Non-Injectable Insulin Market Outlook:

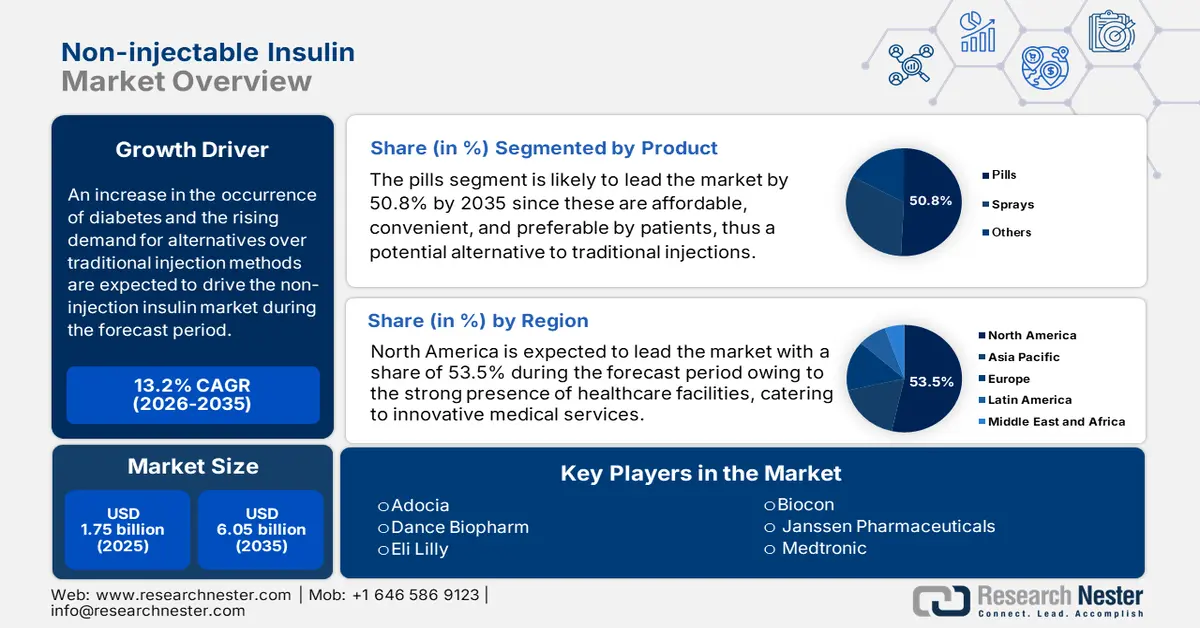

Non-Injectable Insulin Market size was valued at USD 1.75 billion in 2025 and is set to exceed USD 6.05 billion by 2035, expanding at over 13.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-injectable insulin is estimated at USD 1.96 billion.

The market ensures varied strategies such as oral insulin, inhalable insulin, and transdermal patches, with the objective of offering patients more convenient and less discomforting choices. For instance, DPP-4 inhibitors block the action of an enzyme by destroying glucagon-like peptide-1 and gastric inhibitory polypeptide which are naturally occurring hormones that help the body yield more insulin, as stated in the September MyWay Digital Health Organization. Alogliptin, linagliptin, sitagliptin, saxagliptin, and the combination of vildagliptin and metformin are a few drugs for this catergory, thus positively bolstering the market upliftment.

The role of organizations toward the provision of insulin at an affordable is not only a driving factor for the escalation of the non-injectable insulin market, but a smart strategy to attract more consumers. In this regard, in March 2023, Eli Lilly and Company reported a reduction in payer’s pricing of its exclusive and prescribed insulins by 70%. Additionally, the organization also notified the expansion of its Insulin Value Program that covers patient out-of-pocket costs at USD 35 or less every month. The purpose was to ensure easy access to Lilly insulin and assist patients in directing an intricate healthcare system, allowing them to purchase affordable insulin.

