Nuclear Fusion Market Outlook:

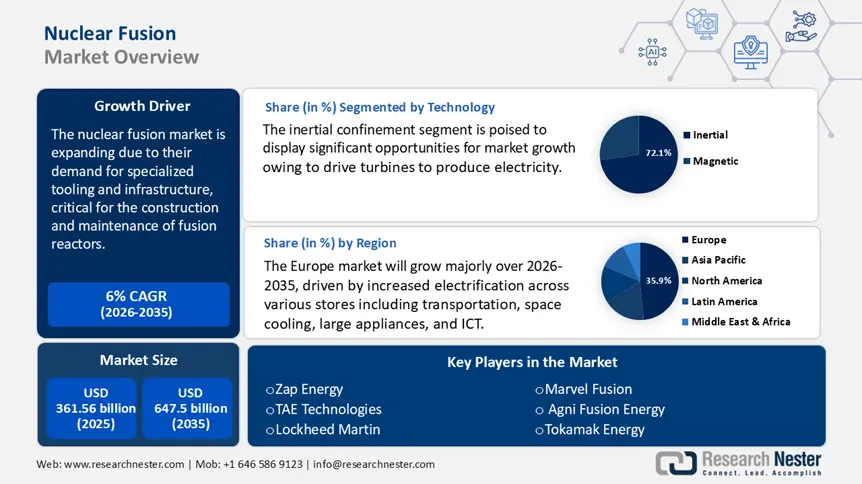

Nuclear Fusion Market size was valued at USD 361.56 billion in 2025 and is set to exceed USD 647.5 billion by 2035, registering over 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nuclear fusion is estimated at USD 381.08 billion.

The nuclear fusion market is witnessing rapid growth, driven by technological advancements, increasing private investments, and the increasing global population. However, the existing energy system is environmentally unsustainable, economically unstable, and contributes to global insecurity. To meet this rising demand, a transition to a clean, affordable, and abundant energy source is essential, requiring a breakthrough in clean energy technology.

Furthermore, landmark projects such as the International Thermonuclear Experimental Reactor (ITER) are under construction in southern France. ITER is the world’s largest tokamak, a magnetic fusion device intended to prove the viability of fusion as a large-scale and carbon-free energy source. By confining and heating plasma within a magnetic field, ITER aims to achieve a net energy gain from thermonuclear fusion, thereby paying the way for future fusion power plants. This ITER project brings together 35 nations including China, the European Union, India, Japan, Korea, Russia, and the U.S. in a collaborative effort to advance fusion science and reactor technology.

On the other hand, private initiatives such as TAE Technologies, a California-based company, have secured substantial private totaling approximately USD 1.2 billion to develop fusion technology. TAE focuses on advanced beam-driven field-reserved configuration (FRC) reactors, aiming to provide a clean, sustainable energy source. The commercialization of fusion energy will transform the global energy landscape, offering a sustainable solution to the world's growing energy needs. Conventional nuclear power plants generate energy through fission, a process in which heavy atoms such as uranium, decay and release energy. In contrast, fusion produces energy by combining light atomic nuclei such as hydrogen under extremely high temperatures and pressure.

Most fusion reactor designs focus on utilizing hydrogen isotopes, namely deuterium (D) and tritium (T), to generate plasma. Plasma is a high-energy state of matter composed of ionized atoms and charged particles. Fusion occurs more rapidly with these isotopes than with regular hydrogen, as it requires lower temperatures and densities. Unlike fission, deuterium-tritium fusion generates only short-lived neutron radiation and doesn't produce long-lived radioactive waste.

Key Nuclear Fusion Market Insights Summary:

Regional Highlights:

