Nickel Hydroxide Market Outlook:

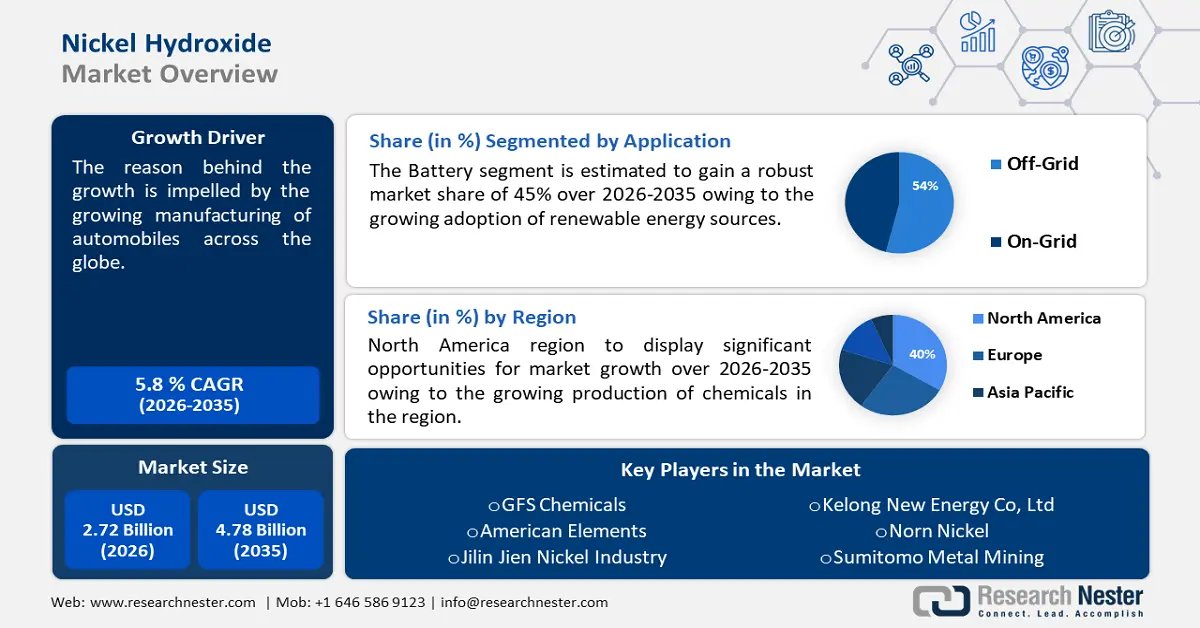

Nickel Hydroxide Market size was valued at USD 2.72 billion in 2025 and is set to exceed USD 4.78 billion by 2035, expanding at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nickel hydroxide is estimated at USD 2.86 billion.

The reason behind the growth is impelled by the growing manufacturing of automobiles across the globe. One of the largest sectors of the global economy is the automotive manufacturing sector led by the growing automation, digitization, and rising disposable income levels among global consumers.

For instance, more than 55 million cars are made annually, up around half of the world's oil usage. Particularly, in 2022 over 85 million motor vehicles were produced globally, a 5% increase from 2021.

The growing advancements in battery technology are believed to fuel the nickel hydroxide market growth. Increasing battery energy density and adding fast charging capabilities are top priorities for battery and electric vehicle manufacturers which has led to the development of new, advanced batteries to increase the amount of energy that can be stored in batteries.

Key Nickel Hydroxide Market Insights Summary:

Regional Highlights:

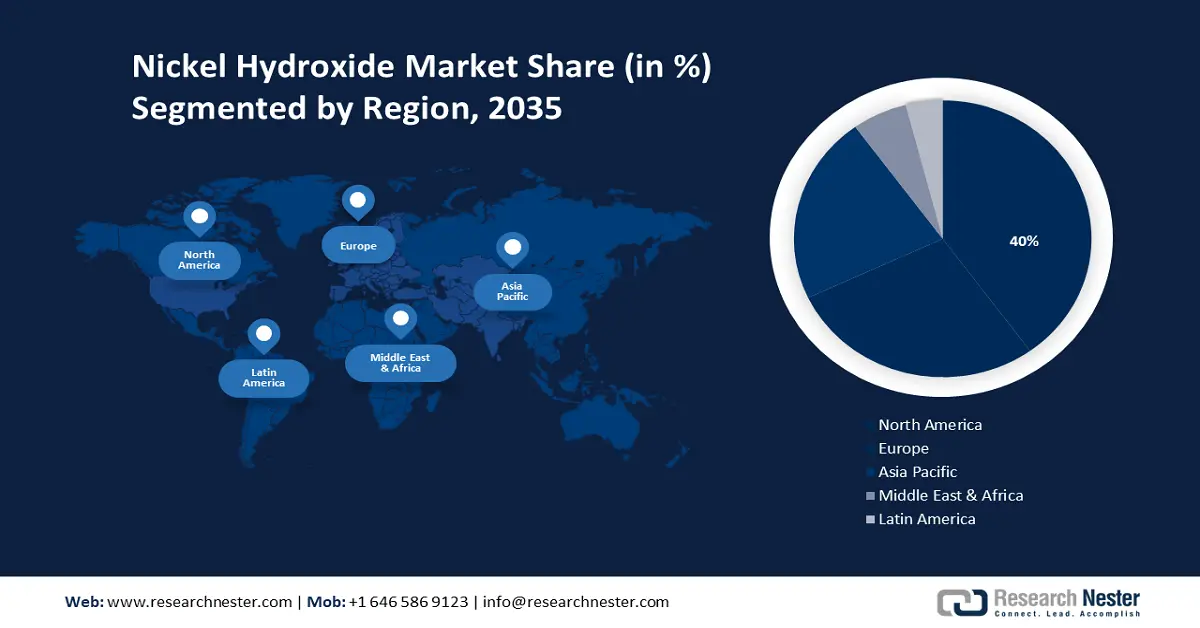

- North America nickel hydroxide market will hold more than 40% share by 2035, driven by the strong performance of the chemical industry.

Segment Insights:

- The battery segment in the nickel hydroxide market is forecasted to achieve a 45% share by 2035, driven by demand for high-performance batteries in energy and transport sectors.

- The automobiles segment in the nickel hydroxide market will experience notable revenue share by 2035, driven by the rise of EVs and hybrid vehicles with high energy density needs.

Key Growth Trends:

- Rising agriculture industry

- Growing usage in waste water treatment

Major Challenges:

- Rising agriculture industry

- Growing usage in waste water treatment

Key Players: GFS Chemicals, American Elements, Jiangmen Chancsun Umicore Industry, Co. Ltd., Jilin Jien Nickel Industry, Kelong New Energy Co, Ltd, Norn Nickel, Sumitomo Metal Mining, Supraveni Chemicals, Tesla Power India Private Limited, Tanaka Chemicals, Tinchem Enterprise.

Global Nickel Hydroxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.72 billion

- 2026 Market Size: USD 2.86 billion

- Projected Market Size: USD 4.78 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Nickel Hydroxide Market Growth Drivers and Challenges:

Growth Drivers

- Rising agriculture industry - Promising catalysts for effective urea oxidation reactions (UOR) include nickel hydroxide (Ni(OH)2), which is essential for agricultural growth.

- Increase need for efficient energy storage systems - Ni-based hydroxides are frequently appropriate for electrochemical energy storage, and grid-scale energy storage, as they have strong faradic activity, and as it is an essential component of energy storage technologies such as nickel-metal hydride (NiMH) batteries.

- Growing usage in waste water treatment - Nickel hydroxide is an important industrial substance with economic value and has garnered a lot of attention as a catalyst in industrial water treatment processes.

- Surging need for flame retardant materials - Nickel Hydroxide Nanopowder can be used as a flame retardant in coatings since it can stimulate the combustion process that produces carbon nanotubes (CNTs).

Challenges

- Availability of alternative batteries - Emerging alternative technologies such as lithium-ion batteries, and solid-state batteries are predicted to negatively impact the expansion of nickel hydroxide market. Essentially, a solid-state battery is a battery technology which substitutes a solid electrolyte for a liquid electrolyte that is referred to as "next-generation batteries" because they possess a greater energy density and twice as much energy density as traditional lithium-ion batteries.

- Varying price of nickel - For instance, more than 55% of nickel is in nickel hydroxide. Since last year, nickel prices have fluctuated, and a rise is anticipated in 2024 and 2025 owing to the opening of the arbitrage between the Shanghai Futures Exchange (SHFE) and LME, the nickel market deficit, declining LME stockpiles, high market premiums on all forms and in different markets, and notable backwardation.