Lilly’s Reduced Payer’s Price of Insulin

|

Insulin Type |

Reduced Cost |

|

Insulin Lispro Injection 100 units/mL |

USD 25 a vial |

|

Rezvoglar and Lantus |

USD 92 per five pack |

Source: Eli Lilly and Company March 2023

Key Non-Injectable Insulin Market Insights Summary:

Regional Highlights:

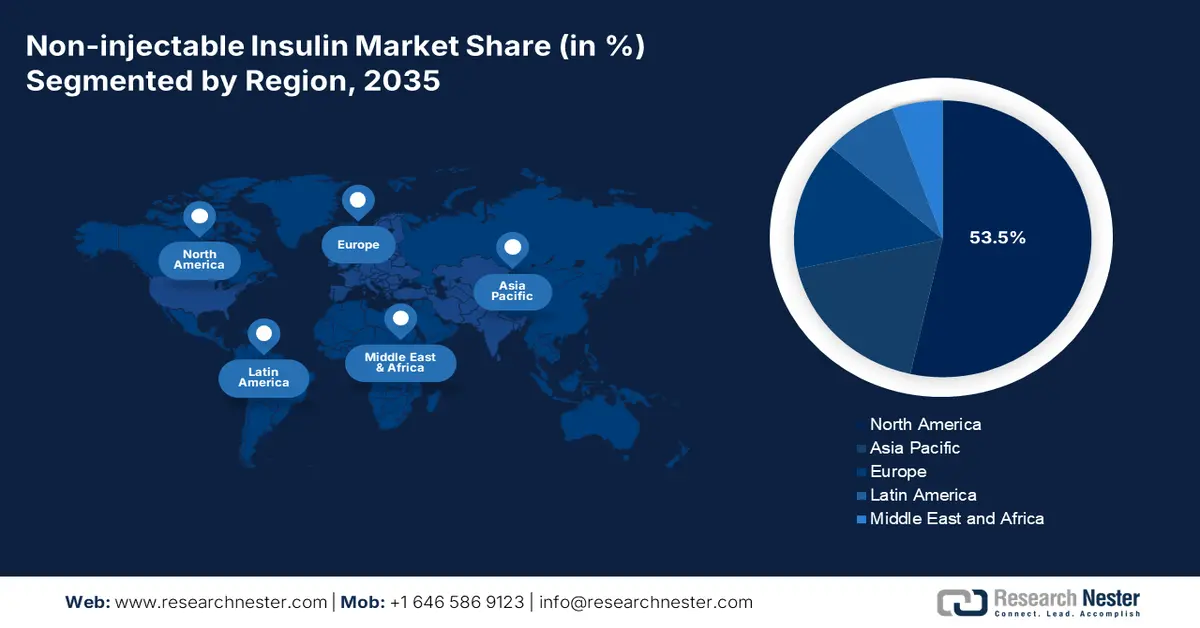

- North America dominates the Non-Injectable Insulin Market with a 53.5% share, driven by the consciousness of patients to adapt to notable non-injectable insulin alternatives, enhancing growth through 2035.

- Asia Pacific's non-injectable insulin market is projected for significant CAGR through 2026–2035, driven by rapid urbanization and expansion of medical infrastructures.

Segment Insights:

- The Pills segment of the Non-Injectable Insulin Market is anticipated to achieve a 50.8% share by 2035, propelled by easy administration and patient adherence.

- The hospital pharmacies segment of the Non-Injectable Insulin Market is forecasted to grow at a considerable rate from 2026-2035, propelled by consistent supply chain availability and the pivotal role of clinical pharmacists in diabetes monitoring.

Key Growth Trends:

- Technology advancement for drugs

- Demand for non-injectable alternatives

Major Challenges:

- Resistance of patients

- Poor regulation establishment

- Key Players: Adocia, Bigfoot Biomedical, Biocon, Dance Biopharm.

Global Non-Injectable Insulin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.75 billion

- 2026 Market Size: USD 1.96 billion

- Projected Market Size: USD 6.05 billion by 2035

- Growth Forecasts: 13.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, China, UK

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 13 August, 2025

Non-Injectable Insulin Market Growth Drivers and Challenges:

Growth Drivers

- Technology advancement for drugs: The provision of non-surgical options including pulmonary, transdermal, nasal, and buccal delivery are advanced forms of insulin intake without the need for injection, which is highly bolstering the non-injectable insulin market. For instance, the Department of Science & Technology in its March 2024 report initiated the development of a pancreas-mimicking system for approachable insulin delivery in diabetes treatment. This advanced approach provides an effective and receptive method for insulin release, addressing the challenges faced by individuals with both type 1 and advanced stage type 2 diabetes.

