Niobium Market Outlook:

Niobium Market size was over USD 3.4 billion in 2025 and is estimated to reach USD 6.5 billion by the end of 2035, expanding at a CAGR of 6.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of niobium is estimated at USD 3.6 billion.

The international niobium market is fundamentally driven by industrial applications. It is very important in medical devices like prosthetics and pacemaker components. According to the Mineral Commodities Summaries in 2024, over 90% of niobium production occurs in Brazil, followed by Canada with 8%. Further, the report also states that Brazil’s total exports reached 50,566 tons in August 2023. These main producing geographies are important as both sources of raw material and for the development of niobium technologies.

The supply chain implications for niobium products include a complex relationship of mining operations, processing facilities, and end-user industries. Niobium is derived from pyrochlore ore that is primarily extracted in Brazil by CBMM. According to the Mineral Commodities Summaries in 2024, the U.S. niobium imports for consumption were 9,110 metric tons in 2022, 10,100 metric tons in 2023, and an estimated 8,900 metric tons in 2024. The demand in the U.S. for Niobium further sources supplies from Canada and various other countries in South America.

Key Niobium Market Insights Summary:

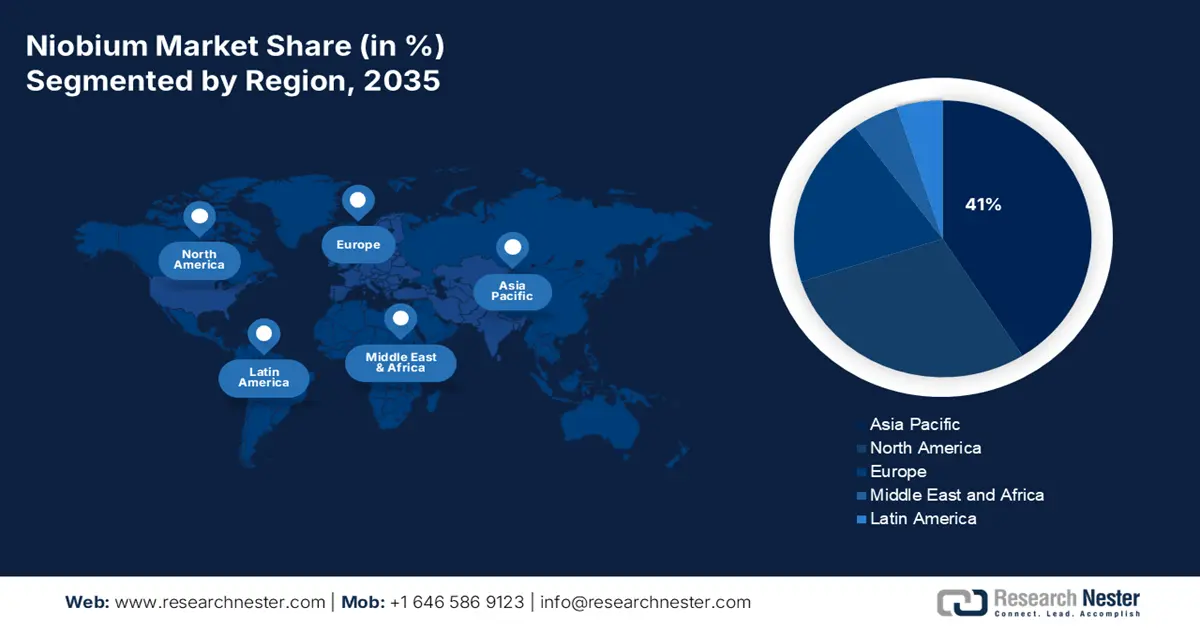

Regional Insights:

- Asia Pacific is expected to secure a 41% share in the niobium market by 2035, with demand in the Niobium Market strengthening as consumption escalates across China, Japan, and India owing to expanding orthopedic procedures and strategic stockpiling initiatives.

- North America is projected to witness notable growth through 2026–2035 as its share advances, encouraged by rising aerospace, automotive, and defense adoption supported by federal investments in high-purity niobium oxide production.

