Neuromuscular Blocking Drugs Market Outlook:

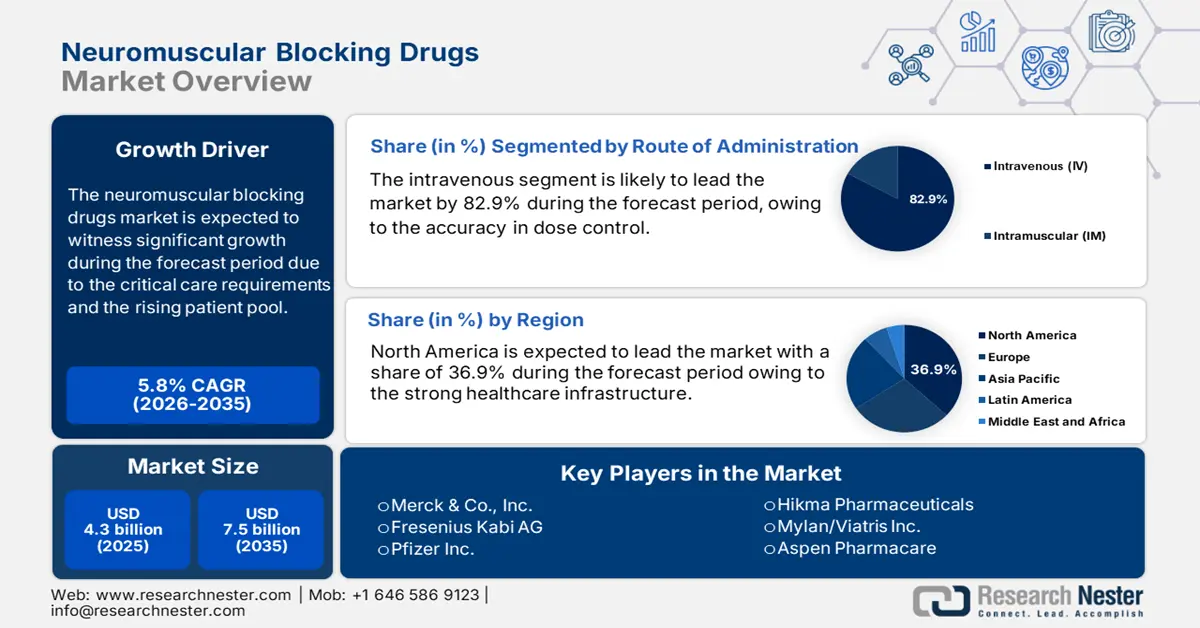

Neuromuscular Blocking Drugs Market size was valued at USD 4.3 billion in 2025 and is projected to reach USD 7.5 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of neuromuscular blocking drugs is assessed USD 4.5 billion.

The global neuromuscular blocking drugs market is driven by the critical care requirements and the rising patient pool. As per the NLM article in May 2024, nearly 234.2 million surgical procedures were performed globally, involving neuromuscular blocking drugs for intubation or muscular relaxation. Further, the market is driven by the rise in the aging population and prevalence of chronic disease. In parts of Latin America and the Asia Pacific, the public health systems have maximized access to anesthesia-aided procedures. As per the WHO report, the developing countries are broadening their healthcare capacities. This expansion in the patient pool necessitates support for long-term stability and volume growth for the neuromuscular blocking drugs (NMBD) market.

On the supply chain side, the production of neuromuscular blocking drugs is highly dependent on Active Pharmaceutical Ingredients (API). The API are mainly manufactured in China, India, and parts of Europe, with final formulation made in the U.S. The Muscular Dystrophy Association report in June 2024 states that NIH has allocated USD 47.08 billion for therapies and drugs related to neuromuscular research. Delay in the raw materials from China has led to the rise in the value chain during the period 2021 to 2022. Further, government-led investment in anesthesia safety mechanisms and research has also risen.

