Global Non-Alcoholic Steatohepatitis (NASH) Therapeutics and Diagnostics Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- AstraZeneca PLC

- Eli Lilly & Company

- Galmed Pharmaceuticals Ltd.

- GENFIT S.A.

- Novo Nordisk A/S

- Novartis AG

- PFIZER INC.

- Siemens Healthineers AG

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- Zydus Lifesciences Limited

- SWOT Analysis

- Comparative Analysis Of The Current Technologies

- Company Share in The Market

- Analysis of Strategic Initiatives Adopted by Key Players

- Drug Type Analysis

- Growth Forecast of Non-Alcoholic Steatohepatitis (NASH) Therapeutics and Diagnostics Market

- Patent Analysis

- Recent Developments

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Drug Type, Value (USD Million)

- Regional Synopsis (USD Million), 2024-2035

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Global Overview

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Drug Type, Value (USD Million)

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Drug Type, Value (USD Million)

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Country Level Analysis, Value (USD Million)

- China

- Japan

- India

- Australia

- South Korea

- Vietnam

- Thailand

- Singapore

- Malaysia

- Rest of Asia Pacific

- Drug Type, Value (USD Million)

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Drug Type, Value (USD Million)

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Segmentation (USD Million), 2024-2035, By

- Drug Type, Value (USD Million)

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Others

- End user, Value (USD Million)

- Hospital Pharmacies

- Retail and Specialty Pharmacies

- Others

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Drug Type, Value (USD Million)

- Cross Analysis of Drug Type W.R.T. End user (USD Million), 2024-2035

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

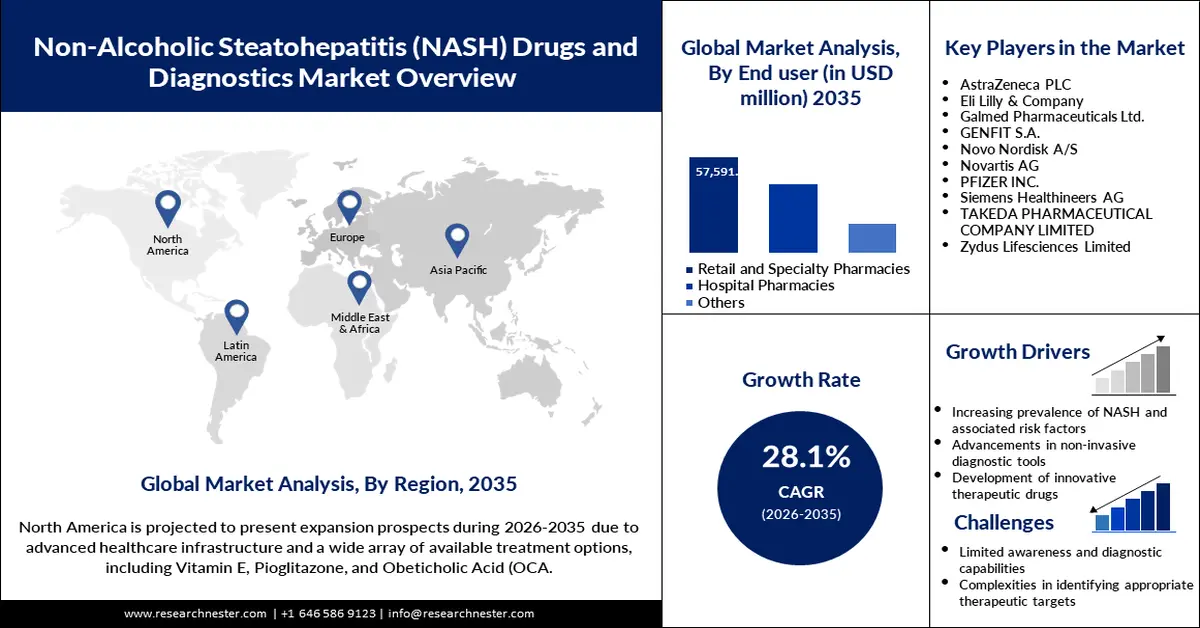

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Outlook:

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market size was valued at USD 24.04 billion in 2025 and is set to exceed USD 138.05 billion by 2035, expanding at over 19.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of non-alcoholic steatohepatitis therapeutics and diagnostics is evaluated at USD 28.17 billion.

