Office Furniture Market Outlook:

Office Furniture Market size was valued at USD 59.7 billion in 2025 and is projected to reach USD 134.8 billion by the end of 2035, rising at a CAGR of 8.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of office furniture is assessed at USD 64.7 billion.

The office furniture market is forecasted to have steady growth due to the measurable shifts in the government capital spending, institutional procurement patterns, and public sector workplace modernization initiatives. The government highly invests in new administrative facilities and office upgrades, driving the steady procurement volumes. As per the Government of Goa report on Economic Survey 2024 to 2025, the reimbursement of expenditure on furniture and furnishings was a maximum of ₹ 2.00 lakh, which was purchased only from the vendors empaneled with the Department of Handicrafts, Textiles, and Coir, Government of Goa. The demand for modular furniture, acoustic solutions, and ancillary pieces supports activity-based working. The market’s foundation remains the corporate sector, with its demand closely aligned with the professional employment levels, commercial real estate development, and corporate profitability.

Regulatory and procurement standards are actively shaping the product development and the competitive dynamics. The government further mandates the corporate ESG policies that make sustainable attributes, which are a baseline requirement for suppliers. On the other hand, the recycled content, adherence to certifications such as BIFMA level, and end-of-life product management are now a critical request for proposal processes, mainly for large corporate and public sector contracts. The U.S. Environmental Protection Agency’s framework on Sustainable Materials Management provides a foundation for these procurement policies, promoting a circular economy approach. In order to stay compliant and competitive, manufacturers must make large investments in R&D and supply chain transparency due to this regulatory climate and the requirement that furniture promote employee well-being, as stated by organizations such as the CDC's NIOSH.

Key Office Furniture Market Insights Summary:

Regional Highlights:

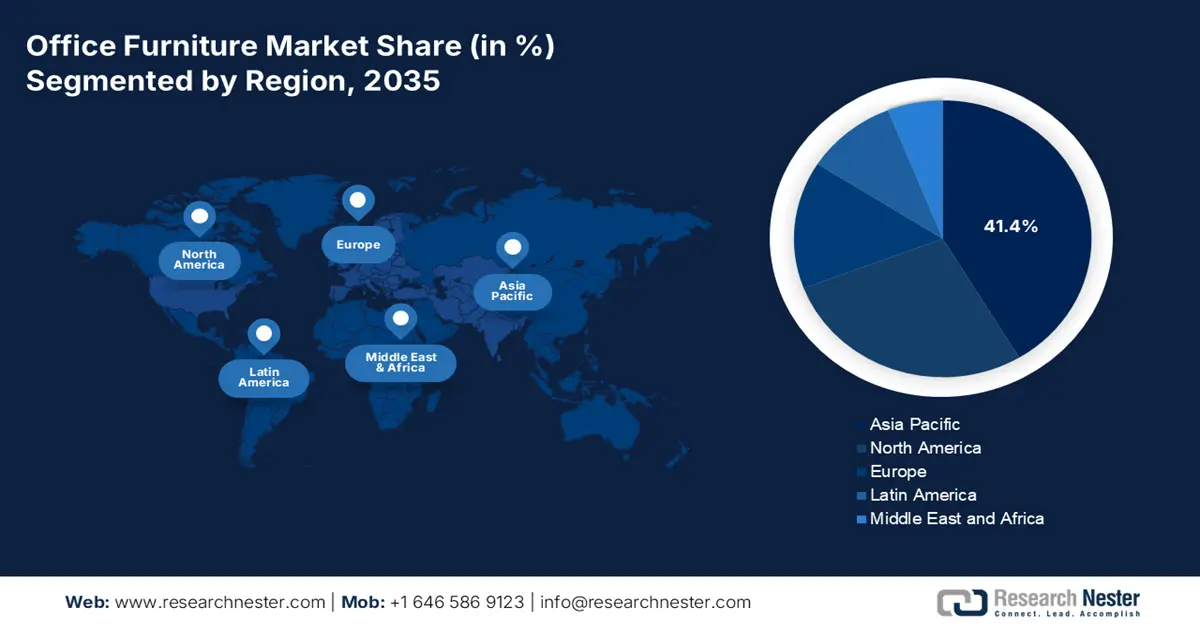

- By 2035, Asia Pacific is set to capture a 41.4% share of the office furniture market as rapid urbanization and large-scale commercial infrastructure initiatives accelerate demand owing to strong economic expansion.

