Neurology Devices Market Outlook:

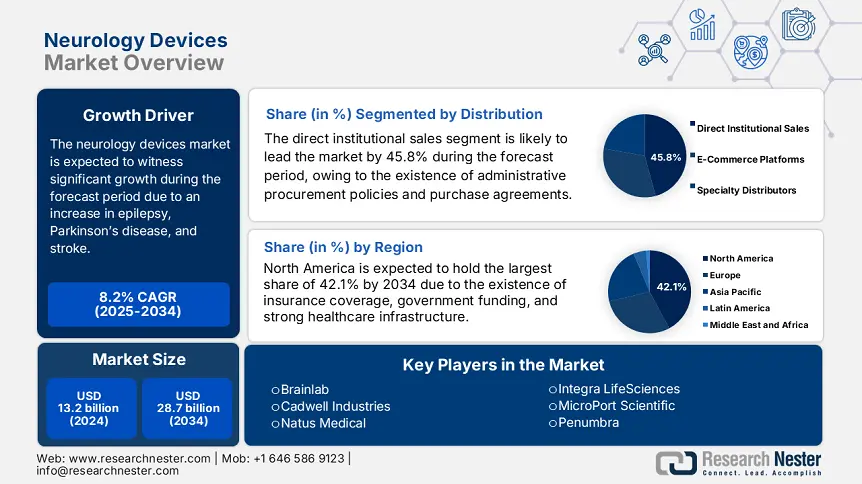

Neurology Devices Market size was valued at USD 13.2 billion in 2024 and is projected to reach USD 28.7 billion by the end of 2034, rising at a CAGR of 8.2% during the forecast period, from, 2025-2034. In 2025, the industry size of neurology devices is estimated at USD 14.1 billion.

The international market is effectively fueled by a rise in the patient pool, with neurological diseases severely impacting more than 1.2 billion people globally. Conditions, including Parkinson’s disease, epilepsy, and stroke, are deliberately contributing to the market demand, with stroke constituting for an estimated 13% of overall deaths across nations. This increase in the patient base has necessitated a strong supply chain dynamic for market, with raw materials such as semiconductor components, titanium, and medical-grade polymers. According to an article published by the BLS in 2023, the U.S. is one of the key producers, with medical devices manufacturing accounting for USD 45 billion every year, thus suitable for uplifting the market.

Furthermore, the worldwide trade facility in the market is being readily shaped by administrative policies and manufacturing dependencies. As per the 2024 ITA Government report, the U.S. generously imports USD 4.1 billion of neurology-based medical devices every year, usually from Ireland and Germany, while exporting an estimated USD 5.3 billion, majorly to Europe and Japan. Besides, assembly lines for neurostimulation devices are also concentrated in Costa Rica, Singapore, and Ireland, effectively leveraging skilled labor and tax incentives. Meanwhile, the provision of investments for conducting suitable research, development, and deployment (RDD) for neurology devices, which has exceeded USD 11 billion annually, with almost 70% provided from Europe and the U.S. government grants.