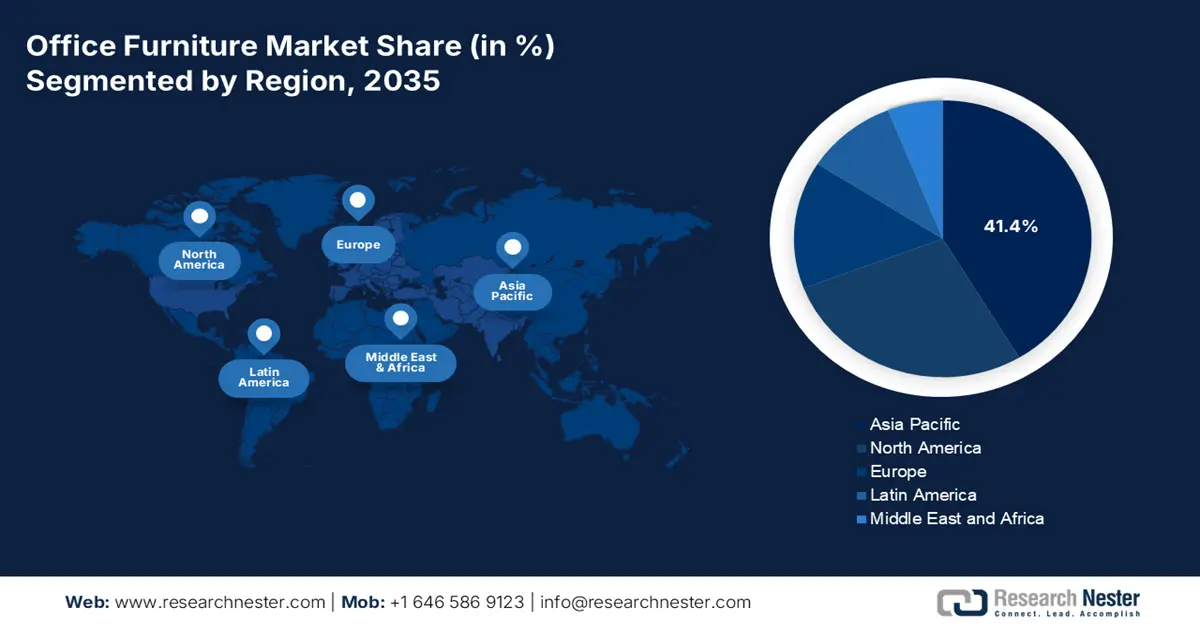

Office Furniture Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the office furniture market and is expected to hold the market share of 41.4% by 2035. The market is driven by rapid urbanization, strong economic expansion, and huge government investments in the commercial infrastructure. Countries such as India are executing large-scale initiatives, such as the Smart Cities Mission, that directly drive the demand for furnishing new administrative and cooperative offices. On the other hand, the rise of the robust technology sector and a rising number of multinational companies establishing regional headquarters are creating a sustained demand for modern and high-quality office interiors. A key regional trend is the increasing emphasis on ergonomic and sustainable products that influences both corporate and ESG mandates and evolving workplace safety standards. The market is highly competitive, featuring a mix of domestic powerhouses and global giants, all vying for a share of the world's fastest-growing office furniture demand.

India is witnessing a rapid growth in the office furniture market, which is driven by the strong economic expansion and significant government infrastructure investment. The key drivers include the development of new commercial real estate in tier 1 and tier 2 cities and the central government initiatives, such as Smart Cities Mission, that spur the demand for furnishing new administrative hubs. The major trend in the country is the rising demand for ergonomic and modular products from the growing IT BPM and startup sector, adapting to hybrid work models. The WITS 2021 data has stated that India has imported USD 13,784.03k office furniture. This data highlights a strong domestic demand that outpaces the local production for certain premium and specialized sectors. Further, international manufacturers have a substantial opportunity to enter the market via strategic partnerships and direct exports to cater to this burgeoning demand.

China’s office furniture market is set to be a global leader in the APAC market and is expected to be driven by its massive domestic manufacturing capacity and extensive supply chain. The demand is mainly driven by the continuous development of commercial real estate in megacities and the government’s strategic push on high-tech industrial parks and innovation zones. The rapid adoption of the smart, technology-fused furniture and a strong pivot on the sustainable manufacturing practices are the significant trends to address both the domestic eco-certification standards and the international import regulation policies. Data from the WITS 2023 report, China has exported USD 931,989.80k of office furniture. This data highlights the rising demand for the manufacturing base in office furniture. Further, investment in modern infrastructure ensures the market's continued dominance and evolution.

