OB/GYN EHR Market Outlook:

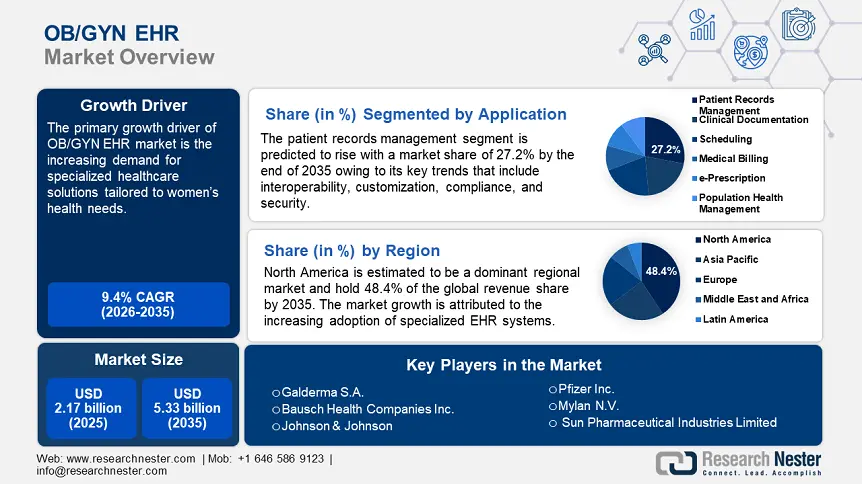

OB/GYN EHR Market size was valued at USD 2.17 billion in 2025 and is set to exceed USD 5.33 billion by 2035, registering over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of OB/GYN HER is estimated at USD 2.35 billion.

The primary growth driver of the obstetrics and gynecology electronics and health records (OB/GYN EHR) market is the increasing demand for specialized healthcare solutions tailored to women’s health needs. OB/GYN practices require specific functionalities, such as tools for managing obstetric and gynecological patient data, which specialized EHRs, can provide. Solutions designed for OB/GYN practices streamline workflows, improve appointment scheduling, and facilitate better communication between providers and patients. Moreover, specialized EHRs help in tracking patient histories, managing care plans, and implementing preventive measures, leading to better health outcomes. EHR systems often integrate with other specialized tools such as ultrasound and lab systems, ensuring comprehensive care and data sharing.

EHR adoption is gaining traction in gynecological offices, owing to its convenience and accuracy in maintaining data. According to the Assistant Secretary for Technology Policy/Office of the National Coordinator for Health Information Technology (ASTP), approximately four out of five office-based physicians (78%) and virtually all non-federal acute care hospitals (96%) in the U.S. have adopted a certified EHR as of 2021. This represents significant 10-year progress from 2011, when 28% of hospitals and 34% of physicians had implemented an EHR.

Key OB/GYN EHR Market Insights Summary:

Regional Highlights:

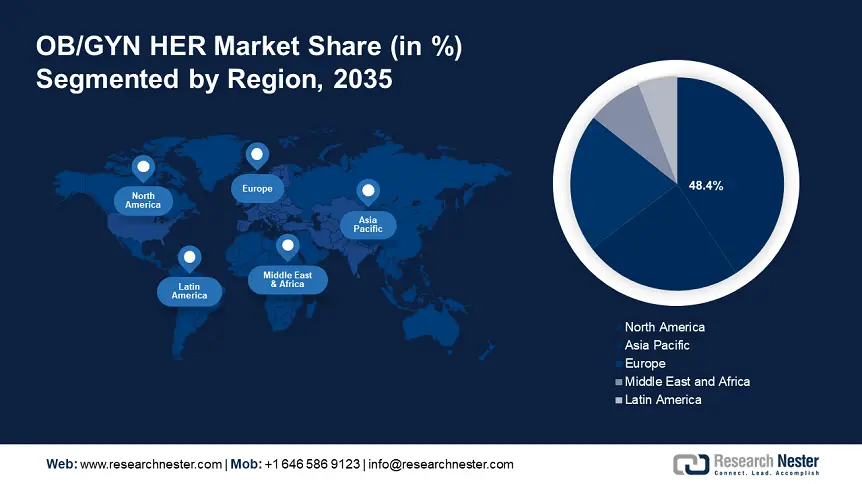

- North America dominates the OB/GYN EHR market with a 48.4% share, driven by the increasing adoption of specialized EHR systems, enhancing efficiency and patient care through 2026–2035.