- Stringent environmental regulations associated with nickel mining may impact the overall production costs

Nickel Hydroxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.72 billion |

|

Forecast Year Market Size (2035) |

USD 4.78 billion |

|

Regional Scope |

|

Nickel Hydroxide Market Segmentation:

Application Segment Analysis

In nickel hydroxide market, battery segment is likely to account for around 45% share by 2035. Nickel hydroxide is utilized as the positive electrode in other rechargeable battery systems, like Ni-Fe and Ni-Cd systems, and has acquired significance as the cathode active material for nickel hydride batteries. For the battery sector, nickel hydroxide combined with cobalt is a well-known powder composition that can be used in rechargeable battery electrodes, nickel metal hydride batteries, and nickel-cadmium batteries.

The primary non-lithium battery material is nickel hydroxide, which is strategically significant as an essential part of high-power, high-cycle life energy storage systems used in the energy, transportation, and aerospace sectors since security concerns are the main priority in these sectors. Moreover, battery manufacturing uses nickel hydroxide as a component which is an essential part of the storage and renewable energy industries, and is a cathode substance utilized in solar cells, which these plants employ to store energy. For instance, through 2026, more than 92% of the expansion in the world's electricity capacity is expected to come from renewable sources.

In addition, the technique of nickel electroplating involves using chemical reduction or electrolytic procedures to deposit nickel on a component that is submerged in an electrolyte solution, which is a great method of surface finishing for engineering and decorative applications as it has a brighter and smoother finish, and has good corrosion resistance and wears.

Furthermore, in chemical processes, nickel hydroxide functions as a non-noble metal co-catalyst, and is considered to be the most active OER catalyst family in alkaline electrolytes.

End-Use Segment Analysis

The automobile segment is set to garner a notable share shortly. In the automobile sector, nickel hydroxide is essential, especially when it comes to electric and hybrid cars (EVs and Vs) as it plays a crucial role in the lithium-ion battery's cathode which is vital for supplying energy to EVs' electric propulsion systems owing to their high energy density.

With increasing environmental regulations, and government incentives for cleaner transportation options, the adoption of electric vehicles is on the rise globally which is expected to drive the demand for nickel hydroxide as it offers higher energy density compared to cobalt-rich alternatives which allows for longer driving ranges and improved performance in electric vehicles. Nickel is more abundant and less expensive than cobalt, making nickel-rich batteries more cost-effective and potentially more sustainable which can contribute to the transition toward cleaner energy and reduced greenhouse gas emissions.

Our in-depth analysis of the global nickel hydroxide market includes the following segments:

|

Purity |

|

|

Form |

|

|

End-Use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nickel Hydroxide Market Regional Analysis:

North American Market Insights

North America industry is likely to dominate majority revenue share of 40% by 2035. With over a million workers and significant trade surpluses, the chemical industry is one of the biggest manufacturing sectors in the US. The chemical industry is the second largest in the world and is one of the country's oldest industries led by the shale gas revolution which has brought the United States back to prominence as a low-cost chemical-producing zone. For instance, in 2022, the US chemical sector is projected to expand its output volume by more than 4%.

European Market Insights

The Europe Nickel Hydroxide market is estimated to be the second largest, during the forecast timeframe attributed to the growing focus on sustainability. As electric vehicles (EVs) and renewable energy sources become more prevalent in Europe, there will likely be a rising demand for energy storage technologies, such as batteries.

Further, the investment in electric mobility and renewable energy storage solutions is projected to be stimulated by the European Union's efforts and legislation aimed at lowering carbon emissions and encouraging clean energy technology, which will raise the demand for nickel hydroxide. For instance, the EU's climate regulation requires member states to reduce their greenhouse gas emissions by more than 50% by 2030.

Nickel Hydroxide Market Players:

- GFS Chemicals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Elements

- Jiangmen Chancsun Umicore Industry, Co. Ltd.

- Jilin Jien Nickel Industry

- Kelong New Energy Co, Ltd

- Norn Nickel

- Sumitomo Metal Mining

- Supraveni Chemicals

- Tesla Power India Private Limited

- Tanaka Chemicals

- Tinchem Enterprise

Recent Developments

- Jilin Jien Nickel Industry a major producer of nickel cathode, announced to resume the manufacturing of nickel cathode by producing over 245t of units.

- Tesla Power India Private Limited announced the launch of ReStore, India's first and foremost refurbished battery brand to offer customers a warranty for about half the price of a brand-new inverter battery, to have a beneficial effect on the economy, the environment, and society at large.

- Report ID: 5801

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nickel Hydroxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.