OEM Insulation Market Outlook:

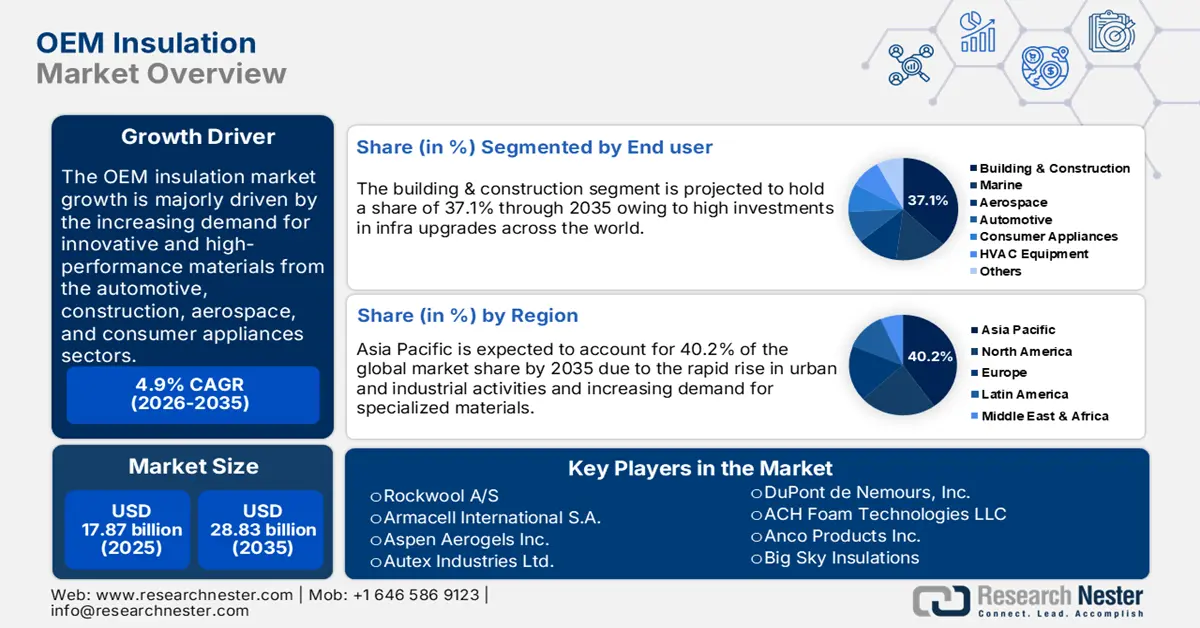

OEM Insulation Market size was over USD 17.87 billion in 2025 and is poised to exceed USD 28.83 billion by 2035, growing at over 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of OEM insulation is estimated at USD 18.66 billion.

The ongoing infrastructure growth in both developing and developed regions is offering profitable opportunities for original equipment manufacturers (OEM) of insulation products. For instance, the report by the Global Infrastructure Outlook a G20 Initiative estimates that the infrastructure investment need is estimated to increase from USD 3.5 trillion in 2025 to USD 4.4 trillion by 2037. Road and railway developments are essential for every country’s growth and directly fuel the demand for reliable and advanced electrical insulating products. Thus, to keep pace with infrastructure upgrades, economies are focused on substantial investments, offering high growth opportunities for original equipment manufacturers.

For instance, according to the analysis by the Observatory of Economic Complexity (OEC), the world trade of electrical insulators stood at USD 2.68 billion in 2023. The top export and import activities were concentrated across China (USD 823.0 million) and the U.S. (USD 406.0 million). The electrical insulator market concentration calculated using the Shannon Entropy amounted to 4.12 in 2023, explaining the export dominance of 17 countries. The same source also states the global trade of insulated wires totaled USD 161.0 billion in 2023, with China (USD 30.3 billion) and the U.S. (USD 29.8 billion) leading the export and import activities.

Leading companies in the OEM insulation market are aiming to earn high percent YoY growth in the coming years backed by robust urban and industrial growth. For instance, Rockwool A/S one of the market leaders reveals that it captured a 6.0% revenue hike and EBIT margin of 17.5% in 2024. Considering 2025 as an optimistic year, the company is investing heavily in capacity expansion and technological innovations to meet growing demands. The company is also poised to earn positive single-digit percent revenue growth and an EBIT margin of nearly 16.0% in 2025.