- The Asia Pacific OB/GYN EHR market is poised for rapid growth by 2035, fueled by rising healthcare expenditure and tech advances.

Segment Insights:

- The Patient Records Management segment is poised for substantial growth, capturing over 27.2% market share by 2035, driven by enhanced clinical decision-making and care continuity.

- Hospitals segment are expected to achieve a notable revenue share by 2035, driven by investment in advanced EHR systems.

Key Growth Trends:

- Increased investment in women’s health

- Telehealth integration

Major Challenges:

- High implementation costs

- Regulatory compliance

- Key Players: CureMD Healthcare, Greenway Health, LLC, Modernizing Medicine, MedicalMine Inc., Benchmark Solutions, Bizmatics, Inc., and Practice Fusion, Inc.

Global OB/GYN EHR Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.17 billion

- 2026 Market Size: USD 2.35 billion

- Projected Market Size: USD 5.33 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

OB/GYN EHR Market Growth Drivers and Challenges:

Growth Drivers

- Increased investment in women’s health: Governments and organizations are promoting women’s health initiatives, leading to increased funding and focus on women-centric healthcare solutions. Investments can lead to advanced analytics capabilities with EHR’s, enabling providers to track and analyze health trends, outcomes, and patient demographics more effectively. Silicon Valley Bank's 2023 Women's Health report states that investments in women's health have increased 314% over the last five years, while overall U.S. healthcare investments have increased by 28%.

- Telehealth integration: Telehealth enables patients to access care remotely, making it easier for women to receive consultations, especially in undeserved areas. There is a growing acceptance of telehealth as a viable option for both patients and privders. According to the American Journal of Managed Care (AJMC) in January 2023, all four U.S. census regions—the Midwest (9.5%), the West (9.5%), the South (6.7%), and the Northeast (3.2%)—saw an increase in telehealth utilization.

EHRs that support telehealth can facilitate remote monitoring of conditions such as high-risk pregnancies, allowing for timely interventions. A telehealth platform integrated with an interoperable EHR system can contribute directly toward achieving better health outcomes, improved patient experience, lower costs, and improved clinician experience. - Technological advancements: Several technological advancements streamline operations and also enhance the quality of care. Advancements that include artificial intelligence (AI) algorithms in diagnostics, risk assessment, and personalized treatment plans, improve clinical decision-making. Applications for patient education, appointment scheduling, and tracking health metrics promote patient engagement and self-management.

Moreover, improved interoperability allows EHR systems to seamlessly share data across various healthcare platforms, enhancing care coordination. Also, devices that monitor vital signs and reproductive health data contribute to more comprehensive patient insights. For instance, according to a 2019 published report by the Journal of Medicine Internet Research (JMIR) stated that almost 20% women were willing to wear devices for pregnancy monitoring all the time or multiple times a day. This highlights the preference of some women to closely monitor their pregnancy.

Challenges

- High implementation costs: The cost associated with purchasing software, hardware, and infrastructure can be substantial, particularly for smaller practices. Training staff to effectively use new EHR systems adds to the overall cost, and prolonged training periods can disrupt patient care. Moreover, beyond initial costs, ongoing maintenance and updates can strain budgets, especially for practices with limited financial resources.

- Regulatory compliance: Keeping up with the evolving regulations requires significant resources, which can be overwhelming for smaller practices. Failure to comply can result in financial penalties, making practices wary of adopting EHRs that may not meet all regulatory standards.

OB/GYN EHR Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 2.17 billion |

|

Forecast Year Market Size (2035) |

USD 5.33 billion |

|

Regional Scope |

|

OB/GYN EHR Market Segmentation:

Component (Software, Services)

Software segment in the OB/GYN EHR market is estimated to exhibit around 10.1% CAGR till 2035. The segment is further bi-furcated into web/cloud-based EHR and on-premises EHR. Software designed specifically for OB/GYN practices allows customization to meet the unique needs of women’s health, including prenatal and postnatal care tracking.

EHR software increasingly supports interoperability, allowing for better data exchange between different healthcare systems, which is crucial for coordinated care. Thus, the segment’s comprehensive capabilities, customization options, and focus on user experience position it as the dominant force in the OB/GYN EHR market. As practices increasingly recognize the benefits of specialized EHR solutions, this segment is expected to continue its growth significantly.