Key Neuromuscular Blocking Drugs Market Insights Summary:

Regional Highlights:

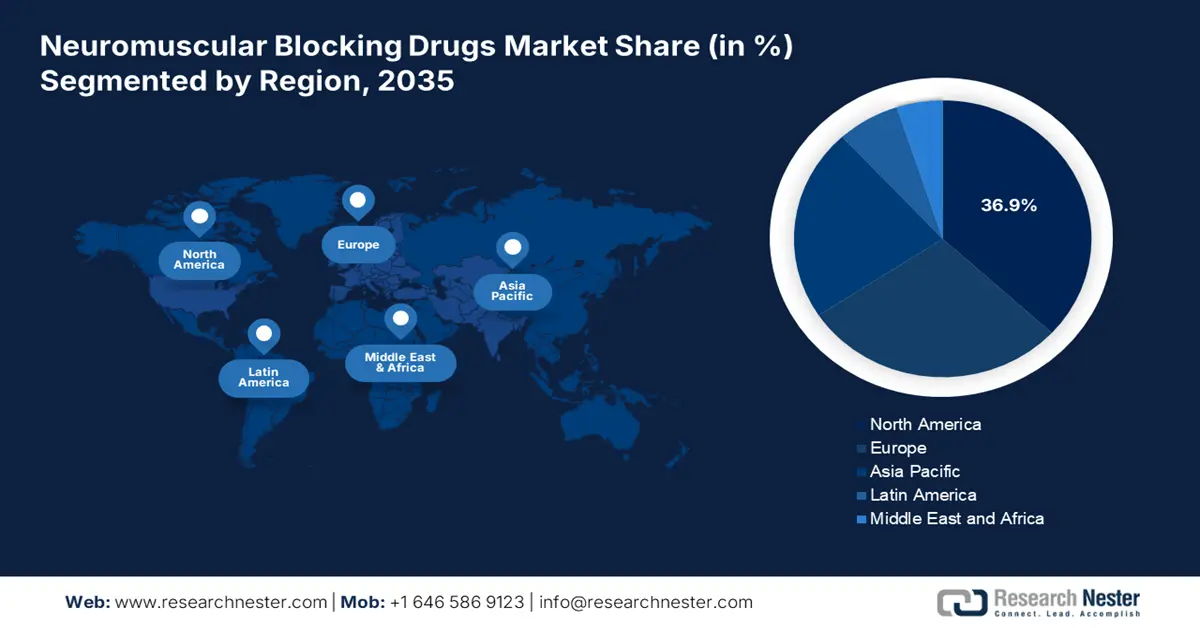

- The North America neuromuscular blocking drugs market is expected to command a 36.9% share by 2035, attributed to the high volume of surgical procedures and government-backed reimbursement frameworks.

- The Asia Pacific region is projected to expand rapidly and capture a significant share by 2035, fueled by growing ICU admissions, national investments in perioperative care, and increasing surgical volumes.

Segment Insights:

- The intravenous segment of the neuromuscular blocking drugs market is expected to account for an 82.9% share by 2035, propelled by its rapid onset, precise dose control, and suitability for both elective and emergency procedures.

- The hospitals segment is projected to secure a 74.9% share by 2035, driven by rising surgical volumes and expanding institutional procurement through government-supported hospital networks.

Key Growth Trends:

- Product innovation by leading manufacturers

- Medicare & Medicaid trends in surgical demand

Major Challenges:

- Deficiency in regional manufacturing of API

- Government-regulated cost ceilings

Key Players: Merck & Co., Inc., Fresenius Kabi AG, Pfizer Inc., Hikma Pharmaceuticals, Mylan/Viatris Inc., Aspen Pharmacare, Sandoz (a Novartis division), Bharat Serums and Vaccines Ltd., Nichi-Iko Pharmaceutical Co., Ltd., Yungjin Pharm Co., Ltd., Troikaa Pharmaceuticals Ltd., Gland Pharma Ltd., Piramal Pharma Solutions, Hameln Pharma GmbH, B. Braun Melsungen AG, Orion Corporation, TTY Biopharm Company Limited, Aurobindo Pharma, Malaysian Genomics Resource Centre, CSL Limited

Global Neuromuscular Blocking Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 7.5 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, China, Germany, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Brazil, Saudi Arabia

Last updated on : 30 September, 2025

Neuromuscular Blocking Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Product innovation by leading manufacturers: Merck & Co. increased its Bridion (Sugammadex) production facilities in partnership with the U.S. Department of Health and Human Services in 2024, surging the domestic production. At the same time, Fresenius Kabi entered multi-year distribution agreements with European public hospitals, allowing greater NMBD availability. These initiatives enhanced logistics resilience, public confidence in reversal agents, and helped each company achieve a growth in market share in the worldwide NMBD business. Further, these growths also made both companies prominent suppliers during regional NMBD shortages in Q4 2024. Additionally, increased production capacity enabled quicker response times in emergency surgical care among high-volume hospitals.