- During 2026–2035, North America is projected to grow at a significant CAGR as the region upgrades workplaces with modular and tech-integrated solutions encouraged by rising sustainability requirements.

Segment Insights:

- By 2035, the corporate office segment in the office furniture market is projected to secure a 55.7% share as organizations redesign workspaces into collaborative cultural hubs impelled by the focus on employee well-being.

- By 2035, the mid-range price point segment is expected to hold the largest share, reflecting strong enterprise demand for ergonomic and durable solutions favored by the optimal balance between cost and quality.

Key Growth Trends:

- Government infrastructure spending

- Sustainability and circular economy mandates

Major Challenges:

- Fluctuating costs of raw material and price volatility

- Adherence to strict ergonomic and sustainability regulations

Key Players: Steelcase Inc. (USA), MillerKnoll (USA) [parent of Herman Miller and Knoll], Haworth Inc. (USA), HNI Corporation (USA), Kokuyo Co., Ltd. (Japan), Itoki Corporation (Japan), Nowy Styl Group (Poland), Kinnarps AB (Sweden), Vitra (Switzerland), Sedus Stoll AG (Germany), Bene AG (Austria), Ahrend (Netherlands), Fursys Inc. (South Korea), Uchida Yoko Co., Ltd. (Japan), Godrej & Boyce (India) [Godrej Interio brand], Koda Ltd. (Malaysia), Zenith Interiors (Australia), Ragnars (Sweden), Martela Corporation (Finland), Lamex Office Furniture (Hong Kong).

Global Office Furniture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.4 billion

- 2026 Market Size: USD 64.7 billion

- Projected Market Size: USD 134.8 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Poland

Last updated on : 27 November, 2025

Office Furniture Market - Growth Drivers and Challenges

Growth Drivers

- Government infrastructure spending: Large-scale government infrastructure spending is the primary driver for the office furniture market. New administrative buildings, transport hubs, and public facilities require complete interior outfitting. For example, significant capital expenditure in India on the highways, railways, and urban development in the year 2025 to 2026 will lead to the establishment of new government offices and control centers. The Ministry of Statistics and Programme Implementation data has indicated that the total cost of the ongoing central sector projects is set to be ₹150 crore and above was substantial as of recent reports. This data is directly linked with the infrastructure investment and the need for furnishing new workspaces that create sustained procurement opportunities, ensuring a strong demand for the suppliers to meet the public sector tenders and durability standards.

- Sustainability and circular economy mandates: Corporate ESG goals and robust government procurement policies are surging the demand for sustainable office furniture. The criteria now include recycled content, end-of-life back programs, and certifications such as BIFMA level. The U.S. Environmental Protection Agency supports sustainable materials management, influencing both corporate and federal purchasing. Manufacturers such as Haworth have reported their utilization of recycled materials and carbon-neutral operations in their sustainability reports, using these credentials as a key competitive advantage for securing large corporate and government contracts. Consequently, furniture manufacturers with dedicated government verticals and pre-qualified status are poised for significant growth.

- Imperative of ergonomics and employee wellbeing: The growing awareness of workplace health is mandating the investment in ergonomic furniture to reduce musculoskeletal-related problems and boost productivity. The regulatory bodies, such as the CDC’s NIOSH, have reported the connection between the ergonomic design and employee well-being. This drives the demand for high-quality, adjustable chairs, sit-stand desks, and monitor arms. Companies are actively researching their WorkSpace Futures group to design evidence-based products that address the physical strain, turning wellness from a perk into a core procurement criterion for corporations aiming to attract and retain talent.

Challenges

- Fluctuating costs of raw material and price volatility: Profits from the manufacturing of office furniture are highly sensitive and unpredictable to the volatile costs of key raw materials such as steel, aluminum, and lumber. Government tariff and trade policies intensify this unpredictability. Despite the office furniture market growth in 2025, manufacturers face various pricing constraints from the inflation of raw material costs. A leading player such as HNI Corporation uses hedging strategies and long-term contracts to reduce this volatility tool not available to small startups. A new entrant is exposed to spot market prices, making financial forecasting difficult and potentially eroding thin margins before a stable customer base is secured.