Application (Medical Billing, e-Prescription, Clinical Documentation, Scheduling, Patient Records Management, and Population Health Management)

Patient records management segment is expected to hold OB/GYN EHR market share of over 27.2% by the end of 2035. Effective patient record management allows OB/GYNs to assess complete and organized patient histories, enhancing clinical decision-making and continuity of care. Moreover, efficient patient record management reduces administrative burden, allowing healthcare providers to spend more time on patient care rather than paperwork.

Also allowing patients to access their records fosters engagement and encourages them to take an active role in their health, which can lead to better health outcomes. For instance, according to the Office of the National Coordinator for Health IT (ONC), the percentage of U.S. adults who reported being offered access to their medical records by a provider or insurer increased by 50% between 2020 and 2022, from 38% to 57%.

End user (Hospitals, Clinics, Ambulatory Surgical Centers (ASCs), and Maternity Centers)

The hospital segment is anticipated to hold a notable revenue share by 2035. Hospitals provide a wide range of services, including obstetric and gynecological care, which necessitate robust EHR solutions for seamless care coordination across departments. Moreover, hospitals often have more resources to invest in advanced EHR systems, enabling them to implement sophisticated features for patient record management, analytics, and reporting.

Our in-depth analysis of the OB/GYN EHR market includes the following segments

|

Component |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

OB/GYN EHR Market Regional Analysis:

North America Market Forecast

North America industry is predicted to dominate majority revenue share of 48.4% by 2035. The market growth is attributed to the increasing adoption of specialized EHR systems. An aging population and rising awareness of women’s health issues are driving demand for specialized OB/GYN services, necessitating efficient EHR systems for better patient management.

In the U.S. a growing number of OB/GYN practices are moving from paper-based records to electronic health records, driven by regulatory incentives and the need for improved efficiency. Government initiatives, such as the 21st Century Cures Act, promote the use of interoperable EHR systems, enhancing coordination and data sharing among healthcare providers.

Additionally, several EHR vendors are driving growth in the OB/GYN EHR market in the country through specialized solutions and features tailored for women’s health. For instance, Epic Systems Corporation is the largest EHR vendor with nearly 38% of hospital installations followed by Oracle Cerner.

In Canada, federal and provincial governments are promoting the adoption of digital health technologies through funding and policies aimed at improving healthcare delivery, including the implementation of EHR systems. The COVID-19 pandemic accelerated the adoption of telemedicine in the country, leading to increased demand for EHR systems that support virtual care and remote patient monitoring.

APAC Market Statistics

Asia Pacific market is expected to increase at a fast pace during the forecasted period owing to the rising healthcare expenditure, technological advancements, and an increasing focus on women’s health services. Several countries including India, China and Japan continue to prioritize digital health initiatives. The adoption of specialized EHR systems in OB/GYN practices is expected to rise significantly.

In China, the government has been substantially increasing healthcare budgets as part of its commitment to improve health services, which supports the adoption advanced EHR systems in various specialties including OB/GYN. In 2020, the total expenditure on healthcare in the country exceeded USD 1.26 trillion, which includes government spending, collective spending, and private out-of-pocket spending.

The Government of India is promoting digital health through initiatives such as the National Digital Health Mission (NDHM), which encourages the use of EHRs to improve healthcare delivery and access. Moreover, the private sector is expanding rapidly, with many private hospitals and clinics adopting EHR systems, contributing to the growth of the OB/GYN EHR market.

Key OB/GYN EHR Market Players:

- AdvancedMD, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CureMD Healthcare

- Greenway Health, LLC

- Modernizing Medicine

- MedicalMine Inc.

- Benchmark Solutions

- Bizmatics, Inc.

- Practice Fusion, Inc.

- Sevocity

- Veradigm LLC.

Key players drive the OB/GYN EHR market by focusing on innovation, usability, interoperability, and patient engagement. By addressing the specific needs of OB/GYN providers and patients, these companies enhance the value of their EHR systems, promoting wider adoption and ultimately contributing to the market’s growth.

Recent Developments

- In 2023, CureMD Healthcare, a leading provider of comprehensive technology solutions for community oncology, announced collaboration with Tempus, a pioneer in artificial intelligence and precision medicine, to incorporate Tempus' advanced genomic testing capabilities into CureMD's cutting-edge Electronic Health Record (EHR) system.

- In July 2021, Charm Health, MedicalMine Inc.'s cloud-based platform, introduced revolutionary smart navigation, a natural language interface to patient records and practice management.

- Report ID: 6506

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

OB/GYN EHR Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.