Nutrition Bars Market Outlook:

Nutrition Bars Market size was over USD 1.54 billion in 2025 and is projected to reach USD 2.44 billion by 2035, witnessing around 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nutrition bars is evaluated at USD 1.61 billion.

The growing demand for sports nutrition products that align with active lifestyles. Nutrition bars, particularly protein bars, have emerged as popular choices among athletes and fitness enthusiasts due to their convenience, portability, and ability to provide essential nutrients. These bars serve as an ideal post-workout snack or meal replacement, helping to replenish energy, support muscle recovery, and promote overall performance, making them an integral part of fitness routines.

Growing consumer awareness about the importance of a balanced diet and physical fitness has fueled demand in the nutrition bars market. According to an NLM report published in August 2018, in the U.S., 14-16% of the total energy intake comprised protein intake, indicating a balanced diet. This showcases the presence of a well-aware population, creating potential consumers for this sector. To meet evolving consumer preferences, companies are innovating with new flavors, functional ingredients such as probiotics and collagen, and diverse formats. The introduction of keto-friendly, gluten-free, and vegan options has further expanded nutrition bars market’s appeal, catering to a broader audience seeking tailored solutions for their dietary needs and wellness goals.

Key Nutrition Bars Market Insights Summary:

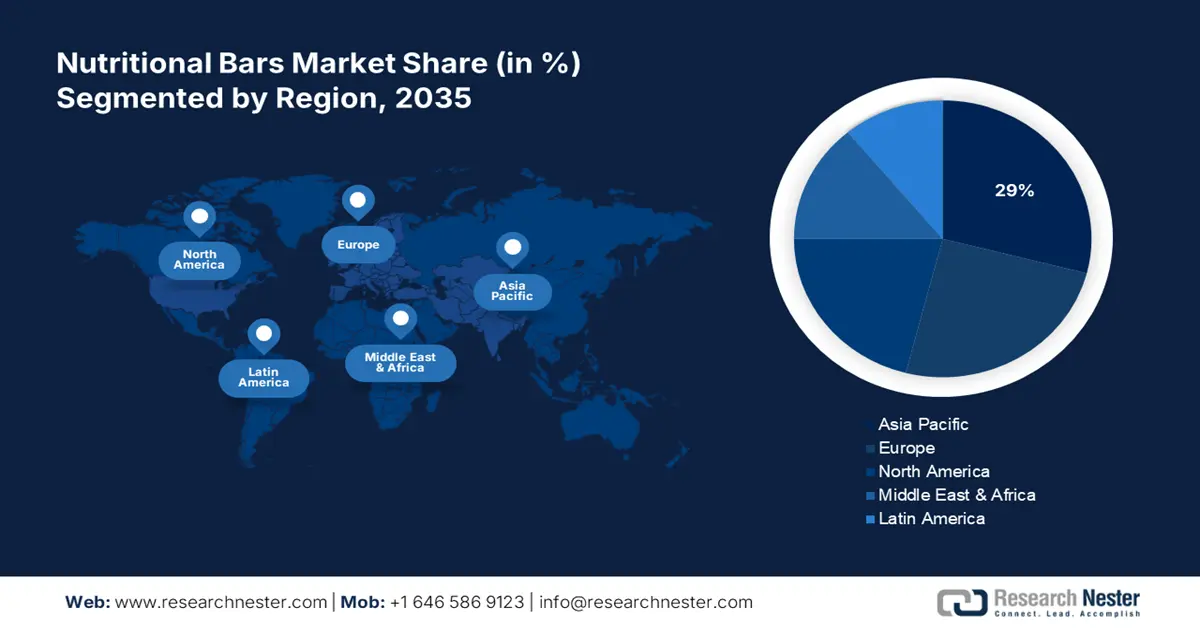

Regional Highlights:

- Asia Pacific leads the Nutrition Bars Market with a 29.00% share, with increasing health-conscious consumers seeking convenient, nutritious snacks driving its dominance and growth prospects by 2035.

- Europe's nutrition bars market is expected to expand exponentially by 2035, propelled by rising adoption of plant-based diets and demand for sustainable, functional snacks.

Segment Insights:

- Protein Bars segment are expected to capture a majority revenue share by 2035, fueled by rising demand among fitness-focused consumers and vegan protein innovations.

- Specialty Stores segment are expected to secure over a 48% share by 2035, fueled by curated, high-quality offerings and personalized customer service for health-conscious buyers.

