Next Generation Computing Market Outlook:

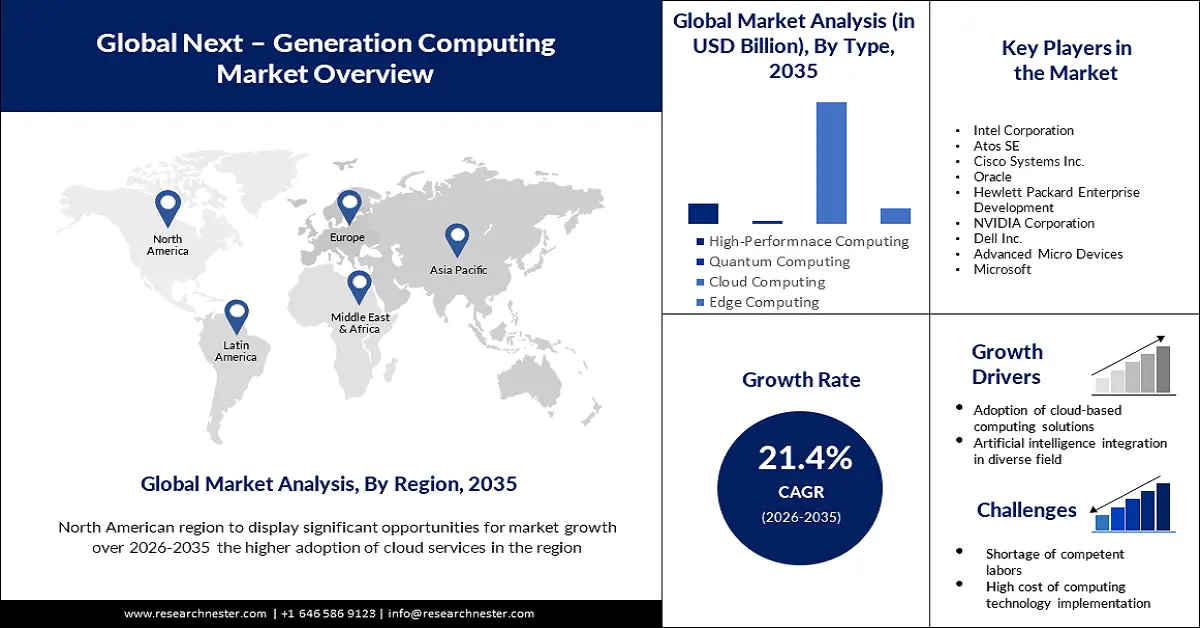

Next Generation Computing Market size was valued at USD 222.53 billion in 2025 and is set to exceed USD 1.55 trillion by 2035, registering over 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of next generation computing is estimated at USD 265.39 billion.

The Internet of Things, the newest technological advancement, produces vast volumes of data from connected gadgets like virtual entertainment, GPS beacons, and home automation systems. Next generation computing is becoming more and more popular as a means of managing and storing the massive volumes of data produced by these channels. It creates copious amounts of sensitive data and piques interest in next generation computing. It includes anticipating hardware breakdowns, measuring temperatures, and enabling autonomous driving. By 2023, there will be about 15.14 billion IoT devices. For example, the Exascale Computing Project (ECP) of the U.S. Department of Energy (DOE) has brought together a multidisciplinary team of computing experts over the past seven years to enhance next generation computer architectures and transform scientific modeling.

In addition to these, using information gathered about how systems work, artificial intelligence AI and machine learning ML can be utilized to assist and create autonomous behavior. To optimize resource management, for example, machine learning techniques can be used to identify patterns in workloads. Furthermore, ML-based dynamic system identification methods—such as recurrent neural networks, which an autonomous manager can adaptively activate to accomplish self-learning—are employed to lower model uncertainty. AI-based autonomic computing's low total cost of ownership is its primary benefit. It drastically cuts down on maintenance work. AI-supported automated IT systems improve system stability, reduce implementation and maintenance costs and time, and contribute to rising demand during the predicted period.

Key Next Generation Computing Market Insights Summary:

Regional Highlights:

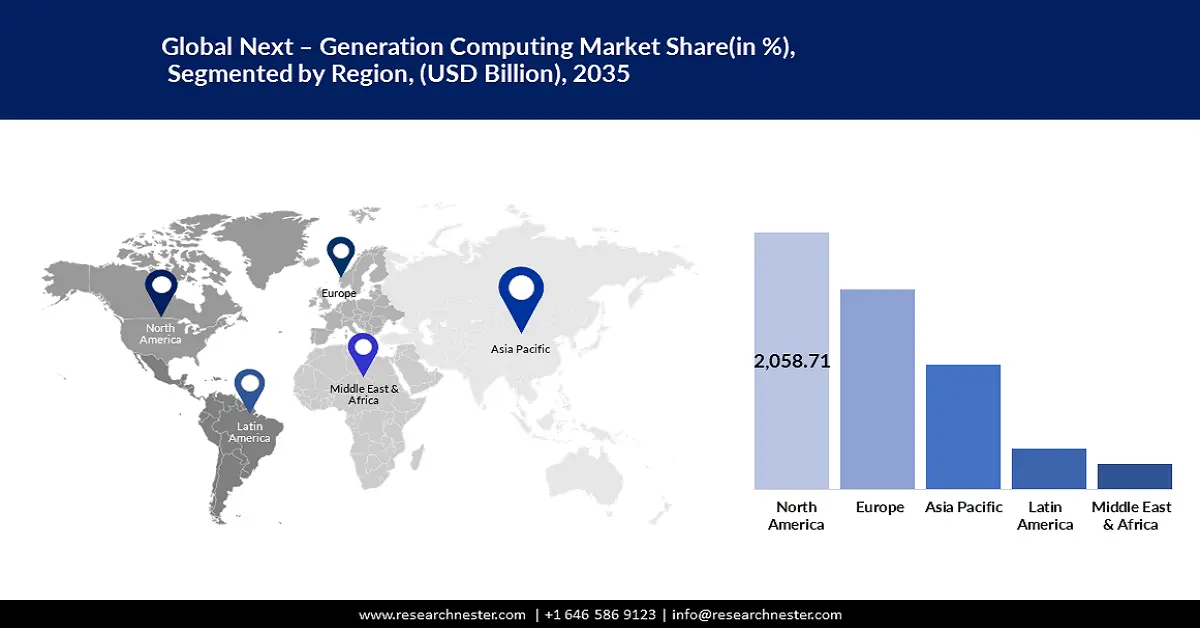

- North America’s next generation computing market will hold over 37% share by 2035, fueled by early adoption and hyperscale server growth.

- Europe’s market will secure 29% share by 2035, driven by the growing reliance on mobile and web-based computing.

Segment Insights:

- The cloud computing segment in the next generation computing market is expected to hold a 74% share by 2035, fueled by automation, remote work, cost-cutting, and the demand for cloud-based solutions.

- The on-premise deployment (next gen computing) segment in the next generation computing market is anticipated to achieve a 54% share by 2035, influenced by sectors prioritizing on-premise solutions for data security and regulatory compliance.

Key Growth Trends:

- Increased Spending on Next Generation Computer Technology

- Artificial Intelligence's Integration in Diverse Industries

Major Challenges:

- High Cost of Computing Technology Implementation

- The shortage of competent labour is another issue the sector is dealing with

Key Players: Oracle, Hewlett Packard Enterprise Development, NVIDIA Corporation, Dell Inc., Advanced Micro Devices, Microsoft, ADLINK Technologies Inc., Qualcomm, BOSCH, SAP, Google, NEC Corporation, Fujitsu, NTT Data.

Global Next Generation Computing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 222.53 billion

- 2026 Market Size: USD 265.39 billion

- Projected Market Size: USD 1.55 trillion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 11 September, 2025

Next Generation Computing Market Growth Drivers and Challenges:

Growth Drivers

-

Increased Spending on Next Generation Computer Technology- The growth of the computer environment is aided by growing government investments in small and medium-sized businesses for the purposes of research, development, and adoption of cutting-edge technologies. The German government announced in April 2020 a USD 4,316 support programme to assist small and medium-sized businesses in coping with the coronavirus pandemic's economic downturn. The next generation computing market is expected to rise due to the growing acceptance of more sophisticated technologies like high-performance computing and quantum technologies, as well as the ongoing potential developments noted in important industries. Major drivers propelling the market expansion are also the ongoing investments made by government agencies and business heavyweights in startups developing this technology. The US National Science Foundation committed more than USD 37 million in April 2022 to the creation of an intelligent, robust, and dependable next generation, or NextG, network. This public-private partnership expedites the translation of basic research findings into new technologies that have the potential to revolutionize the information technology and telecommunications industries in the United States.

-

Artificial Intelligence's Integration in Diverse Industries- The next generation computing industry is expected to grow at a substantially faster rate due to the increasing integration of artificial intelligence (AI) across businesses and organizations. AI is used to automate operations, obtain insights into data, and improve decision-making. The demand for strong computer systems to support AI is growing as it gets more complex. Furthermore, an explosion of data has resulted from the spread of connected devices like smart wearable devices, smart homes, and industrial sensors. This could increase the demand for high-performance computing systems to process the data and draw conclusions from it. Furthermore, as more businesses shift their operations to the cloud, there is an increasing need for strong computing systems to handle complicated computations requiring a lot of processing power, like financial modeling, scientific simulations, and weather forecasting.

