Niacinamide Market Outlook:

Niacinamide Market size was USD 1.7 billion in 2024 and is expected to reach USD 3.4 billion by the end of 2034, growing at a CAGR of 9.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of niacinamide is evaluated at USD 1.9 billion.

The worldwide market is readily backed by a well-established nutraceutical and pharmaceutical patient pool, especially in dermatological and metabolic applications. As per an article published by the National Institutes of Health (NIH), niacinamide is severely preferred for type 1 diabetes, hypercholesterolemia, and pellagra, with an approximate 25 million patients in the U.S. depending on B3-derived treatments. Besides, the active pharmaceutical ingredient (API) supply chain is effectively concentrated in China, with 55% of international production, India, and Germany, with notable manufacturing centers catering to Europe-based Pharmacopoeia and the U.S. Pharmacopeia (USP) standards, thus suitable for the market development.

Furthermore, according to an article published by the International Trade Centre (ITC), it has been indicated that niacinamide exports increased to USD 2.3 billion as of 2023, with China accounting for USD 855 million, followed by Germany with USD 325 million, and Switzerland with USD 215 million as notable suppliers in the overall market. Besides, the U.S. is considered the largest producer and accounts for 40% of the worldwide market demand, which is further followed by Japan and Europe. Meanwhile, investments in research, development, and deployment (RDD), particularly for niacinamide-specific therapies, have amounted to USD 425 million as of 2023, thereby denoting a huge market growth opportunity.

Niacinamide Market - Growth Drivers and Challenges

Growth Drivers

- Affordable interventions and administrative expenditure: The existence of government-based health and medical programs, especially Medicare in the U.S., tends to cover niacinamide-driven treatments for metabolic diseases, including dyslipidemia and diabetes. For instance, Medicare expenditure on niacinamide medications has reached USD 1.5 billion as of 2023, thereby reflecting a 9.5% year-over-year (YoY) enhancement. This upliftment in the market is highly fueled by clinical evidence, which is effectively supported by the market’s affordability. This has been demonstrated by the 2022 AHRQ study report, wherein it has been stated that early intervention with niacinamide can diminish hospitalizations by almost 20%, thus saving USD 3.8 billion in the U.S. healthcare expenses.

- Anti-aging application and dermatological enhancement: The international skincare sector’s transition toward science-driven ingredients has effectively positioned the niacinamide sector as one of the topmost active compounds, with FDA-accepted products increasing to 28% as of 2023. Besides, the efficacy in aiding hyperpigmentation, rosacea, and acne is perfectly documented, with Germany reporting almost 13 million patients utilizing niacinamide-based dermatological treatments as of 2025. Meanwhile, telemedicine is deliberately escalating the integration, with the U.S. teledermatology platforms witnessing a 45% surge in niacinamide prescriptions, thereby suitable for market upliftment.

- Functional food and extended nutraceutical need: The niacinamide’s role in metabolic and cardiovascular health has led to its involvement in dietary supplements and functional foods. In this regard, the NIH has reported that almost 25% of adults in the U.S. currently prefer to consume niacinamide-fortified products, which has doubled over five years. Besides, Europe’s EFSA has accepted niacinamide for energy metabolism support, resulting in a 30% increase in sports nutrition products that contain the ingredient. Meanwhile, in developing economies, micronutrient fortification programs are implementing niacinamide into stable food products to overcome deficiencies, thus creating a huge opportunity for the market.

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Niacinamide Manufacturers (2022–2025)

|

Company |

Strategy |

Revenue Impact (USD Million) |

Year |

|

BASF |

Launched 12% niacinamide serum |

+125 |

2023 |

|

Lonza |

Diabetic neuropathy drug partnership |

+78 |

2024 |

|

DSM |

17 OTC skincare approvals |

+95 |

2024 |

|

Evonik |

India API facility expansion |

+60 (cost savings) |

2023 |

|

Jubilant Life Sciences |

EU FOSHU-certified functional foods |

+65 |

2025 |

Source: FDA, Clinical Trials, PLI, MHLW

Feasible Expansion Models Shaping the Market

Feasibility Models for Market Expansion (2022–2025)

|

Model |

Region |

Revenue/Cost Impact |

Year |

|

Healthcare Partnerships |

India |

+15% Revenue |

2024 |

|

DTC E-commerce |

U.S. |

+22% Online Sales |

2023 |

|

Green Chemistry Grants |

Europe |

-18% Production Costs |

2023 |

|

API Localization |

China |

+USD 225 million Export Revenue |

2025 |

Sources: NHP, FDA, EC, MIIT

Challenges

- Geopolitical hazards and volatility in raw materials: The niacinamide sector production heavily depends on 4.5-dimethylpyridine, which is a precursor, initially supplied from China. In this regard, China executed export restrictions as of 2023, wherein prices increased by 50%, thereby pressurizing Lonza to modify 38% of its procurement to India. Besides, trade wars and geopolitical tensions are also causing disruptions in supply chain dynamics, as has been observed with the China-U.S. tariffs rising API production expenses by almost USD 250 million per year. However, to combat this risk, organizations are generously investing in alternative synthesis methods, including bio-fermentation.

