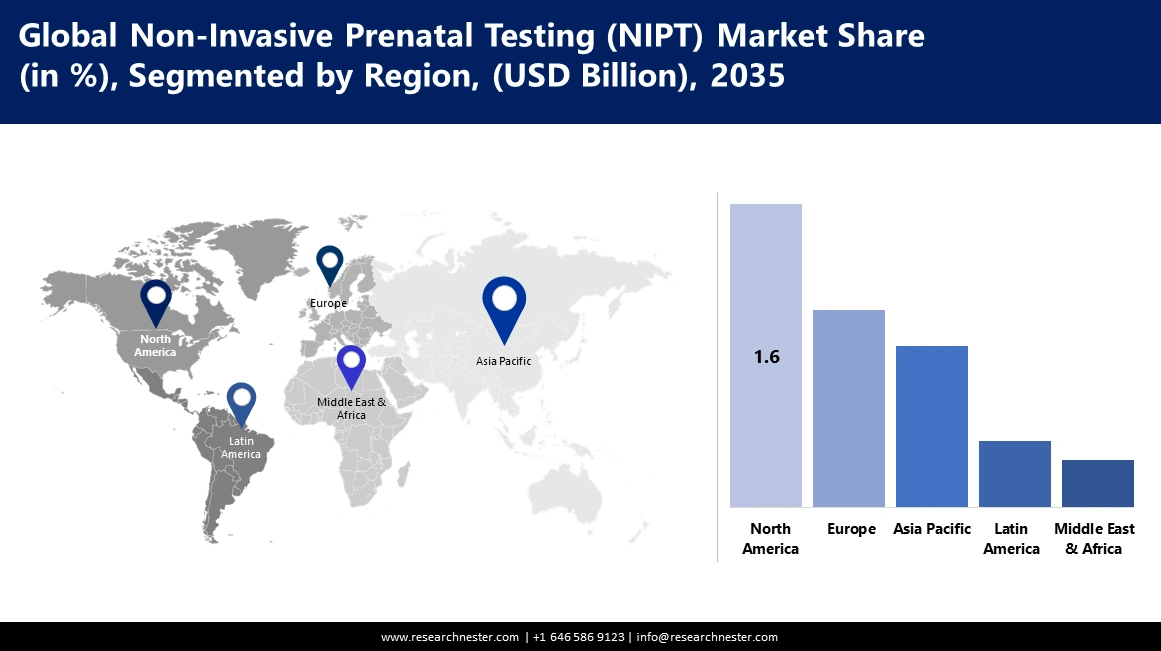

Non Invasive Prenatal Testing Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 37.3% by 2035.The reasons behind this growth are superior, more developed healthcare infrastructure, better awareness about advanced techniques in medications, and good reimbursement policies. Moreover, increasing maternal age, better acceptance of prenatal screening methods, and continuous technological innovations will boost the market expansion.

The United States non invasive prenatal testing market is anticipated to grow at substantial CAGR till 2035. Market growth is further fueled by guidelines from organizations such as the American College of Obstetricians and Gynecologists, which recommended NIPT for all pregnancies in 2023—expanding its base of users for NIPT services. Better insurance coverage also drives higher accessibility: the report indicates over 70% of private insurance plans now cover NIPT, up from 55% in 2021. There is an increase in competition and innovations in the market, with companies designing AI-driven NIPT platforms in 2024 that give higher accuracy and faster results.

The NIPT market in Canada is set to register healthy growth during the forecast period, driven by integration within provincial healthcare systems. The market also trends toward localized testing, reducing reliance on U.S. labs. To fill the demand gap, companies are expanding their roots to Canada via mergers and acquisitions.

For example, in July 2024, Quest Diagnostics announced a definitive agreement to acquire LifeLabs, a trusted provider of community laboratory tests for millions of Canadians. The acquisition is valued at approximately CAD 1.35 billion, including net debt. This development not only enhances accessibility to NIPT testing but also supports the development of local expertise and infrastructure for advanced prenatal diagnostics in Canada.

APAC Market Insights

Asia Pacific non invasive prenatal testing market size is poised to grow significantly through 2035. This expansion is driven by the increasing maternal age across the region, leading to a higher incidence of chromosomal aneuploidies in infants.

Furthermore, improved and developed healthcare infrastructure also acts as a driver to access such advanced prenatal screening techniques for Asia Pacific. A key development that supports this trend is the increasing collaboration among regional and global players in the NIPT space. For instance, in October 2023, BGI Genomics partnered with one of the major healthcare providers in Singapore to establish a NIPT laboratory, further fanning growth demand in Southeast Asia.

China offers the highest market potential, driven by its large population and rapidly improving healthcare sector. The cultural emphasis on prenatal care, coupled with investment that it is funneling into biotechnology, creates fertile ground for the NIPT market to grow.

India’s non-invasive prenatal testing (NIPT) industry is driven by various social, economic, and technological factors. With the increase in DISC (Double Income, Single Child) families in urban areas, people have increased investments in prenatal care. This is likely to boost the adoption of advanced screening methods like NIPT, calling investments from companies.

For instance, in August 2022, Bengaluru-based genetic diagnostics company MedGenome raised USD 50 million for a minority stake led by Novo Holdings. This followed a round led by LeapFrog Investments and Sofina. Further, the market is being further witnessing a rise in adoption of vitro fertilization techniques, thereby fueling the demand for comprehensive prenatal testing.