The continuous increase in the number of patients with obesity and metabolic syndrome is stimulating the demand for NASH therapeutics and diagnostics. As the need for good treatment increases, diagnostics and therapeutic technologies are witnessing expansion including non-invasive diagnostic methods and tailored treatments. As demand for effective therapies grows, advancements in diagnostics and therapeutics are accelerating, particularly in non-invasive diagnostic tools and targeted therapies. For example, Madrigal Pharmaceuticals' Rezdiffra (resmetirom) received FDA approval in March 2024 for treating non-cirrhotic NASH. This reflects how governments worldwide are promoting and enhancing healthcare infrastructure to support early detection and management of liver diseases, further driving non-alcoholic steatohepatitis (NASH) therapeutics and diagnostics market growth.

Furthermore, precision medicine using AI-driven diagnostics is making treatments for NASH personalized and effective. This transformation is further accelerated by strategic partnerships such as Novo Nordisk and Echosens in June 2022 to address the underdiagnosis of NASH. Their collaboration focuses on non-invasive diagnostic tools with the aim of doubling diagnosis rates by 2025. This approach not only attains early detection but also creates lucrative non-alcoholic steatohepatitis therapeutics and diagnostics market opportunities. Such efforts underscore the industry's commitment to improving patient outcomes through innovation.

Key Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Insights Summary:

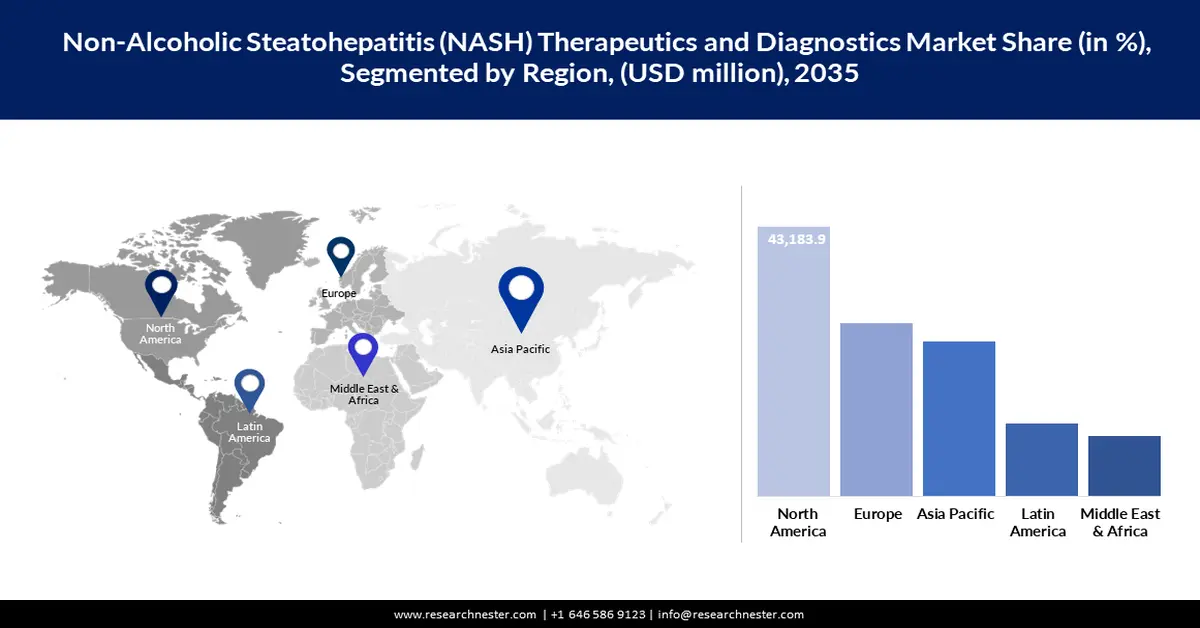

Regional Highlights:

- North America leads the Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market with a 36.8% share, propelled by advanced healthcare infrastructure, obesity and diabetes prevalence, and R&D investments, ensuring strong growth through 2026–2035.