- Out-of-pocket and patient cost-effectiveness expenses: The aspect of upsurged treatment expenses tends to exclude the majority of patients, particularly in developing markets, which negatively affects the overall market globally. In this regard, niacinamide therapies in India usually cost around USD 65 per month, which is 4.5 times the average regular wage, thereby restricting the accessibility to only 20.5% for eligible patients. However, Jubilant Life Sciences overcame this issue by unveiling a USD 7 per month generic and achieving 17.5% of the market share.

Niacinamide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.1% |

|

Base Year Market Size (2024) |

USD 1.7 billion |

|

Forecast Year Market Size (2034) |

USD 3.4 billion |

|

Regional Scope |

|

Niacinamide Market Segmentation:

End user Segment Analysis

Based on the end user, the product manufacturers segment in the niacinamide market is projected to garner the largest share of 68.5% by the end of 2034. This particular category of manufacturers is considered B2B buyers, including nutraceutical producers, cosmetic brands, and pharmaceutical formulators, effectively driving the majority of purchases of high-purity niacinamide. Besides, pharmaceutical manufacturers have readily prioritized USD-grade niacinamide, constituting 55.8% of the share, for cholesterol and diabetes medications, while cosmetic-based formulators highly prefer liquid variants, thus suitable for uplifting the overall segment globally.

Form Segment Analysis

Based on the form, the pharmaceutical-grade segment in the niacinamide market is expected to hold the second-largest share of 59.5% during the forecast timeline. The segment is valued for its nearly 100% purity meeting by following EP and USD standards. This is considered a powder-based formulation, which is essential for metabolic disease treatments, with almost 85% of diabetes medications in Japan comprising niacinamide APIs. Besides these factors, specializations in supply chain dynamics, precision in dosage, and administrative compliance are other trends that are propelling the overall segment.

Application Segment Analysis

Based on the application, the cosmetics and personal care segment in the niacinamide market is projected to hold the third-largest share of 43.5% during the forecast period. The segment’s growth is effectively fueled by an increase in the need for science-based skincare. Product trends, such as multi-functional formulations, and moisturizers and serums, are contributing towards the segment’s growth. For instance, moisturizers along with serums have successfully captured almost 75% of category sales, with almost 15% to 25% of niacinamide concentrations, which is approaching an industrial standard.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

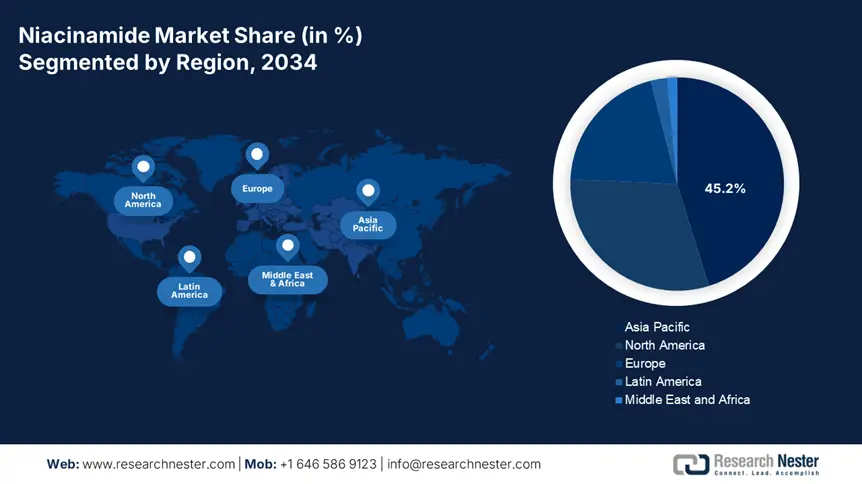

Niacinamide Market - Regional Analysis

APAC Market Insights

Asia Pacific in the niacinamide market is expected to be the dominant region, with the highest share of 45.2% by the end of 2034. The aspects of K-beauty influence, administrative reforms, epidemic in diabetes, and the aging population are major key drivers that are uplifting the overall market in the region. For instance, the presence of 145 million diabetic patients in China is fueling the pharmaceutical demand. Meanwhile, the PLI scheme in India has readily incentivized domestic API manufacturing, while South Korea’s USD 15.8 billion cosmetics export market is driving the demand for niacinamide serum, thus suitable for bolstering market exposure in the overall region.

