Nitrile Gloves Market Outlook:

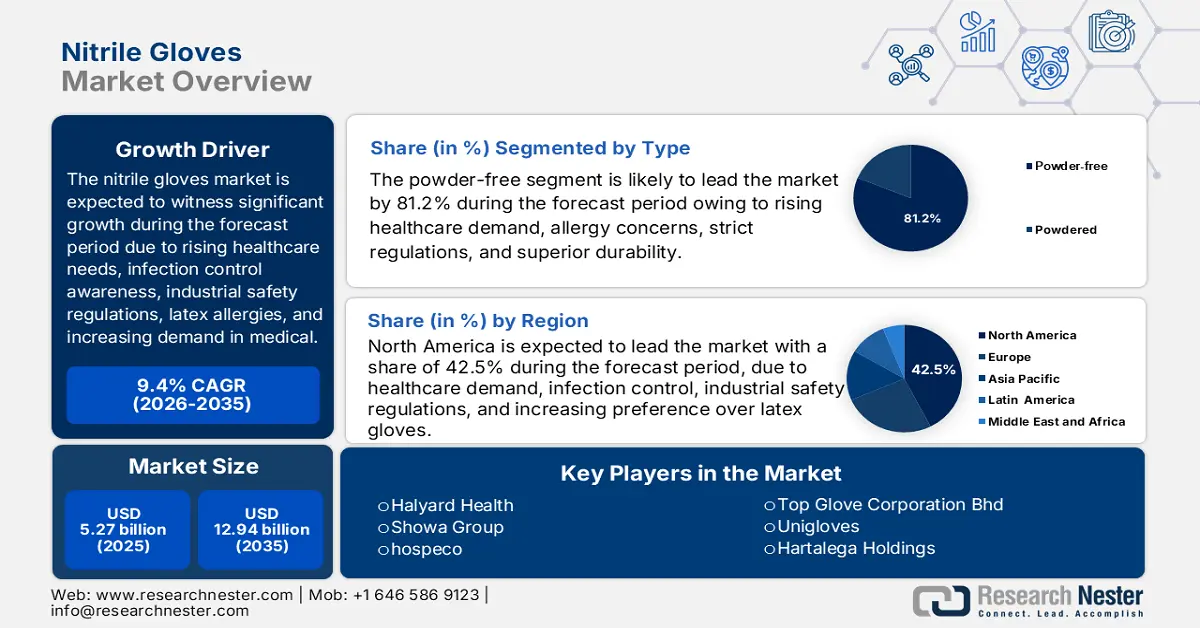

Nitrile Gloves Market size was valued at USD 5.27 billion in 2025 and is set to exceed USD 12.94 billion by 2035, expanding at over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nitrile gloves is estimated at USD 5.72 billion.

These hand coverings are essential in hospitals, clinics, and laboratories due to their superior puncture resistance, chemical protection, and latex-free composition. As the number of surgeries, diagnostic procedures, and patient examinations continues to rise, healthcare facilities increasingly need protective covering to ensure safety and hygiene. With regulatory bodies emphasizing stringent safety measures, the reliance on such handwear is driving significant nitrile gloves market expansion worldwide. For instance, in January 2024, the U.S. government planned to purchase 55,555,500 boxes of disposable, non-sterile, powder-free nitrile patient examination gloves (100 per box) for use in healthcare settings to boost the supply of domestically made personal protective equipment (PPE).

Strict infection control protocols, particularly in the post-pandemic era, have further reinforced the adoption of these gloves. Additionally, the COVID-19 pandemic significantly boosted demand for sterile hand covers across medical and non-medical sectors, reinforcing their importance in infection control. Even post-pandemic, heightened hygiene awareness and preparedness for future outbreaks continue to drive adoption. Additionally, regulatory bodies such as the FDA, OSHA, and WHO enforce strict safety guidelines, including a ban on powdered latex hand covers and mandates for protective equipment. These regulations, combined with growing health concerns, are propelling the sustained escalation of the nitrile gloves market.