Key OEM Insulation Market Insights Summary:

Regional Highlights:

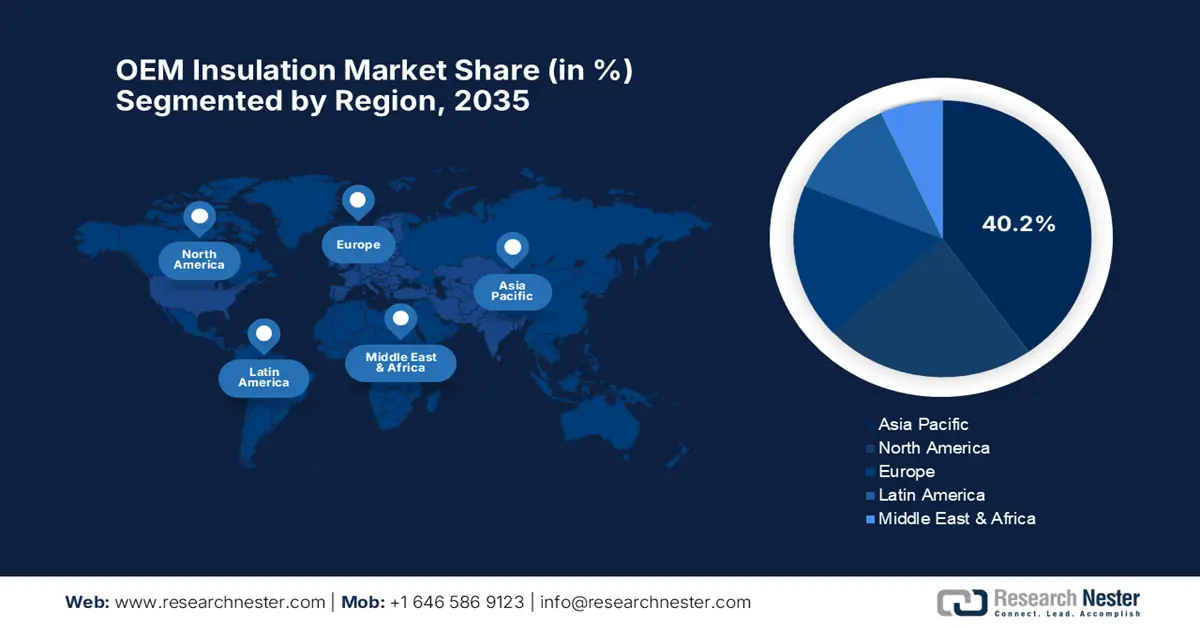

- Asia Pacific leads the OEM Insulation Market with a 40.2% share, propelled by rising construction activities and demand for energy-efficient materials, ensuring robust growth through 2035.

- North America's OEM insulation market is poised for the fastest CAGR through 2026–2035, driven by demand in marine, aerospace, automotive sectors and strong construction activities.

Segment Insights:

- Building & Construction segment is expected to hold over 37.1% share by 2035, propelled by expanding infrastructure and smart city initiatives.

- Mineral Wool segment is expected to capture over a 38.5% share by 2035, fueled by increasing electricity costs, emphasis on sustainability, and excellent thermal and acoustic insulation properties.

Key Growth Trends:

- Growing popularity of zero-emission vehicles

- Technological advancements coupled with smart home trends

Major Challenges:

- Recalls hamper goodwill and revenue growth

- High costs substantial challenges in price-sensitive markets

- Key Players: Rockwool A/S, Armacell International S.A., Aspen Aerogels Inc., Autex Industries Ltd., and Morgan Advanced Materials.