Segment Insights:

- The niobium alloys segment is projected to command a 46% share by 2035 in the Niobium Market, reinforced by escalating adoption of high-strength, lightweight materials across aerospace, automotive, and energy applications.

- The automotive segment is set to capture a substantial share by 2035, supported by the expanding need for high-strength, reduced-weight steel alloys essential for modern and electric vehicles.

Key Growth Trends:

- Growing patient pool and disease prevalence

- Government spending on healthcare and medical devices

Major Challenges:

Regulatory constraints in product approvalsKey Players: CBMM (Companhia Brasileira de Metalurgia e Mineração),CMOC (China Molybdenum Co., Ltd.),Magris Resources (Niobec Mine),Anglo American,IAMGOLD Corporation,Taseko Mines Limited,Alkane Resources Ltd.,Lynas Rare Earths Ltd.,Brazilian Rare Earths Limited,NioCorp Developments Ltd.,Tasman Metals Ltd.,Commerce Resources Corp.,Vital Metals Limited,Globe Metals & Mining,Mosaic Company,JFE Steel Corporation,Nippon Steel Corporation,Mitsubishi Corporation,Shin-Etsu Chemical Co., Ltd.,Hitachi Metals, Ltd.

Global Niobium Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 6.5 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Brazil, China, United States, Canada, Japan

- Emerging Countries: India, South Korea, Germany, United Kingdom, Mexico

Last updated on : 15 September, 2025

Niobium Market - Growth Drivers and Challenges

Growth Drivers

- Growing patient pool and disease prevalence: Niobium is used for multiple applications, including orthopedic implants, cardiovascular therapy, dental applications, and more. The NLM report released in March 2022 depicted that nearly 22 million orthopedic surgeries were performed, requiring niobium, demonstrating the growth of niobium in medical applications in prosthetics and implantable devices, as it is intended to contribute to improved patient outcomes and reduced complications. In addition to this expansion, the increasing prevalence of age-related conditions that increase bone fragility and structural integrity, such as arthritis and osteoporosis, is a further driver of the uptake of niobium implants.

- Government spending on healthcare and medical devices: Niobium is increasingly being used in medical devices, such as implants and prosthetics, because of its durability and biocompatibility. The U.S. government has actively supported the development of advanced materials with its programs. In 2023, government spending in healthcare totalled approximately USD 4.9 trillion, based on the CHCF report in 2025. The aging of the population and the rise of chronic conditions requiring advanced treatment interventions drove this spending.

- Healthcare quality improvement and cost-effective interventions: A major study by the Agency for Healthcare Research and Quality (AHRQ) in 2022 found that the application of niobium in prosthetics, for older patients, led to reduction in hospitalization. This initiative demonstrates the increased acknowledgment of niobium's ability to influence an improved health outcome and reduce health care costs over the long term. The research and results surrounding the use of niobium in healthcare documentation support a significant potential for a marked increase in the use of niobium in entry healthcare documents and rehabilitation. Governments globally have been and are obliged to make sizable investments in infrastructure, which increases the demand for niobium to manufacture steel.

U.S. Niobium Import Sources and Material Breakdown (2020-2023)

|

Category |

Main Import Sources |

Share (%) |

|

Niobium and tantalum ores & concentrates |

Australia |

59 |

|

Congo (Kinshasa) |

12 |

|

|

Mozambique |

6 |

|

|

United Arab Emirates |

5 |

|

|

Other |

18 |

|

|

Niobium oxide |

Brazil |

83 |

|

Thailand |

6 |

|

|

Estonia |

5 |

|

|

India |

3 |

|

|

Other |

3 |

|

|

Ferroniobium & niobium metal |

Brazil |

66 |

|

Canada |

29 |

|

|

Russia |

2 |

|

|

Germany |

1 |

|

|

Other |

2 |

|

|

Total imports |

Brazil |

66 |

|

Canada |

27 |

|

|

Other |

7 |

|

|

By niobium content (material type) |

Ferroniobium |

71 |

|

Niobium metal |

20 |

|

|

Niobium oxide |

8 |

|

|

Niobium ores & concentrates |

1 |

Source: Mineral Commodity Summaries 2025

Challenges

- Regulatory constraints in product approvals: National regulatory agencies have stringent guidelines for the approval of new products that can delay the time-to-market. Due to the high cost of niobium products, these products are not easily accessible to people who are in low-income regions, as government reimbursement programs have many conditions for coverage. Further, these costs and regulatory barriers restrict the widespread use of niobium-based medical devices, even though they have immense clinical benefits. Therefore, manufacturers face challenges in balancing cost and affordability to ensure innovation and product development.