Key Nitrile Gloves Market Insights Summary:

Regional Highlights:

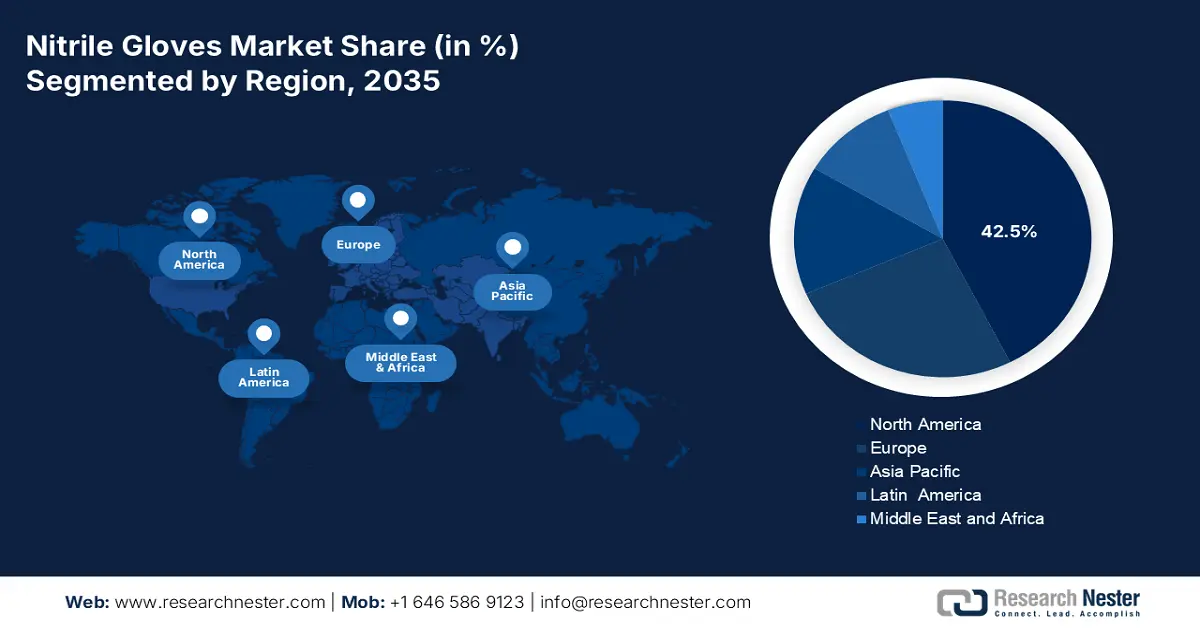

- North America dominates the Nitrile Gloves Market with a 42.50% share, driven by strong demand from the food processing, automotive, and pharmaceutical industries emphasizing hygiene and safety, ensuring growth through 2035.

- APAC’s nitrile gloves market is expected to grow rapidly by 2035, driven by rising healthcare needs, an aging population, and increased production capacity.

Segment Insights:

- The Powder-free segment is projected to capture an 81.2% share by 2035, fueled by allergy concerns and advancements in glove technology.

- The Medical & Healthcare segment of the Nitrile Gloves Market is expected to experience significant growth from 2026 to 2035, driven by increased demand and infection control requirements.

Key Growth Trends:

- Expanding food processing & handling sector

- Expanding e-commerce & online sales channels

Major Challenges:

- Fluctuating raw material prices

- Market saturation & price competition

- Key Players: Hartalega Holdings Berhad, Adenna LLC, Unigloves (UK) Limited, Top Glove Corporation Bhd.

Global Nitrile Gloves Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.27 billion

- 2026 Market Size: USD 5.72 billion

- Projected Market Size: USD 12.94 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Malaysia

Last updated on : 13 August, 2025

Nitrile Gloves Market Growth Drivers and Challenges:

Growth Drivers

- Expanding food processing & handling sector: The food industry notably relies on these protective handwear to maintain hygiene and comply with stringent food safety regulations. Their resistance to oils, fats, and contaminants ensures safe food handling, preventing cross-contamination and ensuring consumer protection. According to estimations from the CDC made in December 2024, foodborne illnesses brought on by recognized bacteria cause an estimated 9.0 million illnesses, 56,000 hospitalizations, and 1,300 fatalities annually in the U.S. With rising concerns about aspects, food processing facilities, restaurants, and catering services are increasingly adopting these gloves. This demand is propagating the nitrile gloves market.

