Next-generation Sequencing Informatics Market Outlook:

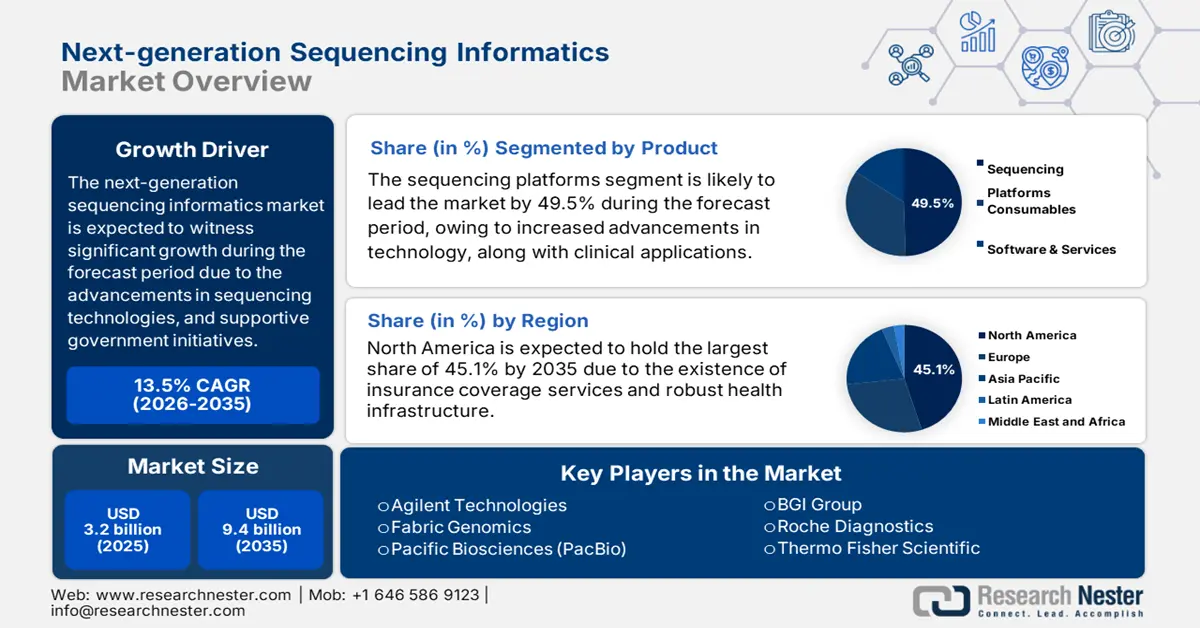

Next-generation Sequencing Informatics Market size was USD 3.2 billion in 2025 and is expected to reach USD 9.4 billion by the end of 2035, growing at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of next-generation sequencing informatics is assessed at USD 3.6 billion.

The worldwide patient pool in the market is gradually extending, attributed to a rise in cancer prevalence as well as chronic genetic diseases. In this regard, the World Health Organization (WHO) has estimated that there will be almost 35 million new cases of cancer yearly by the end of 2050. Besides, government-backed strategies, including the NIH’s All of Us Program, have successfully escalated the market adoption. Moreover, in terms of economic indicators, the producer price index (PPI) has reflected surging expenses in sequencing consumables and bioinformatics software licensing. Likewise, the consumer price index (CPI) is highly fueling the need for prenatal and oncology evaluations. Therefore, all these factors are responsible for uplifting the market across nations.

The market is in a state of transformation, shaped by key forces from the product side of the technology. Assimilation of next-generation sequencing technology. The application of artificial intelligence and machine learning to improve existing products and develop new ones has improved data analysis capabilities with real-time processing across a range of applications. National government initiatives in countries such as China, India, and Germany represent strong policy and funding support for sequencing and related technologies. Collaborative platforms that provide next-generation data-sharing capabilities are appearing in the NGS market. Emerging clinical applications of genomics for disease diagnosis and precision medicine are driving demand for advanced informatics capabilities. In addition to software innovations, hardware approaches are enhancing genomic data processing efficiencies and energy consumption.