North America Market Insights

The office furniture market in North America is defined by several emerging trends, such as the sustainability demands and the high adoption of hybrid work models. The market is growing rapidly at a significant CAGR during the forecast period 2026 to 2035. The key trends of the market are the high demand for modular, collaborative furniture and technology-fused solutions to aid activity-based working. The BIFMA level, a sustainability certification, is now a procurement prerequisite for major corporate and government contracts. The U.S. General Services Administration’s commitment to sustainable federal buildings under its Green Procurement Compilation guides public sector demand. The investment in modernizing the existing office space enhances employee attraction, and productivity remains the primary driver, offsetting the slower growth in new commercial construction.

The U.S. office furniture market is defined by the robust demand fueled by the large-scale federal infrastructure spending and corporate office retrofitting. The implementation of the Bipartisan Infrastructure Law fuels the demand for furniture in the new and modernized federal building, with the U.S. General Services Administration managing a significant portfolio. The corporate investment is aimed at reconfiguring spaces for hybrid collaboration, increasing the orders for modular systems and acoustic solutions. As per the OEC August 2024 to July 2025 data, the U.S. has exported USD 2.78 billion of other furniture, which includes office furniture such as office desks, filing cabinets, shelving systems, and more. According to the CDC's NIOSH, adherence to ergonomic requirements continues to be a primary priority of product development.

U.S. Exports Data on Other Furniture in 2024

|

Country |

Export Value |

|

Canada |

USD 1.58 billion |

|

Mexico |

USD 312 million |

|

UK |

USD 76.5 million |

|

Netherlands |

USD 66.1 million |

|

Australia |

USD 13.5 million |

Source: OEC August 2024 to July 2025

The Canada office furniture market is highly influenced by the significant public investment in the green building infrastructure and federal sustainability mandates. The Canada Green Building Strategy, which focuses on net zero emissions, fuels the demand for furniture with verified environmental product declarations and BIFMA level certifications for all major public sector projects. The consistent demand driver is based on the federal spending on modernizing the national public service workspace. Canada has a deep integration of the North America supply chain and a high reliance on U.S. manufacturing of office furniture, as the country has imported USD 704 million worth of other furniture from the U.S., as per the OEC July 2025 data. In addition, vendors must compete with well-established firms on the basis of cost-effectiveness and sustainability credentials in order to win government contracts.

Europe Market Insights

The Europe office furniture market is defined by strong sustainability regulations, maturity, and a high focus on refurbishment and circular economy principles. Demand is fueled by the ongoing adoption of corporate offices to hybrid work models, which makes the high investment in collaborative and agile furniture over the traditional assigned seating. A key market driver is the European Union's regulatory framework, including the Circular Economy Action Plan, which mandates green public procurement and supports furniture with extended lifespans and recycled content. For example, the EU’s Cohesion Policy funds the regional development, including the modernization of the public administration buildings, which indirectly accelerates the demand. While new commercial construction is slow, the retrofitting of existing spaces to enhance density, collaboration, and employee well-being represents the core growth segment, with Northern and Western Europe leading in the adoption of advanced, sustainable products.

Germany is projected to hold the largest share in the Europe office furniture market by 2035. Robust manufacturing base and the Industry 4.0 initiative are the key drivers demanding the market that demands high-quality, technology-infused workspaces. The country’s robust Green Public Procurement criteria, which are enforced by the Federal Environment Agency that make sustainability certifications a non-negotiable market entry requirement. The government's focus on energy-efficient buildings, which is outlined in its Federal Funding for Efficient Buildings program, further stimulates the demand for compliant interior products. A key trend is the strong demand for contract furniture that supports collaborative engineering and R&D environments, with a significant portion of demand coming from the automotive and engineering sectors’ corporate headquarters and innovation centers.

By 2035, UK is expected to remain in a top position in the office furniture market in Europe. The dominance is due to the significant private sector investment in London’s commercial real estate and strong services sector. Post-Brexit, the UK has strengthened its own environmental targets, with the UK Green Building Council supporting net-zero carbon buildings, which influences corporate procurement. The ongoing redesign of financial services and tech company offices in London and the Southeast to support flexible working. According to the OEC data in 2023, the office furniture exported by the country reached USD 131 million. This data indicates a sustained demand for office spaces that requires new furniture that focuses on well-being and hybrid collaboration solutions.