- Adherence to strict ergonomic and sustainability regulations: Manufacturers must comply with an environmental standard, ergonomic, and a web of international safety. This requires significant investment in testing and certification. Various companies have publicly indicated their BIFMA level certification and sustainable practices as their key point in office furniture market differentiator. For new startup companies, navigating this regulatory landscape is a non-negotiable cost and complexity. Failure to comply not only risks legal penalty but also excludes them from consideration for major corporate and government tenders that mandate such certifications.

Office Furniture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 59.7 billion |

|

Forecast Year Market Size (2035) |

USD 134.8 billion |

|

Regional Scope |

|

Office Furniture Market Segmentation:

End user Segment Analysis

Under the end user segment the corporate office is leading the segment and is poised to hold the revenue share of 55.7% in the office furniture market during the forecast period. The segment is driven by the fundamental shift of the office from the mere workspace to a collaborative and cultural hub. Companies are investing heavily in high-quality and flexible furniture to support hybrid work models and attract employees back to the office. This creates an agile environment with modular workstations and breakout seating. The key driver is the focus on employee well-being, as various studies have depicted that office design directly impacts improved productivity. The 2023 report from the U.S. Bureau of Labor Statistics indicates that sectors such as professional and business services are the primary consumers of office furniture and have a strong employment growth, fueling the demand for new and refurbished workspaces to accommodate evolving teams.

Price Point Segment Analysis

By 2035, the mid-range price point is anticipated to hold the largest share in the office furniture market. The segment is propelled by the optimal balancing of cost with high quality and features demanded by the modern hybrid workplaces. The segment caters to a vast market including the small and medium enterprises and large corporations, furnishing offices or home setups for employees. Buyers in this group seek for ergonomic, durable and aesthetically pleasing furniture without the premium cost of high-end brands the resilience f this segment is aided by the data from the U.S. Census Bureau's 2023 Annual Retail Trade Survey showed continued strong sales in the "other miscellaneous store retailers" category, which includes office furniture, indicating robust mid-market activity as businesses continuously adapt their physical spaces.

Distribution Channel Segment Analysis

The online channels are forecast to achieve the highest revenue share in the distribution channel segment and are fueled by the permanent adoption of the digital procurement processes by both the B2B and B2C buyers. The convenience, advanced visualization tools, and extensive selections are available online and make it a preferred choice for buying platforms. This shift is driven post-pandemic and continues to grow with businesses actively enhancing the efficiency of the e-procurement system for bulk purchases. The retail e-commerce sales accounted for USD 304.2 billion during the second quarter of 2025, based on the U.S. Census Bureau data in August 2025. This data is significantly outpacing total retail growth. This consistent growth in e-commerce underscores the rapid and lasting channel shift within the office furniture market.

Our in-depth analysis of the office furniture market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Material |

|

|

Distribution Channel |

|

|

Price Point |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Office Furniture Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the office furniture market and is expected to hold the market share of 41.4% by 2035. The market is driven by rapid urbanization, strong economic expansion, and huge government investments in the commercial infrastructure. Countries such as India are executing large-scale initiatives, such as the Smart Cities Mission, that directly drive the demand for furnishing new administrative and cooperative offices. On the other hand, the rise of the robust technology sector and a rising number of multinational companies establishing regional headquarters are creating a sustained demand for modern and high-quality office interiors. A key regional trend is the increasing emphasis on ergonomic and sustainable products that influences both corporate and ESG mandates and evolving workplace safety standards. The market is highly competitive, featuring a mix of domestic powerhouses and global giants, all vying for a share of the world's fastest-growing office furniture demand.

India is witnessing a rapid growth in the office furniture market, which is driven by the strong economic expansion and significant government infrastructure investment. The key drivers include the development of new commercial real estate in tier 1 and tier 2 cities and the central government initiatives, such as Smart Cities Mission, that spur the demand for furnishing new administrative hubs. The major trend in the country is the rising demand for ergonomic and modular products from the growing IT BPM and startup sector, adapting to hybrid work models. The WITS 2021 data has stated that India has imported USD 13,784.03k office furniture. This data highlights a strong domestic demand that outpaces the local production for certain premium and specialized sectors. Further, international manufacturers have a substantial opportunity to enter the market via strategic partnerships and direct exports to cater to this burgeoning demand.

