Off-highway Electric Vehicles Market Outlook:

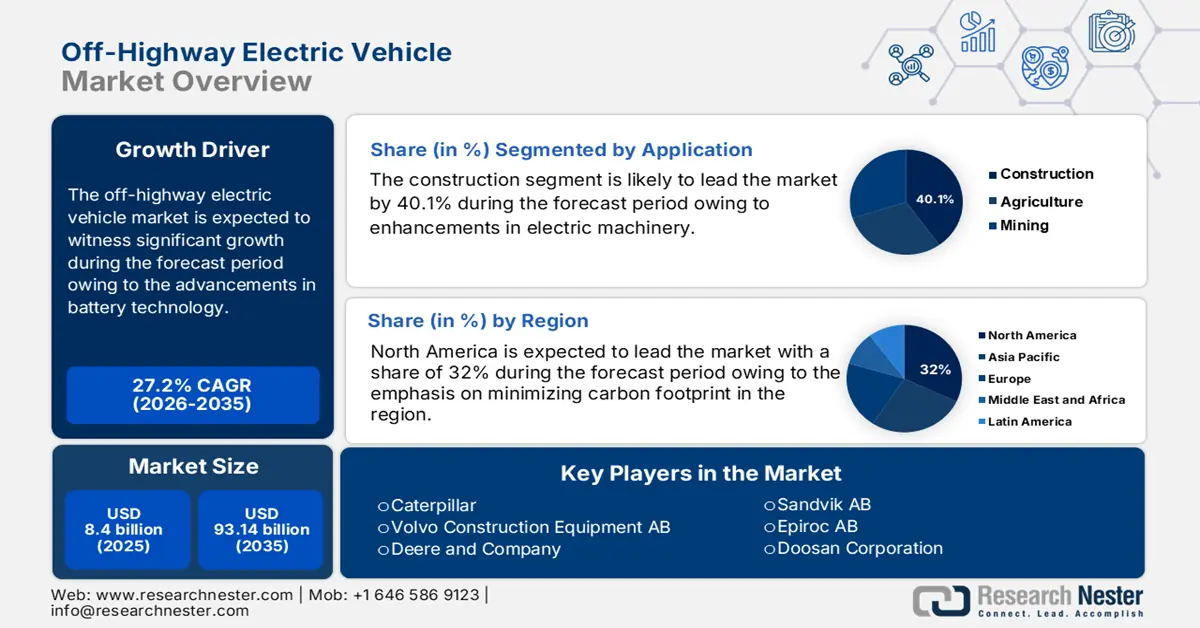

Off-highway Electric Vehicles Market size was valued at USD 8.4 billion in 2025 and is likely to cross USD 93.14 billion by 2035, registering more than 27.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of off-highway electric vehicles is assessed at USD 10.46 billion.

The combination of AI technology with IoT and automation systems in off-highway electric vehicles is expected to lead to industrial transformations throughout the mining, agricultural, and construction industries. Business enterprises are all set to adopt self-governing vehicles and intelligent technology to create more efficient operations, eliminate labor needs, and protect worker safety. These companies are combining autonomous electric tractors with AI-controlled fleet operations and advanced predictive maintenance systems to minimize expenses while maximizing equipment operation time and achieving peak performance levels.

Autonomous systems operate best when used in extensive operations requiring high absolute precision and maximum efficiency. For instance, Komatsu announced its plans to expand its Autonomous Haulage System operations in 2024. By July 2024, Komatsu reached over 750 autonomous haul truck units installed worldwide that collectively executed 10 billion metric tons of material as their first milestone. 10 mining trucks exceeded 100,000 autonomous operating hours. The company uses autonomous haulage system technology powered by AI and IoT, improves mining operations, minimizes expenses, and creates secure working environments.

