O Ring Market Outlook:

O Ring Market size was over USD 10.41 billion in 2025 and is anticipated to cross USD 17.12 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of o ring is assessed at USD 10.89 billion.

O-rings’ crucial role in ensuring manufacturing integrity in the pharmaceutical sector highlights their importance, bolstering demand across various industries. India’s pharmaceutical industry, valued at approximately USD 50 billion and serving over 199+ countries, underscores the critical need for high-quality sealing solutions due to its rapid growth.

In addition to these, factors that are believed to fuel the growth of the O ring market include their exceptional performance along with ease of installation, making it favorable across sectors like automotive and aerospace. Additionally, technological innovations in material science enhance O-ring durability and reliability, further propelling sector growth.

Key O Ring Market Insights Summary:

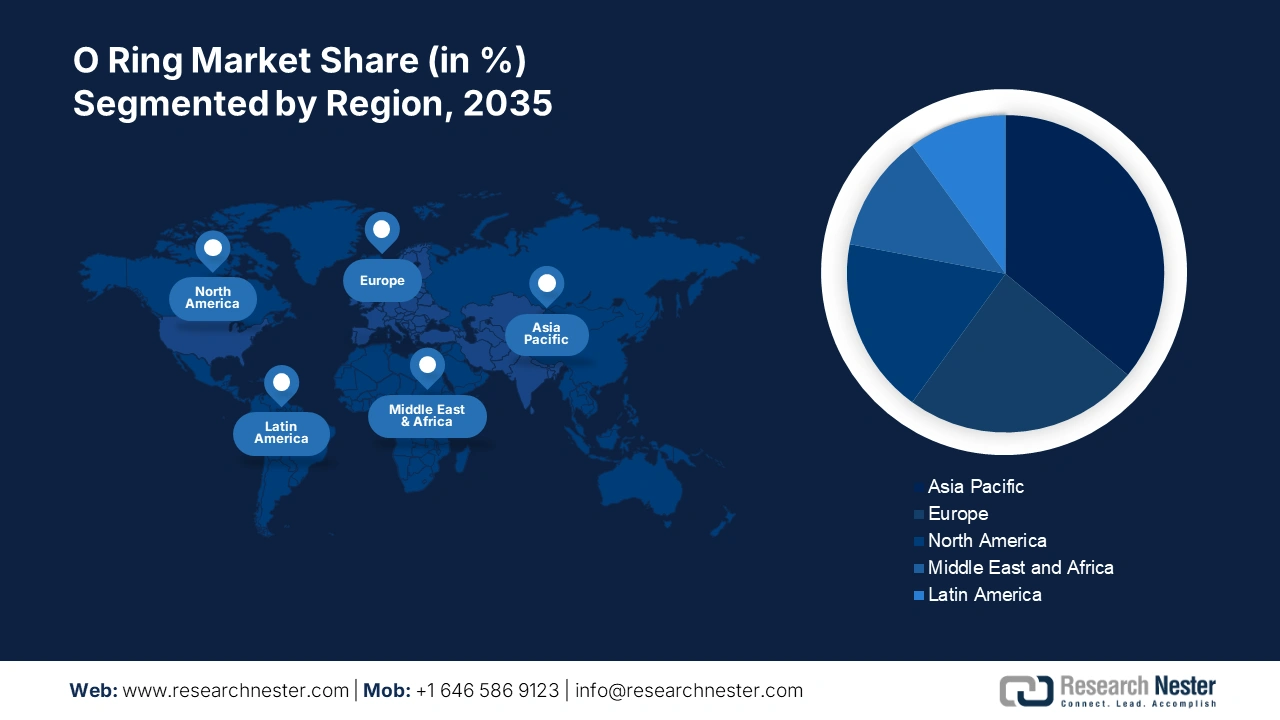

Regional Highlights:

- The Asia Pacific O ring market will secure over 42% share by 2035, fueled by high shipment volumes from China to India, strong importer activity, and rising regional demand.

- The Europe market will account for 22% share by 2035, fueled by robust aerospace and defense sector revenues, a 10.5% average revenue growth rate, and increasing demand from the automotive industry.

Segment Insights:

- The fkm fluoroelastomer segment in the o ring market is projected to capture a 59% share by 2035, driven by its exceptional chemical, thermal, and oxidation resistance properties.

- The aerospace equipment segment in the o ring market is projected to hold a 52% share by 2035, driven by the wide use of O-ring seals offering design simplicity and exceptional sealing performance.

Key Growth Trends:

- Stringent Environmental and Safety Regulations Amid Rising Air Pollution Concerns

- Technological Advancements Amidst Slowing Fuel Economy Improvements

Major Challenges:

- Presence of Cheaper and Lower Quality Products

Key Players: Sealing Devices Inc., Daemar Inc., Ribblex Prime Industries, Allied Metrics Seals & Fasteners, Inc., Flexitallic Group, Oring Industrial Networking Corp., Hi-Tech seals, Arizona Sealing Devices Inc., ISG Elastomers, Eagle elastomer Inc..

Global O Ring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.41 billion

- 2026 Market Size: USD 10.89 billion

- Projected Market Size: USD 17.12 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

O Ring Market Growth Drivers and Challenges:

Growth Drivers

-

Stringent Environmental and Safety Regulations Amid Rising Air Pollution Concerns: Stringent environmental and safety regulations, influenced by increasing concerns over air pollution, are a boosting factor for the O ring market With more than 99% of the population living in areas where air pollution exceeds World Health Organization (WHO) air quality guidelines, and 4.2 million deaths attributed to ambient air pollution annually, there is an urgent need for industries to reduce their environmental impact. This urgency is reflected in the regulations imposed by automotive organizations concerning toxic gas emissions such as nitrogen oxide and carbon monoxide. The implementation of these regulations necessitates the uses of advanced sealing solutions, like O-ring, that can ensure compliance with emission standards while offering durability and efficiency.