China’s office furniture market is set to be a global leader in the APAC market and is expected to be driven by its massive domestic manufacturing capacity and extensive supply chain. The demand is mainly driven by the continuous development of commercial real estate in megacities and the government’s strategic push on high-tech industrial parks and innovation zones. The rapid adoption of the smart, technology-fused furniture and a strong pivot on the sustainable manufacturing practices are the significant trends to address both the domestic eco-certification standards and the international import regulation policies. Data from the WITS 2023 report, China has exported USD 931,989.80k of office furniture. This data highlights the rising demand for the manufacturing base in office furniture. Further, investment in modern infrastructure ensures the market's continued dominance and evolution.

North America Market Insights

The office furniture market in North America is defined by several emerging trends, such as the sustainability demands and the high adoption of hybrid work models. The market is growing rapidly at a significant CAGR during the forecast period 2026 to 2035. The key trends of the market are the high demand for modular, collaborative furniture and technology-fused solutions to aid activity-based working. The BIFMA level, a sustainability certification, is now a procurement prerequisite for major corporate and government contracts. The U.S. General Services Administration’s commitment to sustainable federal buildings under its Green Procurement Compilation guides public sector demand. The investment in modernizing the existing office space enhances employee attraction, and productivity remains the primary driver, offsetting the slower growth in new commercial construction.

The U.S. office furniture market is defined by the robust demand fueled by the large-scale federal infrastructure spending and corporate office retrofitting. The implementation of the Bipartisan Infrastructure Law fuels the demand for furniture in the new and modernized federal building, with the U.S. General Services Administration managing a significant portfolio. The corporate investment is aimed at reconfiguring spaces for hybrid collaboration, increasing the orders for modular systems and acoustic solutions. As per the OEC August 2024 to July 2025 data, the U.S. has exported USD 2.78 billion of other furniture, which includes office furniture such as office desks, filing cabinets, shelving systems, and more. According to the CDC's NIOSH, adherence to ergonomic requirements continues to be a primary priority of product development.

U.S. Exports Data on Other Furniture in 2024

|

Country |

Export Value |

|

Canada |

USD 1.58 billion |

|

Mexico |

USD 312 million |

|

UK |

USD 76.5 million |

|

Netherlands |

USD 66.1 million |

|

Australia |

USD 13.5 million |

Source: OEC August 2024 to July 2025

The Canada office furniture market is highly influenced by the significant public investment in the green building infrastructure and federal sustainability mandates. The Canada Green Building Strategy, which focuses on net zero emissions, fuels the demand for furniture with verified environmental product declarations and BIFMA level certifications for all major public sector projects. The consistent demand driver is based on the federal spending on modernizing the national public service workspace. Canada has a deep integration of the North America supply chain and a high reliance on U.S. manufacturing of office furniture, as the country has imported USD 704 million worth of other furniture from the U.S., as per the OEC July 2025 data. In addition, vendors must compete with well-established firms on the basis of cost-effectiveness and sustainability credentials in order to win government contracts.

Europe Market Insights

The Europe office furniture market is defined by strong sustainability regulations, maturity, and a high focus on refurbishment and circular economy principles. Demand is fueled by the ongoing adoption of corporate offices to hybrid work models, which makes the high investment in collaborative and agile furniture over the traditional assigned seating. A key market driver is the European Union's regulatory framework, including the Circular Economy Action Plan, which mandates green public procurement and supports furniture with extended lifespans and recycled content. For example, the EU’s Cohesion Policy funds the regional development, including the modernization of the public administration buildings, which indirectly accelerates the demand. While new commercial construction is slow, the retrofitting of existing spaces to enhance density, collaboration, and employee well-being represents the core growth segment, with Northern and Western Europe leading in the adoption of advanced, sustainable products.

Germany is projected to hold the largest share in the Europe office furniture market by 2035. Robust manufacturing base and the Industry 4.0 initiative are the key drivers demanding the market that demands high-quality, technology-infused workspaces. The country’s robust Green Public Procurement criteria, which are enforced by the Federal Environment Agency that make sustainability certifications a non-negotiable market entry requirement. The government's focus on energy-efficient buildings, which is outlined in its Federal Funding for Efficient Buildings program, further stimulates the demand for compliant interior products. A key trend is the strong demand for contract furniture that supports collaborative engineering and R&D environments, with a significant portion of demand coming from the automotive and engineering sectors’ corporate headquarters and innovation centers.