Key Off-Highway Electric Vehicles Market Insights Summary:

Regional Highlights:

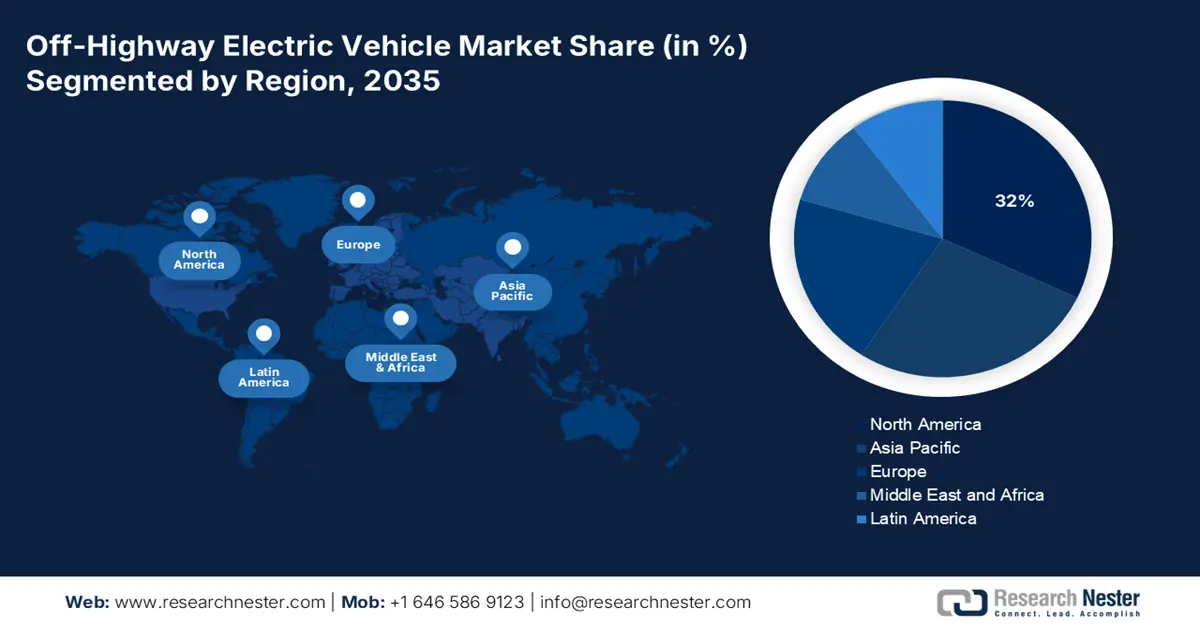

- North America leads the Off-highway Electric Vehicles Market with a 32% share, fueled by the growing attention toward sustainability and minimization of carbon footprints, enhancing growth prospects through 2026–2035.

- The Asia Pacific region is projected to experience rapid growth in the Off-highway Electric Vehicles Market from 2026 to 2035, driven by swift industrialization and urbanization development in China and India.

Segment Insights:

- The Construction segment is expected to experience significant growth from 2026 to 2035, fueled by increasing demand for sustainable construction practices and environmental protection regulations.

- The construction segment is forecasted to secure over 40.1% market share by 2035, driven by electrification enhancing operational efficiency and reducing labor costs.

Key Growth Trends:

- Advancements in battery technology

- Infrastructure and charging advancements

Major Challenges:

- Battery performance and range limitations

- Long charging times and downtime concerns

- Key Players: Caterpillar, Komatsu Ltd., Volvo Construction Equipment AB, and Sandvik AB.

Global Off-Highway Electric Vehicles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.4 billion

- 2026 Market Size: USD 10.46 billion

- Projected Market Size: USD 93.14 billion by 2035

- Growth Forecasts: 27.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Off-highway Electric Vehicles Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in battery technology: Improved battery technology is expected to enhance the expansion of off-highway electric vehicle systems within the off-highway electric vehicles market. The technological performance enhancements of lithium-ion batteries enable off-highway EVs to reach and exceed diesel-powered machines in terms of performance capabilities. Solid-state batteries and lithium iron phosphate technology enhance operational safety and reduce costs while boosting efficiency, further anticipated to drive their adoption in difficult sector activities, including construction, mining, and agriculture.

The off-highway electric vehicles market is also expected to experience an increase in swappable battery technology as this solution enables efficient battery exchange procedures that reduce operational downtime essential for off-highway machines. In December 2024, the U.S. Department of Energy announced its plan to give a USD 7.54 billion loan to Stellantis and Samsung SDI for the construction of two lithium-ion battery factories in Indiana. The initiative is aimed to enhance electricity vehicle battery supply systems while driving fast adoption of electric-powered off-road machinery. - Infrastructure and charging advancements: The advancement of EV charging infrastructure holds a vital position that is expected to propel the acceptance of off-highway EVs. The implementation of fast-charging sites alongside battery-swapping technology and site-based renewable power systems helps industries pursue electrical transitions. Companies are expected to connect solar power and wind turbines for EV charging systems in locations without access to conventional power grid infrastructure to maintain continuous operations in remote sites, including mining operations and construction zones. Innovations improve off-highway EV productivity and reduce breakdowns to make these vehicles viable for commercial and industrial services. Polaris Inc. teamed up with the Michigan Economic Development Corporation to create an electric off-road vehicle charging network for Michigan's Upper Peninsula in June 2024. The new trail system, consisting of about 100 off-road miles, features charging stations for electric off-road vehicles, allowing users to power their vehicles freely throughout remote regions.

