Nickel Hydrogen Batteries Market Outlook:

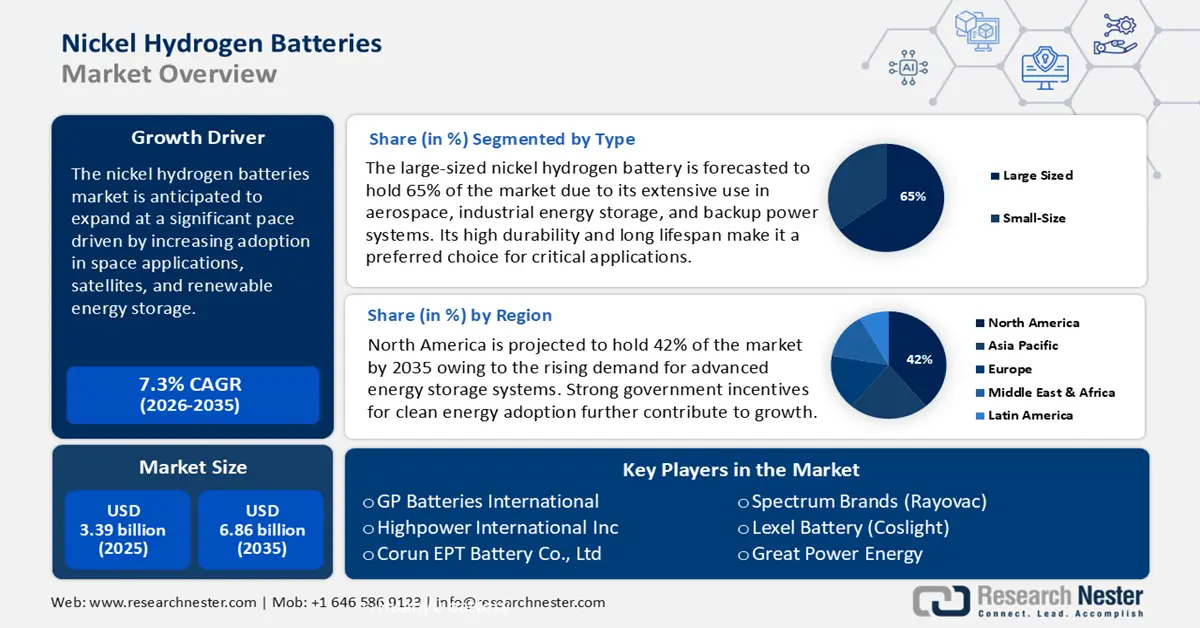

Nickel Hydrogen Batteries Market size was over USD 3.39 billion in 2025 and is poised to exceed USD 6.86 billion by 2035, growing at over 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nickel hydrogen batteries is estimated at USD 3.61 billion.

The nickel hydrogen batteries market is expanding at a significant pace driven by increased demand for long cycle life and high energy density batteries. These batteries are commonly used in aerospace and energy storage industries and are finding new uses in EVs and grid balancing. In October 2023, EnerVenue secured a 525 MWh order from VedantaESS, highlighting the growing demand for scalable nickel-hydrogen storage solutions. As governments continue to subsidize clean energy storage, nickel hydrogen batteries are expected to experience greater demand in renewable energy systems and backup power systems.

With the increasing rate of EV adoption and the development of battery technology, nickel-rich chemistries like NMC and NCA are becoming popular due to their high energy density and cost-effectiveness. The growing adoption of electric vehicles along with the demand for a shift towards more sustainable energy storage solutions mean that nickel-based batteries are set to play a critical role in the future of mobility and renewable energy. In order to get a better view of how nickel containing batteries are positioned in the changing energy and transport sector, the following table provides an overview on the different battery types, their nickel content, and areas of use.

|

Nickel-Based Batteries: Composition, and Role in EV Adoption |

||||

|

Battery Type |

Nickel Content (%) |

Application Area |

Energy Density (Wh/kg) |

Recycling Potential (%) |

|

Nickel-Hydrogen (NiHa‚‚) |

100 |

Aerospace, Renewable Storage |

-45 |

95 |

|

Nickel-Metal Hydride (NiMH) |

60 |

Hybrid Vehicles, Consumer Electronics |

-30 |

95 |

|

Lithium-Ion (NMC) |

60-80 |

EVs, Energy Storage |

-100 |

95 |

|

Lithium-Ion (NCA) |

80 |

High-Performance EVs |

-70 |

95 |

Source: Nickel Institute

The table illustrates the growth of demand for nickel-containing batteries in EVs and energy storage. NiMH and NiH batteries are used in aerospace and hybrid vehicles, while Li-ion batteries such as NMC and NCA are widely used in EVs. Currently, EVs contribute to 18% of the global car sales and the figures are expected to surpass 30% by 2025, thus, high-nickel batteries will be in high demand. The recycling potential of 95% indicates sustainability and strengthens the position of nickel in the energy transition. In the end, newer developments in the NMC cathode materials (with up to 90% nickel) are pushing the efficiency and range enhancements in EVs, driving the NiMH battery market growth.

