Neurorehabilitation Devices Market Outlook:

Neurorehabilitation Devices Market size was over USD 2.35 billion in 2025 and is anticipated to cross USD 8.19 billion by 2035, witnessing more than 13.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of neurorehabilitation devices is assessed at USD 2.63 billion.

The global neurorehabilitation devices market is experiencing significant growth, driven by the increasing burden of neurological disorders such as traumatic brain injury, Parkinson’s disease, stroke, and spinal cord injuries. In addition, the rising awareness about effective treatment procedures among patients and healthcare professionals further inflates the market demand. As per a March 2024 WHO report, over 3 billion people were affected by neurological disorders across the world, being the leading cause of disability, premature death accounting for 3% of all deaths, and 11% of total disability-adjusted life years (DALYs). This upsurge in disorders requires efficient and accessible neurological devices, reinforcing appreciable growth opportunities by 2035.

In addition, ongoing technological advancements such as robotics, virtual reality, and brain-computer interfaces, are enhancing patient outcomes with substantial recovery values. For instance, in February 2025, Subsence Inc. raised USD 17 million in seed funding to advance non-surgical and nanoparticle-based brain-computer interface (BCI) technology. The initiative aims to enhance brain connectivity using nanoparticles that bind with receptors in the brain. These factors are illustrative of the advancements and present an imperative case for targeted intervention toward betterment in the brain health status of the affected population.

Key Neurorehabilitation Devices Market Insights Summary:

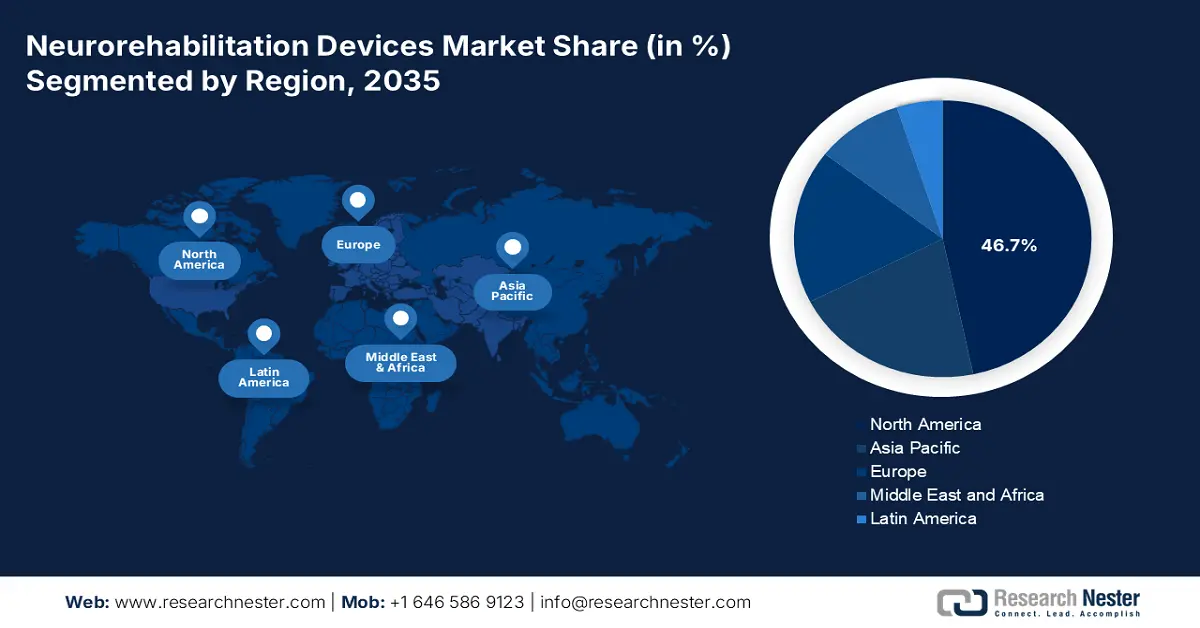

Regional Highlights:

- North America dominates the neurorehabilitation devices market with a 46.7% share, driven by advanced healthcare infrastructure and rising neurological disorders, ensuring robust growth through 2035.

- Asia Pacific's Neurorehabilitation Devices Market is set for lucrative growth from 2026–2035, propelled by rapid healthcare infrastructure development and R&D efforts.

Segment Insights:

- The Neurorobotics segment is expected to grow at a considerable rate from 2026 to 2035, influenced by its ability to enhance patient rehabilitation outcomes.