- Finished drugs and trade dynamics: As per the OEC data, the global trade of pharmaceutical products, including neuromuscular blocking drugs, reached USD 853 billion in 2023. Often, the finished drugs were reassembled in Europe and the U.S. before distribution. However, the export restriction challenges and geopolitical tensions in Asia have put pressure on improved lead times. Investing in nearshore assembly operations and diversifying API procurement are increasingly important tactics being used by multinational pharmaceutical companies. This transformation is surging companies to innovate products and establish partnerships with regional players to stabilize the supply chain and avoid future disruptions.

- Medicare & Medicaid trends in surgical demand: One in 25 people around the globe have undergone surgical procedures, as per the NLM study in May 2024. With expanded access to elective surgery and minimally invasive procedures, NMBD usage is surging in hospitals and outpatient facilities. The Centers for Medicare & Medicaid Services (CMS) predicts that increasing expenditures on perioperative medications suggest sustained NMBD demand. This reflects the increasing importance of NMBDs in improving surgical efficiency, patient safety, and postoperative recovery outcomes among U.S. healthcare institutions.

Effects of Medical Conditions on NMBAs

|

Disease |

Response to nondepolarizing NMBA |

Response to depolarizing NMBA |

|

Amyotrophic lateral sclerosis |

Sensitive |

↑ risk of hyperkalemia |

|

Muscular dystrophy |

Normal |

↑ risk of hyperkalemia, rhabdomyolysis |

|

Burn injury |

Resistance |

↑ risk of hyperkalemia (after the first 24 hrs.) |

|

Elderly age |

Prolonged duration, smaller dose required |

Normal |

|

Guillain-Barré |

Sensitive |

↑ risk of hyperkalemia |

|

Hypothermia |

Prolonged duration |

Normal |

|

Lambert-Eaton syndrome |

Sensitive |

Sensitive |

|

Multiple sclerosis |

Sensitive or Resistant* |

↑ risk of hyperkalemia |

|

Myasthenia gravis |

Sensitive |

Resistance |

|

Spinal cord injury |

Normal |

↑ risk of hyperkalemia (after the first 24 hrs.) |

|

Stroke |

Resistance on affected side |

↑ risk of hyperkalemia |

Source: Open Anesthesia in May 2023

Challenges

- Deficiency in regional manufacturing of API: South Africa and Brazil are the key sources to rely on the import of API, producing supply chain vulnerabilities. During the period 2021 to 2022 shipping delays, the import of API dropped and is reshaping the NMBD formulation availability in public hospitals. As per the WHO Essential Medicines Supply Chain report, the gaps in the supply chain impact the sustainable drug access mainly during trade disputes and pandemics. To overcome these risks in the future, both countries have started pubic private partnerships aimed at enhancing local API manufacturing capabilities. To protect against worldwide supply disruptions, regional health ministries are also building up strategic stocks of vital anesthetics, such as NMBDs.

- Government-regulated cost ceilings: Most of the countries have stringent price ceilings for generic drugs. In Germany and France, reference pricing restricts reimbursement amounts for NMBDs, resulting in low profit margins. In 2023, Fresenius Kabi evaded this by securing volume discounts from public hospital procurements, enhancing availability by 10%. Yet, NMBD prices in India are governed under the Drug Price Control Order (DPCO), dissuading foreign market entry because of low ROI.

Neuromuscular Blocking Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 7.5 billion |

|

Regional Scope |

|

Neuromuscular Blocking Drugs Market Segmentation:

Route of Administration Segment Analysis

Intravenous dominates the segment and is projected to hold the revenue share of 82.9% by 2035. The segment is led by its rapid onset of action, accuracy in dose control, and applicability in both elective and emergency procedures. Intravenous administration is a regular process in the operating rooms and critical care units, where a neuromuscular blockade is required for intubation and ventilation management. As per the CDC's hospital utilization statistics report, mostly NMBDs used for inpatient surgery in the U.S. were delivered intravenously. Further, intravenous formulations also allow for easy titration, improving procedural safety and aligning with the latest surgical standards in high-throughput hospital systems.

End user Segment Analysis

Hospitals dominate the segment and are poised to hold the market share of 74.9% by 2035. Hospitals are the leading end user segment because of their heavy infrastructure demands for surgeries and critical care ventilation, which are the main use cases for NMBDs. As per the ISAPS report in June 2025, 52.6% of surgical procedures were performed in hospitals worldwide, highlighting the demand on NMBDs. Hospital network growth worldwide, particularly within the APAC and MENA regions, accelerates institutional procurement through bulk government contracts. Subsidized reimbursement schemes and centralized buying practices that support large-scale hospital procurement of NMBDs are driving this institutional demand.