Challenges

-

Battery performance and range limitations: Modern battery limitations restrict off-highway EVs in their ability to complete heavy-duty demanding tasks, as they require frequent recharging. Unusual weather conditions during the winter season and summer months may diminish battery performance by affecting discharge rate efficiency and battery lifespan. The essential requirement for continuous production in mining and construction operations makes these technological limitations a reason why diesel options remain more practical for extended remote-area usage.

- Long charging times and downtime concerns: Current fast-charging techniques for off-highway electric vehicles still need significantly more time for recharging in comparison to diesel-powered equipment refueling procedures. The time required for charging can disrupt productivity, primarily in industries such as mining, construction, and agriculture, where continuous operation remains essential. Significant charging times lead companies to enhance their vehicle or charging station investments to sustain their operations while increasing their operational expenses and reducing off-highway EV adoption rates across these industries.

Off-highway Electric Vehicles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

27.2% |

|

Base Year Market Size (2025) |

USD 8.4 billion |

|

Forecast Year Market Size (2035) |

USD 93.14 billion |

|

Regional Scope |

|

Off-highway Electric Vehicles Market Segmentation:

By Application (Construction, Agriculture, Mining)

Construction segment is likely to account for more than 40.1% off-highway electric vehicles market share by the end of 2035, attributed to the combination of electric machinery and increased operational effectiveness. Transforming the dynamics of construction machines through electrification allows operators to operate with increased speed and accuracy in their work. The operational efficiency of electric machinery enables shorter project durations and reduced labor expenses, accelerating the interest of construction firms aiming to boost operational performance.

The segment is also witnessing significant growth, owing to the increasing demand for sustainable construction practices. Stakeholders, consisting of clients and regulatory bodies, increase their focus on construction methods that protect the environment. Businesses that use off-highway EVs benefit their reputation along with off-highway electric vehicles market competitiveness as they achieve their sustainability targets. Electric machinery usage has become mandatory in Oslo city-managed construction projects due to their dual purpose of minimizing emissions and noise pollution, resulting in safer work environments.

Electric Vehicle (Battery Electric Vehicle, Hybrid Electric Vehicle)

The hybrid electric vehicle segment in off-highway electric vehicles market is expected to register significant revenue during the forecast period due to its flexibility. Hybrid electric vehicles that combine combustion engines with electric power systems deliver the broad operational range and required power output for intensive off-highway functions. The multiple power options in HEVs offer operators the benefit of electric power when needed, together with traditional engines to power through demanding terrain and tasks.

Added to their ease of integration, the hybrid vehicles prove beneficial to fleet incorporation, as they need no major infrastructure transformation, thus enabling faster industrial adoption, especially in construction mining operations. Companies are incorporating new advancements in the HEVs for off-highway. For instance, in November 2023, Caterpillar announced its plan to develop a hydrogen-hybrid power solution built on its new Cat C13D engine platform for off-highway applications.

Our in-depth analysis of the off-highway electric vehicles market includes the following segments:

|

Application |

|

|

Electric Vehicle |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Off-highway Electric Vehicles Market Regional Analysis:

North America Market

North America off-highway electric vehicles market is predicted to account for revenue share of around 32% by 2035. This growth is attributed to the growing attention toward sustainability and minimization of carbon footprints. The tightening of environmental standards makes industries rely more on electric machinery to fulfill emission regulations. The adoption of electric power systems has become exceptionally important for the mining industry as well as the construction and agricultural sectors, where heavy-duty diesel machines traditionally dominate.

The off-highway electric vehicles market is pushed significantly by electric alternatives as they deliver major environmental advantages. Government incentives, together with subsidies, serve as essential factors that push customers toward electric vehicle adoption. The adoption of electric off-highway vehicles receives support from local governments through tax breaks and grants as financial incentives. Public policies have been developed to decrease greenhouse gas emissions to advance green technology progress and promote innovation across the off-highway sector. The market growth for EVs has received support from incentive programs that help buyers reduce the initial costs of purchasing electric vehicles.