- Expanding e-commerce & online sales channels: The rise of e-commerce platforms has significantly enhanced the accessibility of such mitts for healthcare providers, industries, and individual consumers. The global healthcare e-commerce industry was calculated to be at USD 200.0 billion in 2022, where the digital health sector is expected to exhibit a CAGR of 28.5% by 2026, as per a report from the Magneto Association. Online marketplaces enable bulk purchasing, competitive pricing, and direct-to-consumer sales, streamlining procurement for businesses and individuals. This convenience has expanded the customer base of small clinics, food service providers, and households. Thus, the increasing online availability is driving nitrile gloves market expansion.

Challenges

- Fluctuating raw material prices: The production of nitrile handwear relies on nitrile butadiene rubber (NBR), a material highly sensitive to fluctuations in crude oil prices and global supply chain disruptions. As crude oil prices rise, the cost of NBR increases, directly impacting production expenses. Additionally, supply chain issues, including transportation delays and raw material shortages, further strain manufacturers. These challenges make it difficult for companies to maintain stable profit margins while keeping prices competitive, affecting over- nitrile gloves market stability and progress.

- Market saturation & price competition: During the pandemic, the surge in demand for these hand covers attracted numerous new manufacturers, resulting in market oversupply and intense price competition. As global demand normalizes, established companies struggle to maintain profitability while facing pressure from low-cost suppliers, particularly from regions with lower labor and production expenses. This heightened competition forces manufacturers to innovate, optimize production efficiency, and explore premium or specialized glove segments to differentiate themselves and sustain long-term nitrile gloves market growth.

Nitrile Gloves Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 5.27 billion |

|

Forecast Year Market Size (2035) |

USD 12.94 billion |

|

Regional Scope |

|

Nitrile Gloves Market Segmentation:

Type (Powdered, Powder-free)

By type, the powder-free segment is estimated to dominate around 81.2% nitrile gloves market share by the end of 2035. The segment is growing due to increasing demand for safer, hypoallergenic options in healthcare, food processing, and individual applications. Increased incidences of latex allergies due to inhaling latex powder from these gloves, particularly in medical settings, are driving the adoption of alternative options. According to a DermNet report in November 2024, the estimated prevalence of latex allergy in the general population was approximately 4.3%. Furthermore, advancements in manufacturing technology have enhanced the comfort and durability of powder-free mittens while complying with global standards, making them the preferred choice for professionals.

End user (Medical & Healthcare, Automotive, Oil & Gas, Food & Beverage, Metal & Machinery, Chemical & Petrochemical, Pharmaceutical, Cleanroom, Others)

Based on end users, the medical & healthcare segment is anticipated to hold the majority of nitrile gloves market share over the forecast period. The segment’s surge is attributed to rising healthcare needs, increasing surgical procedures, and stringent infection control regulations. The COVID-19 pandemic heightened the demand for personal protective equipment, reinforcing the necessity for nitrile hand covers in hospitals and clinics. Additionally, these offer superior punctuator resistance, chemical protection, and hypoallergic properties, making them ideal for medical professionals. Government initiatives and expanding healthcare infrastructure further drive the market surge in this segment.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-user |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nitrile Gloves Market Regional Analysis:

North America Market Statistics

North America in nitrile gloves market is expected to capture over 42.5% revenue share by 2035. North America has a strong food processing and service industry that emphasizes hygiene and safety, fueling demand for nitrile gloves, known for their resistance to oils, fats, and chemicals, these gloves ensure compliance with food safety regulations. In 2021, the U.S. food and beverage manufacturing sector employed 1.7 million people (USDA, December 2024), highlighting a vast workforce needing protective gloves. Additionally, growing industries such as automotive and pharmaceuticals require durable, chemical-resistant handcovers, further creating a market surge. This increasing demand across multiple sectors significantly boosts nitrile gloves market expansion.