- The Stroke segment of the Neurorehabilitation Devices Market is anticipated to achieve a 52.50% share from 2026 to 2035, fueled by improved movement recovery outcomes and increased funding support.

Key Growth Trends:

- Cutting-edge technological breakthroughs

- Rising instances of brain-degenerative concerns

Major Challenges:

- High cost of the equipment

- Shortage of skilled professionals

- Key Players: Biometrics Ltd, Bioness Inc., Ectron Limited, Ekso Bionics, Abbott, and more.

Global Neurorehabilitation Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.35 billion

- 2026 Market Size: USD 2.63 billion

- Projected Market Size: USD 8.19 billion by 2035

- Growth Forecasts: 13.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Neurorehabilitation Devices Market Growth Drivers and Challenges:

Growth Drivers

- Cutting-edge technological breakthroughs: The major driver of the neurorehabilitation devices market is the latest and exclusive technologies that aid brain monitoring and evaluation. For instance, in December 2023, Kandu Health, Inc. announced clinical evidence from its post-acute stroke care program, reporting a 4% 30-day and 10% 90-day readmission rate, which is less than half of typical rates. These strong outcomes emphasize the rising adoption of technological advancements with an increased focus on long-term stroke patient outcomes.

- Rising instances of brain-degenerative concerns: The principal driver for the market is the rising burden of disorders such as Parkinson’s disease. These conditions in severe cases lead to cognitive decline, necessitating long-term rehabilitation. As per the August 2023 WHO report, 8.5 million people are diagnosed with Parkinson’s disease, with 5.8 million people having disability adjusted life years. It further stated that rehabilitation can be highly helpful in managing the condition. Hence, they fuel the market growth through catering to the ever-increasing interest in the effective treatment of such neurodegenerative conditions.

Challenges

- High cost of the equipment: The main bottleneck in the market is the rising costs of advanced rehabilitation devices. The cost is further exacerbated by devices such as robotic exoskeletons, brain-computer interfaces, and AI-based systems, which require significant investment for procurement and maintenance. This lack of affordability can lead to financial burden, especially in developing countries, resulting in a huge number of the population remaining untreated. In addition, budget constraints in brain-related issues also diminish market growth and awareness worldwide.

- Shortage of skilled professionals: The major limiting factor in the market is the lack of skilled professionals who are trained to operate and manage neurorehabilitation technologies. Mostly, the usage of complex devices requires adequate knowledge of neurology and robotics, which creates a barrier in clinical settings. Thus, some people who require proper attention do not access these due to such an implementation deterrent, not only locking people out from full and effective care but further accentuating improper treatment which widens disparities in health in communities.

Neurorehabilitation Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.3% |

|

Base Year Market Size (2025) |

USD 2.35 billion |

|

Forecast Year Market Size (2035) |

USD 8.19 billion |

|

Regional Scope |

|

Neurorehabilitation Devices Market Segmentation:

Indication (Stroke, Multiple Sclerosis, Parkinson’s Disease, Cerebral Palsy)

Based on the indication, the stroke segment is likely to hold more than 52.5% neurorehabilitation devices market share by 2035. The dominance is attributable to the positive outcomes such as movement impairment among stroke patients, which further inspires global leaders to enhance their product portfolio. In April 2025, Kandu Health, Inc. and Neurolutions, Inc. announced their merger formation, that is, Kandu, Inc., aiming for enhanced stroke recovery with BCI technology and personalized telehealth services. It further stated that the company secured USD 30 million from Ally Bridge Group and AMED Ventures to support commercialization and provide stroke care accessible to patients, further boosting market growth.

Product (Neurorobotics, Brain-Computer Interface, Wearable Devices, Non-invasive Stimulators)

Based on the product, the neuro-robotics segment is projected to grow at a considerable rate in the neurorehabilitation devices market during the forecast period. The dominance is attributable to the capabilities in enhancing patient recovery outcomes. For instance, in January 2025, NEURA Robotics announced that it had secured €120 million (USD 131 million) in series B funding to advance its cognitive and humanoid robotics innovations, which was led by Lingotto Investment Management. Hence, such rising investments underscore the growing demand for neurorobotics, particularly in rehabilitation, which is proven to be helpful.