- Demand for non-injectable alternatives: The implementation of a non-invasive drug delivery system is an essential growth factor for the non-injectable insulin market. As per the 2021 NLM report, it ensures painless drug management methods including drug delivery across the biological barriers of the mucosal surfaces or the skin. Additionally, it also diminishes needle-based complications and reduces huge healthcare expenses related to drug administration by healthcare professionals, thus an optimistic approach towards market upliftment.

Challenges

- Resistance of patients: Few patients are reluctant to shift away from newly introduced practices of insulin intake which poses a challenge for the non-injectable insulin market to flourish. The aspect of reliability and usefulness of non-injectable insulin approaches, and being apprehensive regarding the level of blood sugar control as conventional injections are a few factors due to which patients display hindrance towards the adoption of the new approach. Also, over time patients are accustomed to the traditional use of insulin injections, comprising sentimental and psychological attachment, resulting in a limit to market expansion.

- Poor regulation establishment: Low accessibility of insulin to poor and developing nations is a huge restraint for the non-injectable insulin market to expand and grow. As per the October 2022 CIDRAP report by the University of Minnesota, diabetic patients in low- and middle-income nations lack access to the insulin they require to manage their condition, with only 27% of 108 poor countries recording all the insulins classified as vital medicines by the World Health Organization (WHO)—and 22% registering none. Hence, this gap in insulin provision is a result of inadequate regulatory strategies, hindering the market upliftment.

Non-Injectable Insulin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.2% |

|

Base Year Market Size (2025) |

USD 1.75 billion |

|

Forecast Year Market Size (2035) |

USD 6.05 billion |

|

Regional Scope |

|

Non-Injectable Insulin Market Segmentation:

Product (Pills, Sprays)

Pills segment is likely to account for non-injectable insulin market share of around 50.8% by 2035. Factors such as easy administration, patient adherence, effectiveness and reliability, and less invasive are driving the segment's growth. In February 2025, Oramed Pharmaceuticals Inc. announced its agreement to distribute its Protein Oral Delivery technology into a fresh formed joint venture, OraTech Pharmaceuticals Inc. with Hefei Tianhui Biotech Co., Ltd. This will hasten the development and commercialization of Oramed’s ORMD-0801 oral insulin and other POD-based innovative oral drug delivery technologies, thus driving the overall market upliftment.

Distribution Channel (Hospital Pharmacies, Online Pharmacies, Drug Stores)

The hospital pharmacies segment is emerging as one of the most prominent segments in the non-injectable insulin market at a considerable rate. Factors including care services, product evaluation, influential patient choice, and consistent availability of the supply chain are positively impacting the growth of the segment. As per a clinical study conducted on 450 patients by Diabetes Epidemiology and Management in March 2025, there was a reduction in the HbA1c levels from 9.95% to 9.05% under the observation of pharmacists and a decrease in the level from 10.2% to 8.5% without any observations. Thereby, a clinical pharmacist plays a pivotal role in monitoring patients with diabetes, thus a positive impact on the market.

Our in-depth analysis of the global non-injectable insulin market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-Injectable Insulin Market Regional Analysis:

North America Market Analysis

By 2035, North America non-injectable insulin market is set to dominate over 53.5% revenue share, characterized by the consciousness of patients to adapt to notable non-injectable insulin alternatives. As per the 2025 American Diabetes Association Organization report, metformin, dipeptidyl peptidase 4 inhibitors, glucagon-like peptide 1 and dual GLP-1/gastric inhibitory peptide receptor agonists, sodium-glucose cotransporter 2 inhibitors, sulfonylureas, and thiazolidinediones (TZDs) are non-insulin medications for patients with type 2 diabetes. Besides, alpha-glucosidase inhibitors, bile acid sequestrants, dopamine-2 agonists, and meglitinides are other medications that positively impact the market.

The most significant growth driver in the U.S. non-injectable insulin market is the availability of oral and non-insulin pharmacological agents. According to a clinical study conducted by NLM in September 2024, a recent model-based meta-analysis was done on 121,914 patients to evaluate the A1c levels for various hypoglycemic drugs. These types of drugs generally fall into the category of receptor-based agonist drugs comprising an overall magnitude of efficacy. For instance, the A1c level for DPP-4 inhibitors is 0.66%, SGLT2 inhibitors is 0.83%, and GLP-1 receptor agonists is 1.24%. Therefore, the availability of all these drugs as non-injectable insulins is highly amplifying the market in the country.