Niobium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 6.5 billion |

|

Regional Scope |

|

Niobium Market Segmentation:

Product Type Segment Analysis

The niobium alloys segment is estimated to account for the largest share of 46% in the niobium market over the discussed timeframe. Niobium alloys have gained a lot of attention in aerospace, automotive, and energy applications. Niobium alloys provide an opportunity to bolster the development of new high-strength materials as these industries or the world are moving toward higher-strength, lightweight, and high-performance materials. Ferroniobium leads the subsegment and is estimated to hold 79.7% in 2035. Mineral Commodity Summaries 2024 states that the U.S. consumes ferroniobium primarily in the steel industry for about 57% of end-use and in superalloys.

Application Segment Analysis

During the evaluated period, the automotive segment will have a staggering share in the niobium market. Automotive growth will likely stem from the increasing demand for high-strength steel alloys. Niobium contributes to automotive steel by increasing the strength and reducing the weight - two critical characteristics of a modern car. Steel containing niobium will be necessary to meet the performance, safety, and energy efficiency requirements of the growing demand for electric and lightweight vehicles. Additionally, automakers are searching for more niobium-related solutions as they lower carbon emissions.

End user Segment Analysis

By 2035, aerospace will dominate the end-user niobium market. The segment is driven due to the extensive use of niobium, based on its exceptional strength-to-weight ratio and ability to operate at high temperatures. Furthermore, the manufacture of airframe structures, rocket subassemblies, and jet engine parts heavily relies on niobium-based superalloys. This demand is directly fueled by increased defense and aerospace budgets. Further, the U.S. Department of Air Force has requested USD 215.1 billion for air power procurement and research and development. A sizable amount of this money goes toward platforms that use niobium-enhanced materials.

Our in-depth analysis of the niobium market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Purity Level |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Niobium Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to account for the largest 41% share in the world niobium market by the end of 2035. The demand for niobium is mainly being propelled by nations such as China, Japan, and India. Based on the PIB report in December 2023, nearly 141 procedures were conducted regarding orthopedic diseases, and the Ayushman Bharat healthcare plan had reported 20.25 million hospital stays for orthopedic-related treatment in December 2023, immensely driving the demand for niobium. The trend in the market is shifting towards strategic stockpiling and forming alliances with secure mining facilities to diversify sources of supply and mitigate geopolitical risk.

China's niobium market has grown quickly, largely because of the country’s expansion in infrastructure and EV production. Data from the National Medical Products Administration (NMPA) shows that government spending on niobium rose over the last five years. China produced approximately 354.39 million tons of steel from January to April 2023, a 4.1% increase compared to the same period in 2022, buoying niobium demand as a key alloying element in high-strength steel, based on the GMK Center report in April 2023. Additionally, China is a major consumer of niobium in industrial applications, including the production of high-strength steel for its fast-growing automotive industry.

Ferro-niobium Import and Export Data in 2023

|

Country |

Import |

Export |

|

India |

USD 62.7 million |

USD 1.16 million |

|

China |

USD 18.1 million |

USD 1.01 billion |

|

Japan |

USD 184 million |

USD 234 K |

Source: OEC 2023

North America Market Insights

North America is poised to exhibit a notable CAGR in the global niobium market throughout the discussed period. The U.S. and Canada are dominating the region and are driven by strong demand from the aerospace, automotive, and defense sectors. Based on the Mineral Commodity Summaries 2025, the U.S. Department of Defense awarded USD 26.4 million in 2024 for establishing high-purity niobium oxide production facilities domestically, which is critical for aerospace and defense sectors. These industries depend on niobium alloys for their lightweight and strong properties. More investments in EVs and sustainable energy solutions also increase niobium usage. Moreover, federal healthcare budgets encourage the use of niobium-based treatments in medical devices.