Key Next generation Sequencing Informatics Market Insights Summary:

Regional Highlights:

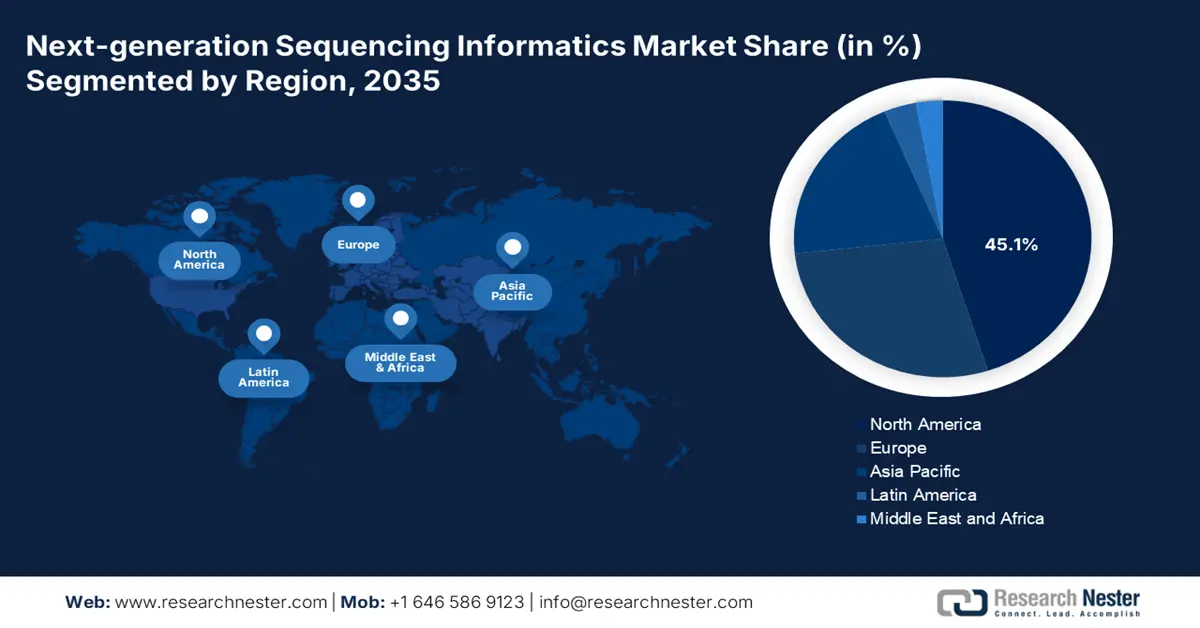

- North America in the Next-generation Sequencing Informatics Market is projected to command the largest 45.1% share by 2035, driven by robust government funding and the presence of advanced healthcare infrastructure.

- Asia Pacific is expected to hold a 20.3% share and register a growth rate of 15.2% between 2026 and 2035, owing to precision medicine initiatives and rising cancer prevalence across the region.

Segment Insights:

- The sequencing platforms segment in the Next-generation Sequencing Informatics Market is anticipated to capture a dominant 49.5% share by 2035, propelled by extended clinical applications and technological progressions.

- The oncology diagnostics segment is projected to account for 38.7% share by 2035, supported by the rising global cancer burden and increasing precision in medicines.

Key Growth Trends:

- Advancements in sequencing technologies

- Integration of AI and Machine Learning in data analysis

Major Challenges:

- Gaps in compensation and expenses

- Complicated acceptances and administrative delays

Key Players: Illumina, Company Overview, Business Strategy, Key Product Offerings, Financial Performance, Key Performance Indicators, Risk Analysis, Recent Development, Regional Presence, SWOT Analysis, Thermo Fisher Scientific, Roche Diagnostics, BGI Group, Oxford Nanopore Technologies, QIAGEN, Agilent Technologies, Pacific Biosciences (PacBio), PerkinElmer, Fabric Genomics, DNAnexus, Sophia Genetics, Macrogen, MedGenome, Bio-Rad Laboratories.