Non-Depolarizing Type Segment Analysis

The aminosteroids including rocuronium and vecuronium in the non-depolarizing type segment lead the segment by 2035. The market is driven by the wide usage of routine surgical procedures and compatibility with Sugammadex, which provides a quick and safe neuromuscular blockade reversal. As per the NLM study in July 2021, 4.3 million in patients who are adults are encountered involving rocuronium or vecuronium. In industrialized markets, aminosteroids are now the recommended option for anesthetic regimens due to the growing need for intermediate-acting drugs with predictable pharmacokinetics. As per the AHRQ and FDA report, aminosteriods have a high safety profile used for quick patient recovery in the U.S., leading to a reduction in hospitalization stay and lower procedural complications.

Our in-depth analysis of the global neuromuscular blocking drugs market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Non-Depolarizing Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neuromuscular Blocking Drugs Market - Regional Analysis

North America Market Insights

North America neuromuscular blocking drugs market is expected to maintain the highest regional share by 2035, with about 36.9% of total revenue at a CAGR of 6.1% due to large volumes of surgical procedures, strong healthcare infrastructure, and government-supported reimbursements. Increasing demand for general anesthetics in inpatient and outpatient surgery, as well as ICU modernization and national readiness programs, continues to promote adoption. Supported by top associations like AMA, PhRMA, and Innovative Medicines Canada, the region is experiencing faster regulatory clearances, generics growth, and public-private R&D partnerships, making North America a market and innovation center for neuromuscular blocking drugs up to 2035.

The neuromuscular blocking drugs market in U.S. is driven by the inpatient surgery procedures, 12.0 to 21.4 operations per 100,000 people having undergone surgeries for various issues, based on the NLM report in April 2024. A primary driver dominating the market is the favourable reimbursement for sugammadex, which reached a significant portion of Medicare Part B spending on reversal agents. Federal support is substantial, with the NIH allocating significant funding for research into safer anesthetic agents. Continued investment from federal agencies and a strong surgical volume base ensure steady market growth.

The neuromuscular blocking drugs market in Canada is driven by the universal and publicly funded healthcare system. The key trend is the proactive assessment and new drugs funding by the Canadian Agency for Drugs and Technologies in Health which has recommended the newer NMBDs and reversal agents to enhance patient outcome. The Government of Canada report in 2023 has depicted that the prescription drugs is growing at a CAGR of 7.1% from 2018 to 2023. This growth is further supported by the adoption of advanced neuromuscular blocking drugs within Canada’s hospital and surgical settings.

Prescription Drug Utilization Trends

|

Year |

Drug costs |

Dispensing costs |

Claims |

Claimants |

|

2013 |

1.00 |

1.00 |

1.00 |

1.00 |

|

2014 |

1.06 |

1.04 |

1.04 |

1.03 |

|

2015 |

1.12 |

1.06 |

1.07 |

1.06 |

|

2016 |

1.17 |

1.11 |

1.11 |

1.09 |

|

2017 |

1.25 |

1.16 |

1.15 |

1.13 |

|

2018 |

1.30 |

1.21 |

1.19 |

1.13 |

|

2019 |

1.42 |

1.29 |

1.25 |

1.22 |

|

2020 |

1.50 |

1.39 |

1.30 |

1.13 |

|

2021 |

1.61 |

1.39 |

1.27 |

1.16 |

|

2022 |

1.68 |

1.45 |

1.30 |

1.20 |

|

2023 |

1.92 |

1.51 |

1.39 |

1.30† |

Source: Government of Canada 2023

Asia Pacific Market Insights

The APAC is the fastest-growing region in the neuromuscular blocking drugs market and is anticipated to hold a considerable market share by 2035. The market is supported by rising ICU admissions, increasing surgical volumes, and national investment in perioperative and emergency care. India, Japan, and China are dominating countries in the market, with Japan focusing on advanced anesthetic drugs. This growth is further being fueled by trends including aging populations, a rise in the prevalence of trauma and chronic illnesses, and easier access to anesthetic treatments in remote hospitals. The region is strengthened by high R&D investments and fast drug review by AMED, CDSCO, and NMPA.

China is the dominating shareholder in the market in Asia Pacific region. The NLM study in February 2025 has provided evidence that the annual number of surgeries in china exceeded 1.25 million, highlighting the immense requirement of neuromuscular blocking drug, sustaining robust market growth. Further, the Healthy China 2030 initiative has prioritized access to essential perioperative drugs in public hospitals across Tier 2 and Tier 3 cities. This strategy lines up with the availability of critical care drugs and expanded health care reform goals across rural areas.