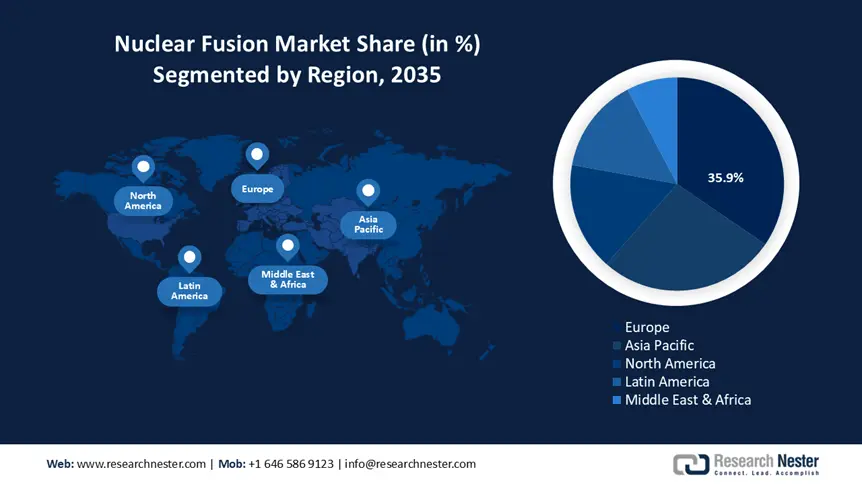

- Europe commands a 35.9% share of the Nuclear Fusion Market, fueled by Europe's leadership in nuclear research and sustainable energy investments, positioning it as a global leader through 2026–2035.

Segment Insights:

- The Inertial Confinement segment is projected to hold 72.1% market share by 2035, driven by advancements in fusion ignition technologies.

- The magnetic confinement segment is expected to capture a 27.1% share by 2035, fueled by consistent progress in magnetic confinement technology, as seen in projects like China's EAST and ITER.

Key Growth Trends:

- Increasing need for tooling in the industry

- Advancements in generation IV technology

Major Challenges:

- High cost of nuclear energy

- Technical challenges in achieving sustainable fusion

- Key Players: Zap Energy, First Light Fusion, General Fusion, TAE Technologies, Commonwealth Fusion, Tokamak Energy, Lockheed Martin, Hyperjet Fusion, Marvel Fusion, Helion, HB11, Agni Fusion Energy.

Global Nuclear Fusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 361.56 billion

- 2026 Market Size: USD 381.08 billion

- Projected Market Size: USD 647.5 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Nuclear Fusion Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing need for tooling in the industry: The nuclear fusion market is witnessing a growing demand for specialized tooling and infrastructure, critical for the construction and maintenance of fusion reactors. Manufacturing fusion reactor components presents challenges such as developing material that can endure extreme heat and neutron radiation, managing intense heat exhaust, and achieving precise engineering tolerances. This is highly driven by the intricate design and operational requirements of fusion technology, where precision-engineered tooling is essential to attain the essential conditions for sustained fusion reactions.

The development and production of specialized tools for nuclear fusion play a crucial role in enhancing material science and engineering while strengthening the industry's supply chain ecosystem. For instance, the UK Atomic Energy Authority (UKAEA) is collaborating with an industry partner to accelerate fusion power plant design using next-generation digital tools, aiming to enhance design integration and efficiency.

This improves operational efficiency and the safety of fusion plants, which drives the nuclear fusion market through increased investments and cross-industrial collaborations. For example, advancements in high-precision robotic systems for handling plasma-facing components have significantly enhanced reactor performance and longevity. Companies such as General Atomic and Tokamak Energy are at the forefront of developing such innovative solutions.

-

Advancements in generation IV technology: The sudden leap in nuclear energy offers improved safety, efficiency, and sustainability over its predecessors. These enhancements are most important to the nuclear fusion market, where the traditional reactors produce long-lived radioactive waste requiring secure storage over extended periods. Moreover, conventional reactor uses only a small fraction of energy potential in nuclear fuel, leading to inefficiencies, and ensuring reactor safety to prevent accidents has been a critical concern in nuclear energy. Addressing longstanding challenges such as waste management, fuel efficiency, and operational safety, drives the advancements in generation IV technology.

The integration of generation IV technologies into fusion reactors improves their feasibility and attractiveness, leading to increased investments in research and development and fostering nuclear fusion market expansion. For instance, the Sodium-cooled Fast Reactor (SFR) is designed to consume actinides from spent nuclear fuel, thereby minimizing long-term radioactive waste. Very High-Temperature Reactor (VHTR) employs inherent safety characteristics, such as a negative temperature coefficient, which naturally decreases the reactor’s power output if the temperature rises excessively.

