Night Vision Surveillance Camera Market Outlook:

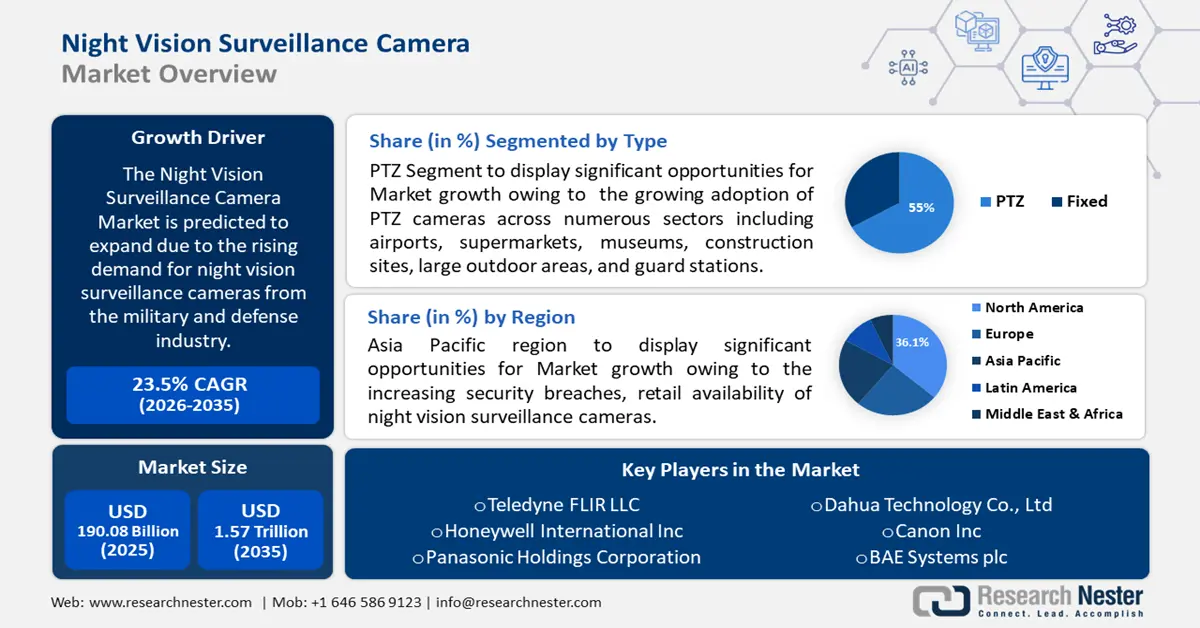

Night Vision Surveillance Camera Market size was valued at USD 190.08 billion in 2025 and is likely to cross USD 1.57 trillion by 2035, registering more than 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of night vision surveillance camera is assessed at USD 230.28 billion.

The market is estimated to grow on the back of the rising demand for night vision surveillance cameras from the military and defense industry for security & safety concerns & monitoring border areas. In addition, the military and defense sectors are adopting and spending more on night vision surveillance cameras to meet the increasing demand for night patrol and combat operations. According to World Bank data, global military expenditure in proportion to gross domestic product (GDP) stood at around 2.4% in 2020, up from 2.2% in 2019.

The global night vision surveillance cameras market is also estimated to witness growth on account of the rising trend of smart homes. According to estimates, the number of smart homes worldwide is expected to reach 345 million by 2023, up from 220 million in 2020. Moreover, this figure is expected to cross USD 460 million by the end of 2025. Additionally, the integration of near-infrared (NIR) imaging technology in night vision surveillance cameras is expected to drive market growth as it enables night vision systems to track and detect motion even in dim light or darkness. Hence, such a factor is anticipated to boost the growth of the market in the coming years.

Key Night Vision Surveillance Camera Market Insights Summary:

Regional Highlights:

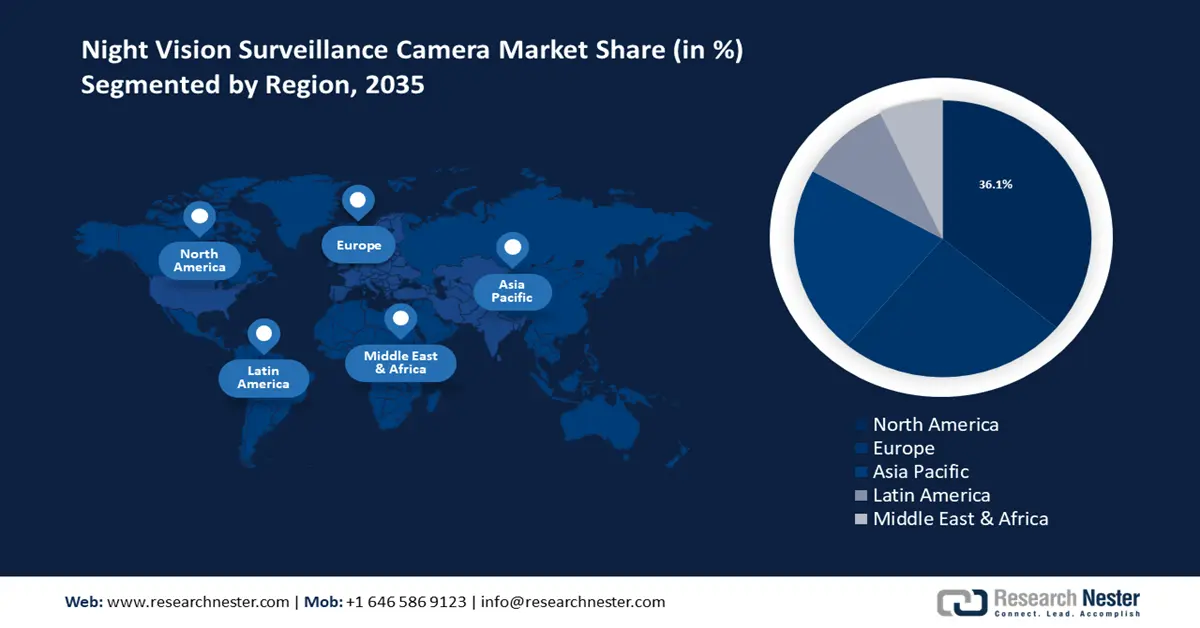

- North America’s night vision surveillance camera market is predicted to capture 36.1% share by 2035, driven by growing security concerns and night vision adoption across public infrastructure.

Segment Insights:

- The ptz (pan, tilt, zoom) segment in the night vision surveillance camera market is anticipated to capture a 67% share by 2035, attributed to the increasing adoption of PTZ cameras across sectors such as airports and supermarkets.

- The public sector & defense segment in the night vision surveillance camera market is forecasted to command the largest share by 2035, fueled by the need to prevent terror attacks and enhance surveillance in high-risk zones.

Key Growth Trends:

- Rising Government Support through Various Schemes and Investments

- Increased Research & Development Expenditure

Major Challenges:

- Insufficient Data Storage Capacity

- Less Awareness about the Benefits of Night Vision Surveillance Cameras in the Market

Key Players: Axis Communications AB, Teledyne FLIR LLC, HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD, BAE Systems plc, L3Harris Technologies, Inc., Canon Inc., Bosch Sicherheitssysteme GmbH, Honeywell International Inc., Panasonic Holdings Corporation, Dahua Technology Co., Ltd.

Global Night Vision Surveillance Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 190.08 billion

- 2026 Market Size: USD 230.28 billion

- Projected Market Size: USD 1.57 trillion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, United Arab Emirates

Last updated on : 9 September, 2025

Night Vision Surveillance Camera Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Government Support through Various Schemes and Investments – Modern technology enables night vision surveillance cameras to be incorporated inside drones. Moreover, the increasing use of drones for security purposes is anticipated to increase the market demand for night vision surveillance cameras. According to the data, in September 2021, the Indian government allocated a production-linked incentive (PLI) scheme worth USD 3 billion for the drone and auto industry.

-

Increased Research & Development Expenditure – As per data by the World Bank, global research and development expenditure in proportion to gross domestic product (GDP) was around 2.63% in 2020, up from 2.2% in 2018.

-

Rising Number of Stadiums Globally – According to data published in 2020, there were about 5,500 stadiums around the world and Brazil has the second highest number of stadiums, i.e., around 880.

-

Benefits of Night Vision Surveillance Cameras in Homes and Offices – According to recent statistics, if a surveillance camera is installed in a home, the chances of theft are reduced by 250%.

-

Rising Heavy Investment in Infrastructures – According to the data, in the next five years, the Indian government is planning to spend USD 1.3 trillion on infrastructure through the National Infrastructure Pipeline.