Key Nickel Hydrogen Batteries Market Insights Summary:

Regional Highlights:

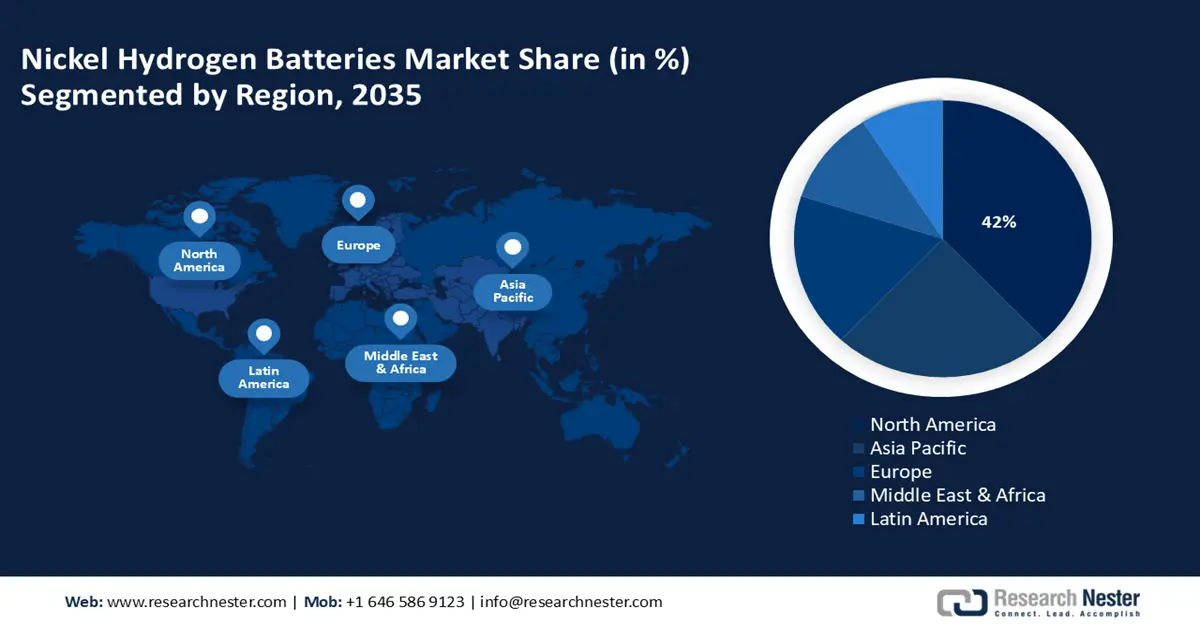

- North America holds a 42% share of the Nickel Hydrogen Batteries Market, driven by renewable integration and investments in energy storage, ensuring sustained leadership through 2026–2035.

- The Nickel Hydrogen Batteries Market in Asia Pacific is projected to grow significantly by 2035, driven by increased EV production and battery technology advancements.

Segment Insights:

- The Automotive Segment is anticipated to achieve a 46% share by 2035, propelled by increasing adoption of hydrogen and hybrid vehicles.

- The Large-Sized Segment is projected to capture a 65% share by 2035, fueled by durable, long-use applications in harsh conditions and aerospace.

Key Growth Trends:

- Increasing demand for long-term energy storage

- Expansion in hydrogen-powered transport

Major Challenges:

- Raw material supply chain constraints

- Competition from lithium-ion batteries

- Key Players: GS Yuasa, GP Batteries International, Highpower International Inc, Corun, Huanyu Battery, Spectrum Brands (Rayovac), Lexel Battery (Coslight), EPT Battery Co., Ltd, Energizer Holdings, Great Power Energy.

Global Nickel Hydrogen Batteries Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.39 billion

- 2026 Market Size: USD 3.61 billion

- Projected Market Size: USD 6.86 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 13 August, 2025

Nickel Hydrogen Batteries Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for long-term energy storage: Nickel-hydrogen batteries are becoming more popular as industries look for long cycle life and high energy density batteries. These batteries are mainly used in large-scale energy storage, aerospace, and renewable energy integration owing to the high cycle life. Furthermore, due to their long service life, they are suitable for long-term usage without much maintenance, especially in backup power applications and grid storage. In October 2023, EnerVenue received an order of 525 MWh from VedantaESS, proving the increasing need for nickel hydrogen storage. As governments and corporations continue working toward the adoption of clean energy, nickel hydrogen technology is set to be a significant enabler of grid balancing and long-duration energy storage.