A1c Efficacy for Other Hypoglycemic Drugs

|

Drug Types |

A1c % |

|

Alogliptin 25mg |

0.66% |

|

Canagliflozin 100mg |

0.84% |

|

Glipizide 5-20mg |

0.86% |

|

Pioglitazone 15mg |

0.62% |

|

Rosiglitazone 4mg |

0.67% |

|

Saxagliptin 2.5mg |

0.59% |

|

Liraglutide 1.2mg |

1.13% |

Source: NLM September 2024

In Canada, the growth in the non-injectable insulin market is increasing rapidly due to the production of antidiabetic drugs. As per the July 2023, Government of Canada report, there has been an expansion in the spending of such drugs in the country from 4.2% to 7.9% in 2021. This has reflected a new change in diabetes treatment creating a surge in the cost per capita from USD 26 to USD 71. In addition, the sale of these drugs in Canada constituted 71% of the new-generation/non-insulin subclasses. Antidiabetic drugs are usually highly priced in the country with an overall additional spending of USD 703 million, thus an optimistic opportunity for the market to expand.

APAC Market Statistics

The Asia Pacific non-injectable insulin market is expanding at a rapid pace owing to rapid urbanization and expansion of medical infrastructures, ultimately resulting in innovative diabetes management solutions. As per the February 2025 NLM report, the western Pacific region accounted for 38% of global cases of diabetes. This is expected to increase to 152 million by 2045, especially in the Southeast Asian region. However, to combat this, the implementation of digital health technologies ensures personalized care, streamlined self-management tools, and patient engagement, thus positively driving market growth in the region.

In India, the non-injectable insulin market is stimulated by key players’ contributions to providing inhaled insulin. For instance, in December 2024, Cipla Limited stated the regulatory approval of Afrezza’s, an inhalation powder, marketing and distribution by the Central Drugs Standard Control Organisation (CDSCO) in India. It will improve glycemic control in adult patients and provide a patient-centered solution to diabetes management in India. Besides, it is a rapid-acting insulin distributed through an inhaler as compared to current insulins which are given as injections, thus a positive growth for the market.

In China, the non-injectable insulin market is witnessing substantial growth due to the presence of a needle-free insulin injector and a conventional insulin pen. As per a study conducted on 427 regional patients by EClinicalMedicine in June 2020, there was a reduction in the HbA1c by 0.55% for patients who implemented the needle-free insulin injector. On the other hand, the HbA1c reduction was 0.26% in the case of the conventional insulin pen. Therefore, the adoption of both these devices ensures a smooth process of insulin therapy by lowering the non-inferior glycemic effect and enhancing patient satisfaction.

Key Non-Injectable Insulin Market Players:

- Adocia

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bigfoot Biomedical

- Biocon

- Cipla Limited

- Dance Biopharm

- Eli Lilly

- Janssen Pharmaceuticals

- Medtronic

- Novo Nordisk

- Oramed Pharmaceuticals

- Sanofi

- Senseonics

- Verily Life Sciences (formerly known as Google Life Sciences)

- Zafgen

- Bristol Myers Squibb

The companies’ landscape in the non-injectable insulin market is rapidly changing due to the launch of the latest products along with approval for their commercialization and availability, especially to patients suffering from diabetes. For instance, in April 2023, Insulet Corporation notified the approval of Omnipod GO, an insulin delivery device cleared for use for people with type 2 diabetes and more than 18 years of age who would typically undertake regular injections of long-acting insulin. It has been effectively designed to serve over 3 billion people utilizing basal insulin or transitioning to insulin therapy to treat the chronic disease.

Here's the list of some key players:

Recent Developments

- In December 2024, Bristol Myers Squibb declared the approval of Opdivo Qvantig injection by the U.S. FDA for subcutaneous utilization, a combined product of nivolumab co-formulated with recombinant human hyaluronidase (rHuPH20), especially for adults.

- In May 2022, Eli Lilly and Company's Mounjaro, once-weekly GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist, was authorized by the U.S. FDA as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes.

- Report ID: 7230

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-Injectable Insulin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.