- The Asia Pacific region is projected to achieve a significant CAGR in the Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market from 2026 to 2035, driven by better healthcare access, awareness, and screening programs.

Segment Insights:

- The Vitamin E and Pioglitazone segment is anticipated to achieve a notable share by 2035, driven by their efficacy in alleviating NASH symptoms and reducing liver fibrosis.

- The Retail and Specialty Pharmacies segment is poised for substantial growth from 2026-2035, fueled by expanding access to advanced therapeutics and tailored patient support.

Key Growth Trends:

- Increase in the prevalence of obesity and metabolic disorders

- Improvement in diagnostics and non-invasive technologies

Major Challenges:

- Limited awareness and underdiagnosis

- Regulatory and clinical challenges

Key Players: AstraZeneca PLC, Eli Lilly & Company, Galmed Pharmaceuticals Ltd., Pfizer Inc., Genfit SA, Novo Nordisk A/S, Takeda Pharmaceutical Company Ltd., and Arcturus Therapeutics Inc.

Global Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.04 billion

- 2026 Market Size: USD 28.17 billion

- Projected Market Size: USD 138.05 billion by 2035

- Growth Forecasts: 19.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in the prevalence of obesity and metabolic disorders: Unhealthy eating and sedentary living contribute to the rise in obesity and metabolic disorders that are increasing the cases of NASH. Furthermore, obesity and metabolic syndrome remain central among all the risk factors of fatty liver diseases, so there is an urgent need to enhance diagnostic and therapeutic solutions. Advanced tools are increasingly critical to better manage and monitor the conditions. In November 2023, Echosens received FDA clearance for a device known as FibroScan, a non-invasive test that measures stiffness and fat content in the liver. This technology enhances both early diagnosis and ongoing monitoring of patients with NASH, providing a safer alternative compared to the traditional approaches.

-

Improvement in diagnostics and non-invasive technologies: Non-alcoholic steatohepatitis (NASH) therapeutics and diagnostics market for better safety and convenience for patients. These innovations reduce the need for invasive procedures such as biopsies, making early detection more accessible. For example, in October 2023, Siemens Healthineers launched the Enhanced Liver Fibrosis (ELF) test. The diagnostic tool gives important insights into liver fibrosis that help in the better management of the disease. Such a development underlines the industry's commitment to enhancement in diagnostics by addressing comfort for the patient and efficiency of care.

-

Increased R&D investments in targeted therapies: Several pharmaceutical companies are accelerating efforts to develop targeted therapies for the treatment of NASH to respond appropriately to the increasing demand. This is also enabling newer approaches in patient care through substantial research and development investments. In January 2024, 89bio initiated a Phase III clinical trial with their promising drug candidate, specifically for the treatment of NASH. Such a strategic step in the competitive environment would help to realize patient-oriented solutions. Such focus on R&D will lead toward advancements that provide more accessible therapeutic options in the non-alcoholic steatohepatitis therapeutics and diagnostics market.

Challenges

-

Limited awareness and underdiagnosis: Despite its increasing prevalence, non-alcoholic steatohepatitis (NASH) remains significantly underdiagnosed, largely due to limited awareness among patients and healthcare providers. Many individuals with NASH remain asymptomatic until the disease progresses, delaying timely intervention. Additionally, the lack of standardized diagnostic tools contributes to the underdiagnosis, as invasive liver biopsies remain the primary method for confirmation.