-

Technological Advancements Amidst Slowing Fuel Economy Improvements: While the global fuel economy has seen a significant improvement of 1.7% annually over the last twelve years, advanced economies have experienced a significant slowdown, with fuel consumption enhancement averaging about 0.2% per year. This deceleration highlights the critical role of technological innovations in the O ring market. Enhanced efficiency of O-ring is crucial for addressing the fuel economy challenges, offering a pathway to optimize energy usage and reduce emissions in automotive and aerospace applications. This existing need for high-performing sealing solutions becomes increasingly crucial in a landscape where achieving fuel efficiency gains is becoming more challenging, underscoring the importance of continuous innovations in the O ring market .

-

Expansion of Industries: The rising demand for O-rings is significantly attributed to the expansion of various important industries, including aerospace & aviation, automotive, chemical & petrochemical, oil & gas, water & wastewater treatment, electrical & electronics, food & beverages, medical & healthcare, among others. The versatile and sustainable role of the O-rings in these varied and ultimately essential sectors underscores their critical importance, boosting revenue and sectoral growth as these industries continue to evolve and expand.

Challenges

-

Presence of Cheaper and Lower Quality Products: The presence of such products in the aftermarket is indeed a significant challenge, as it restricts the opportunities for key players to establish their foothold. These products often attract users due to their lower initial cost which in return have a shorter life cycle, leading to increased long-term expenses for consumers and negative impact on the reputation of reliable manufacturers.

-

The outer jacket material of these products is easily prone to scratches, rendering them unsuitable for applications involving abrasive materials such as slurries or powders.

-

These products are designed for static and slow-moving rotary applications, making them unsuitable for highly dynamic systems.

O Ring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 10.41 billion |

|

Forecast Year Market Size (2035) |

USD 17.12 billion |

|

Regional Scope |

|

O Ring Market Segmentation:

Type Segment Analysis

The FKM Fluoroelastome segment in the O ring market is estimated to gain the largest revenue share of about 59% by 2035. The segment growth can be attributed to the ultimate properties of FKM fluoroelastomers, which include extensive carbon-fluorine bonds leading to outstanding chemical, thermal, and oxidation resistance, which forms the basis of their significant sectoral share. Additionally, the pricing of fluoroelastomers was noted at approximately USD 45,740 per MT on a FOB basis for grades with a Mooney viscosity (MV) of 25-40, reflecting the O ring market valuation of its quality. All these ultimate components like temperature range, excellent mechanical characteristics, and high-density quality feel underpin FKM’s dominance.

End Use Segment Analysis

The aerospace equipment segment in the O ring market is estimated to gain a significant share of about 52% in the year 2035. The segment growth is primarily fueled by the rigorous application of O-ring seals in important sectors like aerospace. attributes like design simplicity, size variety, reusability, cost-effectiveness, adaptability, and exceptional sealing performance underpin this growth. Particularly dominant in aerospace equipment, these seals' utility underscores their pivotal role in ensuring operational efficiency and reliability across diverse industrial landscapes, driving their unparalleled market demand.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

O Ring Market Regional Analysis:

APAC Market Insights

The O ring market in Asia Pacific, is anticipated to hold the largest share of about 42% by the end of 2035. The market growth in the region is propelled by the impressive scale of shipments of O-rings from China to India, which stood at a staggering 237.7k, courtesy of 6,590 Indian importers engaging with 7,084 suppliers based in China. India’s robust position is not just regional but global, as it emerges as the world’s first importer of O-rings. The heavy import activity underpins the regional growth prospects. India’s towering import figures of 2,183,650 shipments highlight the nation’s central role in the regional dynamics. This expanding inflow of O-rings into the region, mainly from China and India, is set to foster boosting growth opportunities within the Asia Pacific region, bolstering the expansion and fortifying its demand.

European Market Insights

The Europe O ring market is estimated to be the second largest, registering a share of about 22% by the end of 2035. The market’s expansion is majorly due to the impressive performance of the aerospace and defense sectors in the region, which have reported combined revenues reaching USD216,853 million and an average revenue growth rate of 10.5%. Such robust financial indicator suggests a dynamic sectoral expansion, propelled by the increasing demand for O-rings in these industries. Europe’s growing automotive fleet and the corresponding aftermarket further contribute to this upward trend, ensuring a continuous demand trajectory for automotive distributors in the O ring market. The synergy of the thriving aerospace, defense, and automotive industries in Europe is the cornerstone of the expected steady revenue, setting the stage for a sustained increase in demand for O-ring across Europe region.

O Ring Market Players:

- Sealing Devices Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay

- Daemar Inc.

- Allied Metrics Seals & Fasteners, Inc.

- Flexitallic Group

- Oring Industrial Networking Corp.

- Hi-Tech seals

- Arizona Sealing Devices Inc.

- ISG Elastomers

- Eagle elastomer Inc.

Recent Developments

- Align capital partners (ACP) a private equity firm, has recently expanded its portfolio through macro rubber and plastics, a leading provider of custom sealing solutions that operates under its umbrella. This strategic move came with the acquisition of Allied Metrics Seals, a well-known distributor specializing in diverse range of O-rings, seals and gaskets.

- Solvay, a leading chemical company announced the plan of strategic expansion to increase it capacity of Tecnoflon fluoroelastomer FKM by 30% at its facility in Italy. This is done in response to the growing sectoral demand for high performing sealing solutions. The expansion aimed to enhance solvay’s ability to supply these critical components widely used in various industries.

- Report ID: 5911

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

O Ring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.