of Clean Energy Demonstration (OCED). The purpose is to significantly invest in projects that are aimed at lowering emissions from energy-intensive sectors. Moreover, the aspect of clean hydrogen production tax credit is also creating a positive impact on the market in the country.

New Clean Hydrogen Production Tax Credit in the U.S. (2022)

|

Carbon Intensity (kg CO2e/kg H2) |

Max Hydrogen PTC Credit ($/kg H2) |

|

0 to 0.4 |

USD 3.0 |

|

0.4 to 1.5 |

USD 1.0 |

|

1.5 to 2.5 |

USD 0.7 |

|

2.5 to 4 |

USD 0.6 |

Source: United States Energy Association

Canada in the offshore support vessel (OSV) market is gradually developing due to the presence of the Atlantic Canada offshore wind catalyst, investment tax credits, federal regulatory reform, decommissioning liability, sustained offshore hydrocarbon activity, as well as the Arctic sovereignty nexus and critical minerals. For instance, in September 2022, the Government of Nova Scotia has readily targeted to provide 5 gigawatts of offshore wind energy by the end of 2030 to significantly support its budding green hydrogen sector. Besides, as per an article published by the Government of Canada in November 2023, the country’s Budget 2023 has readily proposed to unveil the Clean Hydrogen ITC initiative, with the objective to support clean ammonia production at a 15% credit rate. Besides, proposed tax measures have ensured revenue impacts, which are also positively affecting the market’s growth in the country.

Yearly Revenue Impacts of Proposed Tax Measures in Canada (2023)

|

Tax Type |

2024-2025 |

2025-2026 |

2026-2027 |

2027-2028 |

2028-2029 |

Total |

|

Clean Technology and Clean Electricity Investment Tax Credits- Equipment Using Waste Biomass |

26 |

193 |

214 |

210 |

210 |

853 |

|

Regional Journalism Labour Tax Credit |

60 |

30 |

30 |

5 |

4 |

129 |

|

Dividend Received Deduction by Financial Institutions- Exception |

40 |

45 |

40 |

45 |

45 |

215 |

Source: Government of Canada

Europe Market Insights

Europe in the offshore support vessel (OSV) market is predicted to witness development at a considerable rate during the stipulated duration. The market’s growth in the region is highly propelled by its evolution as the regulatory epicenter and global innovation for energy transition-based marine support. The market’s growth is also driven by the legally binding regional Green Deal as well as the REPowerEU plan, which has mandated huge offshore renewable extensions to gain energy independence and climate neutrality. Besides, as per an article published by the World Economic Forum in December 2023, the low-carbon hydrogen strategy of readily producing almost 30 TWh (an estimated 0.9 Mtpa) of green hydrogen by the end of 2030 effectively comprises scenarios for pipeline exports to the region, which is suitable for bolstering the market.

The offshore support vessel (OSV) market in the UK is gaining increased exposure, owing to the legally mandated and unmatched offshore wind expansion, along with the presence of an active and mature hydrocarbon industry. Besides, according to an article published by the UK Government in April 2022, with the adoption of smart planning, high environmental standards can be maintained by enhancing the deployment pace by 25%. In addition, the government has the ambition to effectively deliver 50GW by the end of 2030, which comprises almost 5GW of advanced floating wind. This is further poised to result in 90,000 employment opportunities in the industry within the same timeline. Moreover, this overall deployment is significantly backed by almost £160 million in supply chains and ports, as well as £31 million in research and development.

The offshore support vessel (OSV) market in Norway is also growing due to the aggressive and pioneering state-based push into the offshore wind as well as the electrification of the overall maritime industry. For instance, as per an article published by the Wind Europe Organization in June 2022, the country’s government is poised to allocate 30 GW of offshore wind capacity by the end of 2040. Regarding this objective, the government has successfully identified two zones for upliftment and is steadily planning to ensure an auction for a 1.5 GW floating wind farm from the upcoming year. Besides, at present, the overall region comprises only 3 floating wind farms with a total capacity of more than 100 MW. Moreover, players in the country can adopt 5 % to 14% of the international floating wind market, which is equivalent to a turnover amounting to €9.5 billion, thus making it suitable for the market’s growth.