China TR-PM is a small modular nuclear reactor. It is an (HTGR) High-Temperature Gas-cooler pebble-bed generation IV Reactor that started to produce power in December 2021 and entered commercial operation in late 2023, the world's 1st operational generation IV reactor demonstrates the potential of enhanced nuclear technologies in improving reactor safety and efficiency.

Similarly, TerraPower's development of the Natrium reactor, which combines a sodium fast reactor with a molten salt energy storage system, exemplifies the potential of generation IV advancement to revolutionize energy production. The convergence of Generation IV and enhancements and fusion technology development foster a dynamic environment for innovation, attracting interest from governments, private investors, and international collaborations committed to shaping the future of energy production.

Challenges

-

High cost of nuclear energy: The substantial cost of nuclear fusion technology remains a major obstacle to its widespread adoption and nuclear fusion market expansion. The development of fusion reactors demands significant capital investment, not only for construction but also for extensive research and development. These high costs stem from the technological complexities, the necessity for enhanced material capable of withstanding extreme conditions, and the prolonged timeline required to transition a reactor from concept to operational development.

As a result, the high financial burden places nuclear fusion at a competitive disadvantage compared to more established and cost-effective renewable energy sources. Consequently, the growth of the nuclear fusion market is constrained, as investors and governments assess the economic viability of fusion projects to alternative energy generation methods.

-

Technical challenges in achieving sustainable fusion: Achieving a controlled nuclear fusion reaction that generates more energy than it consumes remains a significant technical challenge. Maintaining the extreme temperatures and pressures required for fusion is highly complex, and current technology has yet to achieve a stable, continuous net energy gain, an essential milestone for practical and scalable energy production. This core challenge hampers the transition from experimental fusion reactors to operational systems, delaying development timelines and raising concerns about the feasibility of fusion as a reliable energy source.

Nuclear Fusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 361.56 billion |

|

Forecast Year Market Size (2035) |

USD 647.5 billion |

|

Regional Scope |

|

Nuclear Fusion Market Segmentation:

Technology (Inertial Confinement and Magnetic Confinement)

Inertial confinement segment is predicted to dominate over 72.1% nuclear fusion market share by 2035. In inertial confinement fusion, devices use intense energy sources such as lasers or ion beams, to rapidly compress small spherical pellets containing deuterium-tritium 9D-T) fuel to exceptionally high densities. This compression generates shock waves that heat the fuel, and upon reaching a critical threshold, ignition occurs, leading to fusion reactions. The National Ignition Facility (NIF) in the U.S. made notable progress in this field in August 2021, when it announced a fusion yield of 1.3 megajoules (MJ), representing a considerable advancement towards achieving ignition.

In a conceptual fusion power plant employing ICF, the process would involve the rapid and repetitive ignition of fuel pellets potentially multiple times per second. The immense heat produced from these fusion reactions would then be hardened to generate steam, which in turn would drive turbines to produce electricity. This approach aims to replicate the sun's energy production mechanism, offering the prospect of a virtually limitless and clean energy source for the future.

On the other hand, magnetic confinement contributes to a 27.1% share of the nuclear fusion market during the forecast period. The magnetic system uses an electromagnet to contain plasma confined in a toroidal (doughnut-shaped) chamber. In tokamaks, plasma is heated to a temperature exceeding 100 million degrees Celsius, as demonstrated by China. Experimental Advanced Superconducting Tokamak (EAST), which maintained such temperatures for over 1000 seconds. The heating method includes a strong electric current within the plasma and employs auxiliary systems like microwave heating. For instance, the ITER project plans to use an electron cyclotron resonance heating (ECRH) system to heat electrons in plasma using high-intensity electromagnetic radiation.

During the fusion process, plasma attains extremely high temperatures, requiring effective confinement to maintain high stability and efficiency. Magnetic fields are specifically well suited for this purpose, as charged ions and electrons naturally follow magnetic field lines, preventing energy loss. To avoid contact with reactor walls which would cause heat dissipation and energy loss, plasma is confined within a toroidal magnetic field.

For optimal confinement a poloidal field component is superimposed on the toroidal field, creating a helical magnetic structure that effectively contains and controls plasma. With its proven solution to continuous progress, inertial confinement is foremost among the potential solutions to global energy demand. The prevailing strength in the technology sector signifies the trust between public and private investors.