Global Next generation Sequencing Informatics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 9.4 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, Brazil

Last updated on : 12 September, 2025

Next-generation Sequencing Informatics Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in sequencing technologies: Next-generation sequencing (NGS) technologies are evolving and accelerating the speed at which sequencing can be performed with the introduction of small. These new and/or improved sequencing platforms facilitate rapid and affordable sequencing and bring NGS within reach of smaller labs and hospitals that previously relied on outsourcing. The faster and more accurate result provided by NGS improves the turnaround time for clinical and research applications. Generating and validating better accuracy is increasing genomic sequencing demand and creating a superior user experience for researchers.

- Integration of AI and Machine Learning in data analysis: The role of AI and ML in NGS data analysis provides an increasingly important strategic tool to increase accuracy and reduce NGS data interpretation time. AI and ML algorithms can identify large and complex genetic variants (mutations) as well as numerous patterns or biomarkers in genomics that would not typically surface in a traditional analysis. This dramatically enhances the prospect for providing personalized medicine, whereby treatments and preventative measures can be administered based on a person’s genomic footprint. The use of AI and ML within an informatics platform also enables the data mining of large volumes of data and more sophisticated predictive analytics, which represents an important advance for genomics research or clinical decision-making.

- Supportive government initiatives and reimbursement policies: Many countries now have government-based programs that promote next-generation sequencing (NGS) through funding, grants, and reimbursement. For instance, with Medicare putting forward huge budgets for oncological testing based on NGS, these policies now encourage the clinical adoption of sequencing-based technologies. Thus, with reduced financial barriers for the healthcare provider and their patient, there is now increased usage of NGS in the diagnostic and therapeutic platforms. Overall, there is a spinning off of demand for data analysis and data management solutions in the informatics market driven by the substantial need to analyze clinical sequencing data.

Challenges

- Gaps in compensation and expenses: The aspect of high expenditure in the next-generation sequencing informatics market has created several integration risks, especially in government-aided healthcare systems. Likewise, the IQWiG in Germany has imposed stringent price caps on NGS-based products as of 2023, lowering manufacturer profitability and not encouraging advancements. Besides, emerging economies are experiencing obstacles, thus negatively impacting the overall market.

- Complicated acceptances and administrative delays: The market is undergoing prolonged and unreliable regulatory pathways across global economies. These delays are usually intensified by diverse regional standards, such as Europe’s IVDR requires additional clinical proof in comparison to the U.S. frameworks. Besides, small-scale organizations that are devoid of appropriate resources for multi-country trials frequently abandon extension plans, thus causing a hindrance in the overall market.

Annual number of new cancers diagnoses by age group in the United States from 2003 to 2022

|

Year |

0-14 years |

15-39 years |

40-64 years |

65-74 years |

75+ years |

Total Diagnoses (Approx.) |

|

2003 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,500,000 |

|

2005 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,600,000 |

|

2007 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,700,000 |

|

2009 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,750,000 |

|

2011 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,800,000 |

|

2013 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,850,000 |

|

2015 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~1,950,000 |

|

2017 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~2,000,000 |

|

2019 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~2,100,000 |

|

2020 |

Low (decline noted) |

Low |

Moderate |

Moderate |

Moderate |

~1,900,000 (dip due to COVID) |

|

2021 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~2,100,000 |

|

2022 |

Low |

Low |

Moderate |

Moderate |

Moderate |

~2,100,000 |

Source: U.S. Cancer Statistics

Next-generation Sequencing Informatics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 9.4 billion |

|

Regional Scope |

|

Next-generation Sequencing Informatics Market Segmentation:

Product Segment Analysis

Based on the product, the sequencing platforms segment in the next-generation sequencing informatics market is projected to hold the largest share of 49.5% by the end of 2035. The segment’s growth is highly driven by extended clinical applications and technological progressions. The introduction of ultra-high-throughput systems, including Illumina's NovaSeq X, is escalating the implementation. Sequencing platforms are products of great intrinsic value. Based on their cost, they will contribute a greater share of the total revenue-based market estimations. The increasing demand for rapid, high-throughput sequencing in research and clinical settings will support strong system sales and upgrades.