Key Growth Trends:

- Increasing demand for plant-Based and clean-label products

- Rising Prevalence of Chronic Diseases

Major Challenges:

- Increasing competition among brands

- Stringent regulatory compliance

- Key Players: BASF SE, Ajinomoto Co. Inc., Cargill Incorporated, Mondelez International, Glanbia Plc.

Global Nutrition Bars Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.54 billion

- 2026 Market Size: USD 1.61 billion

- Projected Market Size: USD 2.44 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (29% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 14 August, 2025

Nutrition Bars Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for plant-Based and clean-label products: consumers are increasingly seeking products with minimal processing, natural ingredients, and plant-based formulations driven by ethical and environmental concerns. According to the USDA report published in June 2020, the retail sales of organic food and beverages in India reached USD 77.0 million in the same year. This shift reflects growing awareness about sustainability, animal welfare, and the health benefits of natural diets. As a result, manufacturers are focusing on creating vegan and clean-label nutrition bars that use wholesome, non-GMO, and organic ingredients.

- Rising Prevalence of Chronic Diseases: The global rise in lifestyle-related diseases such as obesity, diabetes, and cardiovascular issues has significantly increased the demand for healthier snack alternatives. The World Health Organization estimates that non-communicable diseases, or NCDs, of which lifestyle illnesses are a subset, kill 41 million people a year, accounting for more than 70% of all fatalities worldwide. Consumers are seeking options that align with their dietary needs while supporting overall well-being. Nutrition bars with low sugar, high protein, and added functional ingredients have emerged as a convenient solution to these health concerns.

Challenge

- Increasing competition among brands: The nutrition bars market is highly saturated, with numerous global and local brands competing for consumer attention. This intense competition makes it increasingly difficult for companies to differentiate their products and establish a unique market presence. With many brands offering similar formulations, flavors, and benefits, creating a standout product requires significant investment in innovation, marketing, and branding. Additionally, maintaining customer loyalty in a nutrition bars market flooded with choices is often swayed by new trends, lower prices, or innovative offerings.

- Stringent regulatory compliance: Adhering to strict food safety standards and labeling regulations across diverse regions presents significant challenges for nutrition bar manufacturers. Each country imposes unique requirements regarding ingredient sourcing, processing, and packaging, which manufacturers must navigate carefully to ensure compliance. This complexity increases operational costs and demands extensive quality control measures. Additionally, accurate and transparent labeling, such as allergen declarations and nutrition claims, requires, constant updates to meet evolving regulatory standards. Failure to comply can result in legal penalties, product recalls, and reputational damage.

Nutrition Bars Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 1.54 billion |

|

Forecast Year Market Size (2035) |

USD 2.44 billion |

|

Regional Scope |

|

Nutrition Bars Market Segmentation:

Distribution Channel (Hypermarkets/Supermarkets, Specialty Stores, Online Retail)

By distribution channel, the specialty stores segment is expected to capture over 48% nutrition bars market share by 2035. The segment is growing due to its ability to offer curated, high-quality products tailored to specific dietary needs. These bars, rich in protein, fiber, and essential vitamins, offer a quick and healthy snack alternative for busy lifestyles. Stores often provide personalized customer service and expert advice, attracting health-conscious consumers, looking for a faster solution. Additionally, specialty stores create a focused shopping experience with a premium feel, showcasing niche and innovative brands that are not always available in supermarkets or online, driving customer loyalty and repeat purchases.

Product Type (Cereal/Granola Bars, Protein Bars, Energy Bars/ Meal Replacements Bars, Fruits & Nuts Bars)

Based on product type, the protein bars segment is set to hold the majority revenue share in the global nutrition bars market due to their high demand among fitness enthusiasts, athletes, and health-conscious consumers. These bars are valued for their ability to support muscle recovery, weight management, and sustained energy. The growing trend of active lifestyles and increasing awareness of the benefits of protein-rich diets further drive their popularity. Additionally, ongoing innovations in flavors and formulations, such as vegan protein options, enhance their market appeal due to their increased nutrition offering. According to the NLM report published in September 2023, vegan protein bars consist of 236 g of protein content, making it a preferable choice for good energy sources for people.