-

Regulatory and clinical challenges: The development of effective therapies for NASH has various challenges due to complex regulatory pathways and the essentials of trials. Drug approval requires sound clinical data on safety and efficacy, which can only be achieved by large-volume, long-term studies. From the disease perspective, heterogeneity in NASH further makes it difficult to design a clinical trial because the different patient populations need to be considered and, in addition, at diverse stages of the disease. Another important barrier to developers is regulatory investigations into the side effects a given drug may have.

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.1% |

|

Base Year Market Size (2025) |

USD 24.04 billion |

|

Forecast Year Market Size (2035) |

USD 138.05 billion |

|

Regional Scope |

|

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Segmentation:

Drug Type (Vitamin E and Pioglitazone, Obeticholic Acid (OCA), Lanifibranor, Semaglutide, Resmetirom, Aramchol, Cenicriviroc, Others)

Vitamin E and Pioglitazone segment is anticipated to account for more than 28.7% non-alcoholic steatohepatitis therapeutics and diagnostics market share by the end of 2035. This growth is attributed to their established efficacy in symptomatic alleviation of NASH and liver fibrosis reduction. Both therapies are considered cost-effective for their established clinical outcomes, which is boosting their adoption among healthcare providers. In May 2022, Pfizer Inc. announced that the FDA granted Fast Track designation to its investigational combination therapy for NASH with liver fibrosis, ervogastat (DGAT2 inhibitor) and clesacostat (ACC inhibitor). Such developments play a significant role in driving the demand for this drug type to fulfill unmet needs in the management of NASH.

End user (Hospital Pharmacies, Retail and Specialty Pharmacies, Others)

By 2035, retail and specialty pharmacies segment is projected to hold more than 49.2% non-alcoholic steatohepatitis therapeutics and diagnostics market share, driven by expanding access to advanced therapeutics. For such pharmacies, increasing access to innovative treatments has underlined their growing importance in the healthcare ecosystem. For example, the launch of Rezdiffra by Madrigal Pharmaceuticals in March 2024 further marked the retail and specialty pharmacies segment as a key player in delivering innovative therapies to patients. The specialty pharmacy is anticipated to garner rapid sales revenue as it provides tailored support and timely delivery for complex medications. Furthermore, their strategic positioning increases patient adherence to therapies and optimizes overall patient outcomes, which in turn drives the growth of the overall market.

Our in-depth analysis of the global non-alcoholic steatohepatitis therapeutics and diagnostics market includes the following segments:

|

Drug Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Regional Analysis:

North America Market Analysis

North America non-alcoholic steatohepatitis therapeutics and diagnostics market is set to hold revenue share of over 36.8% by the end of 2035. The dominance of the region is attributed to the advanced healthcare infrastructure, a high prevalence rate of obesity and diabetes, and significant R&D investments by pharmaceutical companies. The U.S. and Canada are two leading markets in North America. Strong research institutions and supporting regulatory environments enhance the market potential of this region.

The U.S. is leading the non-alcoholic steatohepatitis therapeutics and diagnostics market due to the high prevalence of obesity and type 2 diabetes, which are two major risk factors for NAFLD/NASH. In addition, other ongoing drug development advances, such as the emergence of combination therapies, are being made to take care of unmet medical needs for a growing patient population. In March 2024, Max Biopharma and Metaba announced a collaboration on metabolomics studies to explore novel biomarkers and therapeutic targets for metabolic diseases, including NASH. Such partnerships aim to enhance the understanding of disease mechanisms and support the development of targeted treatments.

The non-alcoholic steatohepatitis therapeutics and diagnostics market in Canada is also steadily growing, along with increased awareness and investments in healthcare infrastructure. An increasing trend toward the integration of lifestyle management programs with pharmaceutical interventions reflects a holistic approach to addressing NASH. Government activities aimed at liver health and diseases associated with obesity also create a favorable climate for trying new methods of treatment. Furthermore, new diagnostic technologies are being presented to the market that are likely to enable better identification of patients and improve outcomes of treatment.

