Network Packet Broker Market Outlook:

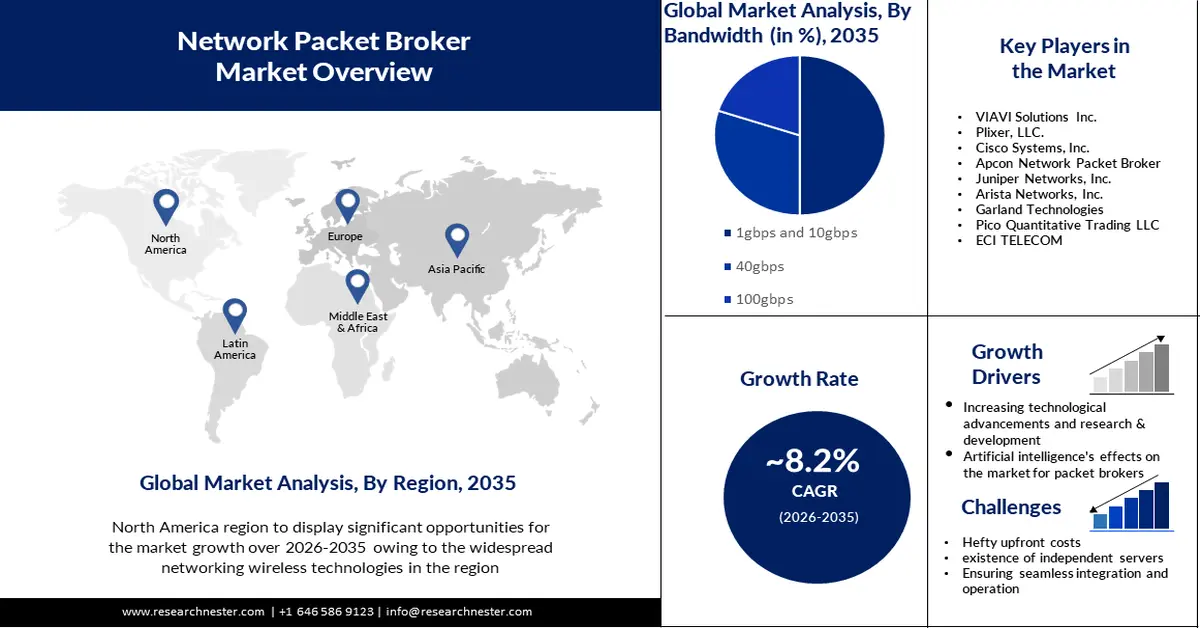

Network Packet Broker Market size was valued at USD 1.01 billion in 2025 and is set to exceed USD 2.22 billion by 2035, expanding at over 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of network packet broker is estimated at USD 1.08 billion.

The main factor driving the network packet broker market is the growth of data centers and the widespread use of cloud-based computing platforms for secure networks by different industrial sectors. In December 2023, there were about 10,978 data center locations worldwide.

In addition to these, Network security has become an organization's top priority due to the growing frequency and sophistication of cyber threats. Network packet brokers improve data security by enabling real-time monitoring and threat detection.

Key Network Packet Broker Market Insights Summary:

Regional Highlights:

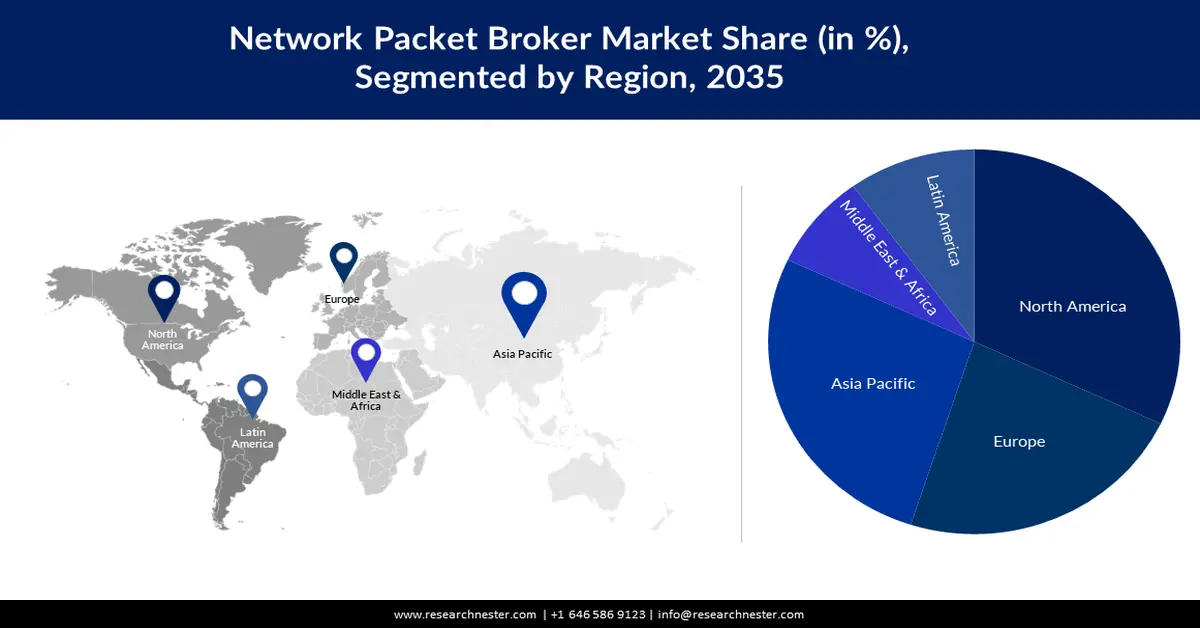

- North America network packet broker market will secure over 32% share, driven by the widespread use of cloud-based network infrastructure, wireless networking devices, and rising data center deployments, forecast period 2026–2035.

- Asia Pacific market will account for 27% share, fueled by improved network infrastructure, increased portable device usage, and expanding data center deployments driven by government initiatives, forecast period 2026–2035.

Segment Insights:

- The 1gbps and 10gbps segment in the network packet broker market is projected to grow significantly by the forecast year 2035, attributed to decreasing costs and rising demand for high-speed connectivity in diverse industries.

- The enterprise segment in the network packet broker market is anticipated to experience robust growth through 2035, driven by rising enterprise digitization and the need for high-performance network connectivity.

Key Growth Trends:

- Increasing technological advancements and research & development

- Positive impact of the COVID-19 pandemic

Major Challenges:

- Hefty upfront costs

Key Players: VIAVI Solutions Inc., Plixer, LLC., Cisco Systems, Inc., Apcon Network Packet Broker, Juniper Networks, Inc., Arista Networks, Inc., Garland Technologies, Pico Quantitative Trading LLC, ECI TELECOM.

Global Network Packet Broker Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.01 billion

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 2.22 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Network Packet Broker Market Growth Drivers and Challenges:

Growth Drivers

- Artificial intelligence's effects on the market for packet brokers- In the upcoming years, artificial intelligence (AI) is expected to drive the network packet broker business. By utilizing next-generation network packet brokers, businesses can become nimblers and match their IT strategy with their objectives. Furthermore, AI can assist IT teams in quickly identifying the network-based underlying cause of an application disruption. It is simple to identify the issues and quicker to put remedies into practice. It is anticipated that the application of AI technology will alter network configuration, optimization, and management. It makes it possible to automate monotonous and repetitive operations alike. As a result, market participants are embracing new growth opportunities and can soar to greater heights with the integration of AI. Big businesses were twice as likely to utilize AI in 2022 as small businesses. 53% of international IT businesses in 2022 said that AI use has increased during the preceding two years. AI is present in 77% of the gadgets that are in use today.

- Increasing technological advancements and research & development- Significant R&D initiatives and technology developments for the creation of cutting-edge wireless networking systems are anticipated to generate enormous market expansion prospects. Businesses are putting more and more effort into introducing sophisticated network packet brokers that function with the newest devices and innovations, like 5G and 4G LTE. More generally, it is anticipated that the rollout of 5G will coincide with a rise in global data consumption; estimates indicate that by 2028, mobile data traffic will reach about 330 exabytes per month, more than tripling the amount used in 2022.

- Positive impact of the COVID-19 pandemic- The network packet broker industry was driven by the COVID-19 outbreak. To maintain regular business operations throughout the critical phase of the pandemic, companies were compelled to modernize their digital platforms to design an appropriate system for employee communication and to offer a crisis management mechanism. With a focus on digital components and solutions, a strong networking infrastructure is necessary to guarantee high connection, which has led to the network packet broker market explosive growth.

