Nickel Cadmium Battery Market Outlook:

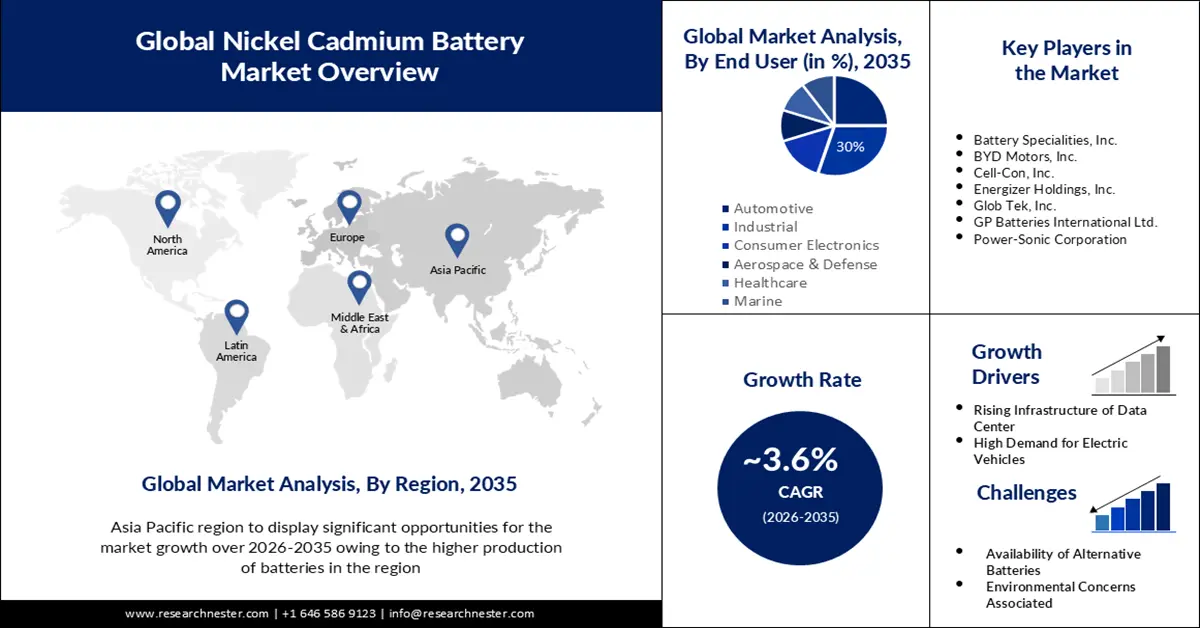

Nickel Cadmium Battery Market size was over USD 1.14 billion in 2025 and is projected to reach USD 1.62 billion by 2035, witnessing around 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nickel cadmium battery is evaluated at USD 1.18 billion.

The growth of the market can be attributed to the increasing demand for electric vehicles. Nickel-cadmium (NiCd) batteries are widely used in electric vehicles owing to their high discharge rates, long cycle, and reliability. The usage of EV batteries in India is expected to reach over 15 GWh by 2025 and nearly 60 GWh by 2030. Investments in the cell manufacturing business of India are expected to exceed USD 9 billion by 2030.

In addition to these, factors that are believed to fuel the market growth of nickel-cadmium batteries include the rising sales of portable electronics, such as smartphones, laptops, wearables, tablets, and others. Moreover, nickel-cadmium batteries are frequently used in industrial and commercial applications such as power tools, and emergency lighting.

Key Nickel Cadmium Battery Market Insights Summary:

Regional Insights:

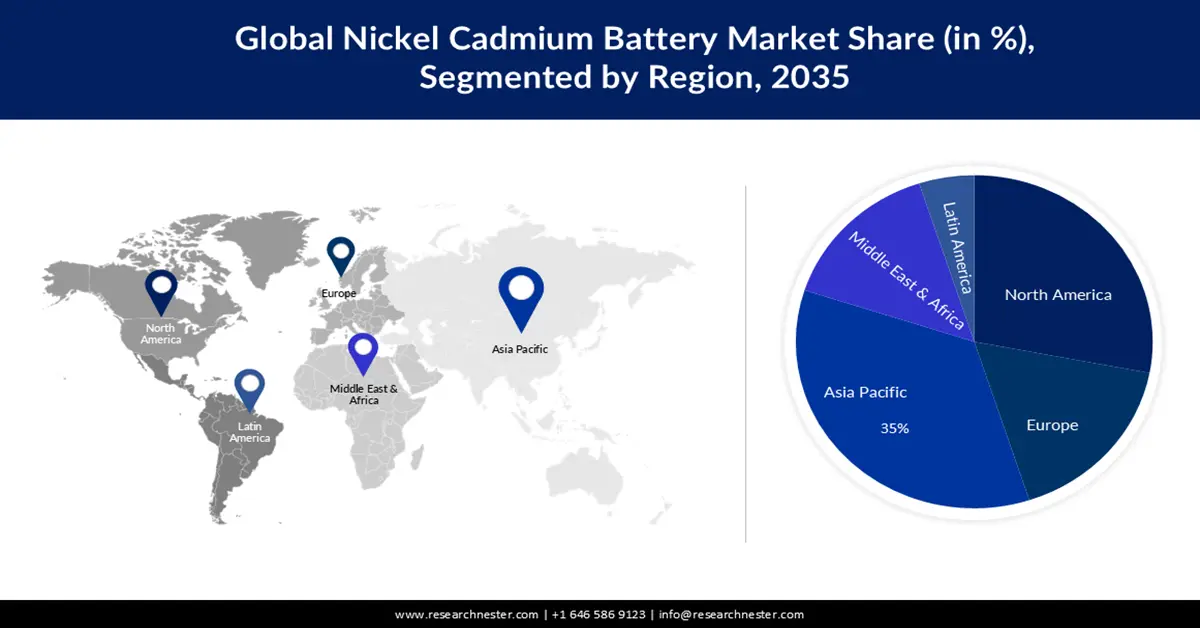

- The Asia Pacific nickel cadmium battery market is expected to hold a 35% share by 2035, impelled by rising investment in boosting the production of batteries.

- The North America market is projected to capture a 26% share by 2035, owing to the increasing instances of power outages.

Segment Insights:

- The Asia Pacific nickel cadmium battery market is expected to hold a 35% share by 2035, impelled by rising investment in boosting the production of batteries.

- The North America market is projected to capture a 26% share by 2035, owing to the increasing instances of power outages.

Key Growth Trends:

- Growing Instances for Power Outages

- Rise in the Number of Aircraft

Major Challenges:

- Environmental Concerns Associated with Nickel Cadmium Batteries —

- Availability of Other Batteries in the Market

Key Players: ALCAD A.B., Battery Specialties, Inc., BYD Motors, Inc., Cell-Con, Inc., Energizer Holdings, Inc., Glob Tek, Inc., GP Batteries International Ltd., GS Yuasa Corporation, Power-Sonic Corp., Saft Groupe SAS.

Global Nickel Cadmium Battery Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.14 billion

- 2026 Market Size: USD 1.18 billion

- Projected Market Size: USD 1.62 billion by 2035

- Growth Forecasts: 3.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Thailand, Indonesia

Last updated on : 24 November, 2025

Nickel Cadmium Battery Market - Growth Drivers and Challenges

Growth Drivers

- Growing Instances for Power Outages - Nickel-cadmium batteries provide important backup power capabilities to ensure public transport systems continue to run securely in the event of a power outage. According to the most recent IEA data, the number of people living without electricity worldwide is expected to rise by about 20 million in 2022, reaching nearly 775 million.

- Rise in the Number of Aircraft - Industrial nickel-cadmium batteries are the chosen battery technology for both civilian and military aircraft. In the event that the primary power supply fails, they provide backup power for avionics and other critical onboard equipment. In spite of the pandemic imposed by COVID-19, the global aircraft fleet was around 25,600 in 2022. It is also expected to exceed 38,000 by 2032.

- Expanding Infrastructure of Data Center -Nickel-cadmium batteries work absolutely fine in a wide range of temperatures, thus making them suitable for use in data center infrastructure management. There were about 8,000 data centers in 110 different countries as of January 2021. These six countries include the United States, which accounts for around 33% of all data centers, the United Kingdom, which accounts for around 6%, and China, which accounts for nearly 5%.

Challenges

- Environmental Concerns Associated with Nickel Cadmium Batteries — These batteries contain toxic materials, including cadmium and nickel. After their expiration date, if they are not disposed of properly then it can pose serious harm to the environment. This has led to some restrictions on the use of these batteries in certain applications.