The neuromuscular blocking drugs market in India is experiencing rapid growth due to the rising surgical procedures performed, increasing use of anesthesia in critical care, and expanding healthcare infrastructure. With the rising elderly population and incidence of chronic diseases that require surgeries are the crucial drivers of the market. Further, the government initiatives are strengthening the hospitals and raising the private sector investment for advanced facilities in the healthcare sector for market expansion. Additionally, greater awareness of safe anesthesia practices is enhancing NMBD adoption.

Europe Market Insights

The neuromuscular blocking drugs market in Europe is significantly expanding and is poised to hold the largest market share by 2035. The market is fueled by the rising demand for intensive care interventions and surgical procedures. The region witnesses a rise in cardiovascular and chronic respiratory conditions, raising the demand for NMBD mainly in critical care units. Further, the technological advancements in enhanced monitoring protocols and short-acting NMBDs are improving patient care. Countries like the UK, Germany, and France are driving the market with the rise in the aging population and procedural volume in public hospitals.

Germany is expected to dominate the neuromuscular blocking drugs market in Europe and is estimated to capture the largest share by 2035. The market is propelled as a result of strong national procurement policies, centralized delivery of healthcare, and technological advancement. The Federal Ministry of Health has initiated a large-scale investment in the procurement of surgical and ICU medicines via national tenders, which have improved efficiency and access. As per the Eurostat report in November 2024, the healthcare expenditure reached €488,677 in 2022, including anesthesiology. Additionally, collaborations with local pharma producers (such as Fresenius Kabi) have promoted production locally and reduced drug shortages.

France Neuromuscular Blocking Drugs (NMBDs) market is growing steadily due to a rise in surgical intervention and increasing intensive care units. The strong public healthcare system and high per capita healthcare spending in France favor the use of both conventional and newer NMBDs, including reversal agents. Rising demand for patient safety, fast recovery, and newer forms of anesthesia further fuels market growth. On the other hand, public policy and hospital purchase programs increases the availability, making France a major player in the European NMBD market.

Healthcare Expenditure in Europe

|

Country |

2019 |

2020 |

2021 |

2022 |

Overall Change 2014-22 (%) |

|

Germany |

407,025 |

431,941 |

466,713 |

488,677 |

51.4 |

|

France |

270,562 |

279,815 |

307,568 |

313,574 |

26.6 |

|

Spain |

113,776 |

120,093 |

126,001 |

131,114 |

39.7 |

Source: Eurostat, November 2024

Key Neuromuscular Blocking Drugs Market Players:

- Merck & Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fresenius Kabi AG

- Pfizer Inc.

- Hikma Pharmaceuticals

- Mylan/Viatris Inc.

- Aspen Pharmacare

- Sandoz (a Novartis division)

- Bharat Serums and Vaccines Ltd.

- Nichi-Iko Pharmaceutical Co., Ltd.

- Yungjin Pharm Co., Ltd.

- Troikaa Pharmaceuticals Ltd.

- Gland Pharma Ltd.

- Piramal Pharma Solutions

- Hameln Pharma GmbH

- B. Braun Melsungen AG

- Orion Corporation

- TTY Biopharm Company Limited

- Aurobindo Pharma

- Malaysian Genomics Resource Centre

- CSL Limited

The neuromuscular blocking drugs market is dominated by Merck, Fresenius Kabi, and Pfizer based on their worldwide hospital networks and diversified NMBD portfolios. Players such as Hikma, Viatris, and Bharat Serums compete with others based on their portfolio via price-effective injectables. Strategic activities involve hospital group alliances, contract manufacturing, and filing for newer NMBD formulations with regulatory bodies. Japan, India, and South Korea players are capitalizing on local demand and cost competitiveness. Continuous and sustained R&D in short-acting and safer NMBDs keeps innovation for long-term competitiveness.

Below is the list of some prominent players operating in the market:

Recent Developments

- In April 2025, Johnson & Johnson received the FDA approval for IMAAVYTM, which is a new FcRn blocker providing long-lasting disease control in the broadest population of people living with generalized myasthenia gravis (gMG).

- In March 2025, Hikma Pharmaceuticals launched Cisatracurium Besylate Injection, USP in 200mg/20mL and 20mg/10mL doses in the U.S., which is used to provide skeletal muscle relaxation in adults during surgical procedures or during mechanical ventilation in the ICU.

- Report ID: 2564

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neuromuscular Blocking Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.