Challenges

High Cost of Night Vision Surveillance Cameras – The first and foremost obstacle or challenge that comes in the way of this market is the high cost of night vision surveillance cameras. The camera is not cost-friendly and not everyone can afford it. The utilization of unique materials and expensive third-generation technologies increases the price of night vision surveillance cameras.

- Insufficient Data Storage Capacity

- Less Awareness about the Benefits of Night Vision Surveillance Cameras in the Market

Night Vision Surveillance Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 190.08 billion |

|

Forecast Year Market Size (2035) |

USD 1.57 trillion |

|

Regional Scope |

|

Night Vision Surveillance Camera Market Segmentation:

Type Segment Analysis

The night vision surveillance camera market is segmented and analyzed for demand and supply by type into PTZ (Pan, Tilt, and Zoom) and fixed. Out of these segments, the PTZ segment is anticipated to garner the largest market share of 67% over the forecast period. This can be attributed owing to the growing adoption of PTZ cameras across numerous sectors including airports, supermarkets, museums, construction sites, large outdoor areas, and guard stations. Since PTZ cameras can zoom in and are remotely directed, their utilization is seen in various industries for security purposes. According to statistics, in the United States, in 2019, there were about 5,000 airports for public use and about 14,500 for private use, and by 2020, the number of airports for public and private use grew to approximately 5,200 and 14,700. Hence, such a factor is estimated to fuel the growth of the market segment in the coming years.

End-user Segment Analysis

The Global night vision surveillance camera market is segmented and analyzed for demand and supply by end-use application in retail, business organization, transportation, public sector & defense, industrial, stadiums, and others. Out of these, the public sector & defense sector is anticipated to have the highest market share in the forecast period. This can be attributed owing to avoiding the persistence of terror strikes. The public sector and defense segment is anticipated to hold the largest market share in the forecast year. In addition, the rising terror attacks concern road accidents, criminal activities, sleeper cells, natural disasters, unethical activities, and more factors that are there driving the growth of this segment. In the defense industry, various vehicles are needed on board such as tankers, trucks, and armored personnel carriers and it becomes tough for the drivers to see anything at night. In such cases, these vehicles have an enhanced vision system featuring short-wave infrared illumination and sensors with unlimited short-wave infrared night vision camera systems, so that drivers could locate everything comfortably in dangerous territories. Similarly, it is utilized in the public sector as well to locate any criminal activity or so.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Type |

|

|

By End Use Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Night Vision Surveillance Camera Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 36.1% market share by 2035. This can be accredited to the increasing security breaches, retail availability of night vision surveillance cameras, and rising number of stadiums in the region. The federal government of the United States and Canada chose night vision technology to enhance security in public sectors. Also, the US government is focusing on incorporating the night surveillance camera on highways. As per data from the National Highway Traffic Safety Administration, almost one-fourth of driving is done at night in the United States out of which half is done at night. This raises the demand for night vision surveillance cameras in the region.

APAC Market Insights

Further, the market in Asia Pacific is anticipated to grow during the forecast period. This can be attributed owing to the rising infrastructures, and increasing demand for location-based gadgets amongst government sectors and public transportation including airports, train stations, and others. Moreover, rising military and defense spending in the region is also estimated to propel market growth in the APAC region. China is one of the world’s biggest markets for video surveillance or night vision surveillance cameras. As per the Reform Commission and National Development Data, almost all places in China are covered under video surveillance with facial recognition. This is done to reduce the chances of crime in the area and to make sure social stability in the region. Currently, the Chinese government authority is focusing on incorporating night vision surveillance cameras in all public sectors.

Night Vision Surveillance Camera Market Players:

- Axis Communications AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teledyne FLIR LLC

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO. LTD

- BAE Systems plc

- L3Harris Technologies, Inc.

- Canon Inc.

- Bosch Sicherheitssysteme GmbH

- Honeywell International Inc.

- Panasonic Holdings Corporation

- Dahua Technology Co., Ltd

Recent Developments

-

BAE Systems plc’s U.S. Subsidiary BAE Systems Inc. announced the launch of the “Hawkeye” sensor, which has high-performance imaging capabilities and is optimal for surveillance applications and battery-powered military systems. The new 1.6-megapixel Hawkeye sensor also features market-leading night-vision capabilities and allows for imagery to be captured during cloudy conditions.

-

Teledyne Technologies Incorporated, announced the successful acquisition of FLIR Systems, Inc. FLIR now will be a part of Telendyne’s digital imaging segment and the newly formed company will be operating under the name of Telendye FLIR LLC.

- Report ID: 4255

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.