Challenges

- Hefty upfront costs- The upfront costs associated with deploying and purchasing network packet brokers, together with the associated training costs for optimal utilization, may deter cost-conscious organizations. Two main barriers to adoption are the high cost of SaaS-based network monitoring systems and the dearth of professionals managing these solutions.

- It can be a little challenging to implement and integrate network packet brokers with the present network architecture. Ensuring seamless integration and operation poses a challenge for numerous firms.

- It is expected that the existence of independent servers will impede the network packet broker market growth.

Network Packet Broker Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 1.01 billion |

|

Forecast Year Market Size (2035) |

USD 2.22 billion |

|

Regional Scope |

|

Network Packet Broker Market Segmentation:

Bandwidth Segment Analysis

Based on the bandwidth the 1gbps and 10gbps segment in the network packet broker market is attributed to hold the largest revenue share of about 50% during the forecast period. These days, 10Gbps NPBs are the most used variety. Traffic from access switch uplinks and aggregation/core switches, which often operate at speeds of 10Gbps and above, is captured by 10Gbps network packet brokers. Network packet brokers with speeds of 1 and 10 Gbps are extensively used in a variety of industries, including telecoms, government agencies, and other service providers. High bandwidth network packet brokers are currently becoming very popular in the market. Because of this, the cost of 1 and 10 Gbps NPBs has been coming down, which encourages the use of these NPBs for the best possible network expansion. Large corporate organizations can do a variety of tasks with adequate internet network speed owing to the average 10 Gbps speeds that most data centers across the globe operate at. Moreover, due to the growing demand for automated and streamlined data center administration, this segment is projected to hold a significant network packet broker market share during the projection period. The worldwide industry for data center automation was projected to be USD 6.8 billion in 2021 and is projected to grow to USD 7.6 billion in 2022.

End User Segment Analysis

Based on end users the enterprise segment in the network packet broker market is expected to hold the largest revenue share of about 48% during the forecast period. To handle enormous volumes of data, growing enterprise applications demand high-performance connectivity, continuous uptime, high throughput, and high reliability. Network packet brokers are being used in businesses to meet these needs. Big businesses in a variety of sectors have been utilizing digitization more and more to enhance their operational procedures. Network packet brokers' market will eventually develop due to the changing digitization in healthcare, e-commerce, banking, and education, as well as enterprise data centers.

Our in-depth analysis of the global network packet broker market includes the following segments:

|

Bandwidth |

|

|

Network Set-Up |

|

|

Security Tools |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Network Packet Broker Market Regional Analysis:

North America Market Insights

Network packet broker market in the North American region is projected to hold the largest revenue share of about 32% during the projected period. The growth of the market is due to the region's widespread use of cloud-based network infrastructure and the widespread penetration of wireless networking devices. The growth of the business is being aided by the rising number of data centers and the increasing internet penetration in the area. It was predicted that between 2024 and 2029, there will be a steady increase in the number of internet users in North America, amounting to 51 million people. Following nine years of growth, the number of users is predicted to reach 512.95 million in 2029, marking a new peak.

Innovative network packet products are available from the leading regional providers of network packet broker solutions.

APAC Market Insights

Network packet broker market in the Asia Pacific region is predicted to hold the second-largest revenue share of about 27% during the forecast period. The market is expanding as a result of improved network infrastructure and increased regional use of portable devices. Growing government initiatives and investments from APAC's technologically advanced nations including China, India, Japan, Singapore, and Australia are propelling the expansion of data center deployments, which is anticipated to propel the network packet broker market. The need for NPBs is also fuelled by the growth of small and medium-sized businesses and their integration of digital technologies.

Network Packet Broker Market Players:

- Keysight Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VIAVI Solutions Inc.

- Plixer, LLC.

- Cisco Systems, Inc.

- Apcon Network Packet Broker

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Garland Technologies

- Pico Quantitative Trading LLC

- ECI TELECOM

Recent Developments

- July 2019: Niagara Networks tried to implement zero trust safety to API communication across an organization network by working with L7 Defense on API security. Niagara Networks gathers network traffic and provides Ammune with full visibility for risk assessment to safeguard the API. Through this partnership, the company grows its clientele.

- October 2022: Renowned technology provider Keysight Technologies, Inc. provides cutting-edge solutions to foster creativity and improve connectivity and security around the world. The Vision 400 Series Network Packet Brokers, introduced by this company, offer improved visibility in 400G hybrid high-speed networks.

- Report ID: 5710

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Network Packet Broker Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.