Asia Pacific Market Statistics

Asia Pacific non-alcoholic steatohepatitis (NASH) therapeutics and diagnostics market is projected to expand at a steady compound annual growth rate over the forecast period, due to better access to healthcare, rising awareness, and proactively conducted screening programs. This growth is further supported by government programs regarding liver health and addressing non-communicable diseases. The large population base of the region and the growing burden of lifestyle-related diseases underpin its significant growth potential in the market.

India is anticipated to record considerable growth in the non-alcoholic steatohepatitis therapeutics and diagnostics market due to growing obesity, diabetes, and sedentary lifestyles among the population. Moreover, the increasing pharmaceutical industry in India facilitates cost-effective production with the distribution of therapeutics at economical rates, hence making treatments more accessible. For example, in July 2022, SRL Diagnostics launched the Fatty Liver Index test in India, which is a big leap toward early identification and management of liver disorders. Such innovations, along with rising efforts taken by the government to take control of metabolic disorders, are projected to drive market expansion.

The non-alcoholic steatohepatitis therapeutics and diagnostics market is expanding at a rapid pace in China due to increasing rates of obesity and diabetes in the country. The government's focus on improving access to healthcare and addressing chronic diseases should fuel further adoption of innovative therapies. Furthermore, partnerships among domestic pharmaceutical firms and international players promote drug development and NASH therapeutics and diagnostics market access. With significant investments in non-invasive diagnostic technologies, China is working to overcome the hurdles to early detection and treatment. As the country has a large pool of patients and increasing healthcare expenditure, there are several opportunities for players to expand.

Key Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Players:

- AstraZeneca PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly & Company

- Galmed Pharmaceuticals Ltd.

- GENFIT S.A.

- Novo Nordisk A/S

- Novartis AG

- PFIZER INC.

- Siemens Healthineers AG

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- Zydus Lifesciences Limited

The presence of major players such as AstraZeneca PLC, Eli Lilly & Company, Galmed Pharmaceuticals Ltd., Pfizer Inc., Genfit SA, Novo Nordisk A/S, Takeda Pharmaceutical Company Ltd., and Arcturus Therapeutics Inc. contributes to the highly competitive nature of the non-alcoholic steatohepatitis (NASH) therapeutics and diagnostics market. These players are pushing the boundaries of innovation, making sizeable investments in research and development to study new mechanisms and treatment options. Furthermore, strategic partnerships and collaborations enable these firms to consolidate resources, tap advanced technologies, and extend services to new markets.

In May 2024, SomaLogic entered into a license agreement with OncoHost to develop precision cancer diagnostics, leveraging SomaLogic's proteomics platform. While primarily focused on oncology, the technologies developed may have applications in other diseases, including NASH, by identifying relevant protein biomarkers. This milestone underlines how clinical progress, together with supportive regulatory initiatives, has reshaped the market, urging players to stay innovative in order to expand and thrive in the competition.

Here are some leading companies in the NASH therapeutics and diagnostics market:

Recent Developments

- In October 2024, Gilead Sciences announced plans to acquire CymaBay Therapeutics for USD 4.3 billion, aiming to expand its liver disease portfolio. CymaBay's lead candidate, seladelpar, is in late-stage development for primary biliary cholangitis and has potential applications in NASH treatment.

- In April 2024, DD-Pharmatech received Fast Track Designation from the U.S. Food and Drug Administration (FDA) for DD01, its investigational treatment for non-alcoholic steatohepatitis (NASH). This designation is intended to expedite the development and review process, addressing the significant unmet medical need in NASH treatment.

- In March 2024, 89bio partnered with a Chinese contract development and manufacturing organization (CDMO) to construct an active pharmaceutical ingredient (API) facility dedicated to the commercial production of their metabolic dysfunction-associated steatohepatitis (MASH) candidate. This strategic move aims to ensure a reliable supply chain and support the anticipated global demand upon the drug's approval.

- Report ID: 6740

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-Alcoholic Steatohepatitis Therapeutics and Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.