Global OEM Insulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.87 billion

- 2026 Market Size: USD 18.66 billion

- Projected Market Size: USD 28.83 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

OEM Insulation Market Growth Drivers and Challenges:

Growth Drivers

-

Growing popularity of zero-emission vehicles: The electric vehicle trend owing to zero-emission goals of countries worldwide is creating a win-win space for insulation product manufacturers. The climatic commitments and sustainable manufacturing practices are driving companies to invest in lightweight, durable, and energy-efficient insulation materials. Insulation products play a vital role in maintaining the temperature and safety of batteries in EVs. The boom in EV sales is set to uplift the market shares of OEMs in the coming years. For instance, the International Energy Agency (IEA) estimates that EV sales crossed 17 million in 2024. The same source also states that in 2023 the EV battery demand crossed 750 GWh, with a hike of 40.0% in 2022.

-

Technological advancements coupled with smart home trends: Technological innovations are positively promoting the sales of innovative insulation solutions. The increasing importance of energy efficiency is anticipated to boost the adoption of improved and high-performance insulation products such as wires, plastics, aerogels, and more. The smart home trend is necessitating owners to invest in reliable and energy-saving electrical insulating products. For instance, in July 2024, the Custom Electronics Design and Installation Association (CEDIA) revealed that the global smart home market size is valued at USD 29.0 billion and is expected to increase at a healthy pace in the coming years. The swift adoption of advanced technologies and automated appliances is set to fuel the demand for next-gen electrical insulators.

Challenges

-

Recalls hamper goodwill and revenue growth: Product recalls due to lack of standardization or technical issues act as major challenges for OEM of insulation products. These often lead to recalls and significantly hamper the goodwill and revenue growth of the manufacturers. For instance, in December 2021, the Government of the U.K., through a prohibition notice recalled Kingspan Insulation Ltd.’s Kooltherm K15 insulation products. Even though it’s a short-term challenge for OEM insulation market players recall has a major reputation hindering potential.

-

High costs substantial challenges in price-sensitive markets: Continuous investments aimed at the development of advanced and innovative insulation products often lead to a rise in the cost of final products. These advanced products witness adoption challenges in price-sensitive markets. On the other hand, developing countries are opportunistic marketplaces for original equipment manufacturers of insulation solutions based on their cost-effectiveness. Pricing strategies are expected to offer lucrative opportunities in the markets of budget-conscious customers.

OEM Insulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 17.87 billion |

|

Forecast Year Market Size (2035) |

USD 28.83 billion |

|

Regional Scope |

|

OEM Insulation Market Segmentation:

Material (Glass Wool, Foamed Plastics, Mineral Wool, Others)

Mineral wool segment is likely to dominate OEM insulation market share of over 38.5% by 2035. The increasing electricity costs and the growing importance of sustainability are pushing the demand for energy-efficient insulation materials. The mineral wool products are highly effective in enhancing energy savings owing to excellent thermal and acoustic insulation properties. These characteristics are further contributing to mineral wool product’s increasing sales. Construction, aerospace, automotive, and marine fields are generating high demand for mineral wool products such as fiberglass and stone wool. According to the U.S. Geological Survey (USGS), the global production capacity for glass fiber was estimated at around 6 million metric tons (about 13 billion pounds) in 2022.

End user (Automotive, Marine, Aerospace, Building & Construction, Consumer Appliances, HVAC Equipment, Others)

In OEM insulation market, building & construction segment is set to capture revenue share of over 37.1% by 2035. The expanding infrastructure development actions and increasing registrations of residential & commercial structures worldwide are fueling the sales of insulation products. Booming urban and industrial activities in both developing and developed regions are generating a profitable environment for original equipment manufacturers of insulation solutions. The smart home trends and smart city initiatives are promoting the adoption of insulation products. For instance, according to Research Nester’s analysis, the U.S. is leading the global building & construction sector. In 2023, the value added in the U.S. private residential segment crossed USD 862.0 billion. Thus, the growing construction activities in residential, commercial, and industrial sectors are set to fuel the sales of insulation solutions.