Application Segment Analysis

Based on the application, the oncology diagnostics segment in the next-generation sequencing informatics market is expected to hold the second-largest share of 38.7% during the forecast duration. The segment’s upliftment is attributed to a surge in the international cancer burden as well as precision in medicines. Besides, cost-effectiveness and administrative approvals are other key drivers that are responsible for positively impacting the overall segment. Cancer is one of the leading causes of death globally, with millions of new cases diagnosed each year. Along with the burden of cancer growing, there is a greater need for accurate, early, and personalized diagnostic tools. NGS-based oncology diagnostics help determine genetic mutations causing cancer and leads to targeted therapies and better patient outcomes, which fuels strong market demand.

End User Segment Analysis

Based on the end user, the pharma and biotech companies segment in the next-generation sequencing informatics market is anticipated to hold the third-largest market share of 28.6% by the end of the forecast timeline. The segment’s development is effectively driven by precision medicine strategies, along with the aspect of drug development. Pharmaceutical and biotech companies mainly leverage NGS informatics within target identification, biomarker discovery, and companion diagnostics. While this is undeniably a high-value use case, the volume of use is much smaller than research institutes and diagnostic laboratories operating thousands of samples routinely, which limits their overall market share. However, all of their applications are high value.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Application |

|

|

End user |

|

|

Workflow |

|

|

Delivery Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next-generation Sequencing Informatics Market - Regional Analysis

North America Market Insights

North America in the next-generation sequencing informatics market is considered the dominant region, with an expected highest share of 45.1% by the end of 2035. The market’s growth in the region is highly fueled by effective government-based funding as well as the presence of strong healthcare facilities. Besides, liquid biopsy integration and AI-based NGS platforms are other notable trends that are positively impacting the market in the overall region. As the leading region in cancer research and treatment, North America has experienced significant clinical adoption of NGS-based diagnostics. The majority of NGS-based tests have been approved by the U.S. FDA. In addition, NGS is increasingly adopted in personalized medicine clinical settings, which will contribute directly to bioinformatics use in helpful new ways. This clinical use is primarily responsible for driving bioinformatics tool growth to enable the interpretation of sequencing results in healthcare.

The next-generation sequencing informatics market in the U.S. has expanded rapidly due technological advancements, expanding clinical applications, and institutional backing. The presence of numerous leading global sequencing technology and bioinformatics companies in the U.S. will continue to spur growth through innovation. The successful introduction of NGS into the broader context of personalized medicine and subsequent clinical demand for capable informatics to handle and analyze large genomic datasets will continue to drive the U.S. NGS informatics market. Finally, many facets in the clinical area have made it easy to incorporate NGS informatics and a contextualized form directly into clinician work flows. As a result, the U.S. market is flourishing and will continue to grow to remain the predominant global leader in genomics and bioinformatics.

The market for next-generation sequencing informatics in Canada is expanding at 10.5%, primarily due to improved investment in genomics research and innovation in health care. Canada has a very strong network of important research institutions and government-supported initiatives to spread the adoption of NGS technologies across many disciplines. Both public and private funders will support the introduction and use of advanced bioinformatics and software tools to fit researchers' and clinicians' needs for analyzing genomic data. As indicated by their funding initiatives, funders such as the Canadian Institutes of Health Research (CIHR) have provided funding to develop and adopt advanced bioinformatics to be able to access and analyze complex genomic data.

APAC Market Insights

Asia Pacific in the next-generation sequencing informatics market is considered the fastest-growing region, with a share of 20.3% and a growth rate of 15.2% between 2026 and 2035, which is highly attributed to government-based precision medicine, along with increasing cancer prevalence initiatives. As governments in the region promote large genome projects and further personalized healthcare initiatives, an environment is being created for NGS to flourish in the region. There is also an increasing burden of chronic diseases and cancer, which is increasing the demand for advanced diagnostic tools. The region has a large population that is genetically diverse and, therefore, has a strong research and biopharma presence. Evidence suggests that both clinical and research applications of NGS informatics are accelerating in the Asia Pacific region.