By 2035, UK is expected to remain in a top position in the office furniture market in Europe. The dominance is due to the significant private sector investment in London’s commercial real estate and strong services sector. Post-Brexit, the UK has strengthened its own environmental targets, with the UK Green Building Council supporting net-zero carbon buildings, which influences corporate procurement. The ongoing redesign of financial services and tech company offices in London and the Southeast to support flexible working. According to the OEC data in 2023, the office furniture exported by the country reached USD 131 million. This data indicates a sustained demand for office spaces that requires new furniture that focuses on well-being and hybrid collaboration solutions.

Key Office Furniture Market Players:

- Steelcase Inc. (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MillerKnoll (USA) [parent of Herman Miller and Knoll]

- Haworth Inc. (USA)

- HNI Corporation (USA)

- Kokuyo Co., Ltd. (Japan)

- Itoki Corporation (Japan)

- Nowy Styl Group (Poland)

- Kinnarps AB (Sweden)

- Vitra (Switzerland)

- Sedus Stoll AG (Germany)

- Bene AG (Austria)

- Ahrend (Netherlands)

- Fursys Inc. (South Korea)

- Uchida Yoko Co., Ltd. (Japan)

- Godrej & Boyce (India) [Godrej Interio brand]

- Koda Ltd. (Malaysia)

- Zenith Interiors (Australia)

- Ragnars (Sweden)

- Martela Corporation (Finland)

- Lamex Office Furniture (Hong Kong)

- Steelcase Inc. is the global leader in the office furniture market and is pioneering with its data-driven workspaces. The company has advanced its market position by incorporating advanced sensors and analytics into its architecture and furniture. The physical-to-digital strategy transforms desks, rooms, and chairs into intelligent systems that provide insights into space utilization and occupant well-being.

- MillerKnoll is a leader in the office furniture market and was formed by the merger of Herman Miller and Knoll, leveraging its portfolio to shape the modern furniture market. The company’s key advancement relies on creating an integrated ecosystem of textiles, furniture, and technology. The company's net sales in the year 2024 reached USD 180.3 million.

- Haworth Inc. has strongly cemented its position in the office furniture market by championing adaptable and technology-enabled workspaces. The company has made advancements in developing a furniture ecosystem that integrates factors such as power, data, and connectivity, supporting the mobile workforce. The company reported global sales of USD 2.5 billion for 2024, in line with the prior year.

- HNI Corporation is the major force in the office furniture market and has advanced via strategic acquisition and a deep focus on the holistic workplace solutions. The company has integrated insights from various brands to understand the evolving work patterns. The advancement is mainly fueled by the creation of furniture that supports a spectrum of activities, from focused work to collaboration, often incorporating technology access points.

- Kokuyo Co., Ltd., is a leading innovator in Japan office furniture market and has made an advancement by blending the furniture design with behavioural science and technology. The company goes beyond manufacturing by researching how office layouts and ergonomic furniture impact creativity and efficiency.

Here is a list of key players operating in the global office furniture market:

Of the top global office furniture manufacturers, the office furniture market is fueled by a mix of dominating giants and specialized firms mainly from North America, Asia, and Europe. The competitive landscape is intensely fragmented and is driven by the evolution of hybrid work models. The key players are strategically focusing on acquisition to expand the market reach and are investing heavily in ergonomic and technology-integrated designs, and shifting towards flexible and collaborative furniture solutions. Sustainability has become the core initiative with companies aiming for circular economy principles and the use of eco-friendly materials to meet the corporate ESG goals and differentiate their offerings in a crowded marketplace. A recent advancement in the furniture market is in November 2024, Pelican Group has launched Pelicanwork, which is a premium line of ergonomic office furniture specifically designed for modern professionals who seek both elegance and efficiency.

Corporate Landscape of the Office Furniture Market:

Recent Developments

- In August 2025, HNI Corporation and Steelcase Inc. has announced that they had entered into a definitive agreement under which HNI will acquire Steelcase in a cash and stock transaction, with a total consideration of approximately USD 2.2 billion to Steelcase common shareholders.

- In February 2025, Flokk expands its presence in the U.S. with the acquisition of Via Seating to strengthen its position as a global leader in office seating and furniture. Through multiple acquisitions Flokk has transformed from a Scandinavian player to the European market leader in office seating and furniture.

- Report ID: 78

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Office Furniture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.