The U.S. forecasts a significant geriatric population, a sophisticated healthcare infrastructure, and higher disposable income levels among patients, all of which serve as strong foundations for the rise of the healthcare industry. Furthermore, the country’s position as the global leader in healthcare spending highlights its commitment to medical advancements. These factors create a promising environment for increasing product demand across the sector. Additionally, ongoing innovations and advancements in surgical practices, including the standardization of procedures, technological improvements, and the implementation of high-reliability organizing (HRO), are set to enhance hospital sector development.

The rise of online retail platforms in Canada has improved access to these sanitized hand covers for businesses and consumers, enabling bulk purchasing, competitive pricing, and direct-to-consumer sales, driving market expansion. Additionally, increasing awareness of latex allergies has led many industries in Canada to shift toward such hand covers due to their hypoallergenic properties. Their growing preference in healthcare, food handling, and industrial applications further strengthens demand, making them a crucial component of workplace safety and hygiene across the region.

APAC Market Analysis

In APAC, the nitrile gloves market is poised to garner the fastest CAGR over the forecast period. The expansion of healthcare services in the Asia Pacific, driven by rising medical needs, an aging population, and strict hygiene standards, is fueling demand for protective handwear in hospitals and clinics. Simultaneously, manufacturers are scaling up production, increasing supply, and making them more accessible and affordable. Their superior durability and protection over latex hand cover further boost adoption. This combination of rising demand and improved supply is accelerating the surge of the market in the region.

The nitrile gloves market in China is expanding as manufacturers invest in advanced production techniques, improving quality, reducing costs, and increasing supply. As one of the leading global exporters, rising international demand, especially from the U.S. and Europe, is driving large-scale production. China exported 329,682,000 kg of gloves in 2021, valued at USD 4,577,044.95 thousand, according to World Integrated Trade Solution. This not only strengthens the export sector in China but also makes such hand coveralls more affordable and accessible domestically. The combination of technological advancements and export-driven escalation is fueling the overall expansion of the nitrile gloves market.

China gloves exports by country in 2021

|

Exporter |

Destination |

Trade Value (USD) |

Quantity (Kg) |

|

China |

The U.S. |

2,067,018.4 |

142,997,000 |

|

China |

Canada |

406,462.0 |

18,933,500 |

|

China |

The UK |

305,859.6 |

20,851,500 |

|

China |

Germany |

244,377.8 |

17,255,600 |

|

China |

Japan |

172,299.7 |

9,076,320 |

The rise in food exports and stricter safety regulations in India create excellent opportunities for the protective handwear industry, particularly in food processing, catering, and packaging. The demand for products with chemical resistance and non-toxic properties is increasing. Additionally, the growing global market, especially from the U.S. and Europe, encourages Indian manufacturers to enhance production capabilities. According to the Indian Brand Equity Foundation (IBEF), the manufacturing sector contributed 16-17% to India's pre-pandemic GDP and is poised for rapid escalation, strengthening the position of India in the global nitrile gloves market and making products more affordable.

Key Nitrile Gloves Market Players:

- Ansell Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hartalega Holdings Berhad

- Adenna LLC

- Unigloves (UK) Limited

- Top Glove Corporation Bhd

- Kossan Rubber Industries Bhd

- MCR Safety

- Superior Gloves

- Ammex Corporation

- Supermax Corporation Berhad

- MAPA Professional

Key companies in the nitrile gloves market are driving innovation through advanced manufacturing techniques, improving glove durability, flexibility, and chemical resistance. They are developing eco-friendly, biodegradable hand covers to address environmental concerns. Automation and AI-driven quality control are enhancing production efficiency, reducing defects, and lowering costs. Additionally, companies are expanding production capabilities to meet global demand while introducing powder-free, hypoallergenic variants to cater to healthcare and industrial sectors, ensuring better safety and comfort. Such key players include:

Recent Developments

- In December 2024, MAPA Professional introduced the Solo 980 thick nitrile glove with enhanced durability, chemical resistance, and dexterity, expanding its presence in the growing thick disposable gloves sector and boosting nitrile glove adoption across industries.

- In September 2024, Top Glove Corporation Bhd announced the results of its assessment on conventional and biodegradable nitrile gloves, highlighting its commitment to sustainability, improving eco-friendly production, and boosting market growth through environmentally responsible innovation.

- Report ID: 7192

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nitrile Gloves Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.