Fuel (Deuterium/tritium, Deuterium, Deuterium, and Helium-3, Proton Boron)

Deuterium and tritium, both heavy isotopes of hydrogen, serve as the primary fuels in nuclear fusion reactions. Deuterium, constituting approximately 0.0312% of natural hydrogen, can be efficiently extracted from seawater, making it a nearly inexhaustible resource. Tritium, on the other hand, is scarce due to its short half-life of 12.3 years. However, it can be synthesized within a fusion reactor by breeding it from lithium through reactions with neutrons produced during fusion. The deuterium and helium-3, a rare isotope on Earth, necessitate extraction from extraterrestrial sources or production through other nuclear reactions.

The research aims to utilize the proton-boron-11 fusion reaction in the future, as it does not directly produce neutrons, although some reactions may occur. Theoretically, the deuterium contained in 1 liter of water has the potential to generate the same amount of energy as the combustion of 300 liters of oil. This vast energy potential means that Earth's ocean holds sufficient deuterium reserves to sustain global energy demands for millions of years.

Our in-depth analysis of the global nuclear fusion market includes the following segments:

|

Technology |

|

|

Fuel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nuclear Fusion Market Regional Analysis:

Europe Market Statistics

By 2035, Europe nuclear fusion market is set to capture over 35.9% revenue share. It remains at the forefront of nuclear fusion research, driven by collaborative efforts such as the ITER project in France. Nuclear fusion will be the major source of energy in the second part of the century, and Europe is well positioned to lead the way if its resources are properly managed. In France and Germany, the rising electricity demand is driven by increased electrification across various stores including transportation, space cooling, large appliances, and information & communication technology (ICT).

Significant progress has been made in expanding electricity access to minimize the number of people serving without electricity below 1 billion over 11% of the global population, especially in rural areas. The European Commission released the Energy 2050 Roadmap, highlighting nuclear power as the basic component of the energy transition. This emphasizes that nuclear energy plays a crucial role in delivering low-carbon electricity while maintaining cost efficiency. Moreover, it outlines 5 scenarios to achieve an 80% reduction in greenhouse gas emissions by incorporating nuclear energy, renewables, carbon capture and storage (CCS). Across all scenarios, electricity is projected to play an increasingly dominant role, nearly doubling its share of final nuclear energy consumption. This leadership is reinforced by significant investments from the European Union, focused on achieving grid parity and sustainable energy generation.

Asia Pacific Market Analysis

Global energy demand is projected to rise significantly in the coming decades, driven by population growth and the economic expansion of developing nations such as China and India. Nuclear power plays a crucial role in meeting this demand, providing a reliable source of baseload electricity while addressing concerns about global climate change. As a low-carbon energy source, nuclear power has one of the lowest life cycles greenhouse gas emissions per unit of energy produced, comparable to renewable energy sources. Unlike fossil fuel-based power generation, nuclear produces minimal greenhouse gas emissions during its life cycle, making it a pivotal component in strategies aimed at mitigating climate change.

Key Nuclear Fusion Market Players:

- Zap Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TAE Technologies

- Commonwealth Fusion

- Helion Energy

- Lockheed Martin

- Hyperjet Fusion

- Marvel Fusion

- Type One Energy

- HB11

- Agni Fusion Energy

Leading players are leveraging innovative approaches in compact fusion reactors and enhanced magnetic confinement technologies to maintain the feasibility and scalability of fusion power. Attracting substantial public and private investors. Their expertise and infrastructure position them at the forefront of advancing fusion energy toward practical implementation.

Recent Developments

- In February 2025, Pine Island New Energy Partners (PINEP), a private equity firm, and Type One Energy, the market's top stellarator fusion company, announced a strategic partnership to speed the development of a more robust supply chain for the fusion energy industry. As the worldwide fusion sector rapidly approaches commercialization, the need to optimize and scale the supply of specialized components and advanced manufacturing skills becomes more pressing than ever.

- In June 2024, Helion Energy actively engaged in the pursuit of harnessing fusion power to contribute to a sustainable energy future in Washington and beyond. The organization is developing one of the world's inaugural fusion power plants. Currently, Helion Energy collaborates with notable clients, including Microsoft and Nucor, as it transitions fusion technology from theoretical concepts to practical applications.

- Report ID: 7377

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nuclear Fusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.