Our in-depth analysis of the global OEM insulation market includes the following segments:

|

Material |

|

|

Insulation Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

OEM Insulation Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific OEM insulation market is likely to capture revenue share of over 40.2% by 2035. The rising construction activities are playing a major role in augmenting the sales of insulation solutions. For instance, the report by the Global Infrastructure Outlook a G20 Initiative reveals that the infrastructure needs of Asia are projected to expand from USD 1.9 trillion in 2025 to USD 2.5 trillion by 2040. The fueling infrastructure sector is poised to offer lucrative opportunities for key market players in the coming years. The boasting demand for energy-efficient materials from the aerospace, automotive, marine, and consumer appliances sectors is further amplifying the overall OEM insulation market growth.

China’s robust automotive sector is expected to double the revenues of OEMs during the foreseeable period. The climatic commitments and zero emission goals are backing the sales of electric vehicles and energy storage batteries. Swift automobile production and sales are creating a lucrative environment for OEMs of insulation products. The IEA report highlights that electric car sales in China totaled 1.9 million in the first quarter of 2024. The same source also explains that the country captured 415 GWh EV battery demand in 2023.

The construction sector of India is estimated to propel the OEM insulation market growth in the years ahead. The smart city initiatives coupled with high investments in railway and road projects are increasing the demand for energy-efficient materials such as fiberglass, electric insulators, and foamed plastics. The report by Invest India estimates that by 2030, the construction sector is expected to contribute USD 1.0 trillion to the country’s economy, with employment increasing by USD 100.0 million. The country holds 3rd position in the urban transit network particularly the metro globally.

North America Market Statistics

The North America OEM insulation market is projected to increase at the fastest CAGR between 2026 to 2035. The marine, aerospace, and automotive sectors are majorly backing the sales of insulation products. The increasing demand for high-performance solutions in these sectors is amplifying the sales of insulation solutions. The robust construction activities and infra-upgrade projects in Canada and the U.S. are also fueling the sales of electric insulators, fiberglass, insulating wires, and foam plastics.

The swiftly expanding construction activities in the U.S. are propelling the sales of advanced insulation solutions. The increasing adoption of smart homes and robust investments in residential and commercial structures are fueling the demand for high-performance insulation technologies. The Associated General Contractors of America (AGC) stated that in 2023 over 919,000 construction structures were recorded in the U.S. Furthermore, the U.S. Census Bureau disclosed that the construction spending in December 2024 was calculated at USD 2192.2 billion.

Canada with a strong presence of automobile manufacturers is backing the sales of insulation solutions. The increasing demand for sustainable vehicles is also driving a high demand for high-performance insulation materials. For instance, the Statistique Canada analysis states that the battery electric vehicle registrations in the country increased from 40,051 in the fourth quarter of 2023 to 56,048 in Q3 of 2024. This reflects that the insulation materials are poised to find high applications in the electric vehicle’s batteries.

Key OEM Insulation Market Players:

- DuPont de Nemours, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACH Foam Technologies LLC

- Anco Products Inc.

- Big Sky Insulations

- Demilec Inc.

- Johns Manville

- Rockwool A/S

- Armacell International S.A.

- Aspen Aerogels Inc.

- Autex Industries Ltd.

- Morgan Advanced Materials

- Owens Corning Corp.

- Paroc Group OY

- Rockwool International A/S

- Saint-Gobain S.A.

- Scott Industries LLC

- Superglass Insulation Ltd.

- The 3M Company

- Triumph Group

Leading companies in the OEM Insulation market are employing several organic and inorganic strategies such as new product launches, technological innovations, mergers & acquisitions, partnerships & collaborations, and regional expansions. The key market players are investing heavily in research and development activities to introduce innovative insulation solutions. This move strongly aids in attracting a wider customer base. They are also entering into strategic collaborations and partnerships to expand their market reach.

Some of the key players include in OEM insulation market:

Recent Developments

- In January 2025, Johns Manville announced the expansion of its insulation portfolio to meet the swiftly increasing demand. The company’s new APP products include fiberglass (JM APP Base), polyester (APPeX/Dibiten), and composite (Bicor/Tricor) reinforcement options.

- In December 2024, Rockwool A/S announced a USD 100 million-plus investment plan for the expansion of its production capacity of industrial insulation solutions in Mississippi. This expansion is aimed at meeting the increasing demand from the Gulf of Mexico region.

- Report ID: 7269

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

OEM Insulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.