The market in China is readily dominating the overall region, with an expected market share of 28.5% during the forecast period. This is effectively attributed to a surge in skincare demand as well as an increase in pharmaceutical API manufacturing. Besides, the country also accounts for 62% of the international niacinamide API outcome, leading to supply to the majority of markets, such as the U.S. and Europe. In addition, administrative spending has upsurged by 18.5% as of 2023 to cater to pellagra in rural locations and aid more than 1.8 million patients every year, thus creating an optimistic outlook for the market.

The niacinamide market in India is expected to grow at a rate of 8.2% during the projected timeline, which is highly driven by cost-effective skincare and generic drug production facilities. Besides, the government has made an allocation of USD 2.3 billion as of 2023, catering to over 21.5% growth over 10 years, to aid at least 2.8 million dermatology and diabetic patients. Meanwhile, the push for public health, development in OTC skincare, and success in the PLI scheme are critical developments that are fueling the market growth in the country.

North America Market Insights

North America in the niacinamide market is anticipated to be the fastest-growing region and grab an estimated 30.5% of the international market share by the end of 2034, along with a 7.8% growth rate, which is readily attributed to pharmaceutical and skincare demand. The U.S. is readily dominating the region, with a surge in regional sales, as well as Medicaid and Medicare coverage extension. Meanwhile, Canada is also witnessing an escalated integration across public health programs. Besides, administrative alignment, preventive healthcare, and clinical dermatology are other notable trends that are uplifting the overall market in the region.

The niacinamide market in the U.S. is expected to account for USD 3.9 billion in niacinamide sales as of 2024, with skincare catering to 45% and diabetes medications, constituting 30%, thereby resulting in the increasing demand. The existence of AHRQ studies, an upsurge in skincare, as well as Medicare expenditure, are other critical developments that are fueling the market demand in the region. For instance, there has been a surge in Medicare expenditure to USD 805 million, which is an increase of 18% over 5 years, for metabolic-based treatments. Meanwhile, there has been a 28% YoY upsurge in serums, along with 11.5% of niacinamide considered as the standard product in the country.

The market in Canada is also significantly growing at 7.3%, with an expected USD 485 million revenue by the end of 2034. The market’s upliftment in the country is centered on the basis of indigenous health, generic dominance, and public health incorporation. For instance, Ontario readily covers niacinamide for more than 200,500 diabetic patients every year. Besides, through generic dominance, there has been the availability of 48.5% of cheap products in comparison to branded alternative options. Meanwhile, an estimated 21.5% of the budget has increase for home-based accessibility to B3 therapies, thus suitable for market upliftment in the country.

North America Niacinamide trade and supply chain facilities (2022-2025) with verified government/industry sources:

|

Facility Type |

Location |

Key Data (2022-2025) |

|

API Production Plants |

Texas, U.S. |

58% of US niacinamide API output (2024) |

|

GMP Formulation Sites |

Ontario, Canada |

13 new Health Canada-approved lines (2023) |

|

Major Import Hubs |

Los Angeles, USA |

Handled 48% of Chinese niacinamide imports (2022) |

|

Distribution Centers |

New Jersey, USA |

26% faster logistics via FDA-tracked warehousing |

|

Research Facilities |

Quebec, Canada |

USD 127 million invested in green synthesis tech |

Sources: FDA, Health Canada, U.S. ITC, HHS, CIHI

Europe Market Insights

Europe in the niacinamide market is anticipated to hold a considerable share of 20.3% during the forecasted timeline, accounting for a valuation of €8.4 billion, with Germany catering 35.7%, France with 25.6%, and the UK with 20.6%. Besides, diabetes management, the existence of Europe health reforms, innovation in skincare, and aging demographics are other notable drivers uplifting the overall market in the region. For instance, almost 37% of the population in Germany is more than 60 years of age, and effectively utilizes niacinamide for metabolic health. Besides, brands in France, such as La Roche-Posay, effectively fuel 32.5% of premium serum sales, while health policies in the region have allocated €2.9 billion for boosting the market.

The market in Germany is deliberately dominating the region’s market share with 35.6% by the end of the forecast period, which is attributed to the existence of skincare industries and strong pharmaceutical infrastructure. Besides, the country increasingly manufactures almost 46% of the region’s niacinamide APIs, with the majority of centers in Leipzig and Frankfurt. Meanwhile, there has been an increase in the government expenditure, which has currently reached €4.1 billion as of 2024, further prioritizing dermatological and metabolic applications, thus suitable for market development in the country.