- Adoption of Cloud-Based Computing Solutions- Large businesses worldwide are adopting cloud-based computing solutions at an increasing rate due to their many advantages, which include reduced costs, increased security, increased mobility, enhanced collaboration, ease of disaster recovery, reduced loss, and automated software upgrades. All end users, even small and medium-sized businesses, are becoming more aware of it, and other players are spearheading the release of next generation cloud-based computing solutions. Furthermore, companies in both developed and emerging nations are utilizing cloud-based software thanks to government expenditures in ICT infrastructure, which is fueling the expansion of cloud-based computing solutions.

Challenges

-

High Cost of Computing Technology Implementation- Computer technology implementation is expensive, particularly for small and medium-sized enterprises. Adoption is severely hampered by implementation expenses, which also restrict market expansion. Furthermore, as businesses might have to spend money on new infrastructure to support these technologies, market growth is anticipated as a result of their adoption. Market expansion may be constrained by the complexity and expense of complying with these rules.

-

The shortage of competent labour is another issue the sector is dealing with.

- Stability and error correction concerns limit the global market share of next generation computing.

Next Generation Computing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 222.53 billion |

|

Forecast Year Market Size (2035) |

USD 1.55 trillion |

|

Regional Scope |

|

Next Generation Computing Market Segmentation:

Type Segment Analysis

The cloud computing segment share in the next generation computing market is expected to reach 74% by 2035. Increased automation and agility, better customer experiences, the desire to cut costs and boost return on investment, the growing popularity of remote work, and the necessity for cloud-based business continuity solutions and services are the main factors driving the cloud computing industry. Additionally, using cloud computing services and cloud-based apps that promote greater levels of flexibility and productivity benefits both organizations and people. The cloud houses 60% of all corporate data worldwide. Global energy consumption is accounted for by cloud data centres at 3%. The annual revenue from cloud infrastructure services is USD 178 billion. Ninety percent of major businesses have implemented a multi-cloud infrastructure. Scalable, quantifiable, and centrally managed on-demand computing infrastructures make sense and match the needs of a variety of businesses, from start-ups to major multinationals. The next wave of cloud computing technology usually does away with the necessity for people to handle cross-border transactions. These systems can be configured as smart contracts or payments, which help fulfil specific requirements and boost demand over the market's projected period.

Deployment Segment Analysis

Next generation computing market share from the on-premise segment is expected to cross 54% by 2035. The growth of the on-premise deployment segment is attributed to grow as it is becoming more and more popular in the next generation computing market. For example, sectors like finance, healthcare, and government that handle sensitive data frequently give priority to on-premise solutions in order to maintain direct control over data security and regulatory compliance. Moreover, on-premise installations may be preferred for applications that require exceptionally low latency, such as real-time processing in manufacturing or vital systems, in order to reduce communication delays connected with cloud-based solutions.

Our in-depth analysis of the global next generation computing market includes the following segments:

|

Component |

|

|

Type |

|

|

Deployment |

|

|

Organization Size |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next Generation Computing Market Regional Analysis:

North American Market Insight

The next generation computing market in North America is projected to be the largest with revenue share of 37% by the end of 2035. One of the first nations to adopt the breakthroughs in next generation computing is North America. There are many foreign organizations and customers in the United States. In a same vein, hyperscale server farms which are extensively employed by informal business providers and distributed computing companies are growing in popularity. The largest search service in North America is supported by these factors. In 2023, the data center industry is expected to generate USD 105.90 billion in revenue. This will raise market demand during the forecast period.

Europe Market Insight

The Europe next generation computing market is estimated to be the second-largest with over 29% share by the end of 2035. With time, computing technology has advanced to the point that mobile computers that are web-based and "almost always available" exist in the region Hardware will soon become a commodity, and the data it produces and the software that powers it will be what give it worth.

Next Generation Computing Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intel Corporation

- Atos SE

- Cisco Systems Inc.

- Oracle

- Hewlett Packard Enterprise Development

- NVIDIA Corporation

- Dell Inc.

- Advanced Micro Devices

- Microsoft

- ADLINK Technologies Inc.

- Qualcomm

- BOSCH

- SAP

- NEC Corporation

- Fujitsu

- NTT Data

- Rakuten Group Inc.

- Okaya Electronics Corporation

Recent Developments

- Intel announced a strategic collaboration agreement with Ericsson to utilize Intel’s 18A process and manufacturing technology for Ericsson’s future next generation optimized 5G infrastructure. As part of the agreement, Intel will manufacture custom 5G SoCs for Ericsson to create highly differentiated leadership products for future 5G infrastructure.

- IBM introduced the new IBM Storage Scale System 6000, a cloud-scale global data platform to meet today’s data-intensive and AI workload demands and the latest offering in the IBM Storage for Data and AI portfolio. Further, it provides up to 7M IOPs and up to 256GB/s throughput for read-only workloads per system in a 4U footprint. read-only.

- Report ID: 5458

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Next Generation Computing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.