The U.S. off-highway electric vehicles market is increasing, owing to the requirement of zero-emission solutions by businesses in the construction, agriculture, and mining sectors. There has been an increasing adoption of electric off-highway vehicles as industries increasingly encounter demands to minimize their environmental impact. Government initiatives for emission reductions and clean energy promotion function as essential elements, supporting the movement. Manufacturers are directed to develop electric alternatives due to stringent non-road emission standards, creating a positive commercial framework.

The off-highway electric vehicles market in Canada is expected to experience significant growth, attributed to the requirement of electric vehicles from the mining and forestry sectors to fulfill new environmental regulations with high-power, emission-reduced machines. The mining industry is anticipated to use electric machinery as diesel equipment poses economic and environmental problems to operation. Manufacturers in the country are all set to use cost reduction as a driving force to decrease their fuel expenses along with maintaining diesel engine-related costs.

The off-highway electric vehicles market in Canada continues to expand as the country’s infrastructure is improving its technology for localized electric vehicle charging capabilities. The government’s investments focus on developing charging facilities that exclusively serve off-highway motorized vehicles. Companies specializing in industry-specific charging solutions have made it simpler for operators to introduce electric vehicles as dedicated power solutions eliminating charging-related downtime. The improved charging infrastructure acts as a key factor in driving electric machinery adoption in essential sectors as it ensures better operational efficiency in remote locations where off-highway EVs are required.

Asia Pacific Market Analysis

The Asia Pacific off-highway electric vehicles market is expected to witness a rapid expansion between 2026 and 2035 driven by the swift industrialization and urbanization development in China and India. The industrial development of these nations requires sustainable and efficient machinery to support infrastructure development in construction and mining operations along with agricultural activities. These electric vehicles serve as affordable answers to industry machinery requirements and work towards emission reduction plus regulatory standards in an expanding off-highway electric vehicles market. In addition, government environmental regulations focusing on pollution control and sustainability support market growth. The implementation of strict pollution limits forces industries to switch to electric systems as governments provide subsidies to promote sustainable technological advancements. The development of charging networks, especially in China, coupled with expanded charging infrastructure, allows electric machinery to operate more efficiently for off-highway applications and progressively replace traditional machinery. Advanced technology development drives the market's expansion rate.

The China off-highway electric vehicles market is expected to grow, owing to the rapid technological advancements of electric vehicle production. Off-highway EV performance and efficiency receive major enhancements from innovations by companies in solid-state battery technology and fast-charging system development. Technological innovations have made China a top player globally in electric vehicles. The off-highway EV market position of the companies in China continues to strengthen through their strategic business agreements along with acquisitions. In January 2023, the Chinese electric vehicle giant BYD launched a new premium brand in the first quarter of 2023, Yangwang, with its first model slated to be an off-road vehicle.

The off-highway electric vehicles market in India is expected to accelerate, as the EV sector in India attracts more foreign investment and dynamic international partnerships. Indian businesses receive rising support from worldwide automobile manufacturers as well as tech corporations for developing electric vehicles that serve off-highway operations. The alliances between companies enable them to access new advanced technologies as well as expand manufacturing operations. Sustainable transportation alongside clean energy initiatives promoted by the local government drives these developments as it supports electric vehicle adoption through supportive policies.

Key Off-highway Electric Vehicles Market Players:

- Caterpillar

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volvo Construction Equipment AB

- Deere and Company

- Sandvik AB

- Epiroc AB

- Doosan Corporation

- CNH Industrial N.V.

- JC Bamford Excavators Ltd.

The competitive landscape of the off-highway electric vehicles market is rapidly evolving, attributed to the integration of advanced technologies in the industry by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global off-highway electric vehicles market:

Recent Developments

- In October 2024, Volkswagen reintroduced the historic Scout brand as an electric vehicle company. The company presented two new models, the Traveler SUV and the Terra pickup truck, and the models are expected to emphasize affordable electric off-road vehicles with low software controls as well as high mechanical buttons.

- In November 2022, Caterpillar announced the development of an electric-powered 793 mining truck, aiming to reduce emissions and operating costs in mining operations and to transform its Arizona-based proving ground into a sustainable testing and validation hub.

- Report ID: 7283

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.