The niacinamide industry in France is expected to capture an estimated 25.9% of the region’s market share during the projected period, which is highly driven by government-based research and development, along with the existence of luxury skincare preferences. Besides, the country has generously made a provision of approximately 7.3% of its overall healthcare budget, accounting for € 1.5 billion as of 2023, for niacinamide, of which 32% has been allocated for premium serums comprising the ingredient. Meanwhile, K-beauty partnerships and collaborations, tax incentives, and cosmetics dominance are other key developments that are suitable for uplifting the market in the country.

Europe-based Government Funding for Niacinamide (2022-2025)

|

Country |

Policy/Initiative |

Funding/Impact (2022-2025) |

Launch Year |

|

France |

Innovation Santé 2030 Niacinamide Program |

€127 million for dermatology R&D |

2022 |

|

Reduced VAT (5.8%) for Medicated Niacinamide Skincare |

15.5% sales increase |

2023 |

|

|

Italy |

AIFA Therapeutic Plan for Metabolic Disorders |

€49 million for niacinamide-diabetes drugs |

2023 |

|

Farmaco Futuro API Production Grants |

€31 million for local niacinamide manufacturing |

2024 |

|

|

Spain |

Plan Farma Strategic Active Ingredients Initiative |

€23 million for niacinamide supply security |

2022 |

|

Andalusian Aging Health Program |

€18 million for geriatric niacinamide formulations |

2024 |

Source: Ministère de la Santé, HAS, AIFA, Ministero della Salute, AEMPS, Junta de Andalucía

Key Niacinamide Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is severely consolidated, with the presence of notable organizations, such as DSM-Firmenich, Lonza, and BASF, collectively accounting for 75% of the overall market share. This has been through vertical integration, along with technological superiority. Besides, investment, expansion, and partnership are a few key strategies that these market players have implemented to boost the overall market. For instance, Takeda entered into a strategic partnership with the Mayo Clinic to create niacinamide-diabetes combination medications, while the €250 million investment by BASF has been successful in catering to regional sustainability mandates.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Industry Focus |

Market Share (2024) |

|

BASF SE |

Germany |

Pharmaceutical-grade niacinamide APIs & cosmetic ingredients |

22.3% |

|

Lonza Group |

Switzerland |

High-purity niacinamide for nutraceuticals & injectables |

18.9% |

|

DSM-Firmenich |

Netherlands |

Niacinamide for functional foods & animal nutrition |

15.1% |

|

Jubilant Life Sciences |

India |

Cost-effective generic niacinamide APIs & formulations |

12.7% |

|

Evonik Industries |

Germany |

Sustainable niacinamide production for cosmetics & pharma |

10.3% |

|

Vertellus Holdings |

U.S. |

Specialty niacinamide for agriculture & industrial applications |

xx% |

|

Aarti Industries |

India |

Budget niacinamide powders for OTC supplements |

xx% |

|

Merck KGaA |

Germany |

Ultra-pure niacinamide for research & diagnostics |

xx% |

|

Lasons India |

India |

Niacinamide for topical dermatological formulations |

xx% |

|

Zhejiang Lanbo Biotechnology |

China |

Bulk niacinamide exports for global markets |

xx% |

|

Hefei TNJ Chemical |

China |

Competitive pricing for cosmetic-grade niacinamide |

xx% |

|

Brother Enterprises Holding |

China |

Niacinamide for haircare & sunscreens |

xx% |

|

Kyowa Hakko Bio Co., Ltd. |

U.S. (Subsidiary) |

Fermentation-derived niacinamide for premium skincare |

xx% |

|

Hunan Zhonglan Chemical |

China |

Industrial-grade niacinamide for corrosion inhibition |

xx% |

|

Celtic Chemicals |

UK |

Niacinamide for European pharmaceutical distributors |

xx% |

Sources: EC, Swissmedic, EMA, CDSCO, BMWi, FDA, DPIIT, BMG, NHP, NMPA, MOFCOM, MIIT, MHRA, MHLW, AMED, PDMA, METI,

Below are the areas covered for each company in the niacinamide market:

Recent Developments

- In May 2024, Lonza Group successfully extended its niacinamide API manufacturing capacity by almost 40.2% at its Visp facility, by investing CHF 128 million to ensure the increasing demand for injectable diabetes treatments.

- In March 2024, BASF SE unveiled the world’s first-ever carbon-neutral niacinamide, Virtuolin NC, at the In-Cosmetics Global trade display, which has been suitable for diminishing emissions by almost 65%.

- Report ID: 7941

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Niacinamide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert