Nephroureteral Stent Market Outlook:

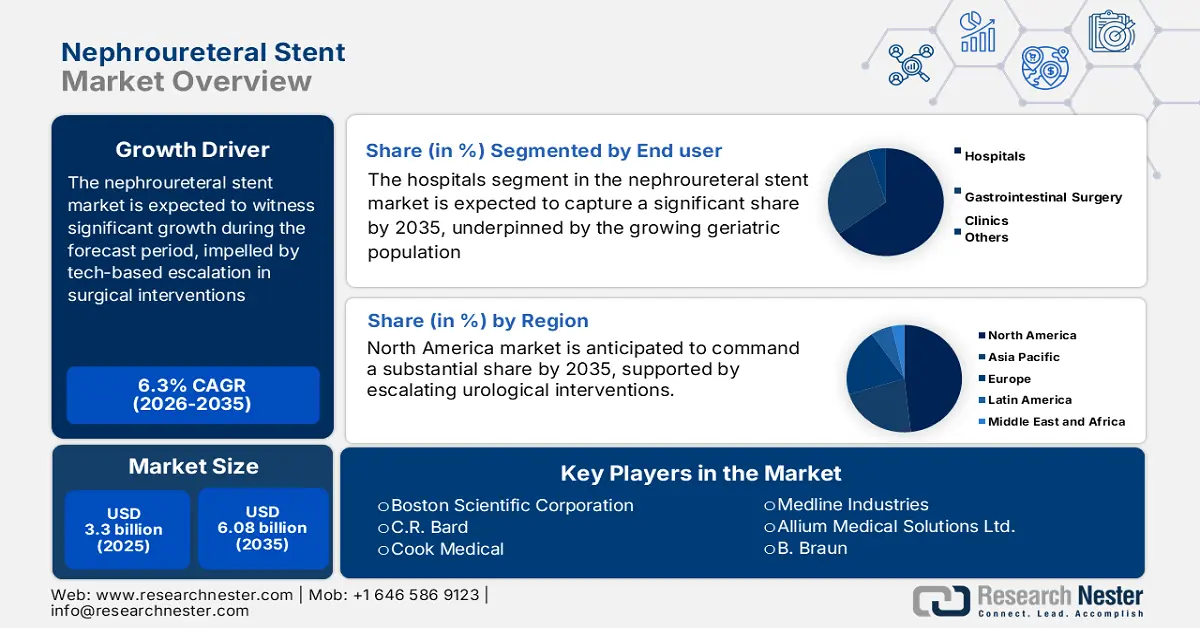

Nephroureteral Stent Market size was over USD 3.3 billion in 2025 and is poised to exceed USD 6.08 billion by 2035, growing at over 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nephroureteral stent is estimated at USD 3.49 billion.

According to an NLM article from April 2023, congenital defects of the kidney and urinary tract are found among 8.0 million newborns from across the globe annually. The increases in sedentary lifestyles are also raising the risk of associated chronic diseases such as kidney stones, fueling adoption in the market. On this note, a 2024 NLM study established a close association between a highly inactive lifestyle and kidney stone occurrence, highlighting its global prevalence rate to be over 9.0% in adults. Additionally, several clinical studies have shown that the geriatric population tends to possess more chances of related urinal problems, which creates a surge for ureteric stents. Simultaneously, the WHO projected the number of people aged 65 and over in the world to reach 1.5 billion by 2050.

These incremental figures represent a large consumer base for the market. Considering the severity and health impact of urinary tract dysfunction, many medical organizations and service providers are adopting innovative solutions. The newly introduced surgical instruments are highly efficient in reducing interventional complexity and risks, acquiring patients’ trust, and inspiring companies to bring more multi-functional tools to this field. For instance, in December 2024, Ureteral Stent Company successfully expanded the application of its RELIEF ureteral stent in preventing vesicoureteral reflux by attaining approval from the FDA. The company previously (in 2022) secured FDA 510k clearance for marketing RELIEF in the U.S. to treat kidney stones and other related issues.

Key Nephroureteral Stent Market Insights Summary:

Regional Insights:

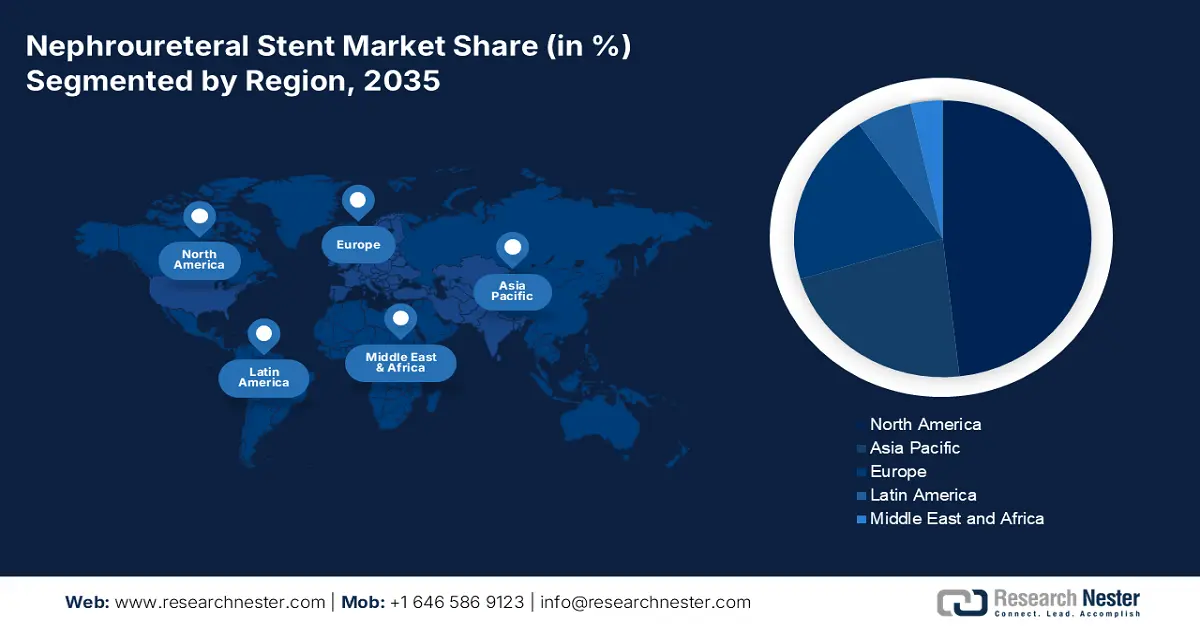

- By 2035, North America is anticipated to capture the dominant share in the Nephroureteral Stent Market, supported by heightened urological interventions owing to intensified R&D initiatives.

- Asia Pacific is projected to exhibit substantial expansion by 2035, reinforced by favorable patient demographics because of the growing CKD burden.

Segment Insights:

- By 2035, the hospitals segment in the Nephroureteral Stent Market is projected to command the leading share, supported by its expanding patient inflow impelled by increasing patient pool due to sedentary lifestyles.

- The double pigtail stent segment is expected to secure a notable share by 2035, underpinned by rising utilization of URS procedures owing to incremental progress in clinical adoption.

Key Growth Trends:

- Tech based escalation in surgical interventions

- Improved access to healthcare services

Major Challenges:

- Complications associated with the procedures

- Lack of skilled professionals

Key Players: Boston Scientific Corporation, C.R. Bard, Cook Medical, Medline Industries, Allium Medical Solutions Ltd., B. Braun, Dextronix, PNN Medical A/S, Teleflex Incorporated, Olympus Corporation.

Global Nephroureteral Stent Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.49 billion

- Projected Market Size: USD 6.08 billion by 2035

- Growth Forecasts: 6.3%

Key Regional Dynamics:

- Largest Region: North America (Largest Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 19 November, 2025

Nephroureteral Stent Market - Growth Drivers and Challenges

Growth Drivers

- Tech-based escalation in surgical interventions: The technological integrations are revolutionizing outcomes in urological procedures. Particularly, the shifting consumer preference for minimally invasive methods is strongly contributing to the growth of the nephroureteral stent market. For instance, in March 2025, Olympus Corporation, in collaboration with Ziosoft, introduced an AI-powered clinical decision tool to assist surgeons in pre-op planning. This system has integrated applications in various medical disciplines, including minimally invasive urologic surgery. The parallel upgradation of stent design, material, bio-compatibility, drug-eluting ability, and self-adjustment functions are further boosting productivity in this sector.

- Improved access to healthcare services: With the focus on streamlining value-based healthcare across the world, many organizations have upscaled their investments and implementations. Specifically, in emerging landscapes, the tendency to adequately equip infrastructure to support every simple to complex intervention is securing a continuous flow of business in this field. For instance, in a July 2024 article, NLM mentioned that the most cost-effective 2030 budget for the upliftment of surgical capacity in low- and middle-income countries (LMICs) is USD 420.0 billion. It also highlighted the importance of UNESCO’s 2030 Sustainable Development Goals (SDGs) Agenda. This trend is widening accessibility in the market.

Challenges

- Complications associated with the procedures: People often face discomforts and side effects after the removal of the stent. Adverse events such as increased frequency & urgency of passing urine, fever, pain, urinary tract infections, and hematuria are expected to hamper wide adoption in the market. Moreover, the additional hassle and expenses of treating these issues may cause patient dissatisfaction and a loss in profitable sales in this sector.

- Lack of skilled professionals: Stent placement is a complex process, and every surgeon does not possess the appropriate skills or capability of stent replacement surgeries. Additionally, the need for frequent replacement and maintenance may escalate the absence of sufficient caregivers. Consequently, the worldwide shortage of trained workforces is preventing many medical settings from accommodating their facilities with offerings from the market.

Nephroureteral Stent Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 6.08 billion |

|

Regional Scope |

|

Nephroureteral Stent Market Segmentation:

End user Segment Analysis

As per the segmentation by end user, hospitals are anticipated to garner the highest revenue for the nephroureteral stent market over the assessed period. The increasing patient pool due to sedentary lifestyles and the growing geriatric population is feeding cash flow in this segment. Government subsidies, coupled with the availability of specialized operating rooms and professionals, make these service providers the most suitable point-of-care for patients. The predominant captivity of this segment can further be testified by the emergence in developing countries. On this note, IBEF reported that the foreign direct investment (FDI) in the hospital industry in India was valued at USD 1.5 billion in 2023. It also mentioned Max Hospital’s USD 590.2 million fund for doubling its infrastructural capacity by 2027.

Type Segment Analysis

Based on type, the double pigtail stent segment is poised to register a remarkable share in the nephroureteral stent market by the end of 2035. This instrument is most commonly used to manage urinary obstructions and facilitate stone removal, involving tools such as ureteroscopy (URS). According to an NLM survey, the number of performed URS surgeries in the UK escalated by 257.0% from 2000 to 2020. It further observed 18.9% and 20.4% increments in using URS and its flexible form for residents aged over 60 from 2015 to 2020 in the same country. This is evidence of incremental progress in clinical adoption and acceleration in the segment’s proprietorship in this sector.

Our in-depth analysis of the global nephroureteral stent market includes the following segments:

|

End user |

|

|

Type |

|

|

Composition Materials |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nephroureteral Stent Market - Regional Analysis

North American Market Insights

North America is expected to hold the largest share in the nephroureteral stent market on the back of increased urological interventions. The presence of key global leaders in the region and their meticulous activities in research and development projects are responsibly supplying necessary tools, including stents, to cope with this demand. This demonstrates a positive growth trajectory in this landscape and attracts more pioneers for participation. For instance, in April 2021, Boston Scientific Corporation attained 510(k) clearance from the FDA to market its Percuflex Nephroureteral Stent System in America for percutaneous drainage. This equipment has been proven to be effective for treating urinary obstruction between the ureteropelvic junction and the bladder.

The U.S. presents a large consumer base for market, owing to the high prevalence of kidney stones. The annual spending on this medical condition by this country surpassed USD 2.0 billion, as per NLM estimation from May 2024. Another NLM observational review from April 2024 revealed that over 600,000 adults in the U.S. experience this ailment annually, exhibiting a prevalence rate of 8.8%. It also identified at least 1 in every 100 infants to be born with ureteropelvic junction obstruction. This fosters a continuous demand for nephroureteral stents.

APAC Market Insights

Asia Pacific is expected to show notable propagation in the nephroureteral stent market over the discussed timeline. This region’s progression is pledged with favorable patient demographics and developing healthcare infrastructure. The rapidly aging population and urbanization across developing countries such as Japan, China, and India encompass a significant number of citizens with nephrology-related diseases. As per the Kidney International Reports from April 2024, approximately 434.3 million people in Asia were suffering from chronic kidney disease (CKD), where its prevalence ranged between 4.7% and 17.4% in the Pacific area. This enlarging burden is pushing authorities in this region to promote early intervention, fueling a surge in this sector.

Besides having a huge burden of CKD, the China market is fueled by its exceptional capacity in manufacturing surgical instruments such as stents. According to OEC, this country secured its position among the top 5 global exporters of medical instruments, incorporating interventional apparatus, with a value of USD 12.3 billion in 2023. This indicates the nation’s capabilities to accelerate production and supply in this field, inspiring both domestic and international leaders to invest and operate in China.

Nephroureteral Stent Market Players:

- Boston Scientific Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- C.R. Bard

- Cook Medical

- Medline Industries

- Allium Medical Solutions Ltd.

- B. Braun

- Dextronix

- PNN Medical A/S

- Teleflex Incorporated

- Olympus Corporation

Key players in the market are currently following more sustainable approaches toward developing and producing related products. Their effort to reduce environmental impacts from medical waste is further cultivating innovation in this field. They are also focused on strategic collaborations and mergers to expand their territory overseas, fostering a new trend of globalization. Moreover, this scenario is creating a pre-established trading environment for new entrants, increasing engagement, and extending the range of options. Such key players include:

Recent Developments

- In November 2024, Cook Medical led a strategic investment of USD 24.0 million as a series C financing for Zenflow and its Spring System technology. The fund intended to empower Cook Medical’s presence in the urology portfolio by supporting Spring System’s regulatory approvals and commercialization in the U.S. market.

- In April 2024, Olympus Corporation attained 510(k) clearance from the FDA for its single-use ureteroscopy system, RenaFlex, for use in diagnostic and therapeutic procedures related to the urinary tract. This double-J stent is expected to solidify the company’s leadership in the nephroureteral pipeline.

- Report ID: 888

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nephroureteral Stent Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.