Canada is leading the niobium market in North America and is expected to benefit from its industrial growth and government investments in health care. As per the Minerals Industry of Canada in 2021, Canada niobium reserves 9.4% of the world’s niobium reserves and is the second largest in the world after Brazil. The emphasis on innovation in alloy development used in high-tech manufacturing and green technologies will continue to create demand for niobium alloys. Furthermore, tax incentives offered to manufacturers will allow for further increases in domestic production of niobium-based products.

Europe Market Insights

From the years 2026 to 2035, the Europe niobium market is projected to achieve significant industry valuation growth due to increasing demand for more lightweight and high-performance materials in the automotive and aerospace sectors and the medical fields. These sectors are experiencing a shift into more sustainable solutions and vehicles, leading to an increase in niobium consumption. The Eurostat report in June 2025 depicts that the nation is highly dependent on imports for niobium, mainly ferro-niobium, obtaining approximately 86% of its niobium from Brazil. The EU aims to advance research and innovation in materials science, which will augment the region's consumption of niobium.

In the UK, niobium is increasingly in demand across both the aerospace and automotive industries and applications such as medical devices. Quite significantly, the UK earmarked 7% of its healthcare budget (in terms of technology and treatments) for niobium in 2023; reflecting a substantial increase from 6.2% in 2020. The niobium market growth is driven by the investment from the National Health Service (NHS) in high performance medical devices and infrastructure. Another primary factor increasing niobium is the UK government is focusing on reducing carbon emissions in the automotive industry.

Germany’s niobium market is set to grow by 2034. The OEC report in 2035 states that Germany has exported USD 13.6 million worth of niobium, tantalum, vanadium, and zirconium. With one of the biggest healthcare and automotive industries in the world, Germany heavily utilizes niobium in high-strength alloys to create lightweight vehicles. The Federal Ministry of Health (BMG) has invested significantly in the development of niobium-based products for medical uses. On the other hand, the government programs are providing subsidies to companies that are innovating in sustainable technologies.

Key Niobium Market Players:

- CBMM (Companhia Brasileira de Metalurgia e Mineração)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CMOC (China Molybdenum Co., Ltd.)

- Magris Resources (Niobec Mine)

- Anglo American

- IAMGOLD Corporation

- Taseko Mines Limited

- Alkane Resources Ltd.

- Lynas Rare Earths Ltd.

- Brazilian Rare Earths Limited

- NioCorp Developments Ltd.

- Tasman Metals Ltd.

- Commerce Resources Corp.

- Vital Metals Limited

- Globe Metals & Mining

- Mosaic Company

- JFE Steel Corporation

- Nippon Steel Corporation

- Mitsubishi Corporation

- Shin-Etsu Chemical Co., Ltd.

- Hitachi Metals, Ltd.

The niobium market is quite competitive, which significantly impacts the global supply of niobium. Companies like Anglo American and Niobec are steadily increasing their market presence by investing in sustainable practices, large-scale mining, and innovative technologies. Additionally, government policies in key markets like Brazil and China are essential in shaping how the market operates. In Japan, China, and South Korea, the steel industry and cutting-edge manufacturing technologies are the main drivers of niobium demand. Meanwhile, in India, Brazil, and Australia, the emphasis is on boosting niobium production to support automotive and infrastructure projects.

Below is the list of some prominent players operating in the global niobium market:

Recent Developments

- In November 2024, CBMM launches world’s first Niobium-based battery anode production facility in Brazil. The company’s target is to achieve 30% of the revenue by 2030 from non-steel-based products.

- In July 2024, AuKing Mining Limited announced the acquisition of 100% interest in the Myoff Creek Niobium/REE project in British Columbia, Canada. The main aim of the project is to search for sources of critical minerals in full steam

- Report ID: 3073

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Niobium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.