Our in-depth analysis of the global market includes the following segments:

|

Indication |

|

|

Product |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neurorehabilitation Devices Market Regional Analysis:

North America Market Statistics

North America's in neurorehabilitation devices market is expected to dominate around 46.7% revenue share by the end of 2035. The region benefits from an increased geriatric population diagnosed with neurological disorders and advanced healthcare infrastructure, necessitating the devices. For instance, in June 2021, Neuros Medical, Inc. announced that it had received a breakthrough device designation for its Novel Altius, which is a high-frequency nerve block system for the management of chronic pain in the lower limb of adult amputees. This trend has heightened awareness among both healthcare providers and patients about the need to address neurological disorders as a critical health issue.

The U.S. market is recounting extraordinary growth prospects leading to increased healthcare spending due to the increasing instances of neurological disorders. In April 2021, the U.S. FDA announced that it authorized the marketing of Neurolutions Inc.’s IpsiHand Upper Extremity Rehabilitation System, which is a brain-computer interface device that assists in rehabilitation for stroke patients. Therefore, with such increased marketing approvals and the presence of key market players, the market will experience significant growth opportunities in the country during the forecast period.

The market in Canada is witnessing significant growth due to the growing instances of brain-associated disorders, in addition to the country’s support to improve research and development with government-backed funding. For instance, in May 2024, the Government of Canada allocated USD 80 million over four years to support the Brain Canada Foundation in conducting research activities for the improvement of brain health. Hence, with such great support from the government aiming for better patient outcomes, the country’s market will expand more.

Asia Pacific Market Analysis

The neurorehabilitation devices market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline due to ongoing advancements in the region’s healthcare infrastructure. Global players are increasingly finding a place for neurorehabilitation devices within their research activities, which has resulted in a context that encourages developing effective equipment to improve quality of life. Consequently, the need for proper brain health encompassing both the psychological and physiological aspects has become more prominent in this region.

The market in India is expecting substantial growth owing to accelerating urbanization and the global leaders establishing their footprint in the country. The strong demand for the devices across the country’s vast landscape has encouraged the key players the launch activities. For instance, in February 2023, Lupin Limited launched Atharv Ability, a world-class, state-of-the-art neuro-rehabilitation center in Mumbai. This marks the first robotic and computer-assisted center with substantial technologies included. These initiatives from various firms enhance competition in the market with steady progression.

The market in China is gaining traction due to growing marketing approvals and companies with a collective goal of improving brain health quality through their inventions. In November 2021, Suzhou MicroPort RehabTech Co., Ltd. announced that its RehabTech TherMotion Cryo-Thermo Compression Device has been approved for marketing in the country, which is to be indicated for musculoskeletal rehabilitation. With such exclusive marketing approvals and holistic treatment procedures, the industry will showcase lucrative growth opportunities in the forecast timeline.

Key Neurorehabilitation Devices Market Players:

- Biometrics Ltd

- Bioness Inc.

- Ectron Limited

- Ekso Bionics

- Abbott

- NEURO REHAB VR

- Rex Bionics Ltd

- Subsence Inc.

- Kandu Health, Inc.

- ReWalks Robotics

- Kinova Inc.

- Tyromotion GmbH

- Helius Medical Technologies

- Reha Technology AG

- Neuros Medical, Inc

- Lupin Limited

- Medtronic

- Rapid Medical

- Suzhou MicroPort RehabTech Co., Ltd.

- Neurolutions, Inc

- NEURA Robotics

- ReShape Lifesciences

- Saebo, Inc.

The company’s landscape in the neurorehabilitation devices market is rapidly evolving, mostly due to the growing advancements to enhance the treatment procedures and reduce side effects. This encouraged the global firms to launch more of such devices across the world to meet the market demand. For instance, in May 2024, Rapid Medical announced its first successful completion of ischemic stroke procedures with the robotic thrombectomy device TIGERTRIEVER. Therefore, with the adoption of such innovative technologies and increased awareness among the global population, market players will invest more in developing rehabilitation devices.

Here's the list of some key players in the market:

Recent Developments

- In April 2025, ReShape Lifesciences entered into a partnership with Motion Informatics to import and distribute FDA-approved Stimel-03, which is an AI-based neurorehabilitation technology in the U.S.

- In March 2024, Neurolutions, Inc. announced that the Centers for Medicare & Medicaid Services (CMS) had granted a new HCPCS Level II code for its IpsiHand Upper Extremity Rehabilitation System. This marks the first BCI-controlled therapy receiving such recognition.

- Report ID: 7550

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neurorehabilitation Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.