- Expansion in hydrogen-powered transport: The increasing demand for hydrogen fuel cell vehicles (FCEVs) and hybrid-electric transport systems has been attributed to the increasing interest in nickel hydrogen battery technology. These batteries offer high energy density, long cycle life, and safety, which are beneficial in commercial transport, aviation, and naval applications. In October 2024, Nikola Corporation delivered an additional 22% of hydrogen electric trucks to market, which confirms the prospects for the use of hydrogen-based energy storage in heavy freight transportation. With hydrogen infrastructure gaining traction in the global hydrogen batteries market, nickel hydrogen batteries are set to become the storage solution of choice for fuel cell electric vehicles and smart mobility systems.

- Government incentives for energy security: Governments around the globe are increasing their spending in advanced battery production and energy storage to decrease the use of fossil fuels and strengthen the grid. Subsidies and incentives are fueling the growth of nickel hydrogen batteries, particularly in e-mobility, stationary storage, and backup power. For instance, in January 2022, Puerto Rico pledged to invest in 460 MWh of nickel hydrogen batteries to enhance its renewable energy capacity and energy resilience. These investments are pushing development and commercialization, which is likely to ensure that nickel-hydroxide battery uptake is continued.

Challenges

- Raw material supply chain constraints: Nickel-hydrogen batteries are produced from high-purity nickel, rare metals, and proprietary electrolytes, which makes the supply chain unpredictable. The demand for battery-grade nickel is increasing globally, putting pressure on EV battery manufacturers, energy storage companies, and industrial suppliers. Owing to fluctuations in supply chain risks and political situations affecting raw material procurement, manufacturers are looking for other options to acquire raw materials and are expanding their manufacturing plants.

- Competition from lithium-ion batteries: Due to their long cycle life and safety characteristics, nickel hydrogen batteries are rivals of lithium-ion batteries that currently dominate the EV and consumer electronics industries. Lithium-ion technology is more energy dense than the other technologies and therefore ideal for use in compact devices. However, the NiMH battery market is focusing on the development of energy density and efficiency to make them suitable for more popular uses.

Nickel Hydrogen Batteries Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 3.39 billion |

|

Forecast Year Market Size (2035) |

USD 6.86 billion |

|

Regional Scope |

|

Nickel Hydrogen Batteries Market Segmentation:

Type (Small-Size, Large Sized)

The large-sized segment is set to capture over 65% nickel hydrogen batteries market share by 2035, attributed to its extensive application in aerospace, industrial storage, and energy grid. These batteries are widely used for deep discharge, long term use, and for conditions that are very harsh. Due to their capability of producing power stably for decades, they are appropriate for renewable energy storage and high-power backup systems. In December 2023, EnerVenue launched pre-assembled nickel hydrogen battery vessels to facilitate the deployment of nickel hydrogen energy storage on a large scale. Such developments are anticipated to propel segment growth during the forecast period.

Application (Automotive, Electrical and Electronics, Consumer Goods)

In nickel hydrogen batteries market, automotive segment is set to dominate revenue share of over 46% by 2035, owing to the increasing use of hydrogen vehicles and hybrid energy solutions. Due to its high cycle life, fast charging, and durability, nickel hydrogen technology has become the most suitable and safest solution for auto makers looking for a long-lasting battery. In April 2023, Stellantis signed an offtake deal with Alliance Nickel for battery grade nickel and cobalt sulfate for electric vehicle production indicating rising industry interest in nickel based chemistries.

Our in-depth analysis of the global NiMH battery market includes the following segments:

|

Type |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nickel Hydrogen Batteries Market Regional Analysis:

North America Market Analysis

North America nickel hydrogen batteries market is expected to hold revenue share of more than 42% by 2035, owing to increasing investments in advanced energy storage technologies and renewable energy integration. The region has been experiencing growth in the production of nickel hydrogen batteries through government policies and private sector investment. The use of long cycle life energy storage technologies is increasing, especially for grid storage, electric transportation, and aerospace applications. With growing energy security issues, nickel hydrogen technology is slowly gaining recognition as the next big thing besides lithium-ion batteries, further strengthening North America’s position in the next-generation battery storage.

Several players in the U.S. are presently investing in nickel hydrogen battery manufacturing to meet the country’s rising need for sustainable energy storage. In October 2023, EnerVenue shared its plan to build a metal-hydrogen gigafactory to manufacture nickel hydrogen batteries for the surging grid storage and renewable energy markets. The facility is in line with the existing national energy policies that advocate for battery diversification and seek to strengthen the domestic supply chains. In this way, by promoting the development of high-cycle-life storage technologies, the U.S. is strengthening its presence in the global market for non-lithium batteries.

Canada is also increasingly positioning itself in the nickel hydrogen batteries market, focusing on the localization of production and the supply chain. In March of 2023, EnerVenue announced its intention to construct a non-lithium battery gigafactory in Kentucky, Canada, specializing in nickel hydrogen batteries for large-scale applications. The outlet will serve the commercial and utility-scale storage markets together with industrial segments, as energy storage is becoming a more critical requirement in the modern world. Through the development of regional production facilities, the country seeks to improve energy security and facilitate the deployment of storage solutions for clean energy sources.

Asia Pacific Market Analysis

Asia Pacific NiMH battery market is expected to witness a steady growth rate till 2035, due to increasing electric vehicle production, increased renewable energy usage, and development in battery technology. Governments of countries such as China, India, South Korea, and Australia are focusing on emerging energy storage technologies for the grid modernization and sustainable transportation. The region is also experiencing a massive investment in gigafactories, thus strengthening Asia Pacific position as the leader in battery manufacturing. The nickel hydrogen battery is expected to gain more traction as the government continues to encourage the industry and as more companies get behind the battery technology.

Players in India are increasingly investing in the domestic battery industry and targeting EV batteries and renewable energy storage. In May 2024, Exide Industries, the battery manufacturing company, revealed its plans to provide lithium-ion batteries for electric two-wheeler makers in India. Through its wholly owned subsidiary Exide Energy Solutions Ltd (EESL), the company is developing a 6 GWh gigafactory in Bengaluru which is planned to start in 2025. Currently, lithium-ion batteries are gaining popularity in India, however, there is increasing demand for long-cycle-life batteries such as nickel hydrogen batteries as part of a transition to clean energy in India.

China is currently one of the most significant producers of nickel-hydrogen, lithium-ion, and solid-state batteries in the world. The leading position in EV manufacturing, energy storage solutions, and battery material supply chains also strengthen the country’s position in the market. In April 2024, China’s Ministry of Industry and Information Technology (MIIT) released new policies to advance the nickel-based battery research and development of high energy density and long cycle life. As energy security and decarbonization remain high priorities, China continues to invest in the development of next-generation battery technologies, cementing its status as a battery powerhouse.

Key Nickel Hydrogen Batteries Market Players:

- GP Batteries International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Highpower International Inc

- Corun

- Huanyu battery

- Spectrum Brands (Rayovac)

- Lexel Battery (Coslight)

- EPT Battery Co., Ltd

- Energizer Holdings

- Great Power Energy

Major battery and energy storage manufacturers are driving the growth in the NiMH battery market, focusing on high-performance, long-cycle-life products for renewable energy, aerospace, and industrial applications. Some of the key players in the global hydrogen batteries market are GS Yuasa, GP Batteries International, Highpower International Inc., Corun, Huanyu Battery, Spectrum Brands (Rayovac), Lexel Battery (Coslight), EPT Battery Co., Ltd., Energizer Holdings, and Great Power Energy. These companies are increasing their research and development efforts to increase the efficiency, scalability, and the cost of the process.

As the companies continue to invest in nickel hydrogen technology, they are focusing on research and development to improve the technology and make it cost effective to sustain the market for energy storage and clean mobility. In September 2024, Battolyser Systems, a Netherlands-based company, raised USD 33 million to further the development of its nickel-iron battery and hydrogen production technology to address the need for a sustainable battery solution.

Here are some leading players in the nickel hydrogen batteries market:

Recent Developments

- In June 2024, EnerVenue raised USD 515 million in funding. This substantial investment is intended to accelerate the company's production of nickel-hydrogen batteries. The funds will support scaling manufacturing capabilities to meet the growing demand for sustainable energy storage solutions. This financial boost underscores investor confidence in EnerVenue's technology and market potential.

- In December 2023, AGL announced a pilot project for a nickel-hydrogen battery at its Torrens Island hub. This initiative aims to test the viability of nickel-hydrogen batteries in large-scale energy storage. The project could lead to more resilient and efficient energy systems if successful. AGL's move signifies a step forward in diversifying energy storage technologies.

- Report ID: 7235

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nickel Hydrogen Batteries Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.