Our in-depth analysis of the global nutrition bars market includes the following segments:

|

Distribution Channel |

|

|

Product Type |

|

|

Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nutrition Bars Market Regional Analysis:

APAC Market Statistics

Asia Pacific in nutrition bars market is expected to account for more than 29% revenue share by the end of 2035. Consumers in Asia Pacific are becoming increasingly health-conscious, seeking convenient and nutrition bars, rich in protein, fiber, and vitamins, carer to the growing demand for balanced diets amidst busy lifestyles. Furthermore, urbanization across the region has led to hectic schedules, driving demand for portable, on-the-go food solutions. Nutrition bars provide a quick and easy way to meet the dietary needs of working professionals and students.

China has a robust e-commerce ecosystem, with platforms like JD.com and Alibaba, has made nutrition bars more accessible. Online channels allow manufacturers to reach a wider audience, offering convenience and personalized options through targeted marketing. Increasing consumer focus on health and fitness, driven by rising incomes and urbanization, has boosted demand for nutrition bars as convenient, nutrient-dense snacks. According to a report published by the USDA, in December 2023, the sales of snack foods including protein and health bars reached over USD 66 billion in the same year. The report further states, that the growth is expected to grow at an annual rate of 2.3%.

Consumers in South Korea are becoming more conscious of their health due to the rising concern about lifestyle diseases, and an aging population. Nutrition bars, rich in protein, fiber, and essential nutrients, cater to the growing demand for healthy, on-the-go snack options. Moreover, the growth of online grocery platforms and health-focused specialty stores has made nutrition bars more accessible, while aggressive marketing and promotional strategies boost their visibility across South Korea.

Europe Market Analysis

The nutrition bars market in Europe is set to expand exponentially owing to consumers increasingly adopting plant-based diets for ethical and environmental reasons. Nutrition bars made from sustainable, vegan ingredients cater to this growing preference, expanding nutrition bars market opportunities. Manufacturers are introducing innovative products with functional benefits, such as protein-rich, low-sugar, gluten-free, and keto-friendly bars. Additionally, flavors tailored to European tastes enhance consumer appeal.

The UK has a large and growing vegan population, fueling demand for plant-based and clean-label nutrition bars. Bars made from natural, organic ingredients without artificial additives appeal strongly to eco-conscious consumers. Manufacturers in the UK are introducing unique flavors, functional ingredients like collagen and probiotics, and tailored options such as keto-friendly and low-sugar bars, catering to diverse consumer needs and boosting nutrition bars market growth. In addition, distribution channels, including supermarkets, convenience stores, and rapidly growing e-commerce platforms, ensure widespread availability.

Emphasis on food safety and transparency in Germany encourages the production of high-quality, clean-label nutrition bars, increasing consumer trust and driving nutrition bars market growth. These bars not only help in managing weight and blood sugar levels but also promote satiety and energy, making them a preferred choice for health-conscious individuals. This has further caused the expansion of online grocery platforms and health-focused e-commerce channels making nutrition bars more accessible. Subscription models and personalized nutrition recommendations further boost consumer interest.

Key Nutrition Bars Market Players:

- General Mills Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Ajinomoto Co Inc

- Cargill Incorporated

- Mondelez International

- Glanbia Plc

- Mars, Incorporated

- HEALTHY BARS

- ADM

- Global Nutrition International

- The Simply Good Foods Company

- The Kellogg Company

Key companies are innovating the nutrition bars market by introducing functional ingredients like probiotics, collagen, and adaptogens to enhance health benefits. Innovations include plant-based protein bars, clean label formulations, and unique regional flavors. Additionally, sustainable packaging solutions and personalized nutrition options through digital platforms reflect their commitment to addressing environmental concerns and providing tailored consumer experiences. For instance, in March 2024, the first line of organic protein bars from Kate's Real Food was released. The three flavors are Peanut Butter Cup, Snickerdoodle, and Peanut Butter Brownie. Such key players include:

Recent Developments

- In September 2024, General Mills Convenience announced a new alternative for the bar set to appeal to convenience store customers searching for a keto-friendly snack. The new Ratio bars provide a pleasing crunch to a diet rich in soft textures. The bars provide 12 grams of protein, only 2 grams of net carbohydrates, and 1 gram of sugar.

- In December 2022, the brand-new performance nutrition bar, SNICKERS Hi Protein bars, was introduced by Mars. SNICKERS Hi Protein bars have the same delicious chocolate, caramel, and peanut components that have made the brand famous, giving customers the Nutritional profile, they want and the flavor they want.

- Report ID: 6799

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nutrition Bars Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.