- Availability of Other Batteries in the Market

- NiCd batteries are Perceived to be Outdated

Nickel Cadmium Battery Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 1.14 billion |

|

Forecast Year Market Size (2035) |

USD 1.62 billion |

|

Regional Scope |

|

Nickel Cadmium Battery Market Segmentation:

End User Segment Analysis

The automotive segment in the nickel cadmium battery market is estimated to gain the largest revenue share of about 30% in the year 2035. The growth of the segment can be attributed to the rising transition to electric vehicle. Passenger electric vehicles are becoming increasingly popular in the world. Around 13% of new vehicles delivered in 2022 were electric. Global sales nearly doubled to 6.6 million in comparison to 2020, increasing the total number of electric vehicles on the road to 16.5 million. Electric vehicle sales climbed by 4 percentage points in 2021. According to the Net Zero Emissions by 2050 Scenario, there are likely to be over 300 million electric automobiles on the road by 2030, with electric cars accounting for 60% of new car sales.

Block Battery Construction Segment Analysis

The L-range segment is expected to hold 46% share of the global nickel cadmium battery market in the year 2035. The growth of the segment is primarily attributed to the higher reliability on the L-range nickel-cadmium batteries. These batteries are specially designed for the application, where a power supply is required for a longer period. Owing to the supply of low currents, the discharge period of these batteries is long. Hence the reliability of these batteries for longer supply is high. There are various applications of L-range batteries, such as railway signaling, emergency braking g system, emergency lighting, PV systems, fire alarms, DC instrumentation, telecoms, and others. The capacity of L-range nickel-cadmium batteries depend on the manufacturer, and the common range resides between 8 Ah 101,680 Ah.

Our in-depth analysis of the global nickel cadmium battery market includes the following segments:

|

Block Battery Construction |

|

|

Cell Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nickel Cadmium Battery Market - Regional Analysis

Asia Pacific industry is expected to hold largest revenue share of 35% by 2035, attributed to rising investment in boosting the production of batteries.The growth of the market can be attributed majorly to the rising investment in boosting the production of batteries. The Japanese commission suggested USD 24 billion in public and private sector initiatives. The government intends to use this money to expand the supply chain and manufacture of batteries by hiring 30,000 suitable individuals. On the other hand, the rising demand for electric vehicle is expected to drive the market growth in the region. EV sales have increased by more than 2,200 percent in India in the last three years, with over 4,42,901 electric vehicles sold in fiscal year 2023, as opposed to around 19,100 in fiscal year 2020. Moreover, with 100% FDI allowed, new production centers, and an enhanced push to improve charging infrastructure, India's electric car industry is picking up speed.

The North America nickel cadmium battery market is estimated to be the second largest, registering a share of about 26% by the end of 2035. The growth of the market can be attributed majorly to the rising instances of power outages. According to the researchers, outages have increased by 64% in the last decade compared to the preceding decade in the United States. From 2000 to 2021, weather-related events caused 83% of all reported power outages, ranging from drought-fueled wildfires to severe storms like tornadoes and hurricanes, many of which will only exacerbate as the earth's temperature increases. Moreover, several devastating storms in 2021 strained the electricity grids in the United States. Households lost electricity for an average of seven hours and twenty minutes, with severe weather events such as hurricanes, wildfires, and snowstorms accounting for more than five of those hours, or almost seventy-two percent.

Further, the market in the Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the rising demand for consumer electronics. Technological breakthroughs, altering customer preferences, and an increased need for cost-effective, simple-to-use, high-performance devices are driving up demand for consumer electronics. Besides this, surging production of batteries is also expected to augment the market growth in the region. By 2030, Europe's battery cell production capacity will have increased to 1.5 TWh. By 2022, Europe is predicted to have a battery cell production capacity of 124 GWh.

Nickel Cadmium Battery Market Players:

- ALCAD A.B.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Battery Specialties, Inc.

- BYD Motors, Inc.

- Cell-Con, Inc.

- Energizer Holdings, Inc.

- Glob Tek, Inc.

- GP Batteries International Ltd.

- GS Yuasa Corporation

- Power-Sonic Corp.

- Saft Groupe SAS

Recent Developments

- ALCAD AB. announced the launch of a new sling range of nickel-cadmium batteries. They are suitable for remote sites such as oil and gas installations, as well as applications with limited space such as outdoor cabinets for services and rail lines.

- Saft Group SAS installed their Saft Sunica. plus nickel battery systems in the Swedish Maritime Administration, the prime navigation entrance to the Port of Gothenburg. It ensures power continuity for the Trubaduren lighthouses crucial solar-powered navigation lights.

- Report ID: 4905

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nickel Cadmium Battery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.