The Asia Pacific NGS informatics market is being significantly propelled by China with significant investments in genomics and biotechnology occurring under national programs such as China's Precision Medicine Initiative. Many of the major sequencing companies, including BGI Genomics, are opening new facilities and growing internationally. The large population of China and government-supported reforms to provide extensive changes to medical care means strong demand for genetic testing, cancer diagnosis, and personalized medicine. All of these factors, along with advancements in AI application to genomic data, is facilitating the rapid growth of NGS informatics capabilities.

The value of the sequencing informatics market in India is going to increase at a compound annual growth rate of 18.5% due to a growing genomics research infrastructure and a growing interest in personalized medicine genomics research initiatives, such as the Genome India Project, and partnerships and collaborations between public research institutes and commercial biotechnology companies. The collaborations and partnerships are increasing demand for sequencing informatics and data analysis solutions. India has a diversity of bioinformaticians and IT professionals that can help to develop and implement informatic tools. As sequencing prices come down and ease of access increases, we can expect the clinical applications of NGS to grow rapidly.

Europe Market Insights

Europe remains steadily, and significantly, growing its NGS informatics market with established healthcare systems, a strong research infrastructure, and a growing interest in precision medicine. The European Union and national governments are backing the large-scale genomic initiatives to direct genomics to personalize healthcare. Moreover, the increasing prevalence of cancer and rare diseases is enhancing the growth of clinical diagnostics adoption of NGS. Regulatory support, multi-university, biotech, and clinical laboratory collaborations, and increased investment in digital health technologies are all fueling demand for bioinformatics across the region.

Germany is a strong leader in the growth of NGS informatics in Europe, owing in part to its developed healthcare system, strong bioinformatics industry. Specific national initiatives such as genomDE are aimed at implementing genomic medicine across Germany, fuelling massive demand for sequencing data analysis and management tools. German universities and biotechnology companies are also large contributors to the cancer genomics and rare disease space, both of which are heavily reliant on NGS genomics and bioinformatics analyses. Together with public investment and support, while they explore innovative applications of genomics in a clinical context, Germany is a powerhouse of NGS informatics in Europe.

France has also been very active in developing the European NGS informatics market through several key initiatives aimed at integrating genomics into everyday healthcare. The current ecosystem in France includes national investments across sequencing infrastructure as well as bioinformatics capabilities to help support personalized medicine at the national level. French research institutes are also contributing important work around cancer, neurological conditions, and hereditary diseases that depend on the use of high-throughput sequencing data and subsequent complex analysis. All of this, combined with existing initiatives to promote policy and research-led use of NGS informatics tools, is meaningfully accelerating the use of NGS informatics within academic and clinical settings across France.

Key Next-generation Sequencing Informatics Market Players:

- Illumina

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific

- Roche Diagnostics

- BGI Group

- Oxford Nanopore Technologies

- QIAGEN

- Agilent Technologies

- Pacific Biosciences (PacBio)

- PerkinElmer

- Fabric Genomics

- DNAnexus

- Sophia Genetics

- Macrogen

- MedGenome

- Bio-Rad Laboratories

The next-generation sequencing informatics sector is severely united with the presence of organizations, including Illumina, accounting for 35.8% of the market share, along with Thermo Fisher, accounting for 22.5%, collectively dominating through proprietary platforms. Additionally, Roche constitutes 13.5% and BGI caters to 9.5% of the overall market share, and they jointly compete on total expenses. Besides, localized manufacturing, portable sequencing, and AI implementation are tactical strategies that are responsible for boosting the market internationally.

Here is a list of key players operating in the global market:

Recent Developments

- In February 2023, Illumina unveiled the NovaSeq X Plus, which is a high-throughput sequencer with USD 240 per genome expense that effectively targets population-based scale projects, such as the NIH’s All of Us Program.

- In August 2025, Thermo Fisher Scientific received approval from the U.S. Food and Drug Administration (FDA) or its Oncomine Dx Target Test. The test enables pathologists and physicians to determine whether human epidermal growth factor receptor 2 (HER2/ERBB2) tyrosine kinase domain (TKD) activating mutations are present in non-small cell lung cancer (NSCLC) tumours.

- Report ID: